The Irish economy unexpectedly shrank last year on the back of a sharp fall-off in net exports linked to the so-called pharma patent cliff.Preliminary figures from the Central Statistics Office (CSO) showed gross domestic product (GDP) contracted by 2.3 per cent in the fourth quarter and by 0.3 per cent for the year as a whole.Published on the same day as the State’s first full return to the bond markets, the figures represent something of a setback for the Government’s recovery plans and reflect the volatile nature of Ireland’s post-bailout economy.The Department of Finance had predicted GDP growth of 0.2 per cent for 2013 on the back of a surge in employment growth which saw the creation of 60,000 new jobs.Gross national product (GNP), which screens out the effects of multinational operations, however, increased by 3.4 per cent last year and by 0.2 per cent in the final quarter.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, March 14, 2014

Ireland’s Parallel Universe

Monday, November 01, 2010

Ireland’s Fiscal Austerity Seen From The Big Picture

One of the popular rejoinders or justifications made by mainstream economists has been to refer to Ireland as an example of the perils of having to impose fiscal austerity.

The general idea is the lack of aggregate private demand as measured by a decline in private spending should be substituted for by the government, in order to boost the economy. This is premised on the assumption that every variable in the economy are homogenous and subject to the same sensitivity from interventionist policies.

Yet we understand Ireland as having an ongoing crisis with her banking industry such that her government has undertaken massive recapitalizations of Allied Irish Bank and Anglo Irish Bank to the tune of “some €50 billion ($68 billion) this year and will push Dublin's budget deficit to an estimated 32% of GDP” according to Wall Street Journal.

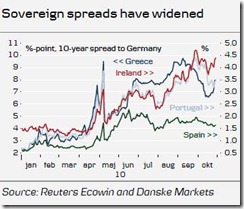

Ireland’s banking woes continues to be reflected on her sovereign spreads as with the other crisis affected Euro nations classified as the PIIGS. (chart courtesy of Danske)

If the focus is plainly on unemployment, then the mainstream is right, high unemployment continues to plague the country. (chart courtesy of tradingeconomics.com)

However, unemployment will always be a lagging indicator. In a market economy as Ireland, profitability will be the primary gauge for investments, which eventually will be reflected on the job market.

First of all, despite the selective nature of evidence brought by the mainstream, Ireland isn’t in all that deep funk.

Ireland appears to be emerging from a deep recession and is expected to continue to grow through 2011 in spite of the fiscal tightening measures.

According to Finfacts

IBEC, the business group, said today the economy will return to growth in 2011 despite the greater than anticipated scale of the fiscal adjustments needed over the coming four years. GNP (gross national product) will grow 1.2% in 2011 and 3.4% in 2012 while GDP (gross domestic product with no adjustment for the profits of multinational operating in Ireland) will grow 2.2% and 3.1%. The forecasts for 2012 can be only guesswork and the outturn depends on the robustness of the international recovery in rich countries.

The business group says the final national accounts data for 2009 show that the nominal size of the economy was much lower than the Department of Finance had originally estimated while the global economic recovery has lost steam in recent months and Government’s growth forecasts for the 2011 to 2014 period now appear too optimistic.

The full accounting of the banking costs means that the debt-to-GDP ratio will reach 100% this year and will peak at about 115% in 2014. While this represents a rapid escalation from the pre-crisis debt ratio it is not exceptional in international terms - - IBEC says it is just above the debt level of the Eurozone and the US, about the same as that in Belgium and below that in Italy.

Second, deflation hasn’t been a persistent scourge as the mainstream paints it to be.

True, the unravelling of the global crisis has brought about a bout of deflation, but this appears to be on the mend.

Third, for the mainstream to argue that politics always favours government intervention, this report from the BBC, (bold emphasis mine)

Despite public sector cuts averaging more than 15%, and a further huge bank bail-out, making Ireland the EU's most indebted nation, the popular backlash against the government's fiscal tightening has never really materialised.

Bottom line: All these add up to demolish the myth that adapting fiscal discipline will be a bane to the economy.