The IMF says that the string of antigovernment protests worldwide are all about rising food prices.

The Wall Street Journal blog writes, (bold emphasis original)

100%: The increase in antigovernment protests associated with a 10% rise in global food prices

Despotic leaders, entrenched inequality and new forms of communication have all played their roles in the political turmoil now shaking the Middle East. But new research by economists at the International Monetary Fund points to another potential contributor: global food prices.

Looking at food prices and instances of political unrest from 1970 through 2007, the economists — Rabah Arezki and Markus Brueckner — find a significant relationship between the two in low-income countries, a group that includes Tunisia, Egypt, Sudan and Yemen. To be exact, a 10% increase in international food prices corresponds to an added 0.5 antigovernment protests over the following year in the low-income world — a twofold increase from the annual average.

Rising food prices represent a symptom and NOT the cause of these riots.

People aren’t too dumb to protest on food prices alone, they attribute events to politics (e.g. inequality and etc...) to markets (e.g. speculation, hoarding, et.al.) to economy (e.g. emerging market growth) or to other exogenous causes (climate change etc...).

While all of the above have some grain of truths in them, they aren’t reflective of the entire picture or the bigger force driving these.

In other words, rising food prices serves as the trigger to the unrest from long built in domestic imbalances.

But here is the bigger picture...

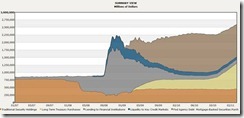

US Adjusted Monetary Base has been exploding!

Chart from St Louis Federal Reserve

US Federal Reserve balance sheet has also been ballooning!

Bank holdings of US government securities have also been exploding. US Banks have been speculating more than lending. (chart from St. Louis Federal Reserve)

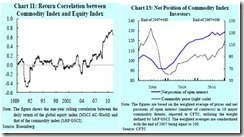

Stock Market leverage has also been ramping up (chart from Pragmatic Capitalism)

Unless money printing has no impact at all, then all these won’t matter. But obviously, money isn’t neutral, and all these money printing have been absorbed somewhere in the financial markets or the real economy.

Surprisingly, the Bank of Japan (BoJ) recognizes this government induced phenomenon. They write,

Globally accommodative monetary conditions have become unprecedented. The relative size of global money stock (M1) measured against the real GDP has surpassed its historical trend (Chart 14). This sustained global excess liquidity not only increases physical demand for commodities thereby affecting fundamentals, but also amplifies speculative factors, both of which are contributing to the sharp rise in global commodity prices.

Incidentally they have been big practitioners of inflationism too. This seems to be a case "where right hand doesn't know what the left hand is doing".

And this only proves how the mainstream economic perspective has been utterly wrong.

In other words, monetary policies by the US, as the de facto foreign currency reserve of the world, have been filtering throughout the global financial system and to the global real economy.

And surging food prices has been aggravated by the shared central bank practice of inflationism and artificially suppressed interest rates by OTHER nations, most especially by the OECD economies.

And in terms of supply side, another key factor behind surging food prices has been due to the restricted international trade of agriculture. Agriculture has been the least globalized among other sectors.

In short, protectionism from the political toxin called “self-sufficiency” has been responsible for the aggregate imbalances of food economics globally.

Chart from Guinness Atkinson

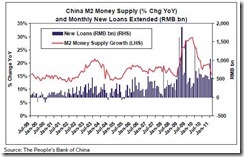

Of course, it is equally nonsense to attribute rising inflation to China as attributed by some observers.

China isn’t the world’s foreign currency reserve. While China is an important driver in the global consumption equation, (in as much as the supply side) China hasn’t been inflating as much as the developed economies. In short, China has only served as an aggravating factor to the main dynamics behind the world’s food price triggered riots. I might add that China has also been plagued by her domestic bubble policies.

Only the politically (and or mathematical formalism) blinded people can’t see anything wrong done by the state. Their knee jerk response is to lay the blame on the doorsteps of either the marketplace or to other nations, for what actually is truly a failure in domestic policies.

To quote Forrest Gump: Stupid is as stupid does.