The great Murray N. Rothbard have presciently warned on this long time ago,

It is little known, however, that there is a federal agency that tops the others in secrecy by a country mile. The Federal Reserve System is accountable to no one; it has no budget; it is subject to no audit; and no Congressional committee knows of, or can truly supervise, its operations. The Federal Reserve, virtually in total control of the nation's vital monetary system, is accountable to nobody — and this strange situation, if acknowledged at all, is invariably trumpeted as a virtue.

Now, Professor Rothbard’s vindication as seen from the Daily Bail’s enumeration of Ben Bernanke’s failures

As you will hear in the collection of videos and stories linked below:

We can sum it up to: POLITICS—being accountable to no one, arbitrarily choosing winners and losers by using and exposing taxpayer money to unnecessary risks and the presumption of superior knowledge (fatal conceit) from which enables experimentation of untested policies that imposes unmeasured externality risks to the global economy.

The sham of independence.

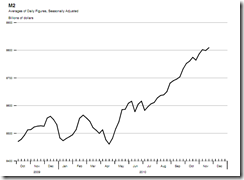

I further include Bernanke’s policies of expanding the Fed’s balance sheets: (both charts from St. Louis Federal Reserve chart which ironically is under Bernanke’s umbrella)

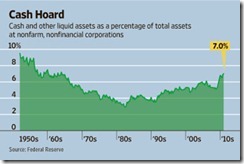

has led to this:

which has done little to the economy.

chart from Money and Markets

But to bolster commodity prices…

and elevate inflation risks…

chart from tradingeconomics.com

…and of course, fueling worldwide excess speculation in financial markets which should bring about the imminence of another crisis.

Again to close with Mr. Rothbard,

It was not enough, however, for the new statist alliance of Big Business and Big Intellectuals to be formed; they had to agree, propound, and push for a common ideological line, a line that would persuade the majority of the public to adopt the new program and even greet it with enthusiasm. The new line was brilliantly successful if deceptive: that the new Progressive measures and regulations were necessary to save the public interest from sinister and exploitative Big Business monopoly, which business was achieving on the free market. Government policy, led by intellectuals, academics and disinterested experts in behalf of the public weal, was to "save" capitalism, and correct the faults and failures of the free market by establishing government control and planning in the public interest.

And thus the (big) banking industry, the US Federal Reserve and the government cartelized system.

Let me repeat: The amount of currency is NOT changing (chart above and below from

Let me repeat: The amount of currency is NOT changing (chart above and below from