A bubble represents a market process in response to government policies.

And as I have pointed out last year I call the topping process of a bubble cycle a Wile E. Coyote moment[1]

rising markets on greater debt accumulation amidst higher interest rates is a recipe for the Wile E. Coyote moment.Markets can continue to run until it finally discovers that like Wile E. Coyote they have run past the cliff.

The Wile E. Coyote momentum continues to blossom in the US and may continue to flourish for as long as stock market returns outpaces the rate of increase in the interest rates or outruns the burden of financing from debt accumulation.

The point of establishing the Wile E. Coyote conditions is to understand the risk environment, and not to predict the timing of its inflection point, where the latter is the work of soothsayers.

Record US stocks are also being pushed by near record margin debt. As of November, based on 1995 US dollar and inflation adjusted chart, NYSE margins debt has been knocking on a record high[2].

Meanwhile corporate buybacks have breached past 2000 and 2007 highs largely funded by debt. On the other hand, retail investors continue to pile into the US stock markets, likewise beating the 2000 and 2007 highs.

As of January 6th, based US flow of funds on US equities[3], households stampeding into the stock markets has largely been channelled through equity mutual funds and equity ETFs as institutional investors sold.

And this fantastic ramping up of record credit via various instruments has been accounted by Prudent Bear’s eagle eyed Doug Noland[4]. (bold mine)

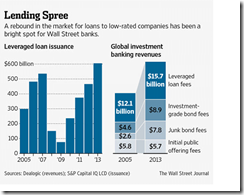

The year 2013 saw record ($1.52 TN from Bloomberg) U.S. corporate debt sales. For the second straight year, investment-grade debt issuance set an annual record ($1.125 TN). Junk bond issuance ($360bn) set a new record, with record sales of payment-in-kind (PIK) and “cov-light” bonds. Junk-rated loan volumes surged to a record $683 billion, surpassing 2008’s $596 billion (according to Standard & Poor’s Capital IQ Leveraged Commentary and Data). Total global corporate bond issuance surpassed $3.0 TN. Global speculative-grade bond sales approached an unprecedented $500 billion (from S&P). Global IPO volumes jumped 37% from 2012 to $160 billion (from S&P).At $233bn, private-equity buyouts reached their highest level since 2007 (Dealogic). The U.S. IPO market enjoyed its strongest issuance year since 2007. A total of 229 deals raised $61.7bn, with dollars raised up 31% compared to 2012. And it’s certainly worth noting that hedge fund assets increased more than $360 billion during the year to reach a record $2.70 TN (from Prequin), despite ongoing (“crowded trade”) performance issues.

This massive absorption of credit from the yield chasing crowd has been indiscriminate, as yield chasing has prompted junk bond issuance as noted above[5] to fresh records above the pre-Lehman levels.

Such incredible record breaking streak where 2000 and 2007 highs have been dislodged, could this time be different?

Yet the speculative excess by mostly the households have driven up earnings based on Dr. Robert Shiller's cyclically adjusted P/E ratio to proximate the 25x trailing earnings level which has been threshold “where secular bull markets have previously ended” notes STA Wealth’s Lance Roberts[6].

It’s interesting to see if the following dynamic will still hold: “if America sneezes, does the world catch a cold?”

And such massive credit creation reminds me of what essentially drives the potential 2014 Black Swan event. From the great Austrian economist Ludwig von Mises[7]

All governments, however, are firmly resolved not to relinquish inflation and credit expansion. They have all sold their souls to the devil of easy money. It is a great comfort to every administration to be able to make its citizens happy by spending. For public opinion will then attribute the resulting boom to its current rulers. The inevitable slump will occur later and burden their successors. It is the typical policy of après nous le déluge. Lord Keynes, the champion of this policy, says: "In the long run we are all dead." But unfortunately nearly all of us outlive the short run. We are destined to spend decades paying for the easy money orgy of a few years.

Will a Black Swan event in the US occur in 2014?

[update: I adjusted for the font size]

[update: I adjusted for the font size]

[1] See How Volatile Bond Markets May Affect the Phisix June 3, 2013

[2] Doug Short, NYSE Margin Debt Is Fractionally Off Its Real All-Time High December 30, 2013

[3] Yardeni Research, Inc. US Flow of Funds: Equities January 6, 2014

[4] Doug Noland 2013 in Review Credit Bubble Bulletin Prudent Bear.com December 27, 2013

[5] Wall Street Journal 'Junk' Loans Pick Up the Slack, January 9, 2014

[6] Lance Roberts Market Bulls Should Consider These Charts January 9, 2014

[7] Ludwig von Mises Come Back to Gold Mises.org April 25, 2013

1 comment:

A black swan event is coming soon.

The terminal phase of liberalism, came with Ben Bernanke’s QEs, and defined the investor as the centerpiece of liberalism as both a paradigm and age. With the trade lower in Retailers, XRT, and Global Financials, IXG, on January 13, 2014, peak liberalism was established, and now the debt serf emerged as the centerpiece of authoritarianism as both a paradigm and age.

Under liberalism, monetary transmission of fiat money went to the investor, this is seen in The Economic Collapse Blog post The number of working age Americans without a job has risen by almost 10 million under Obama. And in The LA Times post US wealth gap grew during recession, Stanford report finds. And in The SCPI report National Report Card on Poverty and Inequality.

Regionalism is the singular dynamo of economic activity under authoritarianism, replacing liberalism’s three dynamos of creditism, corporatism and globalism. Monetary transmission under authoritarianism will become quite effective for a number of people, as bible prophecy reveals “they worshiped and followed after the beast, saying who can make war against it”.

Post a Comment