My source of livelihood has almost entirely been from the local stock market, particularly investing, as I am hardly or rarely a short term trader.

Thus, objective and thorough investigations, assessments and analysis have been IMPERATIVE on me. And as part of my investing philosophy, I try to avoid getting married to a position, in as much as assuming the HIGH RISK role of becoming a stock market CHEERLEADER.

Losing money means my family will starve and this is why I cannot afford to lose money. Therefore such punctilious efforts, on my part, to deal with risks represent what have been known as stakeholder’s problem—where my incentives to attain relevant knowledge are prompted by the degree of my stakes in the financial marketplace. Since I depend on the markets thus I have to know the possible risks attendant to my positions.

And this outlook which I share with you, has not only been based on my battle hardened experience, but also from my candid evaluations of the conditions of the risk environment.

I am not here for an egotistical trip as many have been wont to.

Separating Signals from Noise

I have long been an adherent to the wisdom of the legendary trader Jesse Livermore. I have repeatedly been posting one of my favorite Mr. Livemore’s aphorisms here (bold emphasis mine)

I began to realize that the big money must necessarily be in the big swing. Whatever might seem to give a big swing its initial impulse, the fact is that its continuance is not the result of manipulation by pools or artifice by financiers, but depends on underlying conditions. And no matter who opposes it, the swing must inevitably run as far and as fast and as long as the impelling forces determine.

Simply said, profits are to be made based on underlying conditions which drives the general trend, and importantly, serves as the critical source of big swings.

And this is why I give heavy emphasis at the unfolding events based on the big picture. Unlike most practitioners, I am hardly swayed by vacillations from ticker tape activities.

Yet, ticker tape activities and the big picture frequently represent the noise and signal problem

Nassim Nicolas Taleb in his forthcoming book wonderfully explains the psychological impact from noise and signal[1]

we are not made to understand the point, so we overreact emotionally to noise. The best solution is to only look at very large changes in data or conditions, never small ones.

Just as we are not likely to mistake a bear for a stone (but likely to mistake a stone for a bear), it is almost impossible for someone rational with a clear, uninfected mind, one who is not drowning in data, to mistake a vital signal, one that matters for his survival, for noise. Significant signals have a way to reach you. In the tonsillectomies, the best filter would have been to only consider the children who are very ill, those with periodically recurring throat inflammation.

There was even more noise coming from the media and its glorification of the anecdote. Thanks to it, we are living more and more in virtual reality, separated from the real world, a little bit more every day, while realizing it less and less. Consider that every day, 6,200 persons die in the United States, many of preventable causes. But the media only reports the most anecdotal and sensational cases (hurricanes, freak incidents, small plane crashes) giving us a more and more distorted map of real risks. In an ancestral environment, the anecdote, the “interesting” is information; no longer today. Likewise, by presenting us with explanations and theories the media induces an illusion of understanding the world.

And the understanding of events (and risks) on the part of members of the press is so retrospective that they would put the security checks after the plane ride, or what the ancients call post bellum auxilium, send troops after the battle. Owing to domain dependence, we forget the need to check our map of the world against reality. So we are living in a more and more fragile world, while thinking it is more and more understandable.

The bottom line is that many people get confused when working to separate the proverbial wheat from the chaff or when filtering signal from noise. People with lesser stakeholdings are likely to emphasize on the noise which usually signify as “an illusion of understanding the world” and or embrace steeply biased (but unworkable and highly flawed) theories.

The Dopamine Fetish

I would also add that part of the psychological-neuroscience aspect in dealing with markets has been about dopamine neurons.

People’s dopamine neurons, or brain chemicals, gets fired up when rewards attained are GREATER than expected. In contrast, REGRETS are symptoms of depressed dopamine neurons. Thus short term thinking and short term trading have MOSTLY been about the fetish for dopamine trips.

A study on neuroscience suggests that dopamine flows are pervasive during early stages of a ballooning bubble, reflecting desire for profit. However as the bubble peaks, dopamine flows tend to culminate in a cessation just before the market burst[2]

Monetary policies by central banks also whet or induce dopamine powered speculative behaviors[3].

The lesson here is that we should manage our dopamine flows rather than allowing dopamine neurons to dominate the risk-reward tradeoffs that confront our investing decisions. This is basically about Emotional Intelligence (EI)

Let me further add that the technical construct of the Philippine Stock Exchange has been skewed to inculcate upon the public of the upside bias for issues listed on the markets, as well as, the component index.

The rational for this seems to be part of the political designs to exhibit economic booms.

Take shorting. While shorting has been legalized, rigorous procedural and regulatory compliance requirements have made shorting impractical. So we have a facility that has hardly been used.

And since market participants only earn from an UPSIDE price move, thus logically, the dominant entrenched PSYCHOLOGICAL bias would be for the public to yearn for the stock market to go only in one direction—UP.

Next, complimenting the psychological and physiological aspect, monetary policies have also been rewarding speculative activities at the expense of savings and production.

So intensifying speculative activities extrapolates to the herd effect in motion.

Where the basic function of the stock market has been about the cost of buying future income stream relative to insecurities (risk and uncertainty), such functionality has been negated or substituted by rationalizations for price chasing momentum.

Writes Kevin Dowd, Martin Hutchinson, and Gordon Kerr at Cato Forum for monetary policies[4],

Low interest rate policies not only set off a malinvestment cycle but also generate destabilizing asset price bubbles, a key feature of which is the way the policy rewards the bulls in the market (those who gamble on the boom continuing) at the expense of the sober minded bears who keep focused on the fundamentals, instead of allowing the market to reward the latter for their prudence and punish the former for their recklessness. Such intervention destabilizes markets by encouraging herd behavior and discouraging the contrarianism on which market stability ultimately depends. A case in point is the Fed’s low interest rate policy in the late 1990s: this not only stoked the tech boom but was maintained for so long that it wiped out most of the bears, who were proven right but (thanks to the Fed) too late, and whose continued activities would have softened the subsequent crash. The same is happening now but in many more markets (financials, general stocks, Treasuries, junk bonds, and commodities) and on a much grander scale. Such intervention embodies an arbitrariness that is wrong in principle and injects a huge amount of unnecessary uncertainty into the market.

In essence, the inflationary boom psychology has been distorting economic reasoning.

Add to this the leash effects of bailout policies.

The bottom line is that inflation fueled bull markets have become a religion to many.

And advises to undertake prudent positions—based on appraising the risk environment that may adversely affect one’s portfolio—has been seen as sacrilege.

Short Selling Not Recommendable; Contagion Risks

I also do NOT recommend shorting in the Philippines for the following reasons

-the cost to undertake shorts positions have been enormous relative to prospective gains (if a short position is required the best is to do it from overseas)

-a full blown BEAR market for the Philippines has NOT been yet established, although the RISKS from such scenario seem to be STRENGHTENING.

-global regulators have periodically been intervening. The degree of intervention mostly through bailout policies comes with such INTENSITY such that these can TORCH shorts on short notice. A good example has been Europe’s LTRO which singed Euro shorts at the start of the year[5]

-global regulators have innate biases against short sellers. They have done so lately through direct market interventions, such as drastic imposition of shorting bans which forces short covering to investors at a loss. A great example has been the shorting bans on Europe stock markets in mid-2011[6] in the political belief that speculations, and NOT insolvency, have been the fundamental problem that besets the Eurozone. Yet in spite of the bans, European stock markets continue to bleed PROFUSELY. This represents a vivid example of the “illusion of understanding the world” by political agents who always try to shift what has truly been their mistake to the markets.

Lastly I do NOT wish or DESIRE for a bear market.

Because of the limitations to take on hedge positions, bear markets or even phases of consolidation with a downside bias or volatility translates to income drought for me or most market participants (see the structural bull market bias above)

While I am an optimist who believes that the Phisix will reach 10,000 sometime in the future, I am also a REALIST who understands that external forces have a HUGE influence to actions of the local stock markets and that NO trend goes in a straight line.

In suggesting of the countercyclical trend amidst a secular trend I wrote in March[7],

I am not certain whether we will see a repeat of the discontinuities similar to the 1986-1997 bull market cycle or will suffer more than the past cycle before reaching my goal or if the Phisix will proceed to double. What needs to be monitored are drivers of the current trends and the whereabouts of the present boom cycle based on internal and external dynamics.

In short, the PHISIX, despite the secular trend, is VULNERABLE to a CONTAGION risk.

Could this week’s Phisix Divergence Represent an Anomaly?

The local benchmarket, the Phisix, majestically bucked the global stock market carnage last week.

As one would note, the Phisix has not only outperformed the region, the local benchmark basically defied gravity.

China and Malaysia joined the Phisix, as outliers, with hefty gains amidst a sea of red.

Yet such divergences have given the dopamine to Pollyanna trippers the ammunition to declare “bottom” for the market.

I have yet to be convinced.

The gist of the weekly gains or 52% of the Phisix came from Thursday’s activities.

Ironically, the sizable gains occurred in the backdrop of staggering US and global markets.

Media and experts has alluded to reports of sturdy domestic economic growth[8], the hints of a possible upgrade[9] by US rating agency Moody’s on the credit standing of the Philippines and the closure of milestone impeachment trial[10] with a conviction of the accused which favors the administration as reasons for this.

I beg to differ.

I raised this concern on this last Thursday[11]. The Phisix went down to as low as 67 points at the early session, dragged by the selloffs in the US and Europe. But suddenly, aggressive and systematic buying of heavyweights (blue chips) throughout the day pushed the Phisix to close at almost at the peak (76.81) at 73 points. The pendulum swing from loss to gain represented an astounding 2.8%!!!

Buyers seem to have, ironically, been resolutely aggressive to push up prices in an environment of MOSTLY falling stock market prices globally, perhaps in the assumption that local stocks will soon experience a strong surge.

Or is it?

The weekly performance of the heavy cap issues reveals that gains of the Phisix were mostly seen through Ayala Corp (AC), JG Summit (JGS), Banco De Oro (BDO), Metrobank (MBT), SM Investments (SM), International Container (ICT), PLDT (TEL) and Bank of the Philippine Islands (BPI).

The logical part for any buyers under such scenario would be to make use of the dour sentiment to take advantage of price declines to bargain hunt. Yet these have not been the case.

Let me lay out my suspicions.

I do not think that these has been due to general market sentiment, although pushing up the PHISIX index succeeded to give a boost to the general market sentiment.

Thursday closed with a mixed showing between advancers and decliners with the latter having a slight edge. On a weekly basis advancers took a slight lead over decliners showing modest improvement in the market breadth or sentiment.

Second my naughty thoughts suggests that Thursday actions was likely executed to create an impression of economic ‘confidence’. I am not so sure why though. Perhaps to squelch demand for signing waivers for top officials.

Buyers suddenly became price insensitive. The likelihood is that non-market entities may have been responsible for aggressively pushing up Big Caps. I would suspect that these may have been government institutions such as the SSS, GSIS or others.

While it is true that Thursday a net foreign buying, the bulk of these buying can be traced to cross trades at DM Consunji.

Besides, net foreign buying data may not reveal of the real extent of activities that took place. Foreign buying can represent overseas based subsidiaries or branches of locally owned corporate vehicles or tycoons, as well as, foreign based politically allied corporations.

Of course I may be wrong and that there may have been special factors driving up the Phisix.

But if my suspicions are valid then such interventions are likely to produce short term effects.

As example the Bank of Japan’s (BoJ) $13.3 billion[12] interventions DID bring down the Yen for about a month. However the Yen has been regaining lost grounds since. This effectively has neutered tax payer financed interventions. In short $13.3 billion down the drain.

Another question that begs to be asked is WHY the PHSIX alone?

While Malaysia did post hefty weekly gains next to the Phisix, the Malaysia’s benchmark (FBMKLCI:IND, green) has almost missed out the recent bull market. On the other hand, Thailand (SET:IND, orange) and Indonesia (JCI:IND, red) which shared or alternated the lead with the Phisix, since last year, has wilted significantly.

Yet it can be observed that ASEAN’s stock markets have been nearly been moving in nearly synchronous fashion UNTIL the peak in May of this year.

This only means that last week’s gains by the Phisix either represents an ANOMALY or that the Phisix LEADS Asia.

My bet is on the former.

The Decoupling Myth

I have been saying that current environment have been dominated by POLITICAL uncertainty which for the Philippines and ASEAN represents a CONTAGION risk.

If global markets stock markets have been pricing in a bust or the unwinding of malinvestments which is being transmitted to the global economies, then it would dangerous, if not reckless, to presume immunity or “decoupling” where trade and investment linkages of ASEAN economies have been deepening relative to the world.

ASEAN economies have largely been exposed to developments abroad through merchandise trade (exports and imports).

The Philippines merchandise trade represents over 50% of GDP, while Malaysia and Thailand are over 100%.

This means any meaningful economic slowdown in the region or in the world will negatively impact economic growth.

Add to this the potential slowdown effect on remittances and supply chain networks.

The deepening of financial globalization also means the integration of emerging Asia’s capital markets[13] with the world (left chart) and with intra-region (right pane).

In short, the false notion of DECOUPLING will likely melt in the face of a global recession or when a full blown financial crisis, if such phenomenon transpires.

Let me be clear, the conditional term is an IF, while global economies have indeed been slowing down, a global recession or worldwide contagion from euro’s financial crisis has yet to become evident in Asia.

Of course a decoupling COULD happen if there should be massive inflation or even hyperinflation from any of these major economies. However, under the current circumstances this is unlikely to happen.

This means that for those in the belief that the Philippines can decouple from the world, the following chart should be a helpful reminder…

2007-2008 signifies as the contagion based bear market.

Neither has there been an economic recession during the said period nor did earnings fall materially. But the Phisix entered a full blown BEAR Market and lost about 50% peak-to-trough as a result of an exogenously driven financial crisis in 2007-2008.

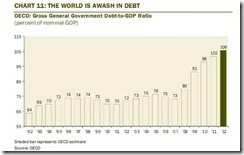

Of course 2008 is different from today. In fact, today has been worst compared to the 2008 crisis. In 2008 the crisis was limited to the banking, property and mortgage industry. Today the crisis dynamics has shifted to envelop banks AND sovereigns. Not to mention that world wide government debts have surged[14] and that US fiscal deficits have skyrocketed (at $1.327 trillion or 8.2 times larger than 2007[15]).

Yet for those who should insist on decoupling, then I wish you the best of luck.

[1] Taleb Nassim Nicolas Noise and Signal — Nassim Taleb Farnam Street, May 29, 2012

[2] ChangingMinds.org The Neuroscience of Financial Bubbles

[3] See How US Federal Reserve Policies Stimulates the Public’s Speculative Behavior, May 8, 2012

[4] Dowd Kevin, Hutchinson Martin, and Kerr Gordon The Coming Fiat Money Cataclysm

[5] Marketwatch.com Euro hits 3-month high on LTRO hopes, February 24, 2012

[6] Wall Street Journal, Europe Short Bans Extended, August 26, 2011

[7] See Phisix: The Journey Of A Thousand Miles Begins With A Single Step, March 12, 2012

[8] ABS-CBNnews.com.ph PH eco grows 6.4% in Q1; highest in ASEAN, May 31, 2012

[9] Businessmirror.com.ph Moody’s raises PHL to ‘positive’ May 29, 2012

[10] See The Lessons and Validity of Public Choice Theory Applied to the Chief Justice’s Corona Impeachment, May 29, 2012

[11] See Phisix: Very Impressive Day or Month End Close for May 2012, May 31, 2012

[12] Bloomberg.com Japan Adopts Stealth Intervention As Yen Gains Threaten Exporter Earnings February 7, 2012

[13] ADB ONLINE Asia Capital Markets Monitor August 2011

[14] Zero Hedge, Presenting Dave Rosenberg's Complete Chartporn, June 1, 2012

[15] Weiss Martin Lehman-Type Megashock Looming, Money and Markets May 21, 2012