The Silver Squeeze – An infographic by the team at The Silver Squeeze Free Infographic

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, May 19, 2013

Infographic: The Silver Squeeze

The Silver Squeeze – An infographic by the team at The Silver Squeeze Free Infographic

Saturday, May 14, 2011

War On Commodities: China Joins Fray, Global Commodity Politics Intensifies

The Europeans have reportedly been breathing down on profits by the banking sector from commodity trades.

The US has been rigging the rules of the game by apply a Pearl Harbor strategy via a spate of margin hikes in the commodity markets over a short period of time.

Now, China joins the bandwagon on the assault on commodity prices.

Reports the Marketwatch,

The Shanghai Gold Exchange said Thursday it will raise margin requirements for silver futures as part of risk-control measures, its third round of increases in less than a month, according to a statement posted on the exchange's web site. Margin requirements will rise to 19% of a contract's value from 18%, while the daily price limit for the one kilogram silver forward contract will rise to 13% from 10% above or below the previous session's close. The new trading requirements will be effective from May 13.

China has been combating her inner demons during the past 2 years and seems as the most problematic nation among major economies in dealing with inflation (aside from India).

Since China has been a key player in the commodity markets then it’s apparent that coordinating policies with her major trading partners might mean more success in attaining price control goals.

From Hostra University

The above chart reveals of the China commodity consumption story as of 2009, relative to the world. And it’s the reason why China’s growth story has partly been tied with commodity price trends.

There is also the supply side story which we won’t be dealing here.

Relative to China’s silver’s price margin hikes:

China’s industrial demand for silver comprises nearly half of the world’s silver consumption.

According to Goldcore,

Today industrial uses account for 44% of worldwide silver consumption and in conjunction with investment and store of value demand, industrial demand continues to grow.

And China’s silver imports have exploded over the years which turned her from an exporter to a major importer.

According to the Wall Street Journal, (bold emphasis mine)

China's net imports of silver hit a record high of 400% in 2010 to 3,500 tonnes .

China used to be a silver exporter now China has become the importer of silver

About 70% of China's silver demand comes from the industrial sectors. Silver is widely used in the China is the third largest producer of mined silver in the world.

China also is a major consumer of silver, absorbing large and rapidly growing volumes of silver in its manufacturing sector.

Chinese silver mining witnesses significant growth and development in recent years, fueled by technological strides in exploration and an increase in production in response to steady growth in domestic and international demand China is a major global producer and consumer of silver-based brazing alloys.

China has some of the world's largest manufacturing facilities for home electronics and electrical appliances, which utilize various type of silver-based solder.

China is the world's largest producer of solar power and electronics.

Silver price increased more than 80% in 2010.

Silver demand in China is soaring thanks to increasing use for industrial and jewelery purposes.

About 70% of China's silver demand comes from the industrial sectors. Silver is widely used in the China is the third largest producer of mined silver in the world.

So controlling silver prices from spiking could mean ‘less statistical inflation’. This should also represent subsidies to her industrial users. Hence the incentive to join the price control bandwagon.

According to the Financial Times,

Chinese speculators have emerged as a big driver of silver’s spectacular rally and subsequent crash with trading in the metal in Shanghai soaring nearly 30-fold since the start of the year.

The commodity, nicknamed “the devil’s metal” for its wild price swings, surged 175 per cent from August to a peak of almost $50 a troy ounce two weeks ago. Since then, it has plummeted 35 per cent, hitting a low of $32.33 on Thursday.

At the same time, silver turnover on the Shanghai Gold Exchange, China’s main precious metals trading hub spiked, rising 2,837 per cent from the start of this year to a peak of 70m ounces on April 26, according to exchange data.

The number of contracts outstanding, an indicator of investor exposure, doubled over the same period.

Manipulating silver’s prices also means punishing savers who buy silver in the form of hedging against currency debasement. As the article above implies, about 30% of silver’s demand in China have been due to “jewelry”. Given the underdeveloped conditions of China’s capital markets, hedging may come in the form of jewelry.

The global war on commodities is becoming more evident by the day...

Reports the Reuters (highlights mine)

There's no question pressure from Washington is growing.

A group of 17 U.S. senators on Wednesday called on the Commodity Futures Trading Commission to crack down immediately on excessive speculation in crude oil markets, demanding the agency's plan to impose position limits within weeks.

...as we see more and more calls for interventions from politicians around the world.

And the assaults on the commodity markets have also been expected to cover agricultural futures soon.

So we should expect continued volatility until governments would run out of ammunition or once commodity demand and supply backfire on their policies.

Yet for as long the US Federal Reserve pursues the policy of inflationism (this includes other major central banks or even China)…

Chart from Minyanville

…the outcome will be higher commodity prices!

Scapegoating speculators and intervening in the markets may temporarily achieve political goals. However, such actions would only worsen the economic balance and lead to even higher prices—the law of unintended consequences.

It is just a matter of time.

In my view, this telling chart forebodes on why the concerted intervention in commodity markets.

Printing money does not equal higher inflation, that’s what’s being portrayed. Why? Because the Fed and their acolytes think that they need more of these, since government spending, for them, is holy grail to resolving socio-economic problems.

Money printing is the way to prosperity, so it is held.

I see higher inflation.

Tuesday, May 10, 2011

It’s Now A War On Commodities: Credit Margins On Oil and Gasoline Products Raised!

The war on precious metals has expanded. It’s now a war on commodities.

Considering the ‘Pearl Harbor’ effect or the initial success of interventions with silver, the series of price manipulation will now include hikes in credit margins of oil and gasoline products.

According to the CBS Marketwatch, (bold highlights mine)

U.S. exchange operator CME Group CME +1.17% said Monday it is raising the margin requirements for trade in a wide range of oil products, effective Tuesday. The requirement for a new position in benchmark New York Mercantile Exchange crude contracts rises to $8,438 from $6,750 previously, with margins also higher for contracts in benchmark Brent crude, gasoline and other products. The hike was the first of its kind since March 4, according to TheStreet.com. June crude oil CLM11 -0.62% traded at $101.95 a barrel early in Tuesday's electronic session, down 56 cents, or 0.6%, from the close of floor trading Monday on the New York Mercantile Exchange.

It would be so naive for some to believe that this equates to “mitigating” the effects of loose monetary policies.

Commodity traders suffer undue losses by the rigging the rules of the game by regulators (I know they are private regulators but they appear to be working in behalf of the government).

This is equivalent of robbing commodity traders of their property rights...just to justify current policies.

What if the US government decides to apply the same to the stock market?

Yet this New York Times article says that CME officials, in raising credit margins, have not been aware of the consequences of these interferences on the commodity markets. (bold highlights mine)

On April 25, half a dozen officials from the CME Group, which runs many of the nation’s commodities exchanges, met via videophone to discuss the eye-popping rise in the price of silver, which had doubled in just six months to about $47 a troy ounce.

They didn’t realize it, but they were about to take the first step toward popping a bubble in global commodities prices.

Worried about the speculative run-up and the increased volatility of the silver market, the officials concluded that it was time to raise the amount of money that buyers and sellers had to put down as collateral to guarantee their trades. The first increase in so-called margin requirements took hold the next day, effectively making it more expensive for speculators and other kinds of traders to play in the market...

This is unalloyed hogwash, if not a sheer self-contradiction in reporting. Yes this smells more and more of the Fed's 'signaling channel' or state engineered propaganda aimed at manipulating inflation expectations.

Raising credit margins for FIVE times (or more than double the existing rate) signifies as deliberate measures to curb the price acceleration of silver.

It’s silliness to say that the effect of this measure had not been known and that officials acted on this out of worries.

Also, the fact that they are now expanding coverage means officials see the initial effects as a policy success, which it hopes to replicate on other markets. In short, path dependency.

Even more nonsensical is to the attribution of a commodity bubble.

What should be underscored as a bubble is the bubblehead policies to justify more intervention.

It is even foolish to believe that price controls or manipulation will continuously work under the current regime which promotes such ‘speculative’ dynamics.

That’s because inflationism induces a flight to real assets. For as long as governments, most especially the US government, continue to debase her currency, people will seek shelter through commodities via the marketplace.

And further is the asinine impression that markets operate in inertia.

The markets function as a discounting mechanism. Since the market has priced in new information or that it is now aware of the rigging of game by political operators, the market has begun to adjust accordingly.

Proof of this is that despite the announcement of increasing oil margins, oil, silver and gold surged yesterday!

What this only means, at this early state, that price manipulation efforts appear to be wearing off! And so goes the ‘mitigation effects’.

As Ayn Rand aptly wrote

When you see that trading is done, not by consent, but by compulsion -- when you see that in order to produce, you need to obtain permission from men who produce nothing -- when you see money flowing to those who deal, not in goods, but in favors -- when you see that men get richer by graft and pull than by work, and your laws don’t protect you against them, but protect them against you -- when you see corruption being rewarded and honesty becoming a self-sacrifice -- you may know that your society is doomed.

Attacking the symptoms, engendered, fostered and nurtured by policymakers, won’t solve or cover the problem. Instead, it is a sign of societal degeneration.

Sunday, May 08, 2011

Philippine Mining Index and the Manipulated Collapse of Commodity Prices

We're living in an amazing world where real assets can be purchased with fantasy money. It won't last because it's illogical and synthetic. But it has already lasted longer than most realists thought possible.-Richard Russell

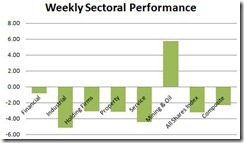

The Phisix finally took a breather, falling by 2.33% over the week, the first decline over 7 weeks. Such loss substantially reduced the year to date gains to only .43%.

The decline had been broad based, but ironically the mining and oil sector eluded the downturn supposedly on a raft of speculations over prospective deals.

I say ironic because such defiance comes in the face of a manipulated collapse of commodity prices in the world markets.

The Manipulated Collapse

Abruptly changing the rules of the game represents manipulation.

Since trades are essentially anchored upon expectations based on existing information which incorporates rules and other operating parameters (e.g. architecture of trading platform), drastically altering the rules midway dramatically shifts the balance of cost-benefit expectations and the economic distribution of resources, as manipulation benefits the regulators and their allies at the expense of market participants.

While I expected the huge run up in silver prices to be met with sharp price volatility[1], I didn’t expect that this would be prompted for by a series of steep credit margin hikes imposed by the CME[2]. Silver prices fell 25% over the week.

Since commodity markets are interrelated, as many investors or institutions position in different commodities or commodity indices, the assault on the silver markets rippled throughout the commodity sphere and to other markets.

One evidence of such imbalance is that even as silver prices collapsed, the physical inventory of silver shriveled[3], instead of ballooning. This means that instead of a panic from a sharp price downswing, many have taken the price drop as an opportunity to accumulate physical silver! What appears to be happening is that the heavily leveraged positions or those who fail to meet the margin calls, have forcibly been closed regardless of price, but the new entrants have used such opportunity to accumulate substantially.

If this should serve as a clue then the interventions mean that the effect on silver prices is likely to be transitory as players adjust to the new environment.

The other point is that the fundamental drivers of silver and other commodities remain firmly entrenched.

Commodity Prices Underpin the Fate of Mining and Resource Firms

Changing the rules midway was part of the scenario of the silver bubble meltdown in 1980. The Hunt brothers, whom attempted to corner the silver market, suffered from the same credit margin hikes which led to their bankruptcy.

But of course, the major factors that led to the commodity bubble bust had been due to sharp increases in the interest rates, coming from a shift in the monetary policy stance by US Paul Volcker led US Federal Reserve, and that a global commodity glut had accrued as the globalization gradually took hold[4].

Except for the manipulation, the above events hasn’t shaped the de facto climate.

Why is this important? Because share prices of mining or other commodity based companies essentially depend on the prices of the commodity products.

The almost two decade of bear market in commodities led to the hibernation of mining and other resource based companies or a slump in terms of stock market prices.

Remember Atlas Consolidated at php 400 per share in the 70s and was seen as a ‘blue chip’? Today, Atlas trades at a measly php 15 per share following years of dormancy in the company’s operations. To consider, real or inflation adjusted prices in the 70s means a lot more Pesos today.

As one would note, the CRB Reuters futures index (lower window) courtesy of chartrus.com[5] squares with the performance of the Philippine Mining Index (upper window).

When I turned bullish on gold in 2003 I called this the “Rip Van Winkle”[6] moment. The concurrent rise of the CRB Reuters index also reflects on the Philippine Mining Index.

The point is that the buoyancy of domestic mining and oil index (or prices of mining and oil companies) greatly depends on the underlying trends of their commodity products.

Commodities As Hedge

The war against precious metals is being waged most possibly as part of the signaling channel tools which Central Banks employ to manage inflation expectations. This I think is part of the orchestrated conditioning employed by the US Federal Reserve that is being used to justify further interventions particularly the QE 3.0[7].

All talks about tightening and the ending of QE part of another series of poker bluff at work.

Given the weak housing market (which risks endangering the balance sheets of the US banking system which Fed chair Bernanke sees as the heart of the US economy), the declining interests of foreign governments to finance US deficits, insufficient private savings and the wobbly financial conditions of states[8], plus the ideological economic (quasi boom) biases and path dependency of the policymaking by US political authorities, the US is left with little option but to reengage in quantitative easing sometime in the near future after the end of the QE 2.0 in June.

And part of the propaganda, through biased research studies by the Fed and allied institutions, has been to delink the Fed’s policies with that of surging commodity prices. And the other way to create this impression is to manipulate the commodity markets.

At the end of the day commodities still represents as insurance from the adverse unintended consequences of the monetary interventionism—an addiction inspired by grand delusions of power.

To quote Michael Taylor[9],

the state exacerbates the conditions which are supposed to make it necessary. We might say that the state is like an addictive drug: the more of it we have, the more we 'need' it and the more we come to 'depend' on it.

[1] See Hi Ho Silver!, April 23, 2011

[2] See War on Precious Metals Continues: Silver Margins Raised 5 times in 2 weeks!, May 5, 2011

[3] See War Against Precious Metals: Silver’s Collapsing Prices in the face of Collapsing Inventories, May 6, 2011

[4] See War on Precious Metals: Silver Prices Plunge On Higher Credit Margins, May 2, 2011

[5] Chartrus.com CRB Reuters Futures

[6] See Philippine Mining Index; We’ve Only Just Begun! April 10, 2006

[7] See War on Precious Metals: The Rationalization Process For QE 3.0, May 7, 2011

[8] See The US Dollar’s Dependence On Quantitative Easing, March 20, 2011

[9] Taylor, Michael The Possibility of Cooperation (Cambridge: Cambridge University Press, 1987), p. 168 Quotes.liberty-tree.ca

Saturday, May 07, 2011

War on Precious Metals: The Rationalization Process For QE 3.0

I have been saying here that the US government’s indirect interventions in the commodity markets, particularly in silver, represents a ratchet effect or rationalizing the effects of past policies by the US government with the intention to apply more of the same policies.

Ratchet effect is technically defined as “A tendency for a variable to be influenced by its own largest previous value.”

Here is what I recently wrote,

First is to apply the necessary interventions on the market to create a scenario that would justify further interventions.

Second is to produce papers to help convince the public of the necessity of interventions.

Then lastly, when the 'dire' scenario happens, apply the next intervention tools.

The rationalization process has been happening. The conditioning (brainwashing) of the public is such that Fed policies have not been inflationary and that market prices have been validating their outlook which should justify further actions.

Proof?

The Wall Street Journal blog has this article, “Commodity Rout Lends Credence to Bernanke’s Inflation Outlook”

All in all, it looks as if Bernanke’s oft-repeated view that the commodities surge, driven by supply shocks, political forces and overseas growth, may indeed be “transitory.” Of course, the issue goes beyond inflation, in that lower oil and food prices may help increase consumers’ spending power, which should help the recovery regain its step.

If you think I am talking conspiracy theory here, I’m not.

The manipulation of the public’s mindset (or mind control) is part of the technical tools used by central banks to influence expectations. This is called the signaling channel.

Writes Shogo Ishii of the International Monetary Fund on his book Official foreign exchange intervention (bold highlights mine)

Under the signaling channel, intervention can be effective if it is perceived as a signal of the future stance of monetary policy...

A central bank has an incentive to follow through with policy actions that justify intervention ex-post to safeguard its credibility and avoid financial losses....

The signaling channel depends in part on the institutional and policy credibility of the central bank. The effectiveness of intervention through signaling relies on influencing market expectations by transmitting information on fundamentals or future policy actions. Intervention must be perceived as credible signals (or threats) of future monetary policies to influence expectations.

So far, pieces of the puzzle fits.

Friday, May 06, 2011

War Against Precious Metals: Silver’s Collapsing Prices in the face of Collapsing Inventories

As prices of silver continue to plunge, physical demand for silver has been swelling.

And this has been causing a swift draining of inventories at the COMEX.

As Zero Hedge’s Tyler Durden points out

At this rate, tomorrow, for the first time, we will see a 32 handle in Comex registered silver ounces, where apparently despite the massive drubbing in paper silver, demand for physical inexplicably persists. Speculators to be blamed for this in 5...4...3...

The war against precious metals has been accentuating the price distortions. Yes they could be blamed on speculators. But the series of credit margin hikes is obviously is a form of price control being waged for political ends.

Either we will see a slump in the demand for physical silver and subsequently growing stockpiles or price manipulations will implode.

What is unsustainable won’t last.

Thursday, May 05, 2011

War on Precious Metals Continues: Silver Margins Raised 5 times in 2 weeks!

The war against precious metals, which I earlier pointed out, continues.

This from Reuters,

The CME Group (CME.O) sharply raised silver futures margins for a fourth and fifth time in under two weeks, an 84 percent rise in trading costs that has helped provoke a nearly unprecedented sell-off.

The 20 percent slide in silver prices since they touched an all-time high of $49.51 an ounce on April 28 has been in large part driven by selling from speculators who may be unable or unwilling to bear the surging cost of holding positions.

Holdings in the world's largest silver-backed exchange-traded fund, iShares Silver Trust, fell by 521.8 tons, or 4.78 percent, from the previous session to 10,387.26 tons by May 4.

The CME, which typically raises margins when volatility in markets increases, dealt the latest blow on Wednesday, announcing two separate, successive margin hikes.

It said margins would rise to $14,000 per contract from$12,000 effective Thursday, May 5, and again to $16,000 effective Monday, May 9. Prior to April 25 the margin stood at $8,700 per contract. One contract holds 5,000 ounces, worth about $200,000 at current prices.

Silver seems to be leading the rest of the other important commodity benchmarks as gold and oil (WTIC) down.

We also have reports that George Soros may have been unloading his holdings of precious metals.

Declining commodities have likewise placed some pressures on some emerging market stock markets as shown by the EEM index.

The point of all these seeming assault on precious metals could be to impress on the public that the Fed’s policies have not been inflationary.

And the possible deployment of price controls via higher margins appears to be supported by propaganda efforts from the US Federal Reserve, which has been issuing a stream of research papers.

Notes the Wall Street Journal Blog,

Over recent months, there’s been a steady flow of research coming out the Federal Reserve’s regional branches that aims to assess the risks generated by surging food, energy and commodity prices.

The latest comes from the Federal Reserve Bank of Boston, and it fits the arc described by much of the existing central-bank writings, which holds that long-run inflation in the U.S. is likely to remain under control despite rising prices for things like gasoline, food, and raw materials used in factories.

In the paper released Wednesday, Boston Fed researcher Geoffrey Tootell wrote “evidence from recent decades supports the notion that commodity price changes do not affect the long-run inflation rate.” He noted his conclusions in the paper were drawn from a brief given to his bank’s president, Eric Rosengren, to assist the official in preparing for a recent Federal Open Market Committee meeting.

In my view this is part of the orchestrated efforts to condition the public for the next round of QEs, particularly QE 3.0.

First is to apply the necessary interventions on the market to create a scenario that would justify further interventions.

Second is to produce papers to help convince the public of the necessity of interventions.

Then lastly, when the 'dire' scenario happens, apply the next intervention tools.

Monday, May 02, 2011

War on Precious Metals: Silver Prices Plunge On Higher Credit Margins

As silver prices have been on a juggernaut, the CME group tightens credit margins to exert control. The result: silver prices take a plunge.

From the Bloomberg,

Silver futures plunged as much as 13 percent, the biggest intraday drop since October 2008, as CME Group Inc. raised the amount of cash that traders must deposit for speculative positions.

The metal for July delivery dropped to $42.2 an ounce before trading at $43.875 an ounce at 11:46 a.m. in Singapore. The CME increased margins by 13 percent with effect from the close on Friday, according to a statement...

Silver is the best performer this year on the Standard & Poor’s GSCI Index of 24 commodities. The metal led the way in April as commodities beat stocks, bonds and the dollar for a fifth straight month, the longest stretch in at least 14 years.

Gold increased 9.2 percent this year and is set for its 11th annual gain, while silver jumped 43 percent as investors increased their holdings in exchange-traded products to a record 15,518 metric tons on April 26.

Hedge-fund managers and other large speculators cut their net-long positions in New York silver futures by 26 percent in the week ended April 26, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets prices will gain, outnumbered short positions by 24,995 contracts on the Comex division of the New York Mercantile Exchange, according to the CFTC.

Initial margins increased to $14,513 per contract from $12,825 and maintenance deposits rose to $10,750 from $9,500, said CME, parent of Comex where the futures are traded.

I am reminded of the climax of the last bubble in silver during 1980, where the Hunt Brothers unsuccessfully attempted to corner the silver market but was foiled through the same measures.

Notes the Wikipedia,

But on January 7, 1980, in response to the Hunt's accumulation, the exchange rules regarding leverage were changed, when COMEX adopted "Silver Rule 7" placing heavy restrictions on the purchase of commodities on margin. The Hunt brothers had borrowed heavily to finance their purchases, and as the price began to fall again, dropping over 50% in just four days, they were unable to meet their obligations, causing panic in the markets.

Yet the conditions of the silver market in 1980 is different than today.

Silver, then, had been rising along with interest rates, where many credit former US Federal Reserve chairman Paul Volcker for ending stagflation by tightening the money supply which prompted interest rates to rise.

However, globalization and commodity supply glut could have been a factor too.

As Dr. Marc Faber wrote,

I would therefore argue that even if Paul Volcker hadn't pursued an active monetary policy that was designed to curb inflation by pushing up interest rates dramatically in 1980/81, the rate of inflation around the world would have slowed down very considerably in the course of the 1980s, as commodity markets became glutted and highly competitive imports from Asia and Mexico began to put pressure on consumer product prices in the USA.

Today, global governments have still been flooding the world with money. In addition, global interest rates remain artificially depressed.

This suggests that downside pressures on silver prices from tighter credit margins would likely to be temporary. As I have repeatedly been saying no trend moves in a straight line.

Though CME Group is a publicly listed company (Nasdaq: CME), it’s a wonder if the US government has a hand in this.

Saturday, April 23, 2011

Hi Ho Silver!

Silver prices went ballistic and has virtually outclassed its commodity peers!

I included the S&P 500 (red) and the emerging market benchmark EEM (blue green) [chart from stockcharts.com]

The parabolic rise of Silver (51% year to date) may give the impression of a bubble at work. Could be, but other commodities have not been emitting the same signals.

Bubbles usually can be identified by across the board ‘rising tide lifts all boats’ increases. The same dynamic can be seen in a ‘flight to real asset’ phenomenon. The difference is with the subsequent outcomes: a boom goes bust while a crackup boom segues into hyperinflation.

The exemplary performance of silver can also due to another fundamental factor: A massive short squeeze!

Writes Alasdair Macleod of Goldmoney, (bold highlights mine)

There are a few banks with large short positions in silver on the US futures market in quantities that simply cannot be covered by physical stock. The outstanding obligations are far larger than the stock available. The lesson from the London Bridge example is that prices in a bear squeeze can go far higher than anyone reasonably thinks possible. The short position in gold is less visible, being mainly in the unallocated accounts of the bullion banks operating in the LBMA market. But it is there nonetheless, and the bullion banks’ obligations to their bullion-unallocated account holders are far greater than the bullion they actually hold.

But there is one vital difference between my example from the property market of 1974 and gold and silver today. The bear who got caught short of London Bridge Securities was right in principal, because LBS went bust shortly afterwards; but in the case of gold and silver, the acceleration of monetary inflation is underwriting rising prices for both metals, making the position of the bears increasingly exposed as time marches on.

No trend goes in a straight line. So silver prices may endure sharp volatilities in the interim.

However, if the short squeeze fundamental narrative is accurate, which will likely be amplified or compounded by the monetary inflation dynamics, then as the fictional TV hero the Lone Ranger would say,

Hi-yo, Silver! Away!

Post Script:

Here is where Warren Buffett made a big mistake.

Berkshire Hathaway reportedly bought 130 million ounces of silver in 1998 at an average of $5.25 per oz. which he subsequently sold at about $7 in 2006. His ideological aversion to metals made him underestimate Silver’s potentials.

Lesson: ideological blind spots can result to huge opportunity costs.

Friday, August 21, 2009

China Opens Silver Bullion For Investment To Public

Wednesday, December 10, 2008

Influencing Gold and Silver Markets, Backwardations Imply Higher Gold and Silver Prices

And it seems that such “influences” have likewise been extended to the precious metal markets. Some agents of the banking sector, which has been under the lifeline of the US Federal Reserve, seems to have built heavy short positions in both the silver and gold markets.

Here is the excerpt (which includes charts) from Resource Investor’s Gene Arensberg,

``As of December 2, as gold closed at $783.39, the CFTC reported that 3 U.S. banks had a net short positioning for gold on the COMEX, division of NYMEX, of 63,818 contracts. The CFTC also reported that as of the same date all traders classed by the CFTC as commercial held a collective net short positioning of 95,288 contracts.

``That means that just three U.S. banks accounted for 66.97% of all the commercial net short positioning on the COMEX for gold futures.

``For silver, it’s even more startling. On December 2, as silver closed at $9.57, exactly 2 U.S. banks held a net short positioning of 24,555 contracts. The CFTC reports that as of the same date all traders classed as commercial held a net short positioning of 24,894 contracts. So, the 2 U.S. banks, with one particular Fed member bank probably holding almost all of it, held a sickening 98.64% of all the collective commercial net short positioning on the COMEX, division of NYMEX in New York.

``Exactly two U.S. banks have practically all the COMEX commercial net short positioning on silver. For a little context, 24,555 net short contracts means that the two banks held net short positions on December 2 for 122,775,000 ounces of silver with silver at $9.57. The COMEX said on December 4, that there were 80,239,857 ounces total in the “Registered” category, so these 2 malefactor banks held net short positioning equal to about 153% of the amount of deliverable silver in ALL the COMEX members’ accounts.

``And people wonder why both silver and gold moved into backwardation over the past two or three weeks? People are apparently worried that they won’t be able to take delivery of gold or silver metal from the COMEX in the future. They'll pay a premium now to get it now.”

In other words, the historical backwardation seen in the gold-silver markets accounts for as the brewing disparities between the precious metals’ physical markets relative to the financial markets or prices in the financial markets don't seem to be in synch with what has been going on in the physical markets.

To quote Professor Antal E. Fekete, ``Gold going to permanent backwardation means that gold is no longer for sale at any price, whether it is quoted in dollars, yens, euros, or Swiss francs. The situation is exactly the same as it has been for years: gold is not for sale at any price quoted in Zimbabwe currency, however high the quote is. To put it differently, all offers to sell gold are being withdrawn, whether it concerns newly mined gold, scrap gold, bullion gold or coined gold…(emphasis mine)

For us, the most probable explanation for such attempts to influence the precious metal markets is to create the impression that “inflation” remains subdued or contained. The US government wants to stoke “inflation” in the asset markets (stocks and real estate), but not in the commodity markets.

To add, by keeping the impression of contained "inflation", this allows authorities to liberally expand its theater of operations as it continues to wage war against debt deflation.

Moreover, such backwardation can also be read as the unintended effects from the distortions brought about by the attempt to influence the gold and silver market prices and as growing indications of the weakening foundations of the US dollar.

Again quoting Professor Feteke, ``Backwardation will pull in stocks from the moon as it were, if need be. The cure for the backwardation of any commodity is more backwardation. For gold, there is no cure. Backwardation in gold is always and everywhere a monetary phenomenon: it is a reminder of the incurable pathology of paper money. It dramatizes the decay of the regime of irredeemable currency. It can only get worse. As confidence in the value of fiat money is a fragile thing, it will not get better. It depicts the paper dollar as Humpty Dumpty who sat on a wall and had a great fall and, now, “all the king’s horses and all the king’s men could not put Humpty Dumpty together again.” To paraphrase a proverb, give paper currency a bad name, you might as well scrap it.

``Once entrenched, backwardation in gold means that the cancer of the dollar has reached its terminal stages. The progressively evaporating trust in the value of the irredeemable dollar can no longer be stopped.” (emphasis mine)

A prolonged backwardation suggests that price suppression schemes will only build unsustainable pressures underneath which will eventually find a release valve and consequently be vented in prices. Thus, gold and silver prices are likely to zoom to the moon!