The dominant consensus idea about the recent crash of oil prices has been due to a “glut”.

Of course, I don’t blame them, that’s because they have come to believe what the government has declared them to be. They take government's word as gospel truth.

For instance the recent disclosure by the US Energy Information Adminstration.

EIA estimates that global oil inventories increased by almost 0.8 million bbl/d in 2014, the largest build since 2008, when falling demand for oil caused prices to drop sharply during the second half of the year. However, unlike in 2008, the current market imbalance has been predominantly supply-driven, as production from countries outside of the Organization of the Petroleum Exporting Countries (OPEC) grew by a record high of 2.0 million bbl/d in 2014. Global oil inventories are expected to continue to grow by 0.9 million bbl/d during the first half of 2015, but to taper off by the end of the year as non-OPEC supply growth, particularly from the United States, weakens because of lower oil prices.

So from the EIA’s perspective it does look like a glut.

But not so fast.

Statistics isn’t economics. If we apply the law of demand which states that "other things remaining same, the quantity demanded of a good increases when its price falls and vice-versa", the rudimentary economic law simply says that if crashing oil has principally been an issue of oversupply then demand will eventually offset the decrease in prices.

Oil which epitomizes energy represent means to an end.

Lower oil prices don’t translate that people will buy more oil products for the sake of buying it, instead, it will be used.

Yet the benefit from lower oil prices, which as explained earlier, represents a shift in allocation from “need” to “want” expenditures. That’s if the savings from energy expenditures is spent and not saved or used to pay debt.

In social context, this would likely mean more travel, more leisure activities and or more non-energy related commerce. Again for the latter, that’s if savings from energy expenditures is spent.

And of course, if the profits from non-oil expenditures will be invested, then this should transmit to growth. Remember it is growth in income that gives additional spending power.

As an example, the law of demand seems in motion in the US. The collapse in energy prices (gasoline in particular) has prompted Americans to drive the most (in terms of mileage) since 2008; notes the Gavekal Team

As a sidenote, because energy represents a means to an end for human activities, this means that energy can be used in both productive and non-productive activities. Committing violence requires energy too. So whether it is crime or war, energy is also involved or used. Government redistribution programs require energy too. Ergo, energy is a means to an end.

This brings us back to the ‘glut’ wisdom held by the consensus.

If oversupply has been a problem that has benighted oil prices, then oil’s predicament should have been limited to oil-and energy related products.

But this doesn’t seem to be the case.

Aside from oil, a wide range of commodity prices have been crashing!

For industrial metals like Zinc, Lead or Aluminum, prices have been collapsing even as LME inventories has likewise been tanking.

From the above metals perspective, with supply sinking as prices collapse, it’s hardly a supply side problem but a demand problem

It’s a different issue for Nickel which looks like a supply side story.

On the other hand, Dr. Copper, a metal that usually illuminates on global economic conditions, has recently crashed along with oil. And only during the recent crash has there been upsurge in inventories. (all charts above from Kitcometals.com)

It’s not just oil and industrial metals.

Prices of iron ore has been in a collapse mode too. (chart from Index Mundi) Such has been much a symptom of the unraveling credit boom in China where a growth slowdown from too much debt has exposed on the build-up of excess capacity of the iron ore supply chain in China and in the rest of the world. (read this CNBC article)

And if lumber serves as a measure of US housing conditions, then struggling prices have not been supportive of a vigorous housing sector recovery.

Even soft commodities have been under severe price pressures: soybeans, corn, wheat and cotton have all been collapsing (chart from Yardeni.com)

The Baltic dry index which supposedly measures the movements of “the major raw materials by sea” mainly by dry bulk carriers of large commodities coal iron, ore, grain and etc…have plummeted to 2008 levels! (chart from investmenttools.com)

The bottom line is that contra consensus, the message of crashing commodities prices has mostly been about a rapidly cooling global economy that has again exposed on excess supplies built during the previous credit boom.

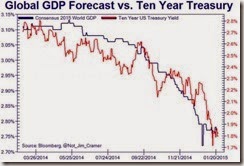

Didn’t the IMF and World Bank recently just downgraded global growth projections?

We don’t even need to rely on projections by multilateral institutions but on the actions of central banks. Actions taken by central banks should reflect on the economic and financial conditions of their constituency.

Today the Australian government joined the rank of 15 nations in cutting interest rates.

The other 15 which cut rates in 2014 includes (as per central bank news) : "Three by Denmark, one by Switzerland, one by Canada and one by Singapore. Another six rate cuts came from central banks in emerging economies: India, Russia, Turkey, Chile, Peru and Egypt. Two central banks in frontier markets cut rates in January: Romania and Pakistan, while another cut was carried out by Albania, a country that is neither an emerging market nor a frontier market"

This against only 6 rate increases: "there have only been six rate increases so far this year, none by central banks in advanced economies, one by an emerging market central bank (Brazil), none among frontier market central banks but five by central banks in other economies: Belarus, Mongolia, Armenia, Kyrguzstan and Trinidad & Tobago."

With central banks of major economies, supported by some central banks of emerging markets in a cutting rate spree to "fight deflation" (translated: weak economies), crashing commodities seems more about growing slack in demand as ramifications to the previous credit boom.

In short, crashing oil prices have been symptomatic of a progressing global bubble bust in motion.

(chart from Zero Hedge)

No comments:

Post a Comment