A comment prompted me to share my insight on the so-called American exceptionalism

American exceptionalism, according to Wikipedia.org, refers to the theory that the United States is qualitatively different from other nations.

America is allegedly “qualitatively different” in two ways (from Wikipedia.org):

-via Alexis de Tocqueville, “emergence from a revolution, becoming "the first new nation", and developing a uniquely American ideology, based on liberty, egalitarianism, individualism, populism and laissez-faire”

-via American Communist Party (1920s), their belief that "thanks to its natural resources, industrial capacity, and absence of rigid class distinctions, the United States of America might for a long while avoid the crisis that must eventually befall every capitalist society.

Wikipedia further adds, ``Although the term does not imply superiority, some writers have used it in that sense.”

I would reckon that every nation’s history is in many ways unique or implies exceptionality, except that to quote Winston Churchill, “History is written by the victors”.

This means that the string of America’s successes may have prompted many writers to overconfidently believe that America’s successes represent a permanent state of order.

In my view, this could be analogized to the famous but worrisome Wall Street maxim “This time is different”.

Also the thought of America’s “exceptionalism” seems guilty of what is called as the survivorship bias or to quote the Wikipedia, “the logical error of concentrating on the people or things that "survived" some process and inadvertently overlooking those that didn't because of their lack of visibility”

Moreover, there is a time consistency problem with both assertions: the ideology of liberty, egalitarianism, individualism, populism and laissez-faire can’t be seen as exclusively unique to the American race, since these can be learned and assimilated by other nations. The world does not operate on a vacuum. People learn and adapt.

Alternatively, if these traits represent the core of exceptionalism, then any significant erosion would also risk reducing such perceived ‘exceptionality’.

Thus, exceptionalism largely depends on how the US struggles to maintain this “uniquely American ideology”, and similarly, how other nations respond to incorporate on such success model as their own.

I am less inclined to respond to the American Communist Party view: industrial capacity is simply an output of this “unique American ideology” while natural resources depends on the economic value assigned to it by the market, while the absence of class distinction seems like an opaque premise—all forms of government have ‘rigid’ class distinctions.

Also in response to implications that America had been endowed with wealth by birthright, it must be remembered that the essence of the annual Thanksgiving Day celebration emanates from a painful chapter of US history, where the Pilgrims experimented with and suffered from the collectivist state which eventually prompted them to espouse the “unique American ideology”.

Writes Heritage Foundation Conn Carroll, (bold emphasis mine)

When the first Pilgrims founded the Plymouth Colony, all property was taken away from families and transferred to a “comone wealth.” In other words, the Pilgrims tried to do away with private property. The results were disastrous. According to Bradford, the stronger and younger men resented working for other men’s wives and children “without any recompence.” And the women forced to cook and clean for other men saw their uncompensated service as “a kind of slavery.” The system as a whole bred “confusion and discontent” and “retarded much employment that would have been to [the Pilgrims’] benefit and comfort.” Unable to produce their own food, some settlers “became servants to the Indians,” cutting wood and fetching water in exchange for “a capful of corn.” Others tragically perished.

It was not until private property rights were restored and every man was allowed to “set corn for his own particular” that prosperity came to the colony. Bradford reported, “This had very good success for it made all hands very industrious. … [M]uch more corn was planted than otherwise would have been. … Women went willingly into the field, and took their little ones with them to set corn.”

More, American exceptionalism does not imply that other countries have been accursed to suffer from ‘codified poverty’. This perspective unjustly sees Americans as in a state of permanent entitlement.

There are reasons why society suffers from impoverishment, but the least of which is that people volunteer to be poor.

The principal cause why many are poor is due to economic repression or policies that interdict people to trade, inhibit the exchange of ideas that leads to innovation and importantly suffer from lack of capital.

As Ludwig von Mises once wrote, [bold highlights mine]

What distinguishes contemporary life in the countries of Western civilization from conditions as they prevailed in earlier ages, and still exist for the greater number of those living today, is not the changes in the supply of labor and the skill of the workers and not the familiarity with the exploits of pure science and their utilization by the applied sciences, by technology. It is the amount of capital accumulated. The issue has been intentionally obscured by the verbiage employed by the international and national government agencies dealing with what is called foreign aid for the underdeveloped countries. What these poor countries need in order to adopt the Western methods of mass production for the satisfaction of the wants of the masses is not information about a "know how." There is no secrecy about technological methods. They are taught at the technological schools and they are accurately described in textbooks, manuals, and periodical magazines. There are many experienced specialists available for the execution of every project that one may find practicable for these backward countries. What prevents a country like India from adopting the American methods of industry is the paucity of its supply of capital goods. As the Indian government's confiscatory policies are deterring foreign capitalists from investing in India and as its prosocialist bigotry sabotages domestic accumulation of capital, their country depends on the alms that Western nations are giving to it.

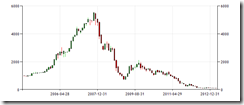

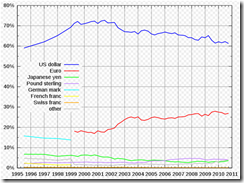

Finally American exceptionalism can be represented by the state of US dollar functioning as the world’s premier currency reserve or forex anchor.

From Google

Looking at the above, I’d say that American exceptionalism has been on a decline and will likely suffer from a further loss of competitiveness, in the condition that her government continues to implement policies that corrodes her “unique American ideology”.