``No drug, not even alcohol, causes the fundamental ills of society. If we're looking for the source of our troubles, we shouldn't test people for drugs, we should test them for stupidity, ignorance, greed and love of power.”-P.J. O'Rourke, American Political Commentator, Journalist

In a recent discussion, a colleague raised the issue of whether locals should consider investing overseas given today’s financial globalization. My immediate reply was that there is no general answer to these concerns as this would depend on the distinct goals of each individual.

Some could see overseas investing as a way to tap overseas opportunities unavailable to the domestic market, others may contemplate on putting eggs into different markets or for portfolio diversification, some because of perceived higher returns or lower transaction costs, some for tax purposes or “recycling of funds” or some for just plain curiosity or even vanity (the need to feel sophisticated).

Nonetheless, global retail overseas investing has been a growing trend supported by the ongoing integration and the deepening of financial markets, technology advances such as real time online trading platforms, relaxation of capital flow regulations and the lowering of so-called Home Bias.

As an example, we previously mentioned of the metaphorical Mrs. Watanabes of Japan, an embodiment of retail investors who, because of their high savings and nearly zero interest rates, have used the international currency market to enhance returns, which became an important foundation of the global carry trade arbitrages.

According to the Economist, the ``Mr and Mrs Watanabe account for around 30% of the foreign-exchange market in Tokyo by value and volume of transactions, according to currency traders, double the share of a year ago. Meanwhile, the size of the retail market has more than doubled to about $15 billion a day.” (highlight mine)

For those who are contemplating to undertake offshore investments should consider the risk-reward tradeoffs than simply plunging into the pool without appropriately understanding the risks involved. As Warren Buffett cautioned, ``Risk comes from not knowing what you're doing.”

Risks From Direct Investing

Here is a rundown on some of the risks we need to consider when investing abroad:

1. Currency Risk-

As defined by Investopedia.com, ``A form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.”

As an example, you may gain 10% from your equity investments abroad but a corresponding 10% loss in the currency from which your equity investments are denominated effectively offsets your gain. A worst case would be to see your equity investments values fall in a currency that is also losing- a double whammy!

The important point is that investing abroad requires the comprehension of the fundamental dynamics of the currency market.

This perhaps is the main reason why the Mr. and Mrs. Watanabes opted for the carry trade arbitrage in the currency market which has now evolved into a $3.2 trillion a day turnover than from equity investments, because currency trading signifies as the simplest route to access offshore opportunities.

In other words, you only have to deal with the currency equation without having to complicate your investing perspective with other risk concerns.

As an aside, this is where home bias has a defined advantage for equity investments, simply because you reduce the risk of currency volatility or your risk spectrum is mostly confined to domestic related influences or variables.

Hence, the optimum goal in investing overseas is to profit from investments on a market that has both an upside potential on the currency and the equity aspects.

2. Beta Risk-

As per Investopedia.com, ``Beta is a measure of a stock's volatility in relation to the market. By definition, the market has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market. A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than the market, the stock's beta is less than 1.0. High-beta stocks are supposed to be riskier but provide a potential for higher returns; low-beta stocks pose less risk but also lower returns.”

Essentially such risk measure is one of correlation of a market (or a benchmark) among other markets or of individual stock or sectoral benchmark relative to its operating market; see Figure 1 as our example.

Figure 1: Danske Bank: Correlation of EM Markets (left) and Global Equity-Financials (right)

Figure 1: Danske Bank: Correlation of EM Markets (left) and Global Equity-Financials (right)In today’s generally deteriorating equity markets, we see the US markets, despite being the epicenter of the crisis, outperforming Emerging Markets (EM). Of course, the chart’s perspective comes from a one year period and doesn’t show the larger picture. Prior to the crisis EM benchmarks have markedly outperformed the US; where, in spite of the present losses, EM continues to outperform over the past 5 years (remember framing matters).

From here we can deduce that EM markets tend to outperform during better days and underperform during periods of stress. The broad implications to portfolio allocations would be to long EM once the recovery is in the horizon and long US markets when the world tilts to a crisis, although perhaps an alternative proposition would be to long Gold or traditional currency havens as Swiss Franc or Japanese Yen for the latter scenario. This also suggests that in order to distribute or dissipate risk requires the arbitrage of different asset classes in different markets around the world.

Another, the left pane illustrates how Financials stocks have been tightly correlated with the general global equity bellwether. While Financial stocks have suffered more than the bellwether of global ex-financial stocks, the strains of the former has likewise generated a downside trajectory to the latter, the causality of which generally accounts for the function of macroeconomic links (see below).

It doesn’t make sense to invest in a market which is highly correlated to your base market unless your goal is to tap industries that are unavailable to the local market. Therefore, if the objective to invest abroad is to diversify, then the ideal approach would be to deal with markets that have either a low or negative correlation.

3. Macroeconomic risk-

Macroeconomic risk generally deals with the performance, structure, and behavior of a national or regional economy as a whole (wikepidia.org).

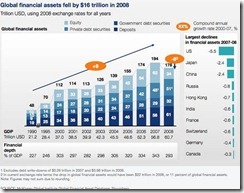

The fundamental reason why the world has been suffering from a growth slowdown or the financial markets agonizing from heavy losses is due to the fundamental impairment of the financial channels (market and banking) whose transmission mechanism is clearly demonstrated above in figure 2.

The tightening of credit conditions from the US led housing-securitization bubble bust have effectively been raising the cost of capital, eroding corporate profits, decreasing business expenditures, magnifying losses in asset holdings among public and private institutions, prompting for the balance sheet restructuring by reducing leverage in private institutions, contracting consumer demand, raising unemployment, lowering prices of commodities and increasing government intervention in markets. And this weakness has been spilling over to the world.

Thus, the recent liquidity contraction translates to a magnified purview of the financial and economic structure of each nation under present turbulent conditions.

Said differently, the performance of markets in reaction to the gummed or gridlocked credit markets and economic downdraft has probably been a reflection of: one) the depth of interconnectedness of a country to the world via trade/financial/political channel, or two) the overall vulnerability of a country’s economic framework.

In essence, macroeconomic risks deal with the risks of an investment theme relative to economic output, national income, inflation, interest rate, capital formation or savings and investment, consumption, fiscal conditions and international trade and finance.

Thus, investing abroad means understanding how economic, financial and political linkages could impact your portfolio.

3. Taxation and Transactional Cost Risk-

From Reuters financial glossary ``The risk that tax laws relating to dividend income and capital gains on shares might change, making stocks less attractive.”

Whereas transaction cost means ``cost incurred in making an economic exchange” (wikipedia.org) which involves the “search or information” cost (search for availability of goods or securities in a specific market), “contracting” cost (cost of negotiation or bargaining) and “coordination/policying and enforcement” costs (meshing of different products and process aside from cost of enforcing the terms of contract) [wikipedia/wikinomics].

This means that prospective investments in overseas market requires the understanding of risk dynamics from the underlying cost structure of the present taxation regime of the host market, aside from its potential changes.

Taxation is part of the transaction costs that could determine the viability of investing overseas. Lower cost of transactions could function as a critical variable if only to wring out additional profits or returns from an economies of scale standpoint.

4. Liquidity Risk-

As defined by investorwords.com, ``The risk that arises from the difficulty of selling an asset. An investment may sometimes need to be sold quickly. Unfortunately, an insufficient secondary market may prevent the liquidation or limit the funds that can be generated from the asset. Some assets are highly liquid and have low liquidity risk (such as stock of a publicly traded company), while other assets are highly illiquid and have high liquidity risk (such as a house).”

In short, liquidity risk can mean the tradeable-ness of a given security or market.

This is somewhat related to the transaction cost where the more liquid or scalable a market is translates to lesser transactional cost.

Example, the Philippine state pension fund Government Service Insurance System (GSIS) has allotted some $1 billion, which makes up around 12% of GSIS’s total loans and investment portfolio for its global investment programme.

This dynamic can be lucidly seen from the AsianInvestor.net article (highlight mine), ``The GSIS will have a tough time generating returns for its members if it continues to stick with Philippine shares because of limited choices and relatively low volume. Low interest rates and the absence of a strong secondary fixed-income market in the Philippines are also constraints.”

Thus, a prospective overseas investor needs to aware of the liquidity conditions of the market or of the specific issues which one intends to deal with.

5. Political and Regulatory risks-

Political risk is a broad definition which essentially encompasses the changing nature of a country’s political structure. This from investorwords.com ``The risk of loss when investing in a given country caused by changes in a country's political structure or policies, such as tax laws, tariffs, expropriation of assets, or restriction in repatriation of profits. For example, a company may suffer from such loss in the case of expropriation or tightened foreign exchange repatriation rules, or from increased credit risk if the government changes policies to make it difficult for the company to pay creditors.”

Such risks get accentuated when government becomes more adverse to private sector participation or to market oriented economic platforms (e.g. Venezuela and Bolivia) or when government policies run roughshod over its constituents (e.g. Zimbabwe) or with its neighbors (e.g. Russia).

As we have noted in Phisix: Learning From the Lessons of Financial History, trade, current account and fiscal surpluses, high forex reserves, low debt or favorable economic or market conditions can be radically overturned by 5 cardinal sins in policymaking; namely-protectionism (nationalism, capital controls), regulatory overkill (high cost from added bureaucracy), monetary policy mistakes (bubble forming policies as negative real rates), excess taxation or war (political instability).

Whereas Regulatory risks are political risks applied more to specific sectors; from investopedia.com, ``The risk that a change in laws and regulations will materially impact a security, business, sector or market. A change in laws or regulations made by the government or a regulatory body can increase the costs of operating a business, reduce the attractiveness of investment and/or change the competitive landscape.”

Hence it is imperative for any overseas aspiring investor to anticipate risks of policy changes that could negatively impact an investing environment.

6. Other Risks

Of course there are other domestic risk issues to deal with such as valuation risks (financial valuation ratios), leverage risks (risks due to debt related exposure) or company specific risks (labor, management, etc.).

Risks From Indirect Investing

Nonetheless one may argue that you can deal with foreign markets through a variety of funds, such as Exchange Traded Funds, ADRs, Hedge funds, mutual funds or trust related funds sold by banks (UITFs) or insurance companies.

But as we previously noted there are issues like:

A. Principal-Agent Problem

This deals with the conflict of interest by investors when dealing with other market participants because of differing goals mostly due to the varied business models. For instance, investors would be mostly concerned about profits or returns on investment (ROI), whereas most brokers would be concerned with the commissions from client transactions while mainstream bankers or fund managers would be interested with the fees generated from the products they sell.

Thus, when bankers, fund managers or brokers issue their inhouse literatures they are mostly designed to sell the products or services they offer than to meet the investor’s objectives.

As Legg Mason’s Michael Maubossin writes in the Sociology of Markets, ``agency theory is relevant because agents now control the market. And, not surprisingly, agents have very different incentives than principals do. And this game is close to zero sum: The more the agents extract, the lower the returns for the principals.”

B. Asymmetric Information

``A situation in which one party in a transaction has more or superior information compared to another. This often happens in transactions where the seller knows more than the buyer, although the reverse can happen as well. Potentially, this could be a harmful situation because one party can take advantage of the other party’s lack of knowledge.” (investopedia.com)

Applied to the financial markets this means that sellers of financial products have more information than the buyer or clients. Thus, clients or investors are likely to submit to the whims of the finance manager, who are usually not invested. In other words, many people have committed their trust and money to fund managers or bankers who don’t even have much stakeholdings in the funds they manage except via fees or profits.

From Chuck Jaffe (marketwatch.com), ``In 46% of the domestic stock funds surveyed, the manager hadn't invested a dime. Other asset classes were far worse with nearly 60% of foreign stock funds reporting no manager ownership, two-thirds of taxable bond funds having no managers with money in the fund, up to 70% of balanced funds having no manager cash and some 78% of muni bond funds having shareholder cash only.”

Besides, investors who bought into funds are subject to information asymmetries on how fund managers or bankers allocate their portfolios. The risk strategies employed by fund managers may not square with the overall risk appetite of the investor or investment managers could be taking in more risks than would be tolerated by their clients.

How Distorted Incentives Contributed To The Mess

How does this relate to investing overseas?

First, no institutions are insuperable. The idea that funds are backed by big institutions should be questioned or scrutinized by every investor here and abroad.

As the lessons from Enron (formerly 7th largest corporation in America) in 2001, the recent fall of the 158 year old Lehman Bros (formerly 4th largest investment bank in the US) and American International Group (largest insurance in the US), fund managers and bankers are not immune to cognitive biases of the herd mentality whose agency problem, because of the desire for more share in the fees derived from profits piled into more leverage and momentum despite being aware of the unsustainable trend and compounded by guiding principle of implicit guarantees of government bailouts, helped triggered the colossal overspeculation fueled by monumental overleverage. It’s not their money anyway.

Evidence? Look at the performance of the $1.9 trillion hedge fund industry (Wall Street Journal), ``Nine out of every 10 of the 4,000 hedge funds surveyed globally by data provider Eurekahedge are performing insufficiently well to beat their high-water mark–the level at which they can charge performance fees, equivalent to a fifth of returns.

``All but 3% of funds of hedge funds were under the mark, according to the survey, as were 90.6% of equity long/short funds, 86% of portfolios focusing on market events, 85.4% of those investing in distressed securities, and 82.6% of futures managers. The picture was also bleak for long-only absolute return funds, 96.5% of which were below their high-water mark. The survey used figures compiled for July 31–the most recent available–and are likely to have worsened since then.”

To consider hedge funds have the ability to trade and profit even on when the market moves to the downside, except for the recent ban on short selling on 950 financial stocks which clearly handicapped their strategies.

Moreover, the agency problem and the information asymmetry dynamics had clearly been a functional component in the bubble formation when investment banks turned into the “originate and distribute models”-where they packaged and sold low quality or subprime mortgages or distributed credit risk, in complicity with the seal of goodstanding from credit rating agencies who ironically derive their revenues from the originators (effectively distorting the incentives to be objective appraisers), to equally unthinking clients or institutions worldwide. Thus, when the bubble imploded, the negative externalities caused by failed government policies espoused and profited by institutional oligopolies borne out of the cartelized financial system will once be folded into the arms of the US government whose concentration risks to the remaining institutions have equally been amplified.

Summary and Recommendations

To recap, to invest overseas isn’t the same as to invest locally primarily because of more risks concerns; particularly currency, beta, macroeconomic, taxation and transactional cost, liquidity, political and regulatory risks and other domestic related risks.

In addition, to rely on indirect exposure abroad via institutional products isn’t as risk free as portrayed by some, or impervious to the corrosive effects of principal-agent and the asymmetric information problem as recent events have clearly shown.

Big institutions have failed and will possibly go under the wringer as the world’s financial system adjust from taking up too much debt more than it can afford. The global credit crisis basically is a consequence of global financial institutions not knowing “who holds what” (similar to the Old maid game), thus we can’t really know who among the big financial players will remain standing or “strong” until the fog from the battlefield has lifted. What we understand is that Asian institutions are supposedly the least impacted compared to their counterparts because of the rear view mirror effects from the Asian Crisis.

The lesson for every investor is to increase their financial literacy and do their homework under some of the risk guidelines as presented above.

For beginners, before trying out overseas investment I suggest for you to get your hands dipped into the local market. Vanity won’t do you any good because tuition fees can be very costly and emotionally distressful. Once you gain experience via the learning curve, you can begin to dabble with markets abroad.

Refrain from the assumption that all markets operate similarly, as advocated by many hardcore technicians, because they aren’t. To analogize using George Orwell’s Animal Farm, ``All animals are equal, but some animals are more equal than others.” In addition, the supposition that markets contain all the information isn’t true as the information asymmetry dynamics above suggests.

It would be recommended that you should use the international markets to compliment your overall portfolio strategy by either going for opportunities not accessible in the domestic markets or to diversify to less correlated markets or to hedge your portfolio using intermarket arbitrage.

Finally, be cognizant of the possible conflict of interest when dealing with institutions whose economic model and incentives are different than yours.