I was shocked to learn that office space rental prices in Myanmar has zoomed past their equivalent in New York’s Manhattan

Sean Danley has spent the past six months scouting office space in Yangon after being sent to establish the Myanmar branch of his U.S.-based employer.

He looked in the city’s three sole 1990s-era towers, where annual rents have climbed to more than $100 a square foot, compared with less than $75 in downtown Manhattan, according to broker CBRE Group Inc. Too expensive, he said.

The villas he considered either didn’t have safety exits, weren’t clean, required sharing space with other companies or were in odd locations -- all unsuitable to the image of his $29 billion in revenue engineering and construction company, which he said he wasn’t authorized to identify. After seeing 10 places and losing one possibility to someone faster with his “bag of money,” Danley is still looking.

BUT the global yield chasing phenomenon has apparently seeped or spread into Myanmar’s economy, as evidenced by escalating the inflating property bubble as I earlier noted in June of 2012

One can sense mania when the investing public imprudently ignore risks. From the same Bloomberg article:

International developers will probably seek partnerships with local counterparts in a country where they’re not yet sure of rules and regulations, Pun said. For large-scale projects, some foreign companies bring their own workers from outside, while also using local resources available, he said.

Foreigners have been stampeding into Myanmar in the anticipation that foreigners will “no longer require a local partner to start a business in the country, and will be able to legally lease but not own property” based on a March 2012 draft foreign investment law (Wikipedia.org).

But foreigners are prohibited to own land and immovable property (PWC).

So the massive influx of foreign investments on the non-property sectors has played a significant role in driving up Myanmar’s property prices to stratospheric heights.

Yet one would wonder how such eye-popping scale of property price inflation has been financed.

Myanmar has a dysfunctional, “outdated and debased” banking system as a result of decades of “abuse by the previous regime”. The banking system has effectively been “shunned by about 90% of the population” (CNN) where the average Burmese simply hold their savings or cash at home.

Financial services such as loans, financial products, interbank operations and other forms of credit barely exists.

And the absence of a viable banking system and capital markets has prompted residents to turn into “real estate as a place to stash their cash” according to a Myanmar based finance analyst (Quartz).

And because of the largely cash based nature of the transactions in the property sector, some analysts opine that the boom-bust cycle in Burma has been “overstated”.

I believe that the cash transaction segment of Myanmar’s markets sizzling hot property markets represents only part of the story.

According to a survey conducted by an IFC report only 16% of households use the formal financial services. The other sources of loans emanates from family, friends and moneylenders [IFC: Microfinance in Myanmar Sector Assessment] So Myanmar has a huge shadow banking system which essentially eclipses the formal banking sector.

Importantly, the idea of the absence of leverage in Myanmar’s property boom may not entirely reflect on reality.

Singapore has played a big role in providing financial services to Myanmar even when US sanctions were in place. According to Hans Vriens of the Insight Bureau Briefings, “Most overseas transactions are handled in Singapore, which acts like an off-shore banking platform for Myanmar and using the informal hundi system”

Additionally, aside from the $2.4 billion of bilateral trade, there has been “significant business presence by Singaporean firms on Myanmar” as well as a “large Myanmar community in Singapore and a pool of Myanmar companies using Singapore as an intermediary hub to expand overseas”. 95% of Myanmar’s foreign transactions reportedly has been coursed through Singapore’s United Overseas Bank (UOB) (Asia One Business).

So loans by the informal sector may have partly been financed by Singaporeans and or Myanmar based investors domiciled in Singapore.

This also implies that while property transactions may have mostly been executed through cash, the source of funding may have been conducted through shadow banks, or through overseas lending via Singapore’s banks or both.

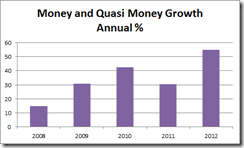

Whatever the source of transactions, one thing is clear, Myanmar’s money supply has been exploding, according to the World Bank’s Data.

Myanmar’s excessively high property prices (or property bubble) is likely either to fall from its own weight or would likely recoil from the prospects of monetary tightening as consequence to ongoing instability in the global bond markets.

It's unfortunate that central bank's inflationism will act as spoiler to what has generally been a positive development.