``Hot money flows are principally associated with pegged exchange rates. Many analysts have misdiagnosed the so-called hot money problem because they have failed to appreciate this all-important linkage. In consequence, they have prescribed exchange controls as a cure-all to cool off the hot money. That prescription treats the symptoms. It fails to treat the disease: pegged exchange rates. Until pegged rates are abandoned, there will be volatile hot money flows and calls to cool the hot money with exchange controls.”- Steve Hanke, The Dead Hand of Exchange Controls

In this issue:

ASEAN Markets Surge, Where will The Next Bubble Emerge?

-The Bubble Or Inflation Psychology

-No ASEAN Bubble Yet

-Why Capital Controls Can Enhance The Bubble Cycle

-Will The Next Bubble Emanate From Technology Or The Kindleberger Model?

-Will The Next Bubble Emerge From Commodity-Emerging Markets?

Since financial markets have mostly been ‘copacetic’ [slang for ok] and performing in the milieu which we had largely anticipated, ironically I find little to write about this week.

While definitely, we will be encountering several “wall of worries” along the way, I feel that, for this year, it’s going to be mostly a “wait-and-harvest” or “wait-to-be-validated” dynamic.

Of course, it’s never going to be a walkover to challenge many of mainstream’s deeply held superstitions, where people ascribe sundry plausible explanations to the underlying conditions in spite of the falsity of the premises-most of them grounded on either tradition or [political/economic] indoctrination, but in frequently doing so occasionally gets one to be weary.

Nevertheless facts are facts.

Perhaps, no one will dispute that the ASEAN-4 equities appear to be in high octane. As we previously noted, once signs of instability in developed economies become subdued[1], we are likely to see a fervid pace of advance among the ASEAN-4 bourses.

And this exactly what happened this week.

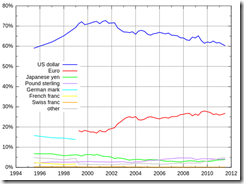

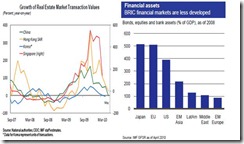

True, the ASEAN-4 has underperformed the US and European markets, but the difference have been starkly remarkable—US and European markets have emerged from the current lows, while ASEAN markets have either been breaking away from recent resistance levels [price ceilings] or adrift at near the resistance levels. (see figure 1)

Figure 1: Bloomberg: ASEAN Equities: Raging Bull Market?!

Well Indonesia’s Jakarta Composite (red line) and Malaysia Kuala Lumpur (orange) are clearly in the second category, while the Philippine Phisix (yellow) and Thailand’s SET (green) are in the breakout zones.

But of course, Indonesia’s JCI has been treading at the newly established milestone highs. And the rest are still below but knocking at record highs, particularly the Philippine Phisix (11.5%) and Malaysia’s KLSE (12.7%).

Meanwhile, Thailand too has been 9.5% off the 5 year (recent boom bust cycle) high, but is still way way way or 54% below her 1994 high.

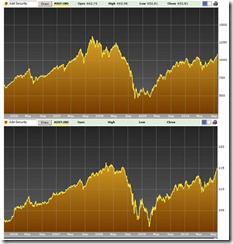

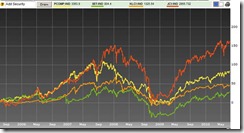

Figure 2: ChartRUS[2]: Thailand’s Boom Bust Cycle-Asian Crisis

Figure 2: ChartRUS[2]: Thailand’s Boom Bust Cycle-Asian Crisis

Incidentally as a grim reminder of a bubble cycle, Thailand had been the epicenter of the Asian Crisis of 1997, which during the heyday saw the Thailand’s SET zoom by about 10x (trough-to-peak) before the harrowing crash.

The Bubble Or Inflation Psychology

Thailand’s SET resembles the typical boom-bust or bubble chart seen at the right window. Meanwhile, the crash notably eviscerated almost entirely ALL the gains accrued by the bubble boom days, whereby from peak-to-trough, the SET lost nearly 90%.

The lesson is that bubble cycles, which are fundamentally policy induced, fosters false or deceptive prosperity which results to a net loss in the society (see figure 3).

Bluntly put, short term panaceas have large negative ramifications which basically offset any short term gains.

Professor Ludwig von Mises described exactly how such cycle would result to undeserved sufferings[3] to the populace, (italics mine)

``The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration. The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions. He does not blame the authorities for having fostered the boom. He reviles them for the inevitable collapse. In the opinion of the public, more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about.”

How true.

The general perception of the public has been to parse events extensively based on superficial treatment of causal linkages.

Many of these are rooted upon the stakeholder’s problem, whereby the incentive to acquire knowledge is proportional to the degree of direct stakeholdings involved in the decision making process, i.e. anent a specific concern, the lesser the direct stakes involved, the lesser the need to obtain knowledge, and vice versa.

Importantly yet, many apply heuristics or cognitive biases in the way they account for the unfolding events. Thus, even if a person has direct stakes in the marketplace, social pressures which influences one’s mental faculties can lead to reckless undertakings borne about by policy induced false signals.

Particularly prominent is “The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions”─ which largely describes the social attributional bias[4].

This is likewise apparent in the vicissitudes in the relationship between clients and or the public with those engaged in the industry [like me!] (Notice the explosion of the public’s revulsion towards Wall Street as the bubble imploded) or even amongst political leaders (Notice too how politicians are always quick to grab credit on the account of positive economic/financial developments which they intuitively would ‘attribute; to their actions, or notice how politicians hastily blame speculators for greed when an inimical event surfaces).

In addition, the mainstream economic doctrine has mostly been slanted towards using mathematical formalism or what I would call “hiding behind the skirts of accounting identities” to rationalize on policies predicated on time preferences of having instantaneous impact. This is in tradeoff to the possible longer term adverse effects.

The visible short term effect has predominantly been what sells easily to the gullible public, who mostly lack economic comprehension. Economic experts, thus, provide the mathematical or scientific justification, to overwhelm the uninformed public, at which politicians gladly employ at everyone’s expense.

All these combined with human nature’s desire for immediate gratification, skews the public towards “more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about” ─where failure to identify the genuine cause-and-effect would reflexively lead the public to desire for more of the same short term nostrums, which seems similar to the mechanics of illegal substance abuse. Thus, the cumulative psychological distortions induced by inflationary policies.

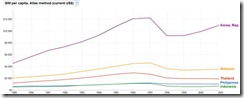

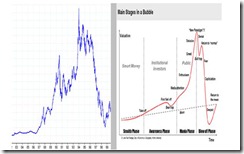

Figure 3: Google Public Data: ASEAN 5 GNI per Capita Atlas Method[5]

Figure 3: Google Public Data: ASEAN 5 GNI per Capita Atlas Method[5]

Yet this has been the same phenomenon which has blighted nations afflicted by the current bubble bust cycle seen in the US and several European economies.

And as previously experienced, the ASEAN-5, which includes the Philippines and South Korea, in the aftermath of the 1997 Asian Crisis saw their GNI per capita based on Atlas Method plummet (see figure 3).

And this is concrete evidence that bubble cycles have always been net negative. Yet policymakers seem to be always looking for an artificially triggered unsustainable boom.

No ASEAN Bubble Yet

Let me be clear, this isn’t to say that ASEAN is already in a bubble. This hasn’t been concretely established.

A Bubble essentially is a symptom of government interventionism via extensive inflationism (e.g. interest rate manipulation, guarantees, subsidies, tax policies etc...) which is ultimately vented on the marketplace.

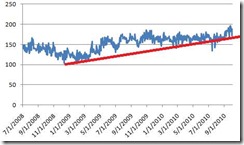

Figure 4: World Bank[6]: World Development Indicators World View

Because bubble cycles have become a regular feature of the global marketplace (see figure 4) since the transition to the current paper money system, we should expect the reappearance of the bubble phenomenon elsewhere.

This is especially true considering the intensive degree of interventionism implemented by global governments to apply band-aid therapy to any economic or financial predicaments including today’s post crisis landscape. As derivative expert and author Satjayit Das narrates[7],

``Botox is commonly used to improve a person’s appearance by removing facial lines and other signs of aging. The effect is temporary and can have significant side effects. The world is currently taking the “botox” cure. A flood of money from central banks and governments -- "financial botox" -- has temporarily covered up unresolved and deep-seated problems.The surface is glossy and smooth, the interior decayed and rotten.”

Moreover, the current state of openness of the international financial system easily functions as transmission mechanism of money in search of yield phenomenon.

Capital mobility, thus, could facilitate to transport bubble conditions from one place to another. It has been no coincidence that bubble cycles has shifted from Japan bubble crash[8] to Mexico’s Tequila Crisis[9] to the Asian Financial Crisis to the Russian Financial Crisis[10] which prompted for the near collapse of the US hedge fund the Long-Term Capital Management[11] to the tech/dot.com[12] bust and finally the US Mortgage crisis triggered Financial crisis of 2007[13]--as global marketplace has become more integrated.

As a caveat, it would be a mistake to treat financial or trade integration as the cause of the crisis. Like knives, trade or financial liberalizations which tend to integrate economic flows are merely tools, whose outcome is based on how it has been utilized.

Why Capital Controls Can Enhance The Bubble Cycle

Globalization cannot by itself engender a bubble because they don’t expand circulation credit (or issuance of credit unbacked by savings). Creation of fiduciary media would be to the account of the banking system.

In addition, globalization isn’t responsible for carefree government expenditures which results to massive budget deficits that periodically have been monetized by government. Thus, inflationism gets to be transmitted outside of the sphere of operations by virtue of the rerating (devaluation) of the currency relative to the others. Devaluation affects the cost structures in the economy and equally this applies to capital flows in reaction to such policies.

Nevertheless financial openness as applied to Asia hasn’t seen any noteworthy progress since the Asian Crisis (see figure 5)

Figure 5: Asian Development Bank: Outlook 2010

According to Asian Development Bank[14],

``The index of de jure financial openness constructed by Chinn and Ito (2008) confirms that, after the Asian financial crisis, restrictions on capital accounts were introduced more often in many Asian economies, including Indonesia, Malaysia, and Thailand. For the rest of developing Asia, de jure financial openness was relatively stable or slightly increasing (i.e., had higher de jure financial index values).”

Capital flows are not significantly a function of ‘fundamentals’, as they are as much determined by relative monetary policies and the relative currency regime, thus capital flows are likely to reflect on the evolving conditions as corollary to these measures, more than “fundamentals” which usually reacts to the incentives provided by the regulatory environment.

Moreover, in contrast to the ADB, which sees the need for capital account restriction as a “guard against economic instability as well as to preserve monetary autonomy”, seems to be a “strawman” argument.

Capital restrictions do not only increase the risk premium by putting property rights into question which inhibits market efficiency thereby restrain economic growth and reduce investment flows, capital controls also fails to account for the backdoor channels where hot money flows can seep into, or smuggled through, which should exacerbate the bubble conditions. As example, despite Venezuela’s stringent capital controls, capital flight[15] from residents appear to accelerate as they flee and seek a safehaven from an increasingly despotic regime.

What deceives people today as the seeming functionality of capital controls is that internal policies have not yet reached enough pressure levels for markets to seek a relief valve.

In other words, regulations will not put a stop to economic order; it will only reconfigure the flows from what is known as legal channels to the underground. Regulations will also not shape the economy in accordance the chimerical whims of the political class. Instead, failed policies will manifest itself in the marketplace or the economy, in terms of shortages, higher rates of inflation, increased unemployment, higher poverty levels and etc..., no matter how the political class exhaustively tries to conceal them.

The basic lesson is that economic laws cannot be repealed by arbitrary regulations.

Yet what is deemed as today’s global imbalances can partly be ascribed to such capital restrictions.

Asian economies may have preferred to recycle to the US their trade surpluses, than within the region largely because of this. And oppositely, the liberal capital flows in the US has attracted Asian money because of the relatively secure property rights which redounds to reduced perception of risks. The liberal capital markets also provide enhanced liquidity which capital restricted markets can’t. So capital restrictions and liquidity are two major factors that also contribute to what mainstream calls as “global imbalances”.

Thus, policy reforms should be directed at capital convertibility for China and more liberalization for Asia and the ASEAN, including the Philippines, than simplistic currency adjustments which does little but promote nonsensical politicking.

Of course, given the fluid political conditions, this equation could dramatically change, especially if China decidedly aims for an aggressively expansion of her influence with her neighbours via economic integration[16], or if the US embarks on policies in the direction of developing economies by virtue of adapting capital controls or by rampant inflationism.

I should further stress that capital restrictions will not “guard against economic instability” because as stated above, capital controls will not prevent markets from ventilating the accrued imbalances as a result of failed policies.

Will The Next Bubble Emanate From Technology Or The Kindleberger Model?

Going back to the risk of an ASEAN bubble, the tendency for bubbles is to look for areas previously unaffected by a bubble bust or from a dislocation such as new technology or new markets (Charles Kindleberger’s model).

It’s not clear if the latter would place a significant influence in the shaping today’s bubble cycles. But as previously pointed out[17], since technology leads the sectoral weightings today in terms of the largest share of market cap of the S&P index, we shouldn’t rule out an emergent bubble from the technology sector.

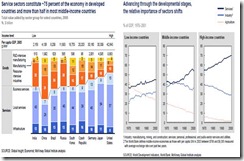

Technology in terms of services is making an immense headway in shaping today’s global economic trends (see figure 6)

Figure 6. McKinsey Global Institute[18]: How To Compete And Grow

Some factors that may prompt for a technology based dislocation (Kindleberger model) bubble are the following:

-less government intrusion in the market clearing process of the previous dot.com bust,

-swift obsolescence rate of the technology cycle and or rapid rate of innovation could mean new applications

-globalization means more consumers of technology products and services, thus a wider reach and bigger markets, albeit a more niche oriented one (another potential source of dislocation)

-importantly, freer markets which allows for more intensive competition could spawn heightened innovation from which new products with widespread application could emerge.

Yet there are many factors from which technology should play a role in shaping markets and the economy. Fundamentally this involves greater dispersion of knowledge and the deeper role of specialization, which some have labeled as the Hayekian Moment.

The impact of which should include vastly improved business processes via the development of organizational capital[19], provide for more real time activities which immensely reduces transaction costs thereby generate an explosion of commercial or commercial related activities, and significantly flatten organizational hierarchy which becomes attuned to the dynamics of a more competitive environment.

Economic development trends appear to be tilted towards having a greater share of technology based service sector (left window). The more competitive an economy is, the greater the share of the technology based service economy (right window).

This, essentially, is the running transition away from the industrial age towards the information age.

Thus, free market based competition has been directing economic development towards more specialization, or in Austrian economics terms-the lengthening of the production structure.

So a Kindleberger bubble should be on our watch list.

As a caveat bubbles, will not occur without leverage or expanded credit, thus the Kindleberger applies in conjunction with the Austrian Business cycle.

Will The Next Bubble Emerge From Commodity-Emerging Markets?

Of course the other prospective bubble area which I’d remain vigilant with are economies that were largely unscathed by the recent bubble bust.

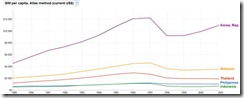

Figure 7: IMF GSFR[20]: Subdued Property Transactions; Deutsche Bank[21]: BRIC Financial Markets

While it may be true that property prices in major Asian markets could have eased (left window, figure 6), as evidenced by the subdued rate of property transactions, this perhaps suggest of a temporary reprieve than from a prolonged hiatus or even a slump.

In addition, as one of the least exposed in terms systemic leverage, Emerging Asia’s financial markets are vastly underdeveloped (right window) relative to the developed markets.

This implies that in today’s highly expansionary policies, areas with the least leverage could likely be more receptive to these conditions, which I suspect is mainly responsible for the outperformance of ASEAN bourses.

Furthermore, sustained momentum generates followers or believers. This is known as the bandwagon or the herding effect.

Hence, should the ASEAN momentum persists, it is likely to draw in more participants from both the local and international arena. And this will likely reinforce expectations which should prompt for a feedback loop mechanism that enhances the trend. A bubble dynamic will become evident once systemic leverage will accelerate combined with a stratospheric surge in the price levels of assets whereby people will rationalize this as ‘this time is different’ or in different lingo as “tiger economy” or etc…

But this is likely a few years away from now, as systemic leverage is hardly on the radar screen.

At the present moment, momentum is likely to gather speed for ASEAN markets if the global marketplace should see continued reduced volatility. I think that the price signals from the US dollar index should be a great indicator.

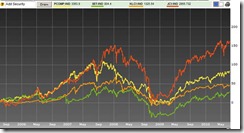

Figure 8: Stockcharts.com: Euro And Global Equity Markets Bounce Back

Major global equity markets appear to be confirming the Euro’s rally (see figure 8) as we fortuitously predicted[22].

Major equity markets seemed to have waited out for more confirmation of the sustainability of Euro’s bounce before taking cue. And coincidence suggests to us that from Shanghai (SSEC), the US S&P (SPX) and the Euro Stoxx 50 (STOX), the actions appear to be simultaneous.

Yet what needs to be established is if the current rally signifies as a major reversal of the current trend or just another countercyclical bounce.

While I don’t think the US or European markets are in a bullmarket, they are likely to be higher at the year end from the current conditions. The steep yield curve as we have been saying will be a major factor in providing cushion to the marketplace.

Finally I am in general agreement with those who think that government debts are a bubble.

But the problem is that US treasuries are unlikely to implode if inflation doesn’t pick up and hamstring the US government’s ability to influence the markets. Global governments in collusion can directly or indirectly intervene in the marketplace which I suspect could have been taking place. The US governments needs low interest rates to finance the burgeoning fiscal deficits, aside from low rates to sustain a steep yield curve to keep her banking system afloat.

And intervention is the most likely route since they will have confidence to do so because yields are low. In fact, present low rates are almost the effect of what quantitative easing has previously done. And as we have been saying for the longest time, any signs of economic weakness will prompt for the US government to use the opportunity to intervene anew.

Proof?

From the Washington Post[23],

``Federal Reserve officials, increasingly concerned over signs the economic recovery is faltering, are considering new steps to bolster growth.

``With Congress tied in political knots over whether to take further action to boost the economy, Fed leaders are weighing modest steps that could offer more support for economic activity at a time when their target for short-term interest rates is already near zero. They are still resistant to calls to pull out their big guns -- massive infusions of cash, such as those undertaken during the depths of the financial crisis -- but would reconsider if conditions worsen.”

Q.E.D.

[1] See Why The Sell-Offs In Global Markets Are Unlikely Signs Of A Double Dip Recession

[2] Chartrus.com, Thailand’s SET

[3] Mises, Ludwig von; The Market Economy as Affected by the Recurrence of the Trade Cycle, Chapter 20 Section 9, Human Action

[4] Wikipedia.org, Attributional Bias

[5] NationMaster.com, GNI (formerly GNP) is the sum of value added by all resident producers plus any product taxes (less subsidies) not included in the valuation of output plus net receipts of primary income (compensation of employees and property income) from abroad. Data are in current U.S. dollars. GNI, calculated in national currency, is usually converted to U.S. dollars at official exchange rates for comparisons across economies, although an alternative rate is used when the official exchange rate is judged to diverge by an exceptionally large margin from the rate actually applied in international transactions. To smooth fluctuations in prices and exchange rates, a special Atlas method of conversion is used by the World Bank. This applies a conversion factor that averages the exchange rate for a given year and the two preceding years, adjusted for differences in rates of inflation between the country, and through 2000, the G-5 countries (France, Germany, Japan, the United Kingdom, and the United States).

[6] WorldBank.org, World Development Indicators World View, p.10

[7] Das, Satyajit, Botox Economics – Part 1, Satyajit Das’s Blog-Fear & Loathing in Financial Products

[8] Wikipedia.org, Japan Asset Price Bubble

[9] Wikipedia.org, 1994 economic crisis in Mexico

[10] Wikipedia.org 1998 Russian financial crisis

[11] Wikipedia.org, Long-Term Capital Management

[12] Wikipedia.org, dot-com bubble

[13] Wikipedia.org Financial crisis of 2007–2010

[14] Asian Development Bank: Outlook 2010 Macro Management Beyond The Crisis, p.87

[15] Venezuelaanalysis.com, Inflation in Venezuela Higher This Half Year July 9, 2010

[16] See Asian Regional Integration Deepens With The Advent Of China ASEAN Free Trade Zone

[17] See What The Distribution Of S&P 500 Sector Weightings Seem To Say

[18] McKinsey Global Institute, How To Compete And Grow A Sector Guide to Policy, March 2010

[19] Garrett Jones, ``Organizational capital is basically the ideas and habits of work that people build at work. We know what physical capital is--the machines. Businesses also build cultures, R&D labs and trained people. A lot of what we are doing at work is building patterns, processes.” Professor Russ Roberts, Garrett Jones on Macro and Twitter, ecotalk.org

[20] IMF, Global Financial Stability Report, Financial Stability Set Back as Sovereign Risks Materialize, July 2010

[21] Deutsche Bank Research, BRIC Capital Markets Monitor, June 2010

[22] See Buy The Peso And The Phisix On Prospects Of A Euro Rally

[23] Irwin, Neill Federal Reserve weighs steps to offset slowdown in economic recovery Washington Post, July 8, 2010