Modern social theory clings to two ultimate presuppositions. First, men are motivated by economic self-interest. Second, democratic institutions can be used to limit the success of such special-interest groups. The ultimate special-interest group, which is not a special-interest group at all, but the general interest, namely, the democratic masses, will be victorious in history. This is the god of the modern world, and this god is defended by a priesthood. The priesthood is mostly academic, and what is not academic is embedded in the media. The professor and the anchorman are the high priests of this well-organized religion.The professors and the anchorman resent any suggestion that there is a hidden group behind them that shapes their thinking. They resent the fact that some people say that they have been bought off. I think it is a mistake to imagine that buying off someone with money constitutes the whole story. They have not merely been bought off. They have bought in. They have bought into the outlook that democracy will triumph over the economic interests of special-interest capitalism.The people who say that the priests of academia and the media have been bought off have not followed the money far enough. These priests have indeed been bought off, but they have been bought off in a very special way. They have been screened in terms of their confession of faith. Their confession of faith must be in favor of the religion of democracy. Anyone who deviates from this faith has not yet been promoted into the highest visible seats of priestly service.These carefully screened spokesmen for the Establishment deeply resent any suggestion that behind the religion of democracy has always been a calculating group whose senior members believe that you can fool all of the people most of the time, and that you can fool most of the professors all of the time. They resent the fact that anybody would suggest that the way they attained their positions is based on crass payoffs. I agree. The payoffs are not at all crass. They are subtle. One of C.S. Lewis's greatest essays is "The Inner Ring." It describes the nature of the payoffs.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, March 15, 2013

Quote of the Day: The Religion of Democracy

Friday, February 01, 2013

Quote of the Day: The Combination of Bad Economics and Bad History is Pernicious.

Few intellectual activities are more mischievous when done poorly than economics or history. The power of fallacious economic reasoning or fallacious historical example to damage society is obvious: the pseudo-economics of mercantilism has been reducing trade and protecting vested interests for many centuries; the pseudo-history of the Aryan “race” lent dignity to German fascism. The combination of bad economics and bad history in bad economic history is pernicious.

Wednesday, January 16, 2013

Video Jon Stewart on the $1 Trillion Platinum Coin: It's a Stupid F*cking Idea

a tongue-in-cheek proposal that was getting traction in DC was that the Treasury (and thus the Administration) could solve its funding problems by simply exploiting a loophole in the law that would permit the Treasury to mint a trillion-dollar platinum coin, deposit it in the Treasury’s account with the Fed, and write checks on that account to cover operating costs. Shame on us that we are even talking about the possibility, and even Paul Krugman has weighed in on the issue. To mint the coin would be to print money, and we know from history that printing money doesn’t solve a debt problem. The Spanish found that out when they scoured the world for gold. The more of it you have in circulation, the less valuable it becomes. The Germans found it out during the Weimar Republic, and the Argentineans found it out in the latter half of last century. Krugman claims it isn’t printing money because the Fed would offset Treasury spending, which would put new money in the hands of the public, with asset purchases. But he is wrong, since he is assuming behavior by another governmental entity to offset the Treasury’s spending and hasn’t apparently looked recently at the Fed’s exploded balance sheet. As the result of its quantitative easing programs, there are no offsetting transactions and wouldn’t likely be such transactions. [italics added]

As the great Ludwig von Mises warned, (bold mine)

There are still teachers who tell their students that “an economy can lift itself by its own bootstraps” and that “we can spend our way into prosperity.” But the Keynesian miracle fails to materialize; the stones do not turn into bread...There is no use in arguing with people who are driven by “an almost religious fervor” and believe that their master “had the Revelation.” It is one of the tasks of economics to analyze carefully each of the inflationist plans, those of Keynes and Gesell no less than those of their innumerable predecessors from John Law down to Major Douglas. Yet, no one should expect that any logical argument or any experience could ever shake the almost religious fervor of those who believe in salvation through spending and credit expansion.

Thursday, October 11, 2012

World Economic Trend: Mercantilism or Globalization?

The number of new protectionist actions peaked in the first quarter of 2009 and bottomed in the third quarter of 2010. However, recent GTA data suggest that protectionist measures are increasing again; protectionist actions in the third quarter of 2011 alone were as high as in the worst periods of 2009 (Evenett, 2011).The Group of 20 (G20) advanced and emerging economies account for most of the trade measures, most of which did not involve tariffs, imposed since 2008. There has been no significant increase in the overall use of tariffs or temporary trade barriers, such as antidumping measures, aimed at assisting local firms injured by import competition (Bown, 2011). Such measures affected only about 2 percent of world trade (Kee, Neagu, and Nicita, 2010; WTO, 2011). The trend of gradual tariff liberalization observed since the mid-1990s has not been affected

“I think it is a good time for the WTO to have a closer look at non-tariff measures (NTMs)”, said WTO Director-General Pascal Lamy, at the launch of the Report. “A clear trend has emerged in which NTMs are less about shielding producers from import competition and more about the attainment of a broad range of public policy objectives. The new NTMs, typically SPS and TBT measures but also domestic regulation in services, address concerns over health, safety, environmental quality and other social imperatives. The challenge is to manage a wider set of policy preferences without undermining those preferences or allowing them to become competitiveness concerns that unnecessarily frustrate trade.”

Tuesday, October 09, 2012

Bastiat on the Political Religion of Mercantilism

The advocates of monopoly maintain that the facts are on their side, and that we have on our side only theory.They flatter themselves that this long series of public acts, this old experience of Europe, which they invoke, has presented itself as something very formidable to the mind of Mr. Say; and I grant that he has not refuted it with his characteristic sagacity. For my own part, I am not disposed to concede to the monopolists the domain of facts, for they have only in their favor facts that are forced and exceptional; and we oppose to these, facts that are universal, the free and voluntary acts of mankind at large.What do we say; and what do they say?We say, "You should buy from others what you cannot make for yourself but at a greater expense."And they say, "It is better to make things for yourself, although they cost you more than the price at which you could buy them from others."Now, gentlemen, throwing aside theory, argument, demonstration — all which seem to affect you with nausea — which of these two assertions has on its side the sanction of universal practice?Visit your fields, your workshops, your forges, your warehouses; look above, below, and around you; look at what takes place in your own houses; note your own everyday acts; and say what is the principle that guides these laborers, artisans, and merchants; say what is your own personal practice.Does the farmer make his own clothes? Does the tailor produce the corn he consumes? Does your housekeeper continue to have your bread made at home, after she finds she can buy it cheaper from the baker? Do you resign the pen for the brush to save your paying tribute to the shoeblack? Does the entire economy of society not rest upon the separation of employments, the division of labor — in a word, upon exchange? And what is exchange but a calculation which we make with a view to discontinuing direct production in every case in which we find that possible, and in which indirect acquisition enables us to effect a saving in time and in effort?It is not you, therefore, who are the men of practice, since you cannot point to a single human being who acts upon your principle.But you will say, we never intended to make our principle a rule for individual relations. We perfectly understand that this would be to break up the bond of society, and would force men to live like snails, each in his own shell. All that we contend is that our principle regulates de facto the relations that obtain between the different agglomerations of the human family.Well, I affirm that this principle is still erroneous. The family, the commune, the canton, the department, the province, are so many agglomerations, which all, without any exception, reject practically your principle, and have never dreamt of acting on it. All procure themselves, by means of exchange, those things that it would cost them dearer to procure by means of production. And nations would do the same, did you not hinder them by force.We, then, are the men of practice and of experience; for we oppose to the restriction you have placed exceptionally on certain international exchanges the practice and experience of all individuals and of all agglomerations of individuals, whose acts are voluntary and can consequently be adduced as evidence. But you begin by constraining, by hindering, and then you lay hold of acts that are forced or prohibited, as warranting you to exclaim, "We have practice and experience on our side!"You inveigh against our theory, and even against theories in general. But when you lay down a principle in opposition to ours you perhaps imagine you are not proceeding on theory. Clear your heads of that idea. You, in fact, form a theory as we do; but between your theory and ours there is this difference:Our theory consists merely in observing universal facts, universal opinions, calculations, and ways of proceeding that universally prevail; and in classifying these and rendering them coordinate, with a view to their being more easily understood.Our theory is so little opposed to practice that it is nothing else but practice explained. We observe men acting as they are moved by the instinct of self-preservation and a desire for progress, and what they thus do freely and voluntarily we denominate political or social economy. We can never help repeating that each individual man is practically an excellent economist, producing or exchanging according as he finds it more to his interest to produce or to exchange. Each, by experience, educates himself in this science; or, rather, the science itself is only this same experience accurately observed and methodically explained.But on your side you construct a theory in the worst sense of the word. You imagine, you invent, a course of proceeding that is not sanctioned by the practice of any living man under the canopy of heaven; and then you invoke the aid of constraint and prohibition. It is quite necessary that you should have recourse to force, for you desire that men should be made to produce those things that they find it more advantageous to buy; you desire that they should renounce this advantage, and act upon a doctrine that implies a contradiction in terms.I defy you to take the doctrine, which you acknowledge would be absurd in the relations of individuals, and extend it, even in speculation, to transactions between families, communities, or provinces. By your own admission it is only applicable to international relations.This is the reason why you are forced to keep repeating, "There are no absolute principles, no inflexible rules. What is good for an individual, a family, a province, is bad for a nation. What is good in detail — namely, to purchase rather than produce, when purchasing is more advantageous than producing — that same is bad in the gross. The political economy of individuals is not that of nations" — and other nonsense of the same kind.And to what does all this tend? Look at it a little closer. The intention is to prove that we, the consumers, are your property! — that we are yours body and soul! — that you have an exclusive right over our stomachs and our limbs! — that it belongs to you to feed and clothe us on your own terms, whatever be your ignorance, incapacity or rapacity!No, you are not men of practice; you are men of abstraction — and of extortion.

Saturday, September 22, 2012

Quote of the Day: The Fallacy of Redistribution

Those who talk glibly about redistribution often act as if people are just inert objects that can be placed here and there, like pieces on a chess board, to carry out some grand design. But if human beings have their own responses to government policies, then we cannot blithely assume that government policies will have the effect intended.The history of the 20th century is full of examples of countries that set out to redistribute wealth and ended up redistributing poverty. The communist nations were a classic example, but by no means the only example.In theory, confiscating the wealth of the more successful people ought to make the rest of the society more prosperous. But when the Soviet Union confiscated the wealth of successful farmers, food became scarce. As many people died of starvation under Stalin in the 1930s as died in Hitler's Holocaust in the 1940s.How can that be? It is not complicated. You can only confiscate the wealth that exists at a given moment. You cannot confiscate future wealth -- and that future wealth is less likely to be produced when people see that it is going to be confiscated. Farmers in the Soviet Union cut back on how much time and effort they invested in growing their crops, when they realized that the government was going to take a big part of the harvest. They slaughtered and ate young farm animals that they would normally keep tending and feeding while raising them to maturity.People in industry are not inert objects either. Moreover, unlike farmers, industrialists are not tied to the land in a particular country.Russian aviation pioneer Igor Sikorsky could take his expertise to America and produce his planes and helicopters thousands of miles away from his native land. Financiers are even less tied down, especially today, when vast sums of money can be dispatched electronically to any part of the world.If confiscatory policies can produce counterproductive repercussions in a dictatorship, they are even harder to carry out in a democracy. A dictatorship can suddenly swoop down and grab whatever it wants. But a democracy must first have public discussions and debates. Those who are targeted for confiscation can see the handwriting on the wall, and act accordingly.Among the most valuable assets in any nation are the knowledge, skills and productive experience that economists call "human capital." When successful people with much human capital leave the country, either voluntarily or because of hostile governments or hostile mobs whipped up by demagogues exploiting envy, lasting damage can be done to the economy they leave behind.

Tuesday, July 31, 2012

Quote of the Day: The Glass Steagall Myth

From Washington Post’s Steve Pearlstein. (hat tip Bob Wenzel)

Repeal of Glass-Steagall has become for the Democratic left what Fannie Mae and Freddie Mac are for the Republican right — a simple and facially plausible conspiracy theory about the crisis that reinforces what they already believed about financial markets and economic policy.

But why let facts get in the way of a good screenplay?

Facts such as that Bear Stearns, Lehman Brothers and Merrill Lynch — three institutions at the heart of the crisis — were pure investment banks that had never crossed the old line into commercial banking. The same goes for Goldman Sachs, another favorite villain of the left.

The infamous AIG? An insurance firm. New Century Financial? A real estate investment trust. No Glass-Steagall there.

Two of the biggest banks that went under, Wachovia and Washington Mutual, got into trouble the old-fashioned way – largely by making risky loans to homeowners. Bank of America nearly met the same fate, not because it had bought an investment bank but because it had bought Countrywide Financial, a vanilla-variety mortgage lender.

Meanwhile, J.P. Morgan and Wells Fargo — two large banks with big investment banking arms — resisted taking government capital and arguably could have weathered the crisis without it.

Did U.S. investment banks create a shadow banking system and derivatives market outside the normal regulatory framework that encouraged sloppy lending and created what turned out to be toxic securities? You betcha.

And did regular banks make some of those bad loans and buy up some of those toxic securities? Yes, they did.

But that was as much a problem at the banks and investment banks that combined as those that remained independent. More significantly, the bulk of the money that flowed through the shadow banking system didn’t come from government-insured bank deposits. It came from money market funds, hedge funds, pension funds, insurance companies, foreign banks and foreign central banks.

Confronted with these inconvenient facts, the conspiracists like to double-down and argue that the real damage caused by repeal of Glass-Steagall is that it triggered a wave of bank consolidation — which has now left more than half of the country’s banking assets under the control of a handful of institutions that are so big that the government has no choice but to bail them out if they risk a meltdown of the financial system.

No doubt about it — too-big-to-fail is a problem. It turns out, however, that it was also a problem in 1984, when Continental Illinois, the seventh-largest U.S. bank with a whopping $40 billion in assets, had to be rescued. It was a problem a few years later when the Fed quietly rescued Citicorp because of mountains of loans to Latin American governments that turned sour. It was a problem in 1998 when the Fed had to orchestrate the rescue of Long-Term Capital Management, a hedge fund with less than $5 billion in capital. And it was the reason behind the Fed’s 2007 rescue of Bear Stearns, with less than a quarter the size of its biggest Wall Street rivals.

Read the rest here

For the left, evidences that goes against them have simply been ignored.

The creed of the infallible moral authority of governments implies that all so-called “market failures” intuitively stem from the lack of government controls or oversight, the repeal of the Glass-Steagall act, notwithstanding.

Canada didn’t have a Glass-Steagall yet avoided the crisis of 2008 (Tom Woods). This only goes to show that, not only from the evidence perspective, their logic has been inconsistent or does not add up.

Reducing government, for the neo-liberals, essentially takes away the path to political nirvana. It would be senseless to argue against faith based political zealotry.

Friday, June 08, 2012

Estonian President Slams Paul Krugman

When apologists for the state don’t have developments going their way, they intuitively employ verbal sleight of hand as defense mechanism.

Given that Estonia has recently been recognized as the pro-austerity model of success, which I recently posted here, Keynesian high priest Paul Krugman quickly wrote to downplay on such progress. Mr. Krugman's comments drew a vitriolic rebuke from the Estonian president.

From the Huffington Post (hat tip Cato’s Dan Mitchell)

The president of Estonia chewed out Paul Krugman on Wednesday, using Twitter to call the Nobel Prize-winning economist "smug, overbearing & patronizing," in response to a short post on Estonia's economic recovery.

Krugman's 67-word entry, entitled "Estonian Rhapsody," questioned the merits of using Estonia as a "poster child for austerity defenders." He included a chart that, in his words, showed "significant but still incomplete recovery" after a deep economic slump.

President Toomas Hendrik Ilves responded to Krugman in a series of outraged tweets, taking offense to Krugman's tone and writing that Krugman didn't know what he was talking about.

"We're just dumb & silly East Europeans. Unenlightened. Someday we too will understand," he tweeted. "Guess a Nobel in trade means you can pontificate on fiscal matters & declare my country a "wasteland". Must be a Princeton vs Columbia thing."

Estonia, which in 2011 became the latest country to join the eurozone, has been heralded by some as an austerity success story. That year, it clocked a faster economic growth pace than any other country in the European Union, at 7.6 percent. Estonia is also the only EU member with a budget surplus, and had the lowest public debt in 2011 -- 6 percent of GDP. Fitch affirmed its A+ credit rating last week.

Politics becomes a religion when people resort to lies and misrepresentation to desperately defend ideas that has been proven to be based on faith and wishful thinking than from reality.

Wednesday, June 06, 2012

Politics a Key Factor for Facebook Unfriends

From Slate

Spouting off about political issues on Facebook and other social sites may be bad for your friend count, according to a new study released Monday by the Pew Internet & American Life Project.

Eighteen percent of the 2,253 adults surveyed by Pew said they had blocked, unfriended, or hidden a friend on a social network over a political post. It isn’t hard to see why: The Pew survey found that because people who post about politics tend to be very liberal or very conservative, the offending posts are more likely to be out of line with other people’s views. Indeed, only one in four users surveyed by Pew said they "usually" or "always" agree with their friends’ political posts; 73 percent said they only sometimes or never do.

Though most people—roughly two in three—take no action over political posts they disagree with, some 28 percent said they counter with a comment or competing post, another behavior the Pew survey said leads to friends going their own way.

My experience says that this is very true.

First of all, you can’t please everyone. Second, the truth hurts or stings the ego. Third, I am not after social desirability or about “friend count” or after "likes". I can say stupid abstract emotional themes, which isn't really me, or popular positions based on economic nonsense, just to get the "likes". But I am after speaking the truth from where I see it or where I stand. Lastly, for many politics IS a religion.

Monday, May 28, 2012

Quote of the Day: The Religion called Environmentalism

The hallmark of science is a commitment to follow arguments to their logical conclusions; the hallmark of certain kinds of religion is a slick appeal to logic followed by a hasty retreat if it points in an unexpected direction. Environmentalists can quote reams of statistics on the importance of trees and then jump to the conclusion that recycling paper is a good idea. But the opposite conclusion makes equal sense. I am sure that if we found a way to recycle beef, the population of cattle would go down, not up. If you want ranchers to keep a lot of cattle, you should eat a lot of beef.

Recycling paper eliminates the incentive for paper companies to plant more trees and can cause forests to shrink. If you want large forests, your best strategy might be to use paper as wastefully as possible — or lobby for subsidies to the logging industry. Mention this to an environmentalist. My own experience is that you will be met with some equivalent of the beatific smile of a door-to-door evangelist stumped by an unexpected challenge, but secure in his grasp of Divine Revelation.

This suggests that environmentalists — at least the ones I have met — have no real interest in maintaining the tree population. If they did, they would seriously inquire into the long-term effects of recycling. I suspect that they don't want to do that because their real concern is with the ritual of recycling itself, not with its consequences. The underlying need to sacrifice, and to compel others to sacrifice, is a fundamentally religious impulse.

That’s from Professor Steven Landsburg, from his book "The Armchair Economist," (source Professor Mark Perry)

Saturday, May 26, 2012

HOT: Charges of Corruption in the Vatican

Even the Vatican has not been spared from charges of corruption and from internal political power struggles.

From the Daily Mail,

Vatican police have arrested Pope Benedict XVI's personal butler following an investigation into the leaking of sensitive church documents, it emerged today.

In a scenes worthy of a Dan Brown thriller, the butler identified as Paolo Gabriele, 46, was held by gendarmes after a special commission of three top senior cardinals had been appointed by a furious Pope Benedict to identify the source of the leaks which have caused severe embarrassment.

Gabriele, who has been at the Pope's side for six years, is one of the German born pontiff's closest members of his inner circle which totals just four lay people and four nuns and he is always at his side - he is so close that he and the nuns who look after him are described as the 'pontiff's family'…

The arrest of Gabriele comes just days after author Gianluigi Nuzzi published a book on the leaked documents called Sua Santita (His Holiness).

The Vatican had condemned the book as 'criminal' and the printing of the documents were a violation of the Pope's privacy it said.

Nuzzi hit back and said that the files were not private and were documents between states and he added they had been given to him by people who work inside the Vatican and in a reference to the Bible, he said the sources wanted to 'get the moneylenders out of the temple'.

Today's arrest came just a month after Pope Benedict turned detective and appointed a special commission to investigate the series of damning and embarrassing leaks of sensitive Catholic Church documents from the Vatican as it still tries to recover from the priest sex abuse scandal.

Dozens of documents including private letters to the Pope have found themselves into the hands of the Italian media in what has been dubbed, unsurprisingly, Vatileaks.

The documents show how contracts were awarded to favoured companies and individuals and also highlight allegations of internal power struggles with the Vatican's bank known as the Institute for Religious Works.

By coincidence on Thursday the head of the bank, Ettore Gotti Tedeschi, who is already under investigation for money laundering resigned after a vote of no confidence and initially there were rumours that he was the person responsible for the leak of documents.

The scandal began in January with the publication of leaked letters from the former deputy governor of the Vatican City archbishop Carlo Maria Vigano, in which he pleaded not to be transferred after he had exposed what he said was corruption over the awarding of contracts.

Earlier the Vatican supported Occupy Wall Street over so-called “corporate greed” and even called for "sweeping reforms".

It had been apparent that the Vatican hardly considered the real political economic conditions (that led to the present juncture) from which impulsive judgment had been passed.

The Vatican hardly realized that they fell for deceptive moral trap laid out by the socialists.

And surprisingly, even the Vatican economist endorsed ECB’s inflationist policies.

I guess with the above report, the idiom “what comes around goes around” applies.

Saturday, November 05, 2011

Client Accounts Transfer from MF Global Holdings may trigger Market Volatility Next Week

Transfers of client accounts from bankrupt futures brokerage MF Global Holdings to new brokers may cause some market volatility next week due to possible liquidations on margin calls.

From FoxBusiness.com (bold emphasis mine)

--Ex-customers of MF Global are gaining access to frozen accounts moved to new clearing house

--Some traders fear new margin calls after the move

--Not all money backing current market positions moved with accounts

Some former customers of MF Global Inc. (MFGLQ) rushed Friday to sort through newly unfrozen funds--and awaited word on whether they will have to put up additional capital to back their market bets.

Friday, CME Group Inc. (CME) transferred about $1.45 billion in 15,000 customer accounts from MF Global's U.S. brokerage--roughly 30% of the 50,000 accounts to be moved--to new clearing firms. A group of 10 clearing firms received the bulk transfers throughout the day Friday and began contacting clients about the accounts.

For many of those new clients, the process was a nerve-wracking experience. Some said they were still unsure of when they would gain access to an active account, which is required to resume trading. Others who gained access rushed to sell some positions in order to meet what they expect will be margin calls due to bets that have turned against them over the past week.

For all open bets in the commodities markets, traders need to put up cash to back the position, known as posting margin. In order to keep holding those bets if the contract falls in value, traders are required to post additional cash with their clearing firm.

But confusion still reigns over much of the market and traders are unsure whether their new clearing firms will require them to post additional margins on their trades.

Reuters estimates that some $1 billion will need to be raised next week (bold emphasis added)

There was little sign yet of mass liquidations analysts feared may ensue as traders rush to raise up to $1 billion in additional margin with new brokers.

But with margins due Friday evening or later, forcible liquidation looming on Monday morning, and thousands of accounts still unsettled, dealers were jittery.

"It seems that without MF (Global) in there...no one wants to be held with big positions, if and when these accounts are allowed to trade. It's better to have a lighter position on, in the event that you get a move in the markets," Bill Raffety, senior analyst for futures brokerage Penson Futures in New York, said of the day's light trade in soft commodity markets.

MF Global holdings chief Jon Corzine, a former chief of Goldman Sachs and former governor of New Jersey, who resigned yesterday without his $12.1 million severance pay, made bet a huge bet in Euro debts in the belief that “Europe wouldn’t let these countries go down”, which obviously boomeranged.

Mr Corzine was apparently undone by his extreme faith in governments to deliver miracles and possibly on expectations of a MF Global bailout—both of which did not occur.The Bank of England (BoE) says that MF Global "posed too small a risk to financial stability to merit a bailout" (Bloomberg)

To add, many of major market participants, like Mr. Corzine, have been positioning based on expectations of the directions of political actions from policymakers and their possible ramifications. This validates my view of how politicized financial markets have been.

Yet our fundamental difference; Mr Corzine trusted governments too much (and was betrayed) while I am too deeply skeptical of each and every actions made by politicians and their wards.

Tuesday, October 25, 2011

Vatican supports Occupy Wall Street

From the Reuters

The Vatican called on Monday for sweeping reforms of the world economy and the creation of a ethical, global authority to regulate financial markets as demonstrations against corporate greed continued to spring up in major cities across the globe.

An 18-page document from the Vatican's Justice and Peace department said the financial downturn had revealed behaviours like "selfishness, collective greed and hoarding of goods on a great scale," adding that world economics needed an "ethic of solidarity" among rich and poor nations.

Urging Wall Street powerbrokers to examine the impact of their decisions on humanity, the Vatican called on those who wanted to change economic structures to "not be afraid to propose new ideas, even if they might destabilise pre-existing balances of power that prevail over the weakest."

The document was released as "Occupy Wall Street" protests this month sparked similar anti-capitalist movements around the world with demonstrators angry over government bailouts of big banks, corporate bonuses, and economic inequality.

Vatican wants the governments to impose “heaven on earth” policies in the delusional belief that governments are essentially ‘immaculate’ and has the power to repeal the law of economics by the use of force. This only shows how Vatican has NO idea of the origins of the evil she decries of, and the complicit role of governments in the current political order.

The Pope needs to know that the Governments has been masterminding the current “collective greed” political arrangements. The Vatican needs to answer who has been conducting bailout policies and most importantly WHY this are being done?

Second, Vatican prefers the use of more violence through the “creation of a ethical, global authority” to discipline or “to regulate” the markets.

It is ironic that the Vatican has been proposing actions which runs contrary to what she preaches.

Just how can love or ‘ethic of solidarity’ be attained through the enforcement of redistributionist policies that have been anchored on violence?

Heaven on Earth.

Monday, April 11, 2011

China' Potemkin Cities and Malls

This obsession towards achieving statistical GDP from central planning reminds me of two John Maynard Keynes quotes,

The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi boom.

If the Treasury were to fill old bottles with bank-notes, bury them at suitable depths in disused coal-mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of repercussions, the real income of the community, and its capital wealth, would probably become a good deal greater than it actually is.The obvious result has been an ongoing quasi-boom (as Keynes has predicted) but which ultimately will be faced with the restrains from natural the law of economics which equates to a prospective bust (from the Austrian perspective).

The desire to uphold the Keynesian unemployment goals will backfire and result to China's version of today's MENA political crisis.

First video is from Dateline

Second video from AlJazeerah

There are still teachers who tell their students that “an economy can lift itself by its own bootstraps” and that “we can spend our way into prosperity.” But the Keynesian miracle fails to materialize; the stones do not turn into bread. The panegyrics of the learned authors who cooperated in the production of the present volume merely confirm the editor’s introductory statement that “Keynes could awaken in his disciples an almost religious fervor for his economics, which could be affectively harnessed for the dissemination of the new economics.” And Professor Harris goes on to say, “Keynes indeed had the Revelation.”

There is no use in arguing with people who are driven by “an almost religious fervor” and believe that their master “had the Revelation.” It is one of the tasks of economics to analyze carefully each of the inflationist plans, those of Keynes and Gesell no less than those of their innumerable predecessors from John Law down to Major Douglas. Yet, no one should expect that any logical argument or any experience could ever shake the almost religious fervor of those who believe in salvation through spending and credit expansion.

Saturday, April 02, 2011

Correlation Isn't Causation: Food Prices and Global Riots

The IMF says that the string of antigovernment protests worldwide are all about rising food prices.

The Wall Street Journal blog writes, (bold emphasis original)

100%: The increase in antigovernment protests associated with a 10% rise in global food prices

Despotic leaders, entrenched inequality and new forms of communication have all played their roles in the political turmoil now shaking the Middle East. But new research by economists at the International Monetary Fund points to another potential contributor: global food prices.

Looking at food prices and instances of political unrest from 1970 through 2007, the economists — Rabah Arezki and Markus Brueckner — find a significant relationship between the two in low-income countries, a group that includes Tunisia, Egypt, Sudan and Yemen. To be exact, a 10% increase in international food prices corresponds to an added 0.5 antigovernment protests over the following year in the low-income world — a twofold increase from the annual average.

Rising food prices represent a symptom and NOT the cause of these riots.

People aren’t too dumb to protest on food prices alone, they attribute events to politics (e.g. inequality and etc...) to markets (e.g. speculation, hoarding, et.al.) to economy (e.g. emerging market growth) or to other exogenous causes (climate change etc...).

While all of the above have some grain of truths in them, they aren’t reflective of the entire picture or the bigger force driving these.

In other words, rising food prices serves as the trigger to the unrest from long built in domestic imbalances.

But here is the bigger picture...

US Adjusted Monetary Base has been exploding!

Chart from St Louis Federal Reserve

US Federal Reserve balance sheet has also been ballooning!

Bank holdings of US government securities have also been exploding. US Banks have been speculating more than lending. (chart from St. Louis Federal Reserve)

Stock Market leverage has also been ramping up (chart from Pragmatic Capitalism)

Unless money printing has no impact at all, then all these won’t matter. But obviously, money isn’t neutral, and all these money printing have been absorbed somewhere in the financial markets or the real economy.

Surprisingly, the Bank of Japan (BoJ) recognizes this government induced phenomenon. They write,

Globally accommodative monetary conditions have become unprecedented. The relative size of global money stock (M1) measured against the real GDP has surpassed its historical trend (Chart 14). This sustained global excess liquidity not only increases physical demand for commodities thereby affecting fundamentals, but also amplifies speculative factors, both of which are contributing to the sharp rise in global commodity prices.

Incidentally they have been big practitioners of inflationism too. This seems to be a case "where right hand doesn't know what the left hand is doing".

And this only proves how the mainstream economic perspective has been utterly wrong.

In other words, monetary policies by the US, as the de facto foreign currency reserve of the world, have been filtering throughout the global financial system and to the global real economy.

And surging food prices has been aggravated by the shared central bank practice of inflationism and artificially suppressed interest rates by OTHER nations, most especially by the OECD economies.

And in terms of supply side, another key factor behind surging food prices has been due to the restricted international trade of agriculture. Agriculture has been the least globalized among other sectors.

In short, protectionism from the political toxin called “self-sufficiency” has been responsible for the aggregate imbalances of food economics globally.

Chart from Guinness Atkinson

Of course, it is equally nonsense to attribute rising inflation to China as attributed by some observers.

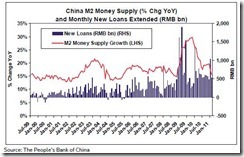

China isn’t the world’s foreign currency reserve. While China is an important driver in the global consumption equation, (in as much as the supply side) China hasn’t been inflating as much as the developed economies. In short, China has only served as an aggravating factor to the main dynamics behind the world’s food price triggered riots. I might add that China has also been plagued by her domestic bubble policies.

Only the politically (and or mathematical formalism) blinded people can’t see anything wrong done by the state. Their knee jerk response is to lay the blame on the doorsteps of either the marketplace or to other nations, for what actually is truly a failure in domestic policies.

To quote Forrest Gump: Stupid is as stupid does.

Thursday, March 31, 2011

Should The Philippines Wage War With China Over The Executions Of The Drug Mules?

“It is just that the Philippines is less powerful than China in warfare” remarked a neighbor in the allusion that the Philippines is powerless to impose her will over its larger and far powerful Asian contemporary following yesterday’s execution of the 3 drug mules.

Stunned by this comment I retorted, “Do you honestly believe that the Philippines should go to war with China for them?”

Such unwarranted emotional interpretation of events appears to be the offshoot of the quality of reasoning peddled by mainstream media which the vulnerable public could have misinterpreted.

From the Inquirer.net

Three Filipinos convicted of drug smuggling were executed in China Wednesday, triggering condemnation in the Catholic Philippines and despair for family members who shared their final moments...

The executions came after repeated pleas by the Philippine government for their sentences to be commuted were turned down, and ended vigils in the country where supporters of the trio had prayed for a miracle.

There are many issues encompassing this case which makes it complex.

One it is the issue of drug trafficking.

Two it is the issue of death penalty.

The populist sentiment seems mostly aligned with the position taken by the influential Catholic church which hasn’t been about the legitimacy of DOMESTIC death penalty laws but death penalty as a moral principle.

From the same article,

Amnesty International as well as the influential Roman Catholic church swiftly condemned the executions.

"We strongly condemn the executions of the three Filipinos," Agence France-Presse quoted Amnesty's Philippine representative Aurora Parong.

"The Philippines should have taken a stronger action, and it is now its moral duty to lead a campaign against death penalty in Asia."

Amnesty International says China is the world's biggest executioner, with thousands of convicts killed every year. The Philippines has abolished the death penalty.

I wholeheartedly agree that death penalty should be abolished. But this is largely a non-sequitur. As you can see from the above article, the Philippines had been suggested to take “stronger action”? But how?

The populist perspective fundamentally ignores the fact that this issue is PRIMARILY about China’s DOMESTIC policies and NOT of ours.

It is the issue of FOREIGN POLITICAL relations.

If the US hasn’t been able to successfully compel China to alter her exchange rate policies (to resolve so called global imbalances) or on other contentious geopolitical issues as the UN environment saving program called the Kyoto Protocol, how the heck can we expect that the Philippines implement “stronger action” on China to save the felons-turned-victims?

As an aside, I don’t have the full knowledge of the circumstances behind this case for me to pass any judgments. I can only deduce from what I read or hear. So I am neutral on this.

So aside from geopolitical relations, the other very important issue is the FALSE impression that the Philippine political leadership can do something at all. This is an example of the religion of politics-the errant belief that government CAN and HAS to do SOMETHING.

Where the local political leadership can hardly control or manage domestic political issues, like the Congressional impeachment of the Ombudsman Merceditas Gutierrez or for many other matters, how can we expect the Philippine government to WANGLE her interests over China? Wage war as my neighbor implied?

The fact is that territorial borders IMPOSE a limit on the sphere of political power influence of the Philippine government.

This also means that the political priorities of the Chinese government will determine the fate of the Filipino drug mules and NOT the Philippine government (as had been the case).

The most we can do is to perhaps appeal—which is what the government did! But this serves no more than as photo OP and as advertisement mileage for politicians.

But in the realization that the Chinese government has been the largest practitioner of the death penalty, mostly applied to their own citizens, Filipinos shouldn’t expect much even from the government’s appeal.

As the Economist reported (bold emphasis added)

CHINA executes more of its own citizens than any other country, and more than all others in the world combined. “Thousands” of Chinese were executed in 2009 according to Amnesty International's annual study, which states that an exact number is impossible to determine because information on the death penalty is regarded as a state secret. But this gruesome record may yet change. The National People's Congress is reported to be reducing the number of offences that are punishable by execution. Among the crimes that currently carry the death penalty are bribing an official and stealing historical relics

Fatalities from China’s death penalty have even been far larger than the composite deaths of the whole world!!!

I’d like to add that there are reportedly some 125 cases of Filipinos scheduled to be executed elsewhere in the world where 85 are allegedly drug related cases, so why pick on China?

I am not a defender of the incumbent administration. But the essential point over this controversy is that the mainstream and the gullible public don’t seem to realize that this is a foreign policy issue, subject to the whims of China’s political leadership regarding the implementation of local rules on our supposedly erring immigrants or OFWs. This is also the issue of China's political and legal system.

This isn’t an issue of nationalist schism.

Importantly, this unfortunate event exposes on the grand delusion that the government CAN do something WHEN they can’t.

Filipinos abroad should realize that they are subject to political risk environment of their host countries that are vastly different than here, and must learn to safeguard their interest than rely on the government.

All the drivel from politicians about more spending to augment legal services for OFWs represent as mere ‘feel-good-vote-buying’ postures. Remember we don’t share the same legal process, institutions or framework with China, thus any assumption for more legal spending would likely only translate to waste.

Finally, when I asked the above question to the media indoctrinated youth, he simply turned around and walked away.

UPDATE: (I forgot to include this)

What happens if the Philippine government does successfully negotiate the mitigation of the sentences of the accused? Would this not serve as moral hazard that could encourage more drug related trades?

It is bad enough for us to expect our government to patently interfere with many aspects of our lives. But it is even worst to believe that our government has to intervene into the lives of people who lives beyond our borders.