``To profit from good advice requires more wisdom than to give it."- Wilson Mizner (1876-1933), US Screenwriter

One thing inspiring about the present rally is that internal sentiment and some technical indicators appear to have turned bullish.

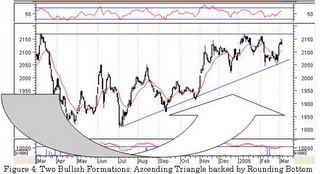

As figure 4 shows, two patterns seen in the Phisix chart formed for about a year manifests of two bullish formations, particularly the ascending triangle coupled with a “rounding bottom”.

Since both bullish formations have been at work for about a year, this can be reckoned as “intensively” bullish, which means that if a breakout ensues, the pattern can lead the Phisix to test 2,530 levels! The estimate is arrived from measuring the bottom of the chart to the present resistance levels applied on the upside from the resistance levels.

Indeed such outlook can be quite exciting, however, one should be reminded that charts can only be used as a guidepost to measure the psychology of the investors/market and are NOT foolproof! Second is that if indeed a breakout follows, it means that the Phisix may test the estimated level for a period of time, similar to the duration of its formation, which may span from one year or even possibly more.

Now of course, such an outlook means adopting the right strategies when and if the Phisix does break the 2,172 resistance levels. Past performance is no guarantee that the future outcome will be similar, as in the case of PLDT, measuring its ALPHA (measurement of stock performance beyond its Beta) through Figure 5, shows that PLDT during the initial stages of the Phisix run in 2003-2004 had greatly outperformed the Phisix.

Figure 5: Measuring PLDT’s Alpha

Today, PLDT still outperforms the Phisix but much to a lesser degree, as shown by the angles of the two disparate trend lines. This means that either PLDT will pick up its momentum and lead the Phisix anew or a coming breakout would come from a broader participation from other heavyweights.

And signs are on the wall. During the past attempts of the Phisix to the resistance levels, most second or third tier issues that were having an upside momentum have been stalled by sellers waiting at the wings at each of the issue’s resistance levels. In short, most issues failed to fulfill a breakout.

Last week, I have noted of several ‘successful’ breakouts on the broadmarket which could mean that local investors could be indeed turning bullish, such as Cebu Holdings Inc.

Finally as a matter of market internals, the breadth had a marked substantial improvement with advancing issues dominating daily activities (even on Friday’s decline). Moreover, as initially stated, foreign capital flows remained significantly positive at P 888.835 million, with inflows seen in the broadmarket while foreign transactions represented about 61% of cumulative turnover.

Obnoxious politics aside, the Phisix is now about 40 points away from its resistance and may consolidate first or move ahead to test its one year high soon. Of course, if the political equation changes (with a violent overthrow of the present government), and if any exogenous blowouts occur (abovementioned risks)...all bets are off. Momentum for the moment is in favor of the bulls.

No comments:

Post a Comment