Below is an interesting perspective on gold from the Economist,

THE creditworthiness of a country used to be judged by the level of its gold reserves. Under the gold standard, a fall in reserves would lead to the central bank taking crisis measures. The country with the biggest reserves in the world is, not surprisingly, America, with 8,134 tonnes. But expressed in terms of reserves per person, the picture looks very different. It is no surprise to see Switzerland at the top of the list, but why is Lebanon in second place? Its reserves were purchased when the country was the Middle East’s financial centre in the 1960s and 1970s and safeguarded through the civil war years by legal restrictions and by central-bank governor Edmond Naim, who according to legend slept in the bank to protect the hoard. China does not feature in the list at all; but gold bugs fantasise about what might happen if the people’s republic were to swap just some of its mountain of Treasury bonds for bullion.

What’s interesting is that with gold prices over $1,500, there has been increasing instances of mainstream media’s reference to the gold standard.

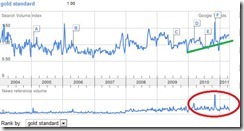

Google Trends reveal of the upward trend in searches made on the “gold standard” (green trend line above window).

And at the bottom pane, in 2010-2011 (red circle) news reference volume has significantly improved compared with 2004-2007 and in 2008-2009.

Signs of things to come? Hmmmmm