The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, August 24, 2013

Video: Humor: Clarke and Dawe on the Bernanke-Speak

Monday, July 22, 2013

Ron Paul: Bernanke’s Farewell Tour

Last week Federal Reserve Chairman Ben Bernanke delivered what may well be his last Congressional testimony before leaving the Federal Reserve in 2014. Unfortunately, his farewell performance was full of contradictory comments about the state of the economy and the effects of Fed policies on the market. One thing Bernanke inadvertently made clear was that the needs of Wall Street trump Main street, the economy, and sound money.Quantitative easing (QE) and effectively zero interest rates have created paper prosperity, but now the Fed must continuously assure Wall Street that the QE spigot will not be turned off. Otherwise even the illusion of recovery will disappear. So Bernanke made every effort to emphasize that the economy was not doing well enough to end QE, while lauding the success of Fed policies in improving the economy.Bernanke was also intent on denying that Fed policies directly boost financial markets. However, the money the Fed creates out of nothing in order to buy mortgage-backed securities and government debt for the QE3 program, benefits first and foremost the big banks and the financial class — those people who are invited to the Fed auctions. This new money then fuels stock bubbles, bond bubbles, agricultural land bubbles, and others. The consequences of this are felt by ordinary savers, investors, and retirees whose savings lose value because of the Fed’s zero interest rate policy.As if Wall Street favoritism and zero returns for savers isn’t bad enough, the Fed wants the rest of America to bear a greater inflation burden. The Fed thinks you should lose two percent of the value of your dollar this year. But Bernanke is not satisfied with having reduced purchasing power by ten percent since the 2008 recession. The inflation picture is actually much worse if we look at the old consumer price index —the one that did not assume that ground beef is a perfect substitute for steak.Using the old CPI metric, as calculated by John Williams at Shadow Government Statistics, we’ve lost close to 50 percent of the purchasing power of our money in just the last five years. So what you were able to buy with the $20 in your pocket before the financial crisis costs more than $30 today. That might be peanuts to Wall Street, but that’s real money for working Americans. And it’s theft by the Fed. It is a direct consequence of the trillions of new dollars the Fed has “not literally” printed—as Bernanke put it.Bernanke’s final testimony before Congress confirms that the Fed has blatant disregard for the extra costs and the new bubbles it is creating. The Fed only understands paper prosperity, not how middle class Americans and the poor suffer the consequences of higher prices, resources misallocations, and distortionary bubbles as well as insidious unemployment.The only way out of this tailspin of monetary favoritism is to restore sound money, which would end the Fed’s ability to manipulate currency and put Wall Street first. The Fed has proven over and over again that it has no respect for the real money that preserves the value of people’s labor, their wealth, and their ability to live free and prosperous lives. It is beyond time for the Fed, Wall Street, and the federal government to stop manipulating money and stealing from the American people under the false guise of paper prosperity.

Friday, July 19, 2013

US Part Time Jobs: Obamacare and Regime Uncertainty

The number of workers holding full-time positions fell in the U.S. in June as part-timers hit a record after rising for three straight months, according to the Bureau of Labor Statistics household data. Part-time employment has been outpacing full-time job growth since 2008. Economists cite still-tough economic conditions as the root cause, with some saying President Barack Obama’s 2010 health-care law exacerbates the trend.U.S. Federal Reserve Chairman Ben Bernanke told a House committee July 17 that policy makers consider underemployment, which includes part-time workers who want full-time jobs, one of the gauges of labor-market strength…The number of part-time employees in June rose by 360,000, the Bureau of Labor Statistics reported, based on its survey of households. Full-time workers fell by 240,000, erasing much of the gains from April and May. The share of Americans who work part-time for economic reasons, meaning they can’t find full-time jobs or because their hours have been cut, is 78 percent higher than in December 2007, when the 18-month recession began.

“It’s hard to make any judgment,” Bernanke said when Stutzman asked if the Patient Protection and Affordable Care Act’s mandates are slowing the economy. Bernanke said that it has been cited in the economic outlook survey known as the Beige Book, which the Federal Open Market Committee considers in assessing the economy.“One thing that we hear in the commentary that we get at the FOMC is that some employers are hiring part-time in order to avoid the mandate,” Bernanke said. He added that “the very high level of part-time employment has been around since the beginning of the recovery, and we don’t fully understand it.”

The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952. Cash made up about 7% of all company assets, including factories and financial investments, the highest level since 1963.

-Small business represents 99.7 percent of all employer firms.-In 2010, there were an estimated 27.9 million small businesses in the U.S.—5.9 million with employees and 21.4 million without employees.-Small businesses employ about half of the country’s private sector workforce.- Small firms accounted for 64 percent or 9.8 million of the 15 million net new jobs created between 1993 and 2011.

The economy remains “bifurcated”, with the big firms producing most of the GDP growth with little help from small business. That balance is shifting, but unfortunately because larger firms are losing ground, not because small business is growing faster. Housing and energy are helping, and that does involve a lot of small businesses but the rout in housing was so severe that there are now supply constraints developing in new home construction due to lost capacity that cannot be easily reconstituted. Home prices are now increasing at double digit rates. Consumer net worth is allegedly doing well due to stock prices and house prices rising. But the quantity of items held, real wealth (houses, cars, fractions of a company owned), is not increasing that fast, just the prices. Been there, done that.

Wednesday, June 19, 2013

JGB Watch: Calm markets; Will the Fed Taper tonight? Yawn

Japan’s exports surged by the most since 2010 as the yen weakened and shipments to the U.S. jumped, boosting Prime Minister Shinzo Abe’s campaign to revive the world’s third-largest economyToday’s data may help to sustain confidence in Abe’s efforts to jump-start the economy with fiscal and monetary stimulus and a rollback of regulations restricting business. Volatility in stocks and bonds has threatened to damp sentiment as Abe and central bank Governor Haruhiko Kuroda seek to pull the nation out of a 15-year deflationary malaise.

Japan's trade deficit rose nearly 10 percent in May to 993.9 billion yen (nearly $10.5 billion) as rising costs for imports due to the cheaper yen matched a rebound in exports, the Ministry of Finance reported Wednesday.Exports rose 10.1 percent in May over a year earlier to 5.77 trillion yen ($60.7 billion) while imports also surged 10 percent, to 6.76 trillion yen ($71.1 billion), the ministry said. Japan's trade deficit in May 2012 was 907.93 billion yen.

Add to the bulging trade deficit the substantial deterioration of Japan’s fiscal balance, this means that the Japanese will have to dip into their rapidly depleting savings or increase on their colossal debt burden just to finance such deficits.

I have repeatedly been pointing out that US treasury yields have been ascendant since July 2012. This happened despite the FED’s QE 3.0 last September which had only a 3-month effect of lowering of UST yields.

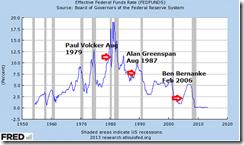

As Federal Reserve chairman Paul Volcker left the Fed chairmanship in August 1987, the interest rate on the 10 year note climbed from 8.2% to 9.2% between June 1987 and September 1987. This was followed, of course by the October 1987 stock market crash.As Federal Reserve chairman Alan Greenspan left the Fed chairmanship at the end of January 2006, the interest rate on the 10 year note climbed from 4.35% to 4.65%. It then climbed above 5%.

Tuesday, June 18, 2013

JGB Watch: Are Rising Yields a sign of Communications Failure? Obama Hints of Bernanke's Retirement

Japanese government bond prices gained after a solid 20-year-bond auction indicated returning stability in the market after weeks of turbulence in the wake of the Bank of Japan's launch of its massive bond-buying program in April….Solid demand for the 20-year auction helped fuel the rises in bond prices in the secondary market.The finance ministry sold ¥1.1 trillion of 20-year bonds with a 1.7% coupon and a lowest price of 100.10, yielding 1.693%, in line with street forecasts.

What central banks may have the world over is a failure to communicate.Officials are struggling to spell out their visions for monetary policy, often amid a chorus of competing views. Chairman Ben S. Bernanke is trying to manage expectations about when the Federal Reserve will slow asset purchases and raise interest rates. Bank of Japan Governor Haruhiko Kuroda’s reflation-push is backfiring by driving up bond yields. European Central Bank President Mario Draghi is dashing investors’ hopes he once kindled for extra stimulus.

President Barack Obama said Federal Reserve Chairman Ben S. Bernanke has stayed in his post “longer than he wanted,” one of the clearest signals the central bank chief will leave when his current term expires next year.“Ben Bernanke’s done an outstanding job,” Obama said in an interview with Charlie Rose that aired yesterday, when asked about nominating him for another term subject to Senate approval. “He’s already stayed a lot longer than he wanted or he was supposed to.”Obama likened Bernanke’s tenure to that of outgoing Federal Bureau of Investigation Director Robert Mueller, who stayed on for two years after his term expired in 2011 and is leaving his post in September. Bernanke’s second four-year stint at the central bank ends Jan. 31.

Thursday, May 30, 2013

Ex-Fed Chair Paul Volcker on Bernanke Policies: Good luck in that

The Federal Reserve, any central bank, should not be asked to do too much to undertake responsibilities that it cannot responsibly meet with its appropriately limited powers,” Volcker said. He said a central bank’s basic responsibility is for a “stable currency.”“Credibility is an enormous asset,” Volcker said. “Once earned, it must not be frittered away by yielding to the notion that a little inflation right now is a good a thing, a good thing to release animal spirits and to pep up investment.”“The implicit assumption behind that siren call must be that the inflation rate can be manipulated to reach economic objectives,” according to Volcker. “Up today, maybe a little more tomorrow and then pulled back on command. Good luck in that. All experience demonstrates that inflation, when fairly and deliberately started, is hard to control and reverse.”

Thursday, February 28, 2013

Ben Bernanke’s Best Inflation Record

In criticizing the central bank's easy monetary policy, Sen. Bob Corker, a Republican from Tennessee, called Bernanke the biggest dove since World War II.Bernanke was quick to push back. "You called me a dove, well maybe in some respects I am, but on the other hand my inflation record is the best of any Federal Reserve chairman in the postwar period – or at least one of the best," he said, citing the 2 percent average inflation rate.

Sunday, September 30, 2012

Lessons from Bernanke’s Thank You Notes

If you have the Federal Reserve’s back, there’s a good chance Ben Bernanke will notice.He may even send you a thank you note.In July, the Fed chairman sent letters of gratitude to five Democratic members of Congress after they delivered speeches on the House floor urging fellow lawmakers to reject the “Audit the Fed” bill authored by retiring Texas Republican Ron Paul, the central bank’s chief antagonist.Their efforts failed to defeat the bill, but they were not in vain, at least in Bernanke’s eyes.“While the outcome of the vote was not in doubt, your willingness to stand up for the independence of the Federal Reserve is greatly appreciated,” Bernanke wrote in the letters, which were obtained by POLITICO through a Freedom of Information Act request.He continued, “Independence in monetary policy operations is now the norm for central banks around the world — and it would be a grave mistake were Congress to reverse the protection it provided to the Federal Reserve more than 30 years ago.”The letters were sent to Reps. Barney Frank, Elijah Cummings, Melvin Watt, Carolyn Maloney and Steny Hoyer.“It's not unusual for the chairman to write thank you notes to members of Congress,” said Fed spokesman David Skidmore.Dated July 26, the notes were written the day after the House voted 327-98 to pass Paul’s bill, which would authorize the Government Accountability Office to audit how the central bank implements monetary policy.

Friday, September 14, 2012

Ron Paul on the Ben Bernanke’s QE 3.0

No one is surprised by the Fed's action today to inject even more money into the economy through additional asset purchases. The Fed's only solution for every problem is to print more money and provide more liquidity. Mr. Bernanke and Fed governors appear not to understand that our current economic malaise resulted directly because of the excessive credit the Fed already pumped into the system.

For all of its vaunted policy tools, the Fed now finds itself repeating the same basic action over and over in an attempt to prime the economy with more debt and credit. But this latest decision to provide more quantitative easing will only prolong our economic stagnation, corrupt market signals, and encourage even more misallocation and malinvestment of resources. Rather than stimulating a real recovery by focusing on a strong dollar and market interest rates, the Fed's announcement today shows a disastrous detachment from reality on the part of our central bank. Any further quantitative easing from the Fed, in whatever form, will only make our next economic crash that much more serious.

(source Lew Rockwell.com)

Inflation is a policy that cannot and will not last.

Thursday, May 10, 2012

Ron Paul: Federal Reserve System is the Epitome of Crony Capitalism

Here is the gist of US congressman Ron Paul’s courageous talk before the Committee on Financial Services, Subcommittee on Domestic Monetary Policy & Technology, United States House of Representatives, May 8, 2012 (From Lew Rockwell)

Much confusion exists over what the Federal Reserve System actually is. Some people claim that is a secret cabal of elite bankers, while others claim that it is part of the federal government. In reality it is a bit of both. The Federal Reserve Board is a government agency, while the Federal Reserve Banks are privately-run government-chartered institutions, and monetary policy decisions are made by the Federal Open Market Committee, which has members from both the Board and the Reserve Banks.

The Federal Reserve System is the epitome of crony capitalism. It exemplifies the collusion between big government and big business to profit at the expense of the taxpayers. The Fed's bailout of large banks during the financial crisis propped up poorly-run corporations that should have gone under, giving them an advantage that no other business in the United States would have received. The bailouts continue today, as banks maintain $1.5 trillion worth of excess reserves at the Fed, reserves which were created through the Fed's purchase of worthless securities from banks. The trillions of dollars that the Fed has injected into the system have the goal of forcing down interest rates. But the Fed fails to realize that interest rates are a price, the price of money and credit, and that forcing interest rates down will only create an even bigger bubble and an enormous economic depression when this entire house of cards comes falling down.

The Federal Reserve is statutorily required to focus on three aims when engaged in monetary policy: full employment, stables prices, and moderate long-term interest rates. In practice, only the first two have received any attention, the so-called "dual mandate." Some reformers have called for the full employment mandate to be repealed, in order to allow the Fed to focus solely on stable prices. But these critics ignore the fact that stable prices are not a desirable goal. After all, with increasing productivity and technological innovation, the natural trend for most goods is for prices to decrease. By calling for the prices of goods to remain stable, the Fed would have to inflate the money supply in order to counteract this trend towards price declines, pumping new money into the system and creating economic distortions. This is exactly what happened during the 1920s, as the Fed's monetary pumping was masked by rising productivity. The result was stable prices, but the malinvestment caused by the Fed's loose monetary policy became evident by 1929. There is no reason to expect that focusing on stable prices today would have a dissimilar outcome.

Other reformers have called for changes to the composition of the Federal Open Market Committee, the body which sets the Fed's monetary policy objectives. On Constitutional grounds, the FOMC is undoubtedly problematic, as government appointees and the heads of the private Federal Reserve Banks work together to set monetary policy objectives that directly impact the strength of the dollar. While all of the members of the FOMC ought to be confirmed by the Senate, debates about the size of the FOMC or whether Reserve Bank Presidents should make up a majority of the members or whether they should even serve at all are largely a sideshow. While the only dissent to monetary policy decisions in recent years has come from Reserve Bank Presidents, there is no reason to think that expanding the FOMC to include more Reserve Bank Presidents would lead to any greater dissent or to any substantive changes to the conduct of monetary policy.

Another proposal for reform is for outright nationalization of the Fed or its functions. No longer would the Fed create money; that function would be taken up by the Treasury, issuing as much money as it sees fit. No longer would the Treasury issue debt to cover fiscal deficits, it would just issue new money to cover budget shortfalls. If what the Fed does now is bad, allowing the Treasury to print and issue money at will would be even worse. These types of proposals hearken back to the days of the first greenbacks, which the U.S. government began issuing in 1863. A pure fiat paper currency, unbacked by silver or gold, the greenbacks were widely reviled. Only once the greenbacks were made redeemable in gold were they accepted by the American people. The current system of Federal Reserve Notes is even worse than the greenback era in that there is no hope that they will ever be redeemable for gold or silver. The only limiting factor is that the Federal Reserve System only creates new money when purchasing assets, normally debt securities. Allowing the federal government to print money without at least a nominal check on the amount issued would inevitably lead to a Weimar-like hyperinflation.

So what then is the solution? The Fed maintains that a paper standard can be adequately managed without causing malinvestment, inflation, or other economic distortions. If the Fed were omniscient and knew the wishes, desires, and future actions of all Americans, this might be possible. But the Fed cannot possibly aggregate or act on the information necessary to engage in monetary policy. The actions of hundreds of millions of individuals, all seeking to better their position in life, acting purposefully towards that aim, cannot possibly be compiled into aggregates or calculated through mathematical equations or econometric models. Neither a single person, nor the members and staff of the FOMC, nor millions of people with millions of computers working in a new Goskomtsen will ever be able to accumulate, analyze, and act upon the information required to create a centrally planned monetary system. Centrally planned fiat paper standards such as the one currently in place in this country are doomed to failure.

This brings us to the question of the gold standard. The era of the classical gold standard was undoubtedly one of the greatest eras in human history. For a period of several decades in the late 19th century, largely uninterrupted by war, the West made enormous advances. Economic productivity increased, art and culture flourished, and living standards rose so that even the poorest citizens lived a life their forebears could have only dreamed of.

But the problem with the gold standard is that it was run by the government, which exercised a monopoly over monetary affairs. The temptation to suspend gold redemption, so often resorted to by governments throughout history, reared its head again with the outbreak of World War I. Once the tie to gold was severed and fiscal restraint thrown to the wind, undoing the damage would have required great fiscal austerity on the part of governments. Emancipated from the shackles of the gold standard, the Western world proceeded to set up a gold-exchange standard which lasted not even a decade before the easy money policies it enabled led to the Great Depression. While returning to the gold standard would certainly be far better than maintaining the current fiat paper system, as long as the government retains the power to go off gold we may end up repeating the same mistakes that occurred from 1934 to 1971 as the government went first off the gold coin standard and finally off the gold bullion exchange standard.

The only viable solution for monetary stability is to get government out of the money business permanently. The way to bring this about is through currency competition: allowing parallel currencies to circulate without any one currency receiving any special recognition or favor from the government. Fiat paper monetary standards throughout history have always collapsed due to their inflationary nature, and our current fiat paper standard will be no different. The Federal Reserve is currently sowing the seeds of its own destruction through its loose and reckless monetary policy. The day of reckoning may still be many years in the future, but given the lack of understanding on the part of the Federal Reserve's decision makers, it is quickly coming upon us.

Incidentally and ironically archrivals Ron Paul and Fed Chair Ben Bernanke had a face to face breakfast meeting the following day.

Here’s the Wall Street Journal Blog reporting on what transpired.

Still, Wednesday’s breakfast brought together two figures who publicly agree on very little. A longtime critic of paper currency and fan of the gold standard, Mr. Paul’s fiery Fed-bashing has enthused his campaign trail supporters, who often start rallies with loud chants of “end the Fed!”

Mr. Bernanke, meanwhile, dedicated a significant chunk of his first lecture at George Washington University in March to enumerating the flaws associated with a system in which the dollar is valued at a fixed price per unit of gold.

So did Wednesday’s meeting overturn any deep-set beliefs?

“He’s for the gold standard now,” joked Mr. Paul.

End the Fed. End Central Banking. End the politicization of money.

Thursday, March 01, 2012

Gold’s near $100 Price Drop Hardly has been about Bernanke’s Stimulus Statement

Media attributes the slump in gold prices to the US Federal Reserve chair Ben Bernanke’s statement last night.

From Bloomberg,

Gold futures fell as much as $100 to below $1,700 an ounce on signs that that the Federal Reserve will refrain from offering more monetary stimulus to bolster the U.S. economy.

In testimony before Congress today, Fed Chairman Ben S. Bernanke gave no signal that the central bank will take new steps to boost liquidity. The dollar rose as much as 0.8 percent against a basket of major currencies, eroding the appeal of the precious metal as an alternative investment. Yesterday, gold reached $1,792.70, a three-month high, even as coin sales by the U.S. mint slumped in February

I am not persuaded that the the reaction in the gold market has entirely been about “refrain from offering more money stimulus”, this seems more like the available bias or post hoc fallacy

That’s because the sell-off seems to have been limited to gold and silver prices. Oil prices seems to have shrugged off the stimulus issue (No, oil prices has hardly been about Iran). The US stock markets too which closed modestly lower has hardly reflected on the the scale of gold’s collapse.

Any concerns over ‘stimulus’ which extrapolates to 'liquidity' would bring about an across the board selling pressure similar to September of 2011

While Mr. Bernanke’s statement may have served as aggravating circumstance, I’d say that either profit taking (yes gold market looked for an excuse and found one in Bernanke) or some unseen developments over the past 24 hours may have led to a crash in gold’s prices.

Nevertheless this is likely to be a temporary episode which means gold prices will recover...soon.

Another important issue to bring up is how mainstream now associates policy stimulus to gold prices. When the public gets to realize that money debasement (inflationist) policies have been the principal cause of price inflation in the asset markets which eventually diffuses into the real economy, the political heat against central banking or central banking policies will intensify.

So far central banks can still afford to hide underneath the cover of esoteric econometrics which the public does not comprehend--a tenuous cover which will eventually be unmasked.

End the Fed, abolish central banking.

Friday, February 17, 2012

Cartoon of the Day: The Johari window of Ben Bernanke

Hat tip Professor Antony Mueller

Thursday, November 03, 2011

Ben Bernanke Dangles QE, Redux

Is the public being hypnotized by US Federal Reserve Chairman Ben Bernanke?

I will give you stimulus, I will give you stimulus, I will give you stimulus, I will give you stimulus…

For the umpteenth time, from the Bloomberg, (emphasis added)

Federal Reserve Chairman Ben S. Bernanke said unemployment is still “far too high” and the Fed may take further steps to boost growth, such as buying mortgage bonds or changing the way it communicates its policy goals to the public.

Additional stimulus “remains on the table,” Bernanke said today at a press conference in Washington, declining to specify conditions that would prompt a move. “While we still expect that economic activity and labor market conditions will improve gradually over time, the pace of progress is likely to be frustratingly slow.”

Bernanke spoke after the policy-setting Federal Open Market Committee said the economy picked up in third quarter and repeated its statement from September that there are “significant downside risks” to the outlook. Officials kept policy unchanged, saying they would lengthen the maturity of the Fed’s bond portfolio and hold the benchmark interest rate near zero through at least mid-2013 if unemployment remains high and the inflation outlook is “subdued.”

Bernanke and his colleagues on the panel cut their growth forecasts for 2012 and said unemployment will average 8.5 percent to 8.7 percent in the final three months of next year, up from a prior range of 7.8 percent to 8.2 percent.

“The medium-term outlook relative to our June projections has been downgraded” and “remains unsatisfactory,” Bernanke said. “Unemployment is far too high,” and “I fully sympathize with the notion that the economy is not performing the way we would like.”

Again the repeated dangling of QE 3.0 or additional stimulus, which represent a monetary policy tool used by Central Banks called as 'signaling channel' or as the article implicitly puts it—“changing the way it communicates its policy goals”—have been directed at conditioning or manipulating the public’s expectations.

We are being treated like Pavlov’s dogs. According to Wikipedia on Classical conditioning, Pavlov used a bell to call the dogs to their food and, after a few repetitions, the dogs started to salivate in response to the bell. The dogs are the financial markets, and the ringing bell is the signaling policy used, and the food is the QE 3.0. In essence, the financial markets are being conditioned to be dependent on US Federal Reserve or central bank policies.

Bernanke must be pleased with how equity markets has responded to his communication tool (see above table from Bloomberg), which seem to have neutralized the surprise developments in Greece.

Yet, the constant conditioning being applied to the market is most likely meant not only to project policy “transparency” but also to reduce political opposition to Bernanke’s favorite tool.

With US money supply growth exploding, which may perhaps be indicative of indirect tools being utilized by team Bernanke, QE 3.0 seems no more than a formality.

On the count of three, you will awaken…

Tuesday, October 18, 2011

Occupy Washington, the US Federal Reserve and the Princeton University

Investing savant Dr. Marc Faber says that demonstrators against Wall Street should instead occupy Washington and the US Federal Reserve.

The Business Intelligence Middle East quotes Dr. Faber (bold emphasis mine)

On the US Federal Reserve’s preference to support the banking and financial class through bubble policies:

We cannot blame Wall Street and well-to-do people for the mishap, for this ratio to have exploded on the upside. We have to blame essentially expansionary monetary policies that favor assets. So you have low consumer price inflation, you have no wage inflation."

In fact, the problem in America is that real wages, real compensation has been down since the 1970s. But at the same time, asset prices, equities, real estate and so forth have gone up dramatically, and that favors people who have these assets. And so the ratio expanded and you have now a record wealth inequality, and income inequality…

On Washington’s bribery of Americans in order to expand welfare state for the benefit of the political class and their cronies.

The problem with government is that the original intention of, especially a democracy, is very good.

Everybody has a say in how societies should be structured, but over time, it becomes very polarized and it moves into the hands of powerful business interests, and also interest groups like the military complex, or say the welfare recipients and so forth…

So you end up with kind of on the one hand a tyranny of the masses where you distribute all kinds of goodies to people. Like in America roughly 50% of the population gets a handout one way or the other from the government. So by continuing to support these people, you get their votes.

The protestors should focus on the root of the problem

Wall Street is a minority, anyone else would have done the same, they use the system but they didn't create the system. The system was created by the lobbyists and by Washington. So they [the protesters] should actually go to Washington and also occupy the Federal Reserve on the way

Professor William L. Anderson further suggests for an Occupy Princeton University movement (highlights mine)

That's right, I am calling for an immediate occupation of...Princeton University, and specifically, its economics department. There is no other place on earth that has given us more players and more enablers of the financial madness that has gripped this economy for many years.

Reason: Because of the notoriety of some of the academic alumnus towards interventionist and inflationist policies: Ben Bernanke, Alan Blinder, Alan Krueger and Paul Krugman

Continue reading Professor Anderson’s explanations here