The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, July 31, 2006

FinanceAsia: Megaworld steps up with new high-yield debt deal

Sunday, July 30, 2006

Liquidity Driven Rally Amidst A US led Slowdown?

``Fear not for the future, weep not for the past." - Percy Bysshe Shelley (1792-1822), English Poet

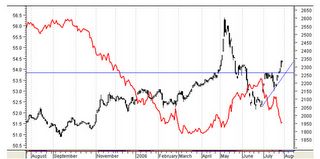

Figure 4: Stockcharts.com MSCI Emerging Free (red line) and MSCI World Index (black line)

Figure 5: The Phisix (black candle) and the

Figure 6: BCA Research: Global Earnings Revised Down

![]() The path of least resistance for global earnings estimates is down until economic growth prospects turn-up anew.

The path of least resistance for global earnings estimates is down until economic growth prospects turn-up anew.

Want a Stock Market tip? PGMA’s SONA was a Mouthful

``Men are more moral than they think and far more immoral than they can imagine.”-- Sigmund Freud

Figure 1 IMF: Foreign Exchange Reserves and Share of Capital flows

Figure 2 IMF:

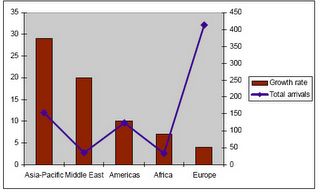

Figure 3 Tourism & Travel Institute: 2004 Positive Growth Rate across all regions led by

Tuesday, July 25, 2006

Reuters: Big Oil renews Asian crude hunt as reserves dwindle

Some say there have been no short supply of oil, and that present prices of oil reflects “speculative or terror” premium.

Well, it looks like major oil companies have been sifting through even from the least prolific fields as signs of desperation to add up on their depleting reserves.

An excerpt from Reuters...

"Because there are opportunity constraints, companies are willing to look at areas that had not previously interested them," said Mark McCafferty, head of

"People are looking at the

Shell, which in 2004 opted not to develop a small oil reserves associated with the

Read more by clicking on this link

Monday, July 24, 2006

Phisix-US Correlation, Heightened Liquidity Risks Calls for Defensive Positioning

``The ladder of success is best climbed by stepping on the rungs of opportunity."- Ayn Rand

Figure 2 stockchart.com: Phisix (candlestick) and S & P 500 (line)

``When weak retail sales figures and the Fed Chairman's comments that he sees the economy slowing are interpreted as good news for stocks, then you know it is time to get out of the market.”

As you know, I have been in the camp of those who think that the US Fed would embark on a gamut of rates cuts once signs of a downturn snowball. I mentioned that political expediency (election season, pressures from the public), inveterate fear of deflation, aside from ideological leanings by the Fed Chief, past actions undertaken by the Fed (see Figure 3) and the huge leverage in its system which translates to more money “created out of thin air” required to settle the chronically exploding liabilities as possible reasons why the Fed would likely accommodate more inflation risks and focus on sustaining asset-driven growth (see June 26 to June 30 Fed Dilemma: Too Much Pressure To Continue Hikes).

Figure 3: Ritholtz Research & Analytics: Liquidity Driven Banking Policy

Figure 4: Ameinfo.com: SC Arab Index

After peaking last December, the SC Arab index has given back over 40% of its gains. It could be that the parabolic rise caused its market benchmarks to stumble under its own weight or that while liquidity continues to be strong; the explosive rise of its stocks was simply unsustainable or lacked the amount of liquidity growth to sustain its pace. It could also mean that Arab stocks have been responding to the liquidity withdrawal measures adopted by global central banks as shown in Figure 5.

Figure 5: Gavekal: Falling Velocity and Global Markets

For the moment, the Phisix’s close correlation with the

Research Process, Value of Time and Probabilities are Key to Outperformance

``Imitation in markets often gets a bad name, but it's important to recognize how vital imitation is in our day-to-day lives. We imitate each other all the time, primarily because other people often have better information than we do. It becomes a problem in markets when everyone starts to imitate one another, and they forget about what they're doing in the first place. It leads to excesses.”- Michael Mauboussin

Domestic Political Developments Unlikely to Drive Markets

Figure 1 Moneyandmarkets.com: Commanding Share of

Thursday, July 20, 2006

CBS Marketwatch Mark Hulbert: Explanations R US

The gullible investing public have been regularly inured to believe, especially by mainstream media and their coterie of analysts, that non-economic events (wars, natural calamities & etc.) have significant impacts in the activities in the financial markets. But do such events really move markets?

Monday, July 17, 2006

Dow Jones 10,700: Marking the Line in the Sand?

I had been looking at 10,400 level, about 10% from the recent highs, as a possible threshold level, but maybe have found a clue from Stockcharts.com's Chip Anderson. According to Mr. Anderson...

"Three big down days have sent the Dow back down to the 10,700 support level. What's that you say? 10,700 is just a number? Just a number like any other? Oh really? Check out this chart:

Sunday, July 16, 2006

Mixed Market Signals, Unfolding Business Cycles

``Ignoring market risk will mean that, from time to time, performance will be lumpy...The fund is unlikely to outperform benchmarks consistently. Rather, the goal is to outperform on average, most of the time, and over the long run.''- Martin Whitman, manager since 1990 of the $8.3 billion Third Avenue Value Fund.

While I might have been right about rising gold prices, the correlation between non-US equity benchmarks, particularly of the emerging market ones, and rising gold prices appears to have broken down.

Figure 2: Stockcharts.com: Rallying US dollar Index and Morgan Stanley Government Securities

Figure 5: Absolute Partners: Average Returns by stage of the Business cycle

Figure 6: stockcharts.com: Phisix in a Predicament

Lebanon’s Proxy War may lead to $85 to $100 oil?

Last week, I mentioned that crude oil treaded at a critical juncture looking for either a correction or a breakout. With the market’s declarative stand, Oil finally resolved the impasse with a breakout to a FRESH record nominal High. Its sibling gold was equally buoyed as shown in Figure 1.

Figure 1 stockcharts.com: Record Oil, Gold Follows

Politics, Flawed Policies and the Road to Hell

``But there are many others who are not bashful about using government power to do "good." They truly believe they can make the economy fair through a redistributive tax and spending system; make the people moral by regulating personal behavior and choices; and remake the world in our image using armies. They argue that the use of force to achieve good is legitimate and proper for government - always speaking of the noble goals while ignoring the inevitable failures and evils caused by coercion. Not only do they justify government force, they believe they have a moral obligation to do so.”-Congressman Ron Paul of