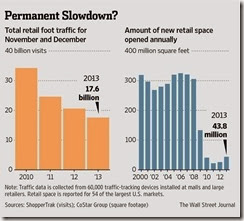

U.S. retailers are facing a steep and persistent drop in store traffic, which is weighing on sales and prompting chains to slow store openings as shoppers make more of their purchases online.Aside from a small uptick in April, shopper visits have fallen by 5% or more from a year earlier in every month for the past two years, according to ShopperTrak, a Chicago-based data firm that records store visits for retailers using tracking devices installed at 40,000 U.S. outlets. Even as warmer temperatures replace the harsh winter weather this year, store visits fell by nearly 7% in June and nearly 5% in July, according to ShopperTrak.New data from Moody's Investors Service shows that the shift to online sales has prompted retailers to scale back store openings and will likely lead them to pare back their fleets even more in coming years, as more than $70 billion in lease debt expires by 2018. Growth in store counts at the 100 largest retailers by revenue has slowed to less than 3% from more than 12% three years ago, according to Moody's.The pressure comes as consumer tastes are changing. Instead of wandering through stores and making impulse purchases, shoppers use their mobile phones and computers to research prices and cherry-pick promotions, sticking to shopping lists rather than splurging on unneeded items. Even discount retailers are finding it harder to boost sales by lowering prices as many low-income consumers struggle to afford the basics regardless of the price.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, August 07, 2014

An Update on the US Shopping Mall-Retailing Bust

Monday, February 10, 2014

Hard Lessons from the US Shopping Mall Bust

Traffic to U.S. retailers was hurt during the financial crisis and recession, when job losses soared and shoppers kept a tight grip on their dollars. But nearly five years into the recovery, it appears many of those shoppers may never be coming back.

A Target spokesman said shoppers are making fewer trips as "traffic has been impacted by the uneven economic environment," but are spending more when they do show up.

Online sales accounted for just 5.9% of overall retail sales in the third quarter, according to the Commerce Department, but they have an outsize impact on how shoppers use stores and what they will pay.

One big shift in store closings has come from retailers shying away from indoor malls, instead favoring outlet centers, outdoor malls or stand-alone stores. Although new retail construction completions are at an all-time low, according to CB Richard Ellis, the supply of new outlet centers has picked up in recent quarters.

Thursday, August 04, 2011

Paradigm Shift: Wealthy Russians Buy US Homes

In my earlier post, I pointed out that the wealthy Brazilians, Indians and Chinese had been lending “support” to the US property sector.

Under the major emerging markets the rubric of the BRIC acronym coined by Goldman Sach’s analyst Jim O’Neil, Russia posed as the missing link.

Not anymore.

From Bloomberg, (bold emphasis mine)

Roustam Tariko, billionaire owner of Russian Standard Bank and Russian Standard Vodka, completed the most expensive home purchase in Miami Beach since 2006 when he bought a $25.5 million estate on Star Island in April.

The transaction made Tariko the neighbor of another wealthy Russian with a taste for Florida luxury living. Vladislav Doronin, chairman of Moscow-based real estate developer Capital Group, paid $16 million in 2009 for the Star Island home previously owned by Shaquille O’Neal, the now-retired professional basketball player.

“In Russia, it’s a status thing now,” Jorge Uribe, a real estate agent with One Sotheby’s International Realty Inc. in Coral Gables, Florida, said in a telephone interview. “If you’re wealthy and you say you have a place in Miami, it’s like saying back in the old days, ‘I own a place in Ibiza or Monaco.’ It’s a cocktail conversation thing.”

International investors are buying some of the priciest homes in America as the broader housing market slumps and a weak dollar makes U.S. property more of a bargain. Sales of residences above $20 million are rising in New York, California and Florida, which are popular business and vacation destinations for foreigners, according to Miller Samuel Inc., DataQuick and real estate brokers who cater to luxury buyers.

This is just one of the manifestations of the effects of globalization from fund flows (capital mobility) to the diffusion of prosperity worldwide.

The same article underscores this, (bold emphasis mine)

The precise number of foreign deals for U.S. luxury properties is difficult to calculate because many purchasers are registered as trusts or limited liability companies. Jed Smith, managing director of quantitative research for the National Association of Realtors, said the number of overseas buyers for multimillion-dollar homes is increasing, helped by the rise of emerging markets such as Russia, Brazil, China and India.

“There’s substantial growing wealth overseas,” Smith said in a telephone interview from Washington. “Just go to the Forbes list of billionaires and see that we’re no longer the only folks on it.”

Of the 214 newcomers to Forbes magazine’s annual global ranking of billionaires this year, 54 were from China and 31 from Russia. The Asia-Pacific region had more billionaires than Europe for the first time in more than 10 years and gained the most of any region, with 105 additions, according to the list. Moscow displaced New York as the city with the greatest number of billionaires with 79, compared with New York’s 58.

If there is anything that would be considered as certain or permanent, (aside from death and taxes) that would be ‘change’.

Saturday, August 29, 2009

US Home Bubble Cycle: Upside Directly Proportional To Downside

This from Mr. Norris, (all bold highlights mine)

``IN the last eight years, home prices in the United States have almost exactly kept up with inflation. But it has been a wild ride.

``During the period, the Standard & Poor’s Case-Shiller 20-city composite index of home prices rose almost 21 percent. The Consumer Price Index also rose almost 21 percent.

``The period, from June 2001 through the June 2009 figures that were reported this week, can be separated into two periods: the five-year boom and the three-year bust. There are limited indications that prices have started to rally in some areas, but the overall index’s move in June just kept up with inflation.

``During the boom, home prices outpaced inflation by 10.7 percent a year for five years. During the bust, they plunged, trailing inflation by 13.6 percent a year."

The interesting observation isn't just "what comes up must go down", but instead "the degree of ascent is almost directly proportional to the scale of decline"...very much like Newton's third law of motion:

The interesting observation isn't just "what comes up must go down", but instead "the degree of ascent is almost directly proportional to the scale of decline"...very much like Newton's third law of motion:For every action, there is an equal and opposite reaction.

This "stages in a bubble" chart has been a frequent post here to underscore how the bubble cycle culminates...

Nevertheless Mr. Norris concludes, ``Now foreclosures are still rising, even as home sales and prices seem to have stabilized. If the worst is over, it will have been a wild ride that ended very close to where it began, but with many people much worse off for the experience."

Lessons:

1. Property prices fundamentally reflects on the degree of the impact from inflationary policies undertaken (extremely loose monetary policies, administrative policies promoting home ownership and tax policies encouraging debt or credit take up).

2. Bubble or inflation policies has had a net negative effect on society, (consumes capital), which requires a lengthy and painful period for healing or rebalancing.

Unfortunately yet, policymakers never seem to learn and continue to adopt short term oriented bubble blowing policies. This would lead us from one crisis to the next but transitioning towards a bigger scale, as the imbalances which needs to be adjusted will have simply been postponed. However, these are accumulated until the laws of nature will ultimately force an adjustment.

In essence, bubble policies are best signified by the idiom jumping out of the frying pan and into the fire.