The stock market's job is to always make you feel like you are missing out on something. The stock market's job is to always make you feel like you should be doing something. The stock market's job is to get you to do the wrong thing at the wrong time—Ian Cassel

In this issue

Philippine PSEi 30’s Crash: Worst January Performance Since 2008 and Asia’s Laggard — A Liquidity-Driven Meltdown?

I. A Lowly Voice in the Wilderness

II. January as Template for 2025 Performance

III. Double Top Pattern?

IV. Was The Selloff Driven By Escalating Liquidity Strains? San Miguel: The Canary in the Coal Mine?

V. Price Distortions from the Changes in PSE’s Membership Amplified the Market’s Volatility

VI. Summary and Conclusion

Philippine PSEi 30’s Crash: Worst January Performance Since 2008 and Asia’s Laggard — A Liquidity-Driven Meltdown?

The Philippine equity benchmark plummeted 10.2% in January, making it the worst performer in Asia. It was also the largest loss in the history of January since 2008. Could escalating liquidity strains be the driving force?

I. A Lowly Voice in the Wilderness

First, the appetizer.

Let’s revisit a few quotes from our previous posts when everyone was predicting a new bull market for the PSEi 30, with expectations of it reaching 7,500 in October. (bold and italics original)

In the backdrop of lethargic volume, concentrated activities, and a rising share of foreign participation, a continuation of global de-risking and deleveraging translates to more liquidations here and abroad, which could expose many skeletons in the closet of the Philippine financial system. August 4, 2024

...

The public has been largely unaware of the buildup of risks associated with pumping the PSEi 30, driven by a significant concentration in trading activities and market internals

The market breadth exhibits that since only a few or a select number of issues have benefited from this liquidity-driven shindig, the invested public has likely been confused by the dismal returns of their portfolios and the cheerleading of media and the establishment. September 15, 2024

...

Bottom line: The levels reached by the PSEi 30 and its outsized returns attained over a few months barely support general market activities, which remain heavily concentrated on the actions of the national team and volatile foreign fund flows.

Instead, the present melt-up represents an onrush of speculative fervor driven by the BSP’s stealth liquidity easing measures, even before their rate cut. Moreover, real economic activities hardly support this melt-up. October 7, 2024

...

Given the current global and domestic economic imbalances, the Year of the Snake may again usher in another period of heightened risk and potential volatility. January 19, 2025

Next, the main course.

II. January as Template for 2025 Performance

The Philippines' main equity benchmark, the PSEi 30, plunged by 4.01% on the last trading day of January, dragging its weekly return to -6.9%, marking its fourth consecutive week of decline.

Figure 1

For the month, the PSEi 30 suffered a 10.2% loss Month on Month (MoM), its most significant monthly decline since the 12.8% crash in September 2022. Annually, it was down by 11.8%.

January is supposed to be the best month for the PSE, rising 9 times in 13 years, with an average return of 0.94%, including 2025.

Yet, returns have been declining both monthly and annually for the past decade and so. (Figure 1, upper window)

True to the volatility of the Snake Year, 2025's 10.2% plunge on January 10 was the worst since 2008, during the Great Financial Crisis, which resulted in a 48% decline and the lowest PSEi 30 level since 2012. (Figure 1, lower image)

Yet, if history were to rhyme, and if January’s performance serves as a template for 2025, it wouldn’t be surprising if the PSEi 30 faces a substantial setback.

Figure 2

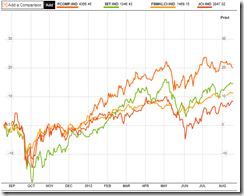

As a result of this week’s thrashing, the Philippine PSEi 30 was the worst-performing Asian bourse. Ten of 19 national indices were down, one remained unchanged, with average returns at -0.41%. (Figure 2, topmost graph)

For January, with 10 of 19 national indices down and a YTD change of -0.5%, the Philippine PSEi 30 was the region's laggard. (Figure 2, middle chart)

Major ASEAN bourses, such as Thailand’s SET and Malaysia’s KLCI, were the weakest links in both weekly and monthly outcomes. (Figure 2, lowest diagram)

Could these be emerging signs of an Asian Financial Crisis 2.0?

III. Double Top Pattern?

This week’s meltdown breached two minor support levels and now seems poised to challenge the October 2022 low.

Figure 3

From a technical analysis standpoint, the PSEi 30 is facing the potential of a 'double top' pattern, where a breakdown below the October low could lead to a retest of the March 2020 level. (Figure 3, upper image)

The panic selling suggests that a significant oversold rebound might be imminent, though the durability of this recovery could be suspect.

IV. Was The Selloff Driven By Escalating Liquidity Strains? San Miguel: The Canary in the Coal Mine?

Mainstream explanations for the selloff have often been influenced by the availability bias or "when people overweight new information or recent events" (Investopedia)

Could the recent sell-offs be attributed to the substantial shortfall in Q4 and 2024 GDP (a development we had anticipated)?

Was it influenced by Trump's tariff threats or the Federal Reserve's pause in their easing cycle?

Or might domestic politics play a role? Specifically, the threat by the BBM administration to shut down the government if the Supreme Court rules in favor of appellants challenging the constitutionality of their controversial budget, or the impending Food Emergency Security measure on rice, set to be implemented on February 4, 2025.

Our best guess is that while these factors might have some influence, a more critical driver of the market turmoil could be the escalating pressures on financial liquidity.

Unlike the 2022 episode, where inflation and rising interest rates were significant factors, the current scenario mirrors the dynamics of the pandemic recession—where the PSEi 30 declines despite monetary easing aimed at combating a recession. (Figure 3, lower graph)

Currently, the GDP growth rate has been decelerating.

Figure 4

Moreover, bank liquidity has been worsening as of November, due to investments in Held-to-Maturity (HTM) assets and undisclosed Non-Performing Loans (NPLs). The cash-to-deposits and liquid assets-to-deposits ratios have been on a long-term downtrend, with the former at its lowest level in over a decade. (Figure 4, topmost graph)

As a reminder, the BSP cut official rates in August, October, and December. It also reduced RRR rates in October, while the aggregate fiscal spending in 11-months reached all-time highs (ATHs), signaling massive stimulus.

Contrary to mainstream expectations, the BSP’s accommodative monetary policy has led to an increase in Treasury bond yields rather than a decrease. (Figure 4, middle image)

This rise is influenced not only by the Federal Reserve's policies but also by domestic inflation, which has been incrementally rising.

Additionally, the yield curve for local Treasuries has steepened significantly, indicating heightened inflation risks. (Figure 4, lowest chart)

Lastly, San Miguel’s deviation from the recent market uptrend might have served as the canary in the coal mine, signaling potential broader market distress.

Also from last October 7, 2024

Finally, SMC share prices continue to move diametrically opposite to the sizzling hot PSEi 30. (Figure 7, lowest graph)

What gives? Will SMC’s debt breach the Php 1.5 trillion barrier in Q3?

Have SMC’s larger shareholders been pricing in developing liquidity concerns? If so, why are bank shares skyrocketing, when some of them are SMC’s biggest creditors?

Figure 5

San Miguel’s share price was one of the biggest casualties, diving below the panic levels of March 2020. (Figure 5, upper window)

Its market capitalization plunged to Php 155 billion while grappling with a debt of Php 1.477 trillion. Falling equity and rising debt—what could go wrong?

Could there be domestic funds facing liquidity constraints, forced to raise cash quickly by selling at any price? And has this liquidation exacerbated San Miguel’s financial dilemma?

V. Price Distortions from the Changes in PSE’s Membership Amplified the Market’s Volatility

Lastly, the reconstitution of the PSEi 30 has contributed to market volatility.

The inclusion of AREIT and China Banking Corporation (CBC), which will replace Wilcon (WLCON) and Nickel Asia (NIKL) effective February 4, 2025, resulted in steep declines for the outgoing stocks: WLCON fell 10.16%, and NIKL plummeted 30.2%. (Figure 5, lower graph)

Meanwhile, funds tracking the PSEi 30 rotated into CBC (+33.81%) and AREIT (+4.74%).

Figure 6

Fundamentals hardly explain the irrational share price behavior of the affected firms.

CBC’s parabolic move has turned it into a meme stock or crypto, even as the share prices of its peers have tumbled.

In the meantime, it also doesn't explain the sharp drop in NIKL's price. Although nickel prices have been on a downtrend, they have not collapsed. (Figure 6 topmost pane)

Shares of competitors FNI and MARC were down 1.96% and 8.96%, respectively, WoW. (Figure 6, middle graph)

In short, the PSE's proclivity to chase top performers while discarding laggards has only amplified the price distortions within the PSEi 30.

VI. Summary and Conclusion

The January 2025 meltdown has brought to light the deteriorating fundamentals underlying the Philippine financial markets and economy.

This crisis is not isolated to the Philippine Stock Exchange (PSE) but also resonates with some ASEAN counterparts. Could this be emerging signs of Asian Crisis 2.0?

If historical trends of January and the volatility associated with the Year of the Snake are to repeat themselves, and if the double top pattern materializes, this suggests a significant deficit or loss for the PSEi 30 by the end of 2025.

Could the recent turmoil in the PSEi 30 be indicative of escalating liquidity pressures among domestic fund managers?

If this is the case, future stress could manifest in the treasury market and influence the US dollar-Philippine peso exchange rate $USDPHP.

Certainly, given that the PSEi 30 has become heavily oversold, a notable rebound might be anticipated. However, this scenario presents not an opportunity for accumulation but rather for liquidation.

Unless one is an expert in scalping, short-term trades involve significant risks (Figure 6, lowest chart)

Remember, cash remains the best defense against a bear market—whether through foreign exchange (FX) accounts or Treasury bills (T-bills).

___

Disclosure: The author holds a

small position in NIKL as of the time of writing.