Some of the nattering nabobs of doom have resurfaced.

They argue that the present weakness in the markets signify as signs of the next market meltdown.

These people seem to argue not from evidence but from dogma.

And people blinded by dogma tend to get market predictions utterly and consistently wrong.

Even if they are correct and that a market meltdown occurs, it isn’t likely the same scenario as 2008.

We must be reminded that despite ANY market condition “there always will be a bull market somewhere”. The intrinsic difference is one of the idiosyncratic operating conditions which produces diverse types of bullmarkets.

In the 2008, despite a general financial market meltdown brought about by the recession that culminated with the Lehman collapse, the bullmarket was seen in the US dollar and US treasuries.

Yet the same experts who failed to see the recent rallies and have made the Great Depression as the fount of their predictions seem to be singing the same tune again.

The idea of a Great Depression circa 2011 is false for the simple reason past conditions are patently dissimilar from today.

True, the US stock markets had its first major episode of correction for the year 2011.

But was it a broad market meltdown?

From US Global Investors

Obviously not.

The energy sector defied last week’s downturn. This goes to show that there has been an ongoing rotation of money—all too symptomatic of inflation dynamics at work.

As it is rare to find this gem of reality check from the mainstream; from the Wall Street Journal

It's important to keep in mind, however, that oil was already trading in the $85 to $90 a barrel range before the recent irruption in the Arab world. The run-up to that price territory began in earnest last year after the Federal Reserve embarked on its QE2 strategy of further monetary easing.

The Fed absolves itself of any responsibility for rising oil prices, attributing them to rising demand from a recovering global economy. Demand has been rising, but not enough to explain what has been a nearly across-the-board spike in prices for dollar-traded commodities. (Natural gas is the big exception, thanks to a boom in domestic exploration.) A spike in one or two commodities can be explained by a change in relative demand. A uniform price spike suggests at least in part a monetary explanation. The Fed will use the Libya turmoil as another alibi, but there's no doubt in our mind that oil prices include a substantial Ben Bernanke premium.

We have been told by most media outlets except the above that rising oil prices represent as a supply shock.

However, even if the Middle East Crisis fizzles out you’d be surprise to see that after the Libya premium would have been covered, oil prices will continually rise and will exceed the last highs and approach the $200 as we have been predicting.

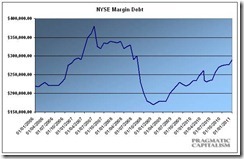

chart from Pragmatic Capitalism

Of course we don’t believe that it’s a bear market, not yet anyway.

What we may be seeing instead could be another bubble at work in the US equity markets as margin trade in the US have been ballooning.

So people who argue that cash should be king will likely be wrong again.

Not with more chatters of QE 3.0 or where global governments have been deliberately destroying the purchasing power of money or currency values. And certainly not when the adjusted monetary base which is one of the monetary component which the Federal Reserve controls.

From St. Louis Fed

At the end of the day, all these money will have to flow somewhere. And unless governments learn to restrain themselves the likelihood is that we would likely see higher commodity prices—food, gold, oil etc....

As a side note fiat money stands for political redistribution, and similarly shackles to freedom and liberty. Meanwhile gold stands for the opposite, as per Ralph Waldo Emerson, “The desire for gold is not for gold. It is for the means of freedom and benefit”. Do not confuse one for the other.

No comments:

Post a Comment