And speaking of markets forcing the hands of central bankers, current developments in the commodity markets seem to be providing us some clues.

From the Bloomberg,

Global food prices rose 1.9 percent in January, the biggest gain in 11 months as the cost of oilseeds, dairy and grains increased, the United Nations Food and Agriculture Organization said.

An index of 55 food items climbed to 214.3 points from a restated 210.3 points in December, the Rome-based FAO said on its website today. All commodity groups in the index advanced, according to the UN agency.

Costlier food is driving up living costs in China, home to about a fifth of the world population. Chinese inflation unexpectedly accelerated in January on the back of food prices, which rose 10.5 percent last month compared with a year earlier, up from 9.1 percent in December, the country’s National Bureau of Statistics reported today.

“International prices of all major cereals with the exception of rice rose in January,” the FAO wrote. “Prices of all the commodity groups that compose the index registered gains, with oils increasing the most.”

Despite the 2008 crisis which has proven to be a reprieve and the temporary hiatus from last year’s slowdown, FAO’s food index (chart from Bloomberg) has resumed its ascent as global central banks embark on a negative real rate environment while central banks of major economies rev up on quantitative easing measures.

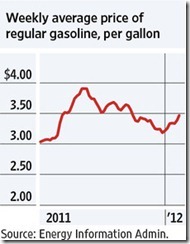

And it is not just in food, in the pump prices in the US has also began to inch higher.

(From Wall Street Journal Blog)

Consumer price inflation has already been staring in the faces of the mainstream experts and authorities, mostly of the Keynesian-Fisherian 'deflation' persuasion, who remain in deep denial……perhaps until CPI index goes berserk.