The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, November 25, 2012

Infographic:Is the US government preparing for a civil war?

Thursday, September 13, 2012

Quote of the Day: Wikileaks’ Tweet on US Embassy Attack at Libya

By the US accepting the UK siege on the Ecuadorian embassy in London it gave tacit approval for attacks on embassies around the world.

Source: Business Insider

For a short background, in fear of extradition to the US (through Sweden) out of political harassment for exposing many of the secrets of the US government, Wikileaks founder Julian Assange sought refuge at the Ecuador Embassy in London which was recently besieged by UK officials.

Wikileaks thus attempts to associate the US embassy attack to the harassment being endured by its founder.

Thursday, May 10, 2012

The Disadvantage of having an American Citizenship

The US government seems to be applying a pincer movement—or a military maneuver where the flanks of the opponent are attacked simultaneously in a pinching motion after the opponent has advanced towards the center of an army which is responding by moving its outside forces to the enemy's flanks, in order to surround it (Wikipedia.org)—to its own citizens, by imposing repressive tax laws that restricts capital movements outside the US.

Now even wealth management firms are advocating wealthy Americans to FLEE the US.

From Bloomberg,

Go away, American millionaires.

That’s what some of the world’s largest wealth-management firms are saying ahead of Washington’s implementation of the Foreign Account Tax Compliance Act, known as Fatca, which seeks to prevent tax evasion by Americans with offshore accounts. HSBC Holdings Plc (HSBA), Deutsche Bank AG, Bank of Singapore Ltd. and DBS Group Holdings Ltd. (DBS) all say they have turned away business.

“I don’t open U.S. accounts, period,” said Su Shan Tan, head of private banking at Singapore-based DBS, Southeast Asia’s largest lender, who described regulatory attitudes toward U.S. clients as “Draconian.”

The 2010 law, to be phased in starting Jan. 1, 2013, requires financial institutions based outside the U.S. to obtain and report information about income and interest payments accrued to the accounts of American clients. It means additional compliance costs for banks and fewer investment options and advisers for all U.S. citizens living abroad, which could affect their ability to generate returns.

“In the long run, if Americans have less and less opportunities to invest overseas, it would be a disadvantage,” Marc Faber, the fund manager and publisher of the Gloom, Boom and Doom report, said last month in Singapore.

The almost 400 pages of proposed rules issued by the U.S. Internal Revenue Service in February create “unnecessary burdens and costs,” the Institute of International Bankers and the European Banking Federation said in an April 30 letter to the IRS, one of more than 200 submitted to the agency. The IRS plans to hold a hearing May 15 and could amend how and when some aspects of the rules are implemented. It can’t rescind the law.

Obviously the Obama administration’s ploy has been to coercively capture resources of Americans through more policies of financial repression channeled through inflationism (negative real rates and QE), taxes, bank regulations, anti money laundering laws and capital controls

More from the same article…

“Bank accounts, investment accounts, mortgages and insurance policies are being refused to American clients, and those with accounts are seeing them closed or have been threatened with closure,” Marylouise Serrato, executive director of American Citizens Abroad, a Geneva-based organization, wrote in an e-mail.

U.S. citizens who live in countries that aren’t served by U.S. banks may find themselves unable to bank at all, and implementation of the law in its current form could cause collateral damage to American businesses abroad, she said.

“Americans either will not be allowed to enter into international partnerships or live and work overseas, and will be replaced by foreign nationals who do not have these limitations,” Serrato wrote. “The extensive reporting requirements of Fatca will be destructive to those who wish to do business internationally as well as to those Americans who are legitimately living and working overseas.”…

While that may be easy for Americans in Singapore, those who live elsewhere face obstacles. Before Fatca, U.S. citizens in Bangkok or Manila could find investment opportunities through non-U.S. banks such as HSBC. Now their only option is to fly to cities where U.S. firms operate.

Limited Choices

If Americans choose to bank with a non-U.S. firm such as HSBC, their investment choices are limited. At the HSBC branch in the bank’s Asia regional headquarters in Hong Kong, Americans can hold only savings deposits. They’re prohibited from opening accounts to trade local stocks or buy products available to non- U.S. customers, including 45 equity funds investing in China or other geographies and industries. There’s only one comparable emerging-markets equity option available on HSBC’s U.S.-based investors’ website.

Financial institutions that choose not to accept American customers still must determine whether new or existing clients are so-called U.S. persons in order to comply with Fatca, according to Michael Brevetta, director of U.S. tax consulting at PricewaterhouseCoopers LLP in Singapore.

The definition includes citizens, green-card holders and non-Americans deemed U.S. residents by being present in the country for at least 183 days over a three-year period, which makes them subject to U.S. tax on their worldwide income, according to the IRS.

Compliance Costs

The compliance costs for banks, asset managers and insurance companies “could stretch into the billions of dollars,” Brevetta said. Private-banking firms in Hong Kong and Singapore already have operating costs between 88 percent and 90 percent of their revenue, compared with 70 percent at Swiss banks, PricewaterhouseCoopers estimated in a September report.

Penalties for not complying will be stiff. Non-U.S. firms that don’t make required disclosures will be subject to 30 percent withholding of certain dividends, interest or proceeds from the sale of assets they or their customers receive from U.S. sources, according to Baker & McKenzie’s Weisman, who has conducted workshops and seminars on the proposed rules for current and potential clients in Hong Kong and Singapore.

Wow. The above essentially signifies as the proverbial “writing on the wall” of the growing desperation by the US government over her unwieldy state of finances due to a bloated and unsustainable welfare-warfare economy.

Not only will US citizens be restricted access to foreign financial institutions, such tax laws are subtle manifestation of protectionism as overseas investments from US investors will be severely limited. [As one would note, foreign banks have been in retaliation to the encroaching protectionist US tax laws by denying Americans access]

President Obama’s nationalist-protectionist rhetoric over BPOs is apparently being realized via arbitrary tax laws. Yet protectionism will only compound to the nation's fragile economic conditions.

F. A. Hayek once warned that Americans are headed towards the road to serfdom. His admonitions appear as becoming a reality with the deepening of America’s police state aside from snowballing political and economic fascism, signs of which the US could be in a slippery slope towards dictatorship.

Yet such laws will have adverse consequences. This should incentivize, not only more tax avoidance measures, but also prompt wealthy Americans to consider giving up on their citizenship.

True, US government has made the exit option a burden. There have been reported incidences where the US government has denied applications by Americans wishing to renounce their citizenship (Sovereign Man).

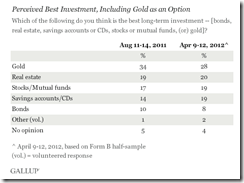

Limiting people's actions increases political destabilization. Again all these seem to square with record gun sales, polls where gold seen as the best investment option, ballooning sales of home safe and even a report where the US government has been preparing for a “civil war”.

Political risks has certainly been mounting in the US as political and economic repression suggest that the US has been increasingly at war with their citizens.

I recall that after college graduation, a relative who is a resident of the US encouraged me to emigrate to the US and apply for American citizenship. Now I realize that this decision of mine to say NO may have seemed worthwhile or the right decision.

Saturday, May 05, 2012

Are Booming Sales of Home Safes signs of the Next Crisis?

In the US, home safes or vaults seem to be in fashion

From Smart Money

In an era marked by financial turbulence, it's probably not surprising that safes have become a popular commodity, with some manufacturers, retailers and installers reporting sales increases of as much as 40 percent from a few years ago. But the bigger eyebrow-raiser is what has happened to those iconic gray-steel boxes of yore: They've undergone an extreme makeover -- or several of them. Taking the place of those old square combination jobs are a range of custom safes, from boutique showpieces to decoy models for the family den -- not to mention the truly offbeat (a hideaway lockbox resembling, ahem, a pair of men's underwear) and the seriously safe (an in-home vault with a price tag of more than $100,000). And that's not even getting into the ever-broadening array of color choices (champagne marble, anyone?) "None of our safes should be hidden in a closet," says Markus Dottling, principal at Dottling, a German specialty-safe manufacturer whose museum-worthy designs can cost more than the average American house.

One thing that isn't driving the safe boom, apparently, is crime. Indeed, U.S. burglary rates have been plunging for years. Still, experts say that many savers and investors feel a lingering sense of insecurity in their finances -- a hard-to-shake fear borne out of the jolting recession and, at times, wobbly recovery -- which is helping to spur the new safeguarding mentality. Tyler D. Nunnally, founder and CEO of Upside Risk, an Atlanta firm that researches investor psychology, says sticking tangible assets in a safe can be a natural reaction to volatility in the markets. "People dislike loss twice as much as they like gains," he says. "They want to protect what they have." Growing numbers of these fearful types simply don't trust their banks to protect them: In a Gallup poll last year, a record-high 36 percent of Americans said they had "very little" or "no" confidence in U.S. banks. (In 2008 and 2009, when the financial crisis was peaking, that figure stood at 22 and 29 percent, respectively.) And growing concern about identity theft has made some people more eager to keep their assets in a form they can see and count, says R. Brent Lang, an investment manager in Surrey, British Columbia: "By acquiring one password, someone can wipe out all your digital wealth," he says.

That’s because many people seem to be taking measures to protect their wealth. “Don’t trust their banks”, “insecurity in their finances” “identity theft” and “crime” has been cited as reasons for the dramatic shift in the perception of risks.

Yet mainstream experts will see “stashing or hoarding cash” as “negative” for the economy which is hardly accurate. As the great Professor Murray N. Rothbard explained in What has Government Done to Our Money? (bold emphasis mine, italics original)

Why do people keep any cash balances at all? Suppose that all of us were able to foretell the future with absolute certainty. In that case, no one would have to keep cash balances on hand. Everyone would know exactly how much he will spend, and how much income he will receive, at all future dates. He need not keep any money at hand, but will lend out his gold so as to receive his payments in the needed amounts on the very days he makes his expenditures. But, of course, we necessarily live in a world of uncertainty. People do not precisely know what will happen to them, or what their future incomes or costs will be. The more uncertain and fearful they are, the more cash balances they will want to hold; the more secure, the less cash they will wish to keep on hand. Another reason for keeping cash is also a function of the real world of uncertainty. If people expect the price of money to fall in the near future, they will spend their money now while money is more valuable, thus "dishoarding" and reducing their demand for money. Conversely, if they expect the price of money to rise, they will wait to spend money later when it is more valuable, and their demand for cash will increase. People's demands for cash balances, then, rise and fall for good and sound reasons.

Economists err if they believe something is wrong when money is not in constant, active "circulation." Money is only useful for exchange value, true, but it is not only useful at the actual moment of exchange. This truth has been often overlooked. Money is just as useful when lying "idle" in somebody's cash balance, even in a miser's "hoard." For that money is being held now in wait for possible future exchange--it supplies to its owner, right now, the usefulness of permitting exchanges at any time--present or future--the owner might desire.

In short, since people don’t know the future and where the perception of the risk of uncertainty are being amplified, the increased demand for money represents people’s satisfaction.

However the mainstream would then use “lack of aggregate demand” or insufficient consumption as further justification for government intrusion. In reality, today’s uncertain environments have been caused by excessive and obstructive role of governments.

Record gun sales (Telegraph) and gold seen as the "best investment option" (Gallup) seem to correspond with the growing demand for home safes or vaults. All these add up to highlight heightened uncertainty.

Add to this a bleak report which noted that the US government may be preparing for a “civil war”.

From Beacon Equity Research,

In a riveting interview on TruNews Radio, Wednesday, private investigator Doug Hagmann said high-level, reliable sources told him the U.S. Department of Homeland Security (DHS) is preparing for “massive civil war” in America.

“Folks, we’re getting ready for one massive economic collapse,” Hagmann told TruNews host Rick Wiles.

“We have problems . . . The federal government is preparing for civil uprising,” he added, “so every time you hear about troop movements, every time you hear about movements of military equipment, the militarization of the police, the buying of the ammunition, all of this is . . . they (DHS) are preparing for a massive uprising.”

Hagmann goes on to say that his sources tell him the concerns of the DHS stem from a collapse of the U.S. dollar and the hyperinflation a collapse in the value of the world’s primary reserve currency implies to a nation of 311 million Americans, who, for the significant portion of the population, is armed.

Uprisings in Greece is, indeed, a problem, but an uprising of armed Americans becomes a matter of serious national security, a point addressed in a recent report by the Pentagon and highlighted as a vulnerability and threat to the U.S. during war-game exercises at the Department of Defense last year, according to one of the DoD’s war-game participants, Jim Rickards, author of Currency Wars: The Making of the Next Global Crisis.

Where government interventionism and inflationism has been intensifying, all designed to protect the interests of vested interest groups (unions), cronies (such as green energy, banking system, and others) and the welfare and warfare state, then the risks of a political economic meltdown grows.

I hope that Americans will come to the realization that interventionism and inflationism are economically unsustainable policies and promptly act to reform the system before disaster strikes. Remember, what happens to the US will most likely ripple across the globe.

Nevertheless, as for everyone else, while we should hope for the best, we should prepare for the worst.