Central bankers and interventionists need to stop approaching the system as one driven by random shocks, because this mind-set leads them to manipulate and attempt to control the system — a cycle that destroys far more in the long run than it saves temporarily.The longer they erroneous thinking persists, the more out of balance things become, until there is a tinderbox of malinvestment ready to ignite in a massive, uncontrollable inferno. Mark Spitznagel

I described the Wile E. Coyote Moment as the incompatibility or the unsustainable relationship between rising trend of risk assets, particularly stock markets, amidst the conflicting forces of ascendant bond yields and of elevated oil prices or particularly $100 per bbl[1].

The stock markets operates on a Wile E. Coyote moment. These forces are incompatible and serves as major headwinds to the stock markets. Such relationship eventually will become unglued. Either bond yields and oil prices will have to fall to sustain rising stocks, or stock markets will have to reflect on the new reality brought about by higher interest rates (and oil prices), or that all three will have to adjust accordingly...hopefully in an 'orderly' fashion. Well, the other possibility from 'orderly' is disorderly or instability.

This is not to say that stock markets won’t rise, but rather rising bond yields compounded by rising oil prices magnifies the risks of sharp and intense downside volatility for credit fueled stock markets.

Thursday’s Global Bond Market Crash and $110 Oil Prices

Stock markets mentally conditioned or programmed to the Bernanke Put or government-central guarantees and from $150 billion a month stimulus (US Fed $85 billion + Bank of Japan $70 billion) have largely been desensitized to risks.

The ingrained belief has been that goverments will continue to support the markets and that expectations of the Fed’s tapering (marginal reduction from the $85 billion) will hardly affect on “fundamentals”.

Yet absent in mainstream media last week was Thursay’s huge crash in the global bond markets[2].

The yields of 10 year US treasury notes (UST) alone jumped 20 basis points to 2.938% from last week’s 2.74%, this week.

Last Thursday, the same UST yields raced by 82 basis points from 2.897% to 2.979% to a two year high which nearly breached the 3% level. Thursday’s huge yield gains virtually erased the declines during the early week.

This week’s remarkable 7.3% weekly upswing in 10 year UST yields compounds on the year-to-date performance where at Friday’s 2.938%, gains on yields have accrued to 123 basis points or 71% year-to-date.

And even more remarkable has been what seems as the broadening of losses of the international sovereign bond markets[3] (soaring yields). With Asia also posting huge increases in sovereign bond yields I would estimate that vastly more than 60% of the $99 trillion bond markets have been afflicted by the actions of the bond vigilantes.

Since stock markets shrugged off the activities in the bond markets, media has largely been reticent of this increasing fragility of the market system’

Yet the sustained spike in yields of the UST appear to be intensifying thereby deepening the degree of volatility or the ambiance of uncertainty in the immensely larger bond markets.

Importantly, UST yields have been rising faster than US equity benchmarks (S&P 500 16.06% Dow Jones 13.88% year to date), the statistical economy 2.5% in 2nd quarter[4] and even corporate earnings at an estimated 3.6% for Q3 2013[5]

In other words, the cost of servicing debt has been climbing alarmingly faster than the economy’s ability to pay them (via real economic growth) and from Ponzi finance dynamics—where the liabilities are growing far more than the increases in asset prices.

In Ponzi finance[6], refinancing debt ultimately depends on a sustained appreciation of the value of assets that should be greater than the cost of debt service.

And for US stocks which has partly been powered by near record levels of net margin debt[7] and from share buybacks funded mostly by bonds[8] in reaction to distortions in the tax environment[9] and to the easy money environment, rising yields across the curve may not only impede fund raising activity to sustain an upside move for the US stocks but also jeopardize the credit quality of stock market borrowers.

Over the past 13 years, rising yields and rising S&P 500 (green arrows) has resulted to either a market crash (2007-8) or major retrenchments (green ellipses). I only noted of the major moves, there are minor symmetries between stocks and UST yields.

But rising yields have not only been a threat, it is being compounded by the recent breakout of oil prices.

Rising yields may reflect on price inflation dynamics. A strong upside on oil prices may reinforce the public’s inflation expectations thus add to pressures for higher UST yields.

In the past, except for one instance, a period of sharp increases in oil prices produced mostly negative returns for US equities[10]. The biggest beneficiaries has been T-bills and high quality debt.

$100+bbl oil have been associated with falling US stocks. $100 oil ($140 bbl) aggravated the troubles of the bursting US housing bubble in 2008 where the S&P dived.

Subsequent events where oil prices jumped over $100 bbl have also shown an eventual ‘meaningful’ retracements for the US S&P 500.

Sharp increases in oil prices has also been associated with 11 of the 12 post-World War II recessions in the US as I previously pointed out[11].

While oil prices are hardly the cause of recessions, they signify as symptoms to an underlying problem. In the current case, if oil prices continue to ascend, which as noted above will exacerbate pressures on the bond markets via the inflation premium, then significantly higher yields will likely undermine economic activities of interest rate sensitive industries. And considering today’s highly leveraged or debt laden economy, a severe slowdown may result to a broad based contamination that would only enhance the risk of a recession.

The accelerating increase of bond yields combined with soaring oil prices can be analogized to a ticking time bomb on the US stock market.

Don’t Ignore the War Premium

And as much as the destiny of bond yields have partly been tied to oil prices. Oil prices have partially been connected with geopolitics.

The Obama administration has been appealing for a limited military strike on Syria[12] based on allegations that the Syrian government has used chemical weapons against the US suppported rebels. Ironically the US government has been in support of rebel groups whom have links to terror ‘Al Qeada’ groups[13].

Yet the US government seems as having a difficult time assembling an international coalition. Even at home, the Obama adminstiration’s proposed military actions has been unpopular.

Some Pollyannaish analysts see the propects of the Syrian war as having little negative effects on the markets. They even cite academic literatures which exhibits how recent engagements by the US has led even to rising markets. Yet this represents an example of underestimating risks by relying on misleading historical data sets and by comparing apples with oranges.

In the current predicament, given evidences that the chemical weapon recently used in Syria’s civil war has been attributed to US supported rebels who may have used this to raise a “false flag” or ‘provocation” to encourage “western intervention”[14], Russian president Vladimir Putin has declared at the G-20 that the Russians will help Syria[15].

The Russian President seems as taking advantage of the unpopularity of Obama’s agenda to score political points. 7 nations, the UN president and the Vatican via Pope Frances have been reported as categorically against a military intervention in Syria.

And of course given Russia’s significant role as energy provider to the EU where 34% of EU’s crude oil imports come from Russia (as of 2010) aside from imports of “significant volumes of refined products”[16], Russia’s energy geopolitics appears to have swayed the EU to mute their support for a US led military intervention.

While declaring strongly against the chemical weapons, the European Union said that military strike should come only after the findings of UN inspections

The point is: during wars of the recent past, there hardly has been a major nuclear power involved in the opposite fence. So underestimating the possible involvement of Russia could signify as a source of a Black Swan.

A Syrian strike by the US could extrapolate to the escalation risks or “one thing leads to another”. As German Field commander and one of the greatest strategists of the 19th century Helmuth von Moltke the Elder said "no plan survives contact with the enemy”[17].

And an accident can provoke a confrontation between the major superpowers of the US-Russia. And initial engagements may spread and intensify.

Once emotions get the better of any of the warring parties, the temptation to use nuclear weapons can be compelling.

Should the military conflict degenerate into a full scale nuclear war where both protagonist holds significant inventory of nuclear weapons[18], then you can kiss tomorrow goodbye.

Given the Philippines has shown to be a lackey of the US, one can’t discount that one of the anti US missiles may be targeted here.

Remember in World War II, the Japanese occupation of the Philippines begun on December 8th 1941, only a day after the bombing of Pearl Harbor[19].

Should we be lucky enough that a nuclear exchange will be limited, the scale of destruction will unlikely be a bullish outcome.

Also remember current warfare involves high technology weaponries to include drones, cyberwarfare and more. So it would be a mistake to view conventional warfare with World War II strategies and tactics.

And even if there won’t be a direct confrontation between two super nuclear powers, the proxy war could prompt for a contagion that sends the Middle East region engulfed in flames, thereby spiking oil prices to $200 bbl or more oil that would cause a global recession.

There is also the financial aspect to the warfare. Russia has $138 billion worth of USTs as of June[20]. Should Russia and her allies wish to undermine financing of the US war machine, they can resort to dumping USTs in order to shoot up bond yields that would unsettle and possibly force a recession on the US economy

During the past where major economies squared off in the battlefield or have threatened to do so, stock markets barely welcomed such conflict.

In the Korean war of 1950-1953[21] where the USSR supported 1.35 million Chinese forces who fought alongside the North Koreans against the combined troops of South Korea and an international alliance led by the US which ended in an armistice, the S&P 500 fell by about 15% during the outbreak.

Perhaps the US markets realized of the limitations in the scope of damage and of the potential contagion, since the conventional methods of the Korean War had practically been a carryover of World War II, such that the negative effects of war had been discounted.

Also inflationary financing of the war may have also contributed to the booming stocks.

A more related event has been the 13 day Cuban missle crisis of October 1962 where the standoff by US and the USSR brought them closest to a nuclear conflict[22].

The seeds of the impasse began when the U.S. launched an embargo against Cuba in February 1962[23], US stocks as measured by the S&P 500 began its gruelling steep 4 month bear market dive. The S&P lost about 28% (peak to trough).

The S&P rallied from July to September only to fall back to the proximity of June lows. The S&P 500 began to rally once the contending parties reached an agreement on October 28th, 1962.

While I am not saying that any of the above will function as the current paradigm, since current events and conditions (including level of technology, political economic environment legal framework, market and legal institutions and etc…) are vastly dissimilar from then, what I am saying is that it would be imprudent to dismiss the risks of a financial market contagion if and when US-Syrian war becomes a reality.

As iconoclast author, philosopher and mathematician Nassim Nicolas Taleb rightly points out[24]

risk management is about fragility, not naive interpretation of past data

Troubled President, the Fed’s Leadership Transition and the Debt Ceiling

Policy and political gaffes and the plunging approval ratings by the US president could also be seen as headwind for the US stock markets

"When the president is in trouble, the stock market is in trouble, that’s according to Economist Eliot Janeway (1913-1993)

A US based analyst Jeffrey Saut, chief investment strategist at Raymond James says US President Obama and the US stock market appears to be in big trouble noting that "Those troubles began with the Benghazi scandal, escalated with the (Department of Justice) spying on news reporter James Rosen, followed by the IRS scandal, and now we have Syria. ..In fact, we are even alienating two of our steadfast allies, Saudi Arabia and Israel, whose silence on our Syrian strategy has been deafening."[25]

I would add the blowback from the NSA expose by whistleblower Edward Snowden as another factor.

The proposed Syrian military caper can be read in two ways or even a combo: one as diversion from policy blunders and an attempt to shore up popularity ratings by appealing to nationalism, and two, a proxy war and a staging point for future actions Iran[26] in favor of the cabal of politcally influential Israel-neoconservative groups and of the military industrial complex.

The underlying cog behind the wheel rational for portentous stock markets from a troubled president is uncertainty. And uncertainty clouds the investors economic calculation and reduces confidence levels which leads to reduced investments or even appetite for speculations.

Political uncertainty hasn’t just affected the domain of the executive branch but also on the leadership of the US Federal Reserve.

Given that the incumbent Fed chair Ben Bernanke is likely due for the exit door or will retire on January 2014, where media has been rabidly speculating on the potential replacement or who President Obama will appoint, the choices of candidates for Mr. Bernanke’s replacement seems to have narrowed down[27] to US Federal Reserve vice chair Janet Yellen or ex-Harvard President and director for President Obama’s US National Economic Council Larry Summers.

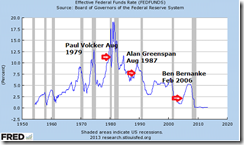

Unknown to many the FED leadership transition process have coincided with large spikes in interest rates as measured by the FED Fund Rate[28]. Current rioting bond yields appear to reinforce such dynamic.

It is possible aside from the many stated reasons (uncertainty over effectivness of current easing policies, too much debt, diminishing real savings or scarcity of capital, inflation premium), uncertainty over the new leadership’s policy direction could exacerbate on the current conditions.

Nevertheless it isn’t a certainty that the assumption of a new Fed chair may calm the bond markets as many of the cited factors may continue to dominate bond market pricing.

Finally another source of uncertainty will likely be the bi-partisan debate on the coming debt limit which is due to be reached by mid-October[29].

Bizarrely the US debt appears to have been “locked in at this implausible limit for three months: $16,699,396,000,000” notes Austrian economist Gary North which may be due to “cooked books”[30]. There seems to be some beef on this. Rising yields of USTs may partly be signalling the “cooked book” “locked in” debt levels uncertainty story, where the public doubts on the accuracy of the reported fiscal conditions, uncertainty may prompt investors to sell.

Bottom line: Risks are Intensifying

Many of the bullish case for a rebound on global (Asian and emerging market) stock markets has been anchored on the US recovery story (aside from Europe and Japan).

But contrary to this assertion, indications are that the Wile E Coyote moment seems as intensifying. Sharply rising bond yields and surging $100+ oil prices have been inconsistent with rising stocks both from theoretical and from empirical perspectives. Thursday’s global sovereign bond market crash reinforces such systemic fragility.

While stocks may rise in the interim, due to the grasping at the straws by increasingly desperate yield chasing seekers, such upside actions, which will likely be limited, will magnify on the downside risks.

And adding to the uncertainties that may push or drive bond yields and oil prices higher is the war premium. A realization of a US military strike on Syria may increase the chances of an accidental confrontation with Russia which may increase the risks of escalation. And even without Russia’s direct involvement, a proxy war could also lead to contagion or a destabilization of the Middle East.

The Syrian war crisis may compound on the troubles brought about by the bond vigilantes. These are risks that shouldn’t be discounted without intense scrutiny and evaluation.

Aside from the war premium, other political uncertainties may blight the risk environment. Political uncertainties reflecting on a troubled leadership for the US executive branch, the transition process on the leadership selection for the US Federal Reserve and the coming debt ceiling debate may add to the turmoil in the US bond markets

Finally bond market volatility in itself represents a major source of market risk or instability. For as long as the volatilities in bond markets has not been contained, global financial markets will remain highly fragile and vulnerable to intense downside actions.

And turmoil in the US equity markets will act as the final nail in the coffin for the global contemporaries.