While bear markets usually accompany economic recessions, the cause and effect does not always hold.

Proof?

The following is China’s Shanghai Index (Bloomberg)

The Shanghai composite melted away nearly one year ahead of the global collapse brought about by the Lehman bankruptcy.

Since October the peak of 2007, today, the SHCOMP still is about 60% off the peak.

Peak to trough, from October 2007 to October 2008, the major Chinese composite lost 70.6% in one year, which means that from 2008-2011, only 10% of the accrued losses had been recovered.

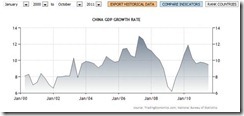

However, the resultant world economic slowdown from the Lehman episode only diminished China’s economic growth rate (tradingeconomics.com) but did not lead to a technical recession.

China’s economic growth rate peaked in 2007 at around 13% and bottomed at 6% in 2009.

That’s partly because of China’s humongous $586 billion stimulus program which temporarily shielded the economy but has led to massive malinvestments.

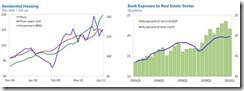

One would note that money supply incrementally grew (red lines) from 2005-2007, but accelerated when the enormous stimulus packaged had been unleashed.

What has been palpable was the growth had been in new loans (chart Guinness Atkinson), which seemed unaffected by the stock market crash.

However, the Shanghai Composite bear market began or coincided with the regime's monetary tightening.

Bank reserve ratios had been serially increased, aside from interest rates which rose in 2007 until February of 2008. (chart from IMF)

However as noted above, the stimulus only prompted speculation to shift money from the stock market towards real estate (see below)

Yet the Chinese government has been attempting to contain the ballooning bubble via the same tools it used against the stock market plus some additional features as financial markets worked around government regulations.

Again from the IMF, (bold emphasis mine)

The central bank has used both reserve requirements and higher interest rates to slow credit but still relies heavily on direct administrative limits on loan growth. The central bank has also introduced a supplemental “dynamically differentiated reserve requirement,” which varies across banks and through time based upon the pace of credit growth at the bank, the capital adequacy ratio, and other factors. Staff argued that this focus on quantity limits has limited the supply of bank credit but with little impact on the cost of capital or demand for new loans.

In addition, with guaranteed loan deposit rate margins, the banks still have strong incentives to expand lending. As a result, the control of monetary aggregates through direct limits on bank lending is already being disintermediated. There has been a significant rise in off-balance sheet provision of loans (e.g. through trust funds, leasing, bankers’ acceptances, inter-corporate lending, and other means) and a growing intermediation of credit through nonbanks and fixed income markets. In addition, over the past several months, there have been large loan inflows from offshore entities recorded in the balance of payments (as Chinese companies go abroad to offset credit restrictions at home). Such avenues were already partially counteracting the impact and effectiveness of monetary tightening and that tendency was likely to increase in the coming years.

The central bank indicated that it was committed to moving gradually to more price based tools of monetary policy, noting that loan and deposit rates had been increased four times since October. The central bank was also now monitoring a broader measure of “social financing”—which includes bank loans, off balance sheet lending, as well as funds raised in the equity and bond markets—in order to better judge financial conditions. They felt that the existing array of tools and the expanded scope of their surveillance would be sufficient to contain disintermediation risks. They also indicated that, to some degree, lending limits could be viewed as an effective microprudential device in a system where risk management and risk monitoring were still insufficiently developed.

The rise of off balance sheet financing would be symptomatic of what Hyman Minky’s would call as speculative financing of a credit cycle. This would somewhat replicate the role of the shadow banking system during the US mortgage crisis.

Bottom line: China’s continuing bear market has been a product of her government’s boom-bust policies.

One more example:Bangladesh

Bangladesh recently experienced a stock market crash that seems detached with the actions of global markets.

The Dhaka index still remains in a bear market since its apex in December of 2010… (Bloomberg)

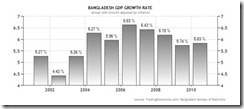

…but there has been no signs of economic recession (tradingeconomics.com) accompanying the bear market

The apparent reason seems to be same: The reversal of the Bangladesh government’s previously induced boom policies with policy tightening that resulted to a stock market bust.

See my earlier explanation here