My cynical view is that 90 percent of financial strategy is either tax minimization, regulatory arbitrage (coming up with instruments to comply with the letter of regulations while violating their spirit), or accounting charades (complying with the letter of accounting rules while disguising reality)— Arnold Kling

In this issue

Inside the SMC–Meralco–AEV

Energy Deal: Asset Transfers That Mask a Systemic Fragility Loop

Segment 1.0: The PSEi Debt

Financed Asset Transfer Charade

1A.

Debt, Not Productivity, Drives the Philippine Economy

1B.

The Big Three Borrowers: MER, SMC, AEV The Mechanism: Asset Transfers

1C.

The Circular Boost: A Fragility Loop

Segment 2.0: San Miguel

Corporation — The Minsky Ponzi Finance Core

2A.

Fragility in Plain Sight

2B.

SMC’s Camouflage Tactics

2C.

The Mirage of Liquidity

2D.

Political Angle: Deals, Influence, and the Administration’s Footprint

Segment 2.1 — Meralco: A

Utility Showing Profit, But Hiding Stress

2.1A.

Chromite Gas Holdings: Meralco’s New Largest Exposure

2.1B.

Q3 and 9M Performance: Meralco’s Money Illusion Revenues

2.1C.

GDP Mirage and Debt Surge and Asset Inflation

2.1D.

What This Really Means: Meralco as the Balance-Sheet Absorber

Segment 2.2 – AEV: Revenue

Spikes as Balance-Sheet Shock Absorption

2.2A

AEV’s Q3–9M: Not Evidence of Business Growth

Segment 3.0 — The Batangas

LNG–Ilijan–EERI Triangle

3.A

How One Deal Created Three Balance-Sheet Miracles

Segment 4.0: Conclusion: How Concentration Becomes Crisis: The Philippine Energy Paradox

Inside the SMC–Meralco–AEV Energy Deal: Asset Transfers That Mask a Systemic Fragility Loop

SMC, Meralco, and AEV’s energy partnership reveals how asset transfers inflate profits, recycle fragility across balance sheets

Disclaimer: This article presents an independent analysis and opinion based solely on publicly available financial reports, regulatory filings, and market data. It does not allege any unlawful conduct, nor does it assert knowledge of internal decision-making or intent by any company or individual. All interpretations reflect broader political-economic dynamics and systemic incentives rather than judgments about specific actors. Readers should treat this as an analytical commentary, not as a statement of fact regarding any wrongdoing.

Segment 1.0: The PSEi

Debt Financed Asset Transfer Charade

1A. Debt, Not Productivity, Drives the Philippine Economy

Debt, not productivity, is the engine of the Philippine economy. We’ve said this repeatedly, but what’s striking in 2025 is how debt growth has concentrated in just a handful of dominant companies.

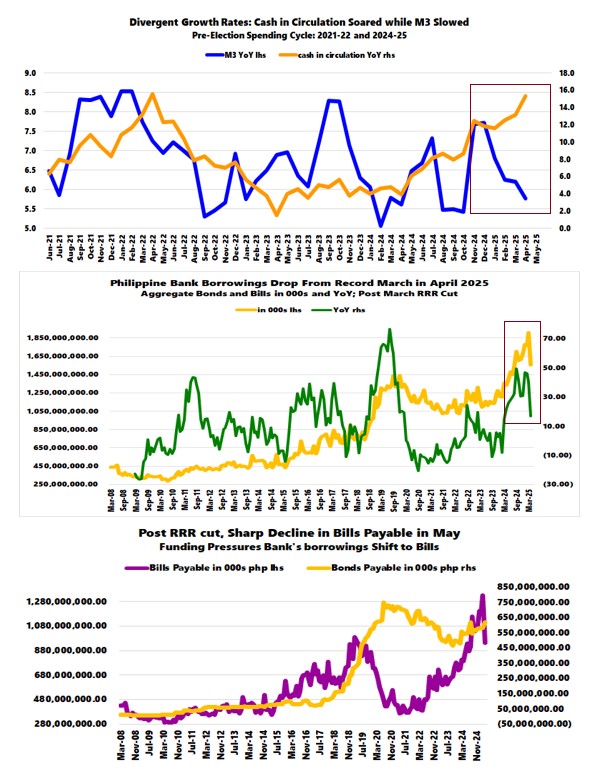

Figure 1

In the first nine months of 2025, the 26 non‑bank members of the elite PSEi 30 added Php 603.149 billion in debt—a growth rate of 11.22%, pushing their total to an all‑time high of Php 5.979 trillion. This was the second fastest pace after 2022. (Figure 1, upper window)

The banks were not far behind. Bills payable of the four PSEi 30 banks rose Php 191.8 billion to Php 1.125 trillion.

Meanwhile, BSP data shows bills and bonds payable across the entire banking industry climbed 9.34% YoY in September (Q3) to Php 1.861 trillion, the third highest on record. (Figure 1, lower chart)

For clarity, let’s stick to the 26 non‑bank PSEi firms.

Note: these figures exclude the rest of the 284 listed companies as of Q2. Because holding companies consolidate subsidiary debt, there are double counts here. And these are only published debts—some firms appear to have shifted borrowings into other liabilities or kept exposures off balance sheet.

Even with those caveats, the Php 5.979 trillion in published PSEi non-bank debt is large enough to equal:

- 16.8% of the Philippine financial system’s September Php 35.582 trillion in resources/assets; and

- 29.74% of the Php 20.15 trillion in nominal GDP over the first nine months.

In short, the debt of the non‑bank PSEi 30 is not just a corporate statistic—it is macro‑significant, shaping both banking dynamics and GDP itself.

1B. The Big Three Borrowers: MER, SMC, AEV The Mechanism: Asset Transfers

Figure 2

In January–September 2025, the top three debt expanders among the non-bank PSEi 30—Meralco [PSE:MER], San Miguel [PSE:SMC], and Aboitiz Equity Ventures [PSE:AEV]—accounted for 52.65% of the Php 603.15 billion increase. (Figure 2, table and chart)

Meralco (MER) debt more than doubled, rising 139.4% from Php 89.147 billion to Php 213.43 billion Php (+Php 124.283 billion).

San Miguel (SMC) debt rose 7%, adding Php 103.312B, reaching a record Php 1.581 trillion. Yes, a T-R-I-L-L-I-O-N!

Aboitiz Equity Ventures (AEV) debt jumped 24.26%, or Php 89.945B, to Php 460.7B.

This was not coincidence.

The synchronized surge reflects the Meralco–Aboitiz buy-in to San Miguel’s energy assets.

As discussed last August

"Beneath the surface, SMC’s debt dynamics resemble quasi-Ponzi finance—borrowing Php 681 billion to repay Php 727 billion in 1H 2025, while plugging the gap with preferred share issuance and asset monetization. The latter includes the deconsolidation and valuation uplift of its residual stakes in the Ilijan power facility and Excellent Energy Resources Inc. (EERI), as well as the $3.3 billion LNG deal with Meralco and AboitizPower in Batangas. Though framed as strategic partnerships, these transactions involved asset transfers that contributed heavily to the surge in reported profits.

"The simulacrum of deleveraging—from Php 1.56 trillion in Q4 2024 to Php 1.506 trillion in Q2/1H 2025—appears to be a product of financial engineering, not structural improvement."

In other words, SMC’s Q2 “deleveraging” was cosmetic.

Its debt didn’t fall because operations improved; it fell because SMC dumped assets, liabilities, and valuation gains onto Meralco and Aboitiz.

1C. The Circular Boost: A Fragility Loop

This buyout sequence increasingly resembles an asset

transfer charade:

- SMC unloads assets with embedded liabilities.

- Meralco and AEV borrow heavily to “acquire” them.

Both sides book accounting gains via fair-value adjustments, reclassification, and deconsolidation.

- Optics improve—higher assets, higher income, stronger balance sheets.

- Substance does not—real cash flow remains weak, debt dependence accelerates, and system-wide concentration rises.

Each company props up another’s balance sheet, recycling fragility and presenting it as growth.

The Philippine power sector is already intensely politicized, dominated by quasi-monopolies that operate in their respective territories. Markets exist only in form; in substance, the sector functions as a pseudo-market inside an oligopolistic cage.

Approximate generation market shares illustrate this concentration: SMC Global ~20–25%, Aboitiz Power ~23%, First Gen + EDC ~12–18%, Meralco/MGen ~7–10%, and ACEN ~5–7% (figures vary by region, fuel type, and year).

Recent deals only deepen this centralization, reinforcing the economic and political power of these dominant players, while regulatory bottlenecks and concentrated capital ensure that true competition remains largely symbolic.

Segment 2.0: San Miguel Corporation — The Minsky Ponzi Finance Core

Q2: The Illusion of Improvement

This maneuver produced a dramatic one‑off effect

in Q2:

- Debt dipped slightly from Php 1.511 trillion (Q1) to Php 1.504 trillion.

- Cash surged +26.5% YoY to Php 321.14 billion.

- Profits exploded +398% YoY, from Php 4.691 billion to Php

23.4 billion.

Q3: The Underlying Reality Reappears

But the illusion unraveled in Q3:

- Revenues contracted –4.5% in a weak economy.

- Profits collapsed –49.5% to Php 11.9 billion.

- Cash rose again +22.4% to Php 344 billion.

Figure 3

Debt soared Php 103.312 billion YoY, Php 76.28 billion QoQ, bringing total debt to a staggering Php 1.58 trillion. (Figure 3, topmost graph, middle table)

2A. Fragility in Plain Sight

Even with the current the sharp rebound in SMC’s share price — whether due to benchmark-ism (potential gaming market prices by the establishment to conceal embedded fragilities) or implicit cross-ownership effects from the Chromite transaction — market cap remains below Php 180B.

- Borrowing growth this quarter alone equaled ≈40-45% of SMC’s entire market cap (as of the third week of November).

- Debt outstanding exceeds annual sales.

- Debt equals 4.44% of the entire Philippine financial system’s assets.

This is not normal corporate leverage.

This is systemic leverage.

2B. SMC’s Camouflage Tactics

SMC has been masking its worsening debt structure through:

- Preferred share issuances (debt disguised as equity), another Php 48.6 billion raised in October.

- Asset transfers involving Meralco and Aboitiz (the Chromite–Ilijan–EERI triangle)

- Aggressive fair-value reclassification and balance-sheet engineering

All three are textbook Minsky

Ponzi Finance indicators: Cash flows cannot meet obligations; survival

depends on rolling over liabilities and selling assets.

2C. The Mirage of

Liquidity

SMC reports cash reserves (Php 344 billion) rising to nearly matching short‑term debt (Php 358 billion). (Figure 3, lowest diagram)

But internal breakdowns suggest:

- A portion of “cash” is restricted

- Some is pledged to lenders

- Some sits inside joint ventures

Balance-sheet “cash” includes mark-to-model items tied to asset transfers

Meaning: true liquidity is far lower than reported.

2D. Political Angle: Deals, Influence, and the Administration’s Footprint

In the current political climate, the administration’s footprint is crucial for every major economic deal.

SMC’s transactions likely benefited from proximity to the leadership — but political shifts also show how influence-connection-network shapes outcomes across the corporate landscape.

Take the Villar group: after apparently losing favor with the administration, their Primewater franchise has been terminated in several provinces, and authorities have cracked down on their real estate assets, claiming prior valuations were inflated. The SEC even revoked the accreditation of the appraiser involved.

Meanwhile, MVP of Meralco reportedly eyes Primewater, underscoring how political favor reshapes corporate fortunes. Where Villar faces contraction, SMC and its allies (Meralco, Aboitiz) secure expansion through administration‑blessed asset transfers.

In any case, it is possible that the deal had administrative blessing—or at least the nudge, given the proximity of the principals involved. The other possible angle is that this could be an implicit bailout dressed up as a buy-in deal.

But the more important point is this:

Even political closeness cannot permanently mask structural insolvency.

SMC is too big to fail on paper — but too debt-bloated to hide forever, or political cover buys time, not solvency.

Segment 2.1 — Meralco:

A Utility Showing Profit, But Hiding Stress

2.1A. Chromite Gas Holdings: Meralco’s New Largest Exposure

Meralco’s Chromite Gas Holdings investment has become its largest exposure among joint ventures and associates, carried at Php 84.08 billion in 2025. Yet, despite the size, Chromite has contributed no direct revenues so far.

The assets acquired from San Miguel Global are framed as enhancing Meralco’s ability to deliver reliable, stable, and cost‑effective electricity—but the numbers tell a different story—one shaped more by accounting and regulatory pass-throughs than by genuine economic or demand strength.

2.1B. Q3 and 9M

Performance: Meralco’s Money Illusion Revenues

Figure 4

The headline 4% GDP in Q3 exposed Meralco’s fragility:

- Revenues in gwh: –2.08% YoY, –6.64% QoQ.

- Electricity sales in pesos: +7.09% YoY, –3.35% QoQ.

- 9M gwh sales: –0.37% YoY, while peso sales rose +6%.

- Profitability: +18.19% in Q3, +9.93% in 9M.

This is classic money illusion: peso revenues rise while physical demand falls. (Figure 4, upper and lower graphs)

Operational output is not driving earnings. Instead, tariff pass‑throughs, higher generation charges, and regulatory adjustments inflate nominal sales. It is a regulatory inflation windfall, not genuine demand strength.

2.1C. GDP Mirage and Debt Surge and Asset Inflation

Meralco’s results reinforce that Q3 GDP was effectively lower than the 4% headline once adjusted for inflation and real‑sector contraction. Nominal growth masks real decline—exactly the GDP mirage motif you’ve been threading.

More troubling is the balance sheet:

- Debt surged +139% to Php 213.4 billion.

- Assets inflated +34.5% to Php 792 billion.

This scale of short‑term expansion is not normal for a utility. It only happens when major assets are shuffled, revalued, or purchased at non‑market prices. Capex and operations do not explain it. Asset transfers do.

2.1D. What This Really Means: Meralco as the Balance-Sheet Absorber

Regulated returns (tariff-based profits) look stable, but the underlying structure is growing riskier. A utility with:

- falling physical demand,

- surging debt, and

- massive non-operational asset expansion

is not strengthening — it is absorbing leverage for some entity.

And that entity is SMC.

The Chromite/Ilijan/EERI structure effectively places Meralco in the role of balance-sheet absorber for San Miguel’s asset-lightening strategy.

Meralco’s earnings stability conceals a fragile, debt-heavy balance sheet inflated by SMC-linked asset transfers, not by real demand or utility fundamentals

Segment 2.2 – AEV: Revenue Spikes as Balance-Sheet Shock Absorption

Almost the same story applies to Aboitiz Equity Ventures.

While AEV publicly emphasizes energy security, stability, market dominance, and regulatory influence as its core priorities, the weakening macro economy reveals a different angle.

Figure 5

AEV posted Q3 revenues of +19.6%, pushing net income up +12.8%. (Figure 5, upper visual)

But on a 9M basis, revenues were only +2.84% while net income fell –10.6% — a clear mismatch between quarterly momentum and year-to-date weakness.

In its 17Q report, AEV notes that fresh contributions from Chromite Gas Holdings, Inc. (CGHI) drove the 5% rise in equity earnings from investees. This aligns precisely with the pattern seen in Meralco: newly consolidated or newly transferred assets creating a one-off jump.

Meanwhile, the balance sheet shows the real story:

- Debt surged 24.3% to Php 460.7B

- Cash jumped 15% to Php 90.84B

- Assets expanded 14.94% to Php 971B

A sudden Q3 revenue surge combined with a weak 9M total is entirely consistent with:

- Newly absorbed assets booking revenue only after transfer

- Acquisition timing falling post–June 2025

- Consolidation effects appearing sharply in Q3

This means the revenue spike is not organic growth — it is the accounting after-effect of assets acquired or transferred in 1H but only recognized operationally in Q3.

AEV’s cash swelling amid rapid debt accumulation strongly

suggests:

- bridging loans used during staged acquisition payments

- temporary liquidity buffers ahead of full transfer pricing

- staggered settlement structures typical in large utility-energy asset sales

- pending regulatory approvals delaying full cash deployment

Cash rises first → debt stays elevated → assets revalue → revenue shows up later.

This pattern is classic in large asset transfers, not in

real economic expansion.

2.2A AEV’s Q3–9M: Not Evidence of Business Growth

They are the accounting shadow of San Miguel’s 1H asset unloading—financed by AEV’s debt surge and disguised as operational growth.

What looks like stability is really fragility

recycling: AEV, like Meralco, has become a balance-sheet counterparty

absorbing the system-wide effects of SMC’s asset-lightening strategy, with

short-term profitability masking long-term stress.

Segment 3.0 — The Batangas LNG–Ilijan–EERI Triangle

3.A How One Deal Created Three Balance-Sheet Miracles

If Segment 2 showed the operational weakness across SMC, Meralco, and Aboitiz, Segment 3 explains why their balance sheets still looked strangely “strong.”

The answer lies in one of 2025’s most consequential but

least-understood restructurings:

The Batangas LNG–Ilijan–EERI triangle.

This single transaction is the hidden engine behind the debt spikes, asset jumps, and sudden income boosts in Q2–Q3.

Once you see this triangle, everything else snaps into

place.

1. The Triangle in One Line

This wasn’t three companies expanding.

It was one deal split three ways, enabling:

- SMC to book gains and create a “deleveraging” illusion

- Meralco to justify its 139% debt explosion

- Aboitiz to absorb a 24% debt spike while looking “strategically positioned”

All this happened without producing a single

additional unit of electricity.

While the EERI–Ilijan complex is designed to deliver 1,200–2,500 MW of gas-fired capacity, as of Q3 only 850 MW are fully operational and a 425 MW unit remains uncertified — meaning the promised output exists largely on paper, not yet in reliable commercial dispatch. This reinforces the point: the triangle deal moved balance sheets faster than it delivered power.

2. How the Triangle Worked

Here’s the real flow:

- SMC restructured and monetized its stakes in Ilijan, Excellent Energy Resources Inc. (EERI) and Batangas LNG terminal

- Meralco bought in — financed almost entirely by new debt

- AboitizPower bought in — also financed by new debt

The valuation uplift flowed back to SMC, booked as income and “deleveraging progress”

The result:

- All three balance sheets expanded

- None of them improved real output

- This was transaction-driven balance-sheet inflation,

not industrial growth.

3. Why This Triangle Matters: It Solves Every Q3 Puzzle

Without this transaction, Q3 numbers look impossible:

- Meralco’s debt doubling despite falling electricity volume

- AEV’s Php 90B debt jump despite declining operating income

- SMC’s “improving leverage” despite worsening cash burn

Once the triangle is added back in, the contradictions

vanish:

- Meralco and AEV levered up to buy SMC’s assets

- SMC booked the valuation uplift as earnings

- All three appeared financially healthier — e.g. cash

reserves jumped— without becoming economically healthier (Figure 5, middle

graph)

Q3 looked disconnected from reality because it was.

4. The Illusion of Progress

On paper:

- SMC: higher profit

- Meralco: larger asset base

- AEV: greater scale

In substance:

- SMC gave up future revenue streams

- Meralco and AEV loaded up on liabilities

- System-wide fragility increased— e.g. accelerates the rising trend of financing charges. (Figure 5, lowest chart)

The triangle recycles the same underlying cash flows, but layers more leverage on them.

This is growth by relabeling, not growth by production.

5. What This Signals for 2025–2026

The triangle exposes the real state of Philippine

corporate finance:

- cash liquidity is tight

- banks are reaching their risk limits

- debt has become the default funding model

- GDP “growth” is being propped up by inter-corporate transactions, not capex

- conglomerates are supporting each other through balance-sheet swaps

Most importantly:

This is a leverage loop, not an investment cycle. The mainstream is confusing balance-sheet inflation for economic progress.

The Batangas LNG–Ilijan–EERI triangle created no new power capacity. Instead, it created the appearance of corporate strength.

Segment 4.0: Conclusion: How Concentration Becomes Crisis: The Philippine Energy Paradox

The Philippine energy sector operates as a political monopoly with only the façade of market competition.

The triad of San Miguel, Aboitiz, and Meralco illustrates deepening centralization, pillared on a political–economic feedback loop.

Major industry transactions, carried out with either administration blessing or tacit nudging, function as implicit bailouts channeled through oligarchic control.

This further entrenches concentration, while regulatory capture blinds the BSP, DOE, and ERC to mounting risks—encouraging moral hazard and ever-bolder risk-taking in expectation of eventual government backstops.

This concentration funnels public and private savings into monopolistic hands, fueling outsized debt that competes directly with banks and government borrowings, intensifying crowding-out dynamics, resulting in worsening savings conditions, suppressing productivity gains, and constraining consumer growth.

Fragility risks do not stop with the borrowers: counterparties—savers, local and foreign lenders, banks, and bond markets—are exposed as well, creating the potential for contagion across the broader economy.

The feedback loop is self-reinforcing: policies fuel malinvestments, these malinvestments weaken the economy, and weakness justifies further interventions that deepen concentration, heighten vulnerability, and accelerate structural maladjustments.

Viewed through a theoretical lens, San Miguel’s ever-expanding leverage fits a Minsky-style financial instability pattern—now extending into deals that serve as camouflaged backstops. This reflects what I call "benchmark-ism": an engineered illusion of stability designed to pull wool over the public’s eyes, mirroring Kindleberger’s cycle of manipulation, fraud, and corruption.

Taken together, these dynamics reveal unmistakable symptoms of late-cycle fragility.

What is framed as reform is, in truth, a vicious cycle of concentration, political capture, extraction, and systemic decay.

____

references

Prudent Investor Newsletters, Q2–1H Debt-Fueled PSEi 30 Performance Disconnects from GDP—What Could Go Wrong, Substack, August 24, 2025

Prudent Investor Newsletters, Is

San Miguel’s Ever-Growing Debt the "Sword of Damocles" Hanging over

the Philippine Economy and the PSE? December 02, 2024