``If stocks are attractive and you don't buy, you don't just look like an idiot, you are an idiot.'' -Jeremy Grantham, Baron Buys, Grantham Spots `Once in Lifetime' Chance

It is a curiosity to occasionally hear questions about profitability in today’s market similar to “Are you up or down?”

Because for as long as people have positions in the financial market whether directly (equities, fixed income, currencies, commodities) or indirectly (mutual funds, hedge funds, ETF, UITF and etc.) the unequivocal answer is that given today’s downside volatility-losses are the rule, not the exception.

Today’s Fad: Losses Everywhere

Think of it; nearly $30 trillion of market capitalization wiped out from global equity markets year to date alone. Banks have written off about $680 billion and still counting. As we earlier argued in Spreading the Wealth? Market IS Doing It!, the political morality polemics about income inequality has been in a wash since market losses appear to have sizably narrowed the controversial gap.

Still world real estate market continues to bleed; in the US estimates of losses have been at $1 trillion (globeandmail.com). We don’t have the collateral damage estimates or casualty figures from the fallout in other markets, most especially in Europe and in some other parts of Asia, which includes China or Japan or Australia.

Nevertheless, we have also enormous unaccounted for losses in the derivative, currency (a roster of emerging market victims from Reuters), commodities, bonds, structured finance and other financial markets.

Retirement accounts of baby boomers have been nursing some $2 trillion in the deficits (msnbc.com), thereby putting in jeopardy the retirement plans of many Americans. With Americans likely to work longer, apparently the incoming Obama presidency would have to deal with policies related to health insurance costs, Social security and Private Pensions and flexible work arrangements to address the challenges of the coming transition.

Moreover, the losses have now been spilling over to the real economy enough to impact corporate bottom lines and dividends. In the US, according to the Howard Silverblatt of S&P (Businessweek), earnings growth which had originally been optimistically forecasted at 14.2% for the third quarter have so far posted 13.9% in the red with 77% of companies reporting.

And by corporations we also mean major pension funds and retirement institutions.

As an example many Filipinos are familiar with the US largest retirement fund, The California Public Employees Retirement System, known as CalPERS, which accounted for a total portfolio value of $185 billion on Friday, down 23% from $239 billion at the start of its fiscal year. (latimes.com). The CalPERS fund is down by nearly $54 billion.

According to the same article, ``CalPERS "is taking hits across all asset classes," Feckner said. But the losses would have been even greater "if we had not spread our money out" by diversifying investments….For now, working with interim executives, CalPERS is sticking with a strategy that leans heavily on stocks, which account for about 40% of its holdings. No decision has been made about shifting the investment mix -- possibly toward bonds and other fixed-income assets, Feckner said.” (emphasis mine)

The point is; much like the CalPERs experience, investing in markets is NOT about “trying to time the markets”, as to literally assess one’s portfolio as being “up or down”, but applying portfolio management across the company’s risk profile and time horizon objectives.

In addition, President Rob Feckner underscores the viciousness of the present bear market as impacting “across all assets” meaning that the collateral damage has been broad based and severe enough for most investor’s to escape its wrath.

Warren Buffett Has Been NOT Immune

Because of ferocity of the bear markets, not even gurus are immune.

We have spilled so much ink about the wondrous feat of the world’s most successful investor Warren Buffett, but viewed from real world developments, Mr. Buffett’s investments have not been entirely unaffected see Figure 1.

On a year-to-date basis, Berkshire Hathaway has fallen victim to the powerful grip of bearmarket forces with its share prices down over 20%. And it is not just in share prices, but likewise reflective of corporate bottom line performance, with most of the damage emanating from derivatives related losses.

Some important highlights from CNN Money, ``Warren Buffett's Berkshire Hathaway Inc. on Friday reported a 77% drop in third-quarter earnings, hurt by declining insurance profits and a $1.05 billion investment loss…

``Berkshire began the year with an unrealized $1.67 billion loss on its futures, options and other derivative contracts. The value of those derivatives, which are tied to the value of the overall markets and the credit health of certain companies, improved in the second quarter by $654 million. But in the third quarter amid unprecedented market turmoil, their value fell by $1.05 billion, leaving a loss of $2.21 billion through the first nine months of the year…

``Berkshire finished the third quarter with $33.4 billion cash on hand. That is up from the end of the second quarter when the company had $31.2 billion cash on hand…

``Year to date, Berkshire's net worth slipped to $120.15 billion from $120.73 billion, but during October, price declines in investments and increased liability for equity index put option contracts accounted for a $9 billion decline in net worth.”

So similar to CalPERs, the troubles of Warren Buffett’s flagship in Berkshire Hathaway have been mainly due to the downside repricing of its asset holdings than from the direct impact of the economic downturn to its operations (yes, insurance and Berkshire’s Mid American subsidiary Constellation Energy has suffered from losses).

Remember, Berkshire Hathaway isn’t just your typical fund manager, but is an active investor to manifold diversified industries tacked into the company’s portfolio as subsidiaries, unlike CalPERs which functions principally as passive investors.

A second observation is that as we wrote in Warren Buffett Declares A BUY!, the recent months have shown Berkshire increasing its cash portfolio but over the year have plunked some $11 billion into the markets. Its cash holdings is still a significant 30% relative to the company’s overall net worth, but down from 40% at the start of the year when using the present net worth figures as basis.

Nonetheless, investments in the market doesn’t have to come directly from Berkshire as some of its subsidiaries have been doing the dirt work of expanding via acquisitions such as office furniture CORT which recently acquired Aaron Rents Corporate furnishing for $72 million (bizjournals).

So yes, while Mr. Buffett’s long term holdings are temporarily “down”, influenced by the gyrations of the market, aside from escalating impact from economic variables, overall, his portfolio’s direction has not been driven by the ridiculous idea of “ticker based” assessment but from the perspective of portfolio risk distributed allocation!

In Berkshire’s case, 60% exposure to market risks and 40% cash at the start of the year has changed to the direction of increasing exposure in market risk given the present conditions.

Betting Against Warren Buffet’s Oracle?

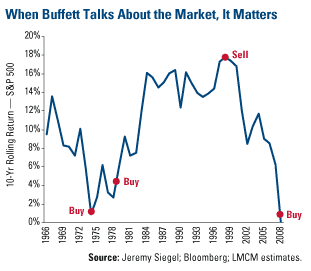

Mr. Buffett hasn’t been your stereotyped market timer, figure 2 from US global investors shows how the legendary Warren Buffett has incredibly “TIMED” the market with his publicized calls to a near precision or perfection during the past 43 years!

Put differently, Mr. Buffett doesn’t exactly “time” the markets in a literal sense as market technicians are wont to do. His selling call in the late 90s didn’t come with outright liquidation of the entire Berkshire’s portfolio simply because some of his portfolio holdings had been designed as a “buy and hold forever”.

Although he did express some regrets for failing to do so, Mr. Warren Buffett quoted at PBS.org in 2004, ``We are neither enthusiastic nor negative about the portfolio we hold. We own pieces of excellent businesses -- all of which had good gains in intrinsic value last year - but their current prices reflect their excellence. The unpleasant corollary to this conclusion is that I made a big mistake in not selling several of our larger holdings during The Great Bubble. If these stocks are fully priced now, you may wonder what I was thinking four years ago when their intrinsic value was lower and their prices far higher. So do I.” (emphasis mine) So if the Oracle of Omaha had been subject to regrets, how much more the mere mortals of the investing world?

To reiterate, in periods where he believes markets are conducive for selling Mr. Buffett raises cash in proportion to his allocation targets and positions defensively. On the other hand, in periods where he thinks opportunities for greater returns with a margin of safety embedded on his risk profile, as he does today, he raises his market risk exposure gradually.

Yet, the Mr. Buffett’s rarified but highly prescient audacious landmark calls can be construed from a combination of his interpretation of economic cycles, fundamental valuations and importantly sentiment, the seemingly indomitable “simple-but-hard-to-apply” Buffett doctrine- ``be fearful when everybody is greedy and greedy when everybody is fearful”.

Given his formidable track record, betting against him isn’t going to be a prudent choice.

The Illusion of Bull and Bear Markets

It also to our understanding that gurus don’t see markets the same way ordinary market participants view them, like in the manner which we typically label as Bull or Bear Markets.

Mr. Nassim Nicolas Taleb, the famed iconoclastic author of the best selling book The Black Swan, wrote in Fooled by Randomness ``I have to say that bullish or bearish are often hollow words with no application in a world of randomness-particularly if such a world like ours, presents asymmetric outcomes.” (highlight mine)

Incidentally, Mr. Taleb has been one of the recent exceptions or outliers, whose managed funds have remarkably been up during the recent gore in the financial markets. This from Wall Street Journal, ``Separate funds in Universa's so-called Black Swan Protection Protocol were up by a range of 65% to 115% in October, according to a person close to the fund.”

While Mr. Taleb’s magic seems to work best with market crashes as he has done so in Black Monday of October 19th 1987, he hasn’t been as effective when markets are going up, ``Mr. Taleb's previous fund, Empirica Capital, which used similar tactics, shut down in 2004 after several years of lackluster returns amid a period of low volatility.” (WSJ)

In parallel, Dr John Hussman recently wrote of the pointless exercise of classifying markets as bullish or bearish, ``From my perspective, the whole issue of bull market versus bear market doesn't get investors anywhere. Asking whether stocks are in a bull market or a bear market is like asking Columbus what kind of trees are planted along the edge of the earth. The question itself makes a false assumption about how the world works. My view is that bull markets and bear markets don't exist in observable reality – only in hindsight. What gain is there to investing based on something that's unobservable when you can manage your investments based on directly observable evidence? What we can observe directly is the prevailing status of valuations and the quality of market action.” (underscore mine)

In short, such gurus tend to view markets strictly in the context of fundamentals than from sheer momentum.

Conclusion

To recap, the sharp volatility in the financial markets has been the prevailing trend such that anyone exposed to the market has been subject to losses in the market directly or indirectly.

Even the biggest institutions or the best investors have not been immune from current adverse market developments.

While this is not to justify present losses in the essence of John Maynard Keynes’ famed pretext, ``It is better for reputation to fail conventionally than to succeed unconventionally", the point is to learn from the perspective of übermarket professionals that investing is not about attempting with futility to catch undulating short term waves but of shaping one’s portfolio based on risk distributed time preference profiles amidst observable evidence of market action and fundamental and or economic parameters.

Yet since the prevailing trend of losses has become a mainstream bias, a mounting chorus from value investors seems to have surfaced.

Warren Buffett’s recent contrarian buy calls may have either generated a momentum or provided justifications for the rising incidences of converts (from former bears into current bulls). We formerly listed Dr. John Hussman, Jeremy Granthan and Mohammed El-Erian as the early apostates.

We are adding to our list prominent market savants are Vanguard’s founder John Bogle, Fidelity International’s Anthony Bolton, former Merrill Lynch’s Bob Farrell, Steve Leuthold, Research Affiliates LLC’s Rob Arnott and others.

Even Dr. Marc Faber believes that the low is near but in contrast to the others believes global markets will ``stick at this low point for a long time.”

Yet, some of the rabid high profile hardcore bears whom have basked in the recent glory of market collapse seem to remain stuck with idea of market Armageddon.

But there seems to be one stark difference between the former (converts) and the latter: the former are full pledged money managers while the latter appears to be ivory towered ensconced members of the academia or publishers who aren’t money managers.

No comments:

Post a Comment