George Soros, one the greatest Hedge Fund Managers of our time, trades stocks very different than a mutual fund or hedge fund manager might today. Soros was trained in economics at the London School of Economics. His view on stocks is driven by his macro view. He is less interested in what a company does or anything about its financials or fundamentals.Soros trades stocks in sectors he expects to perform within his macro view. When he likes a sector he usually purchases 2 stocks from it: First, the market leader usually the Largest Market Cap Company and the second stock he usually purchases is the cheapest, lowest priced stock in the sector. He does this because he believes that if the sector takes off, the cheapest most speculative stock will double or triple while the industry leading stock will just slowly go up over time.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, August 31, 2013

George Soros’ Investing Style

Monday, August 19, 2013

George Soros Hedges Portfolio with a Huge Bet Against the S&P 500

Billionaire George Soros' family office hedge fund, Soros Fund Management, filed its 13F quarterly report with the Securities and Exchange Commission yesterday.As Marketwatch reporter Barbara Kollmeyer points out, one interesting highlight from Soros' filing is that he bought a bunch of puts on the SPDR S&P 500 ETF in Q2.It's his biggest holding in the filing.During the second quarter ended June 30, Soros held 26,157 shares of SPDR S&P 500 and call options on 143,600 shares and put options on 7,802,400 shares in the ETF.via SECIn the first quarter ended March 31, Soros held 17,065 shares and puts on 2,618,700 shares of SPDR S&P 500 ETF.What's so significant about this move is that puts are used for a downside bet.It appears that Soros has placed a large bet through S&P 500 puts, basically giving him the right, but not the obligation, to sell them in the future.So if the S&P 500, or the ETF which tracks the S&P 500 goes down, Soros will profit handsomely.Then again, Soros also bought 66,800 shares of Apple (a major component in the S&P) and he owns a bunch of other stocks. So buying S&P 500 puts can also act as a hedge.

Friday, July 12, 2013

Seth Klarman: For if you must rescue everything, then ultimately you will be able to rescue nothing

Is it possible that the average citizen understands our country's fiscal situation better than many of our politicians or prominent economists?Most people seem to viscerally recognize that the absence of an immediate crisis does not mean we will not eventually face one. They are wary of believing promises by those who failed to predict previous crises in housing and in highly leveraged financial institutions.They regard with skepticism those who don't accept that we have a debt problem, or insist that inflation will remain under control. (Indeed, they know inflation is not well under control, for they know how far the purchasing power of a dollar has dropped when they go to the supermarket or service station.)They are pretty sure they are not getting reasonable value from the taxes they pay.When an economist tells them that growing the nation's debt over the past 12 years from $6 trillion to $16 trillion is not a problem, and that doubling it again will still not be a problem, this simply does not compute. They know the trajectory we are on.When politicians claim that this tax increase or that spending cut will generate trillions over the next decade, they are properly skeptical over whether anyone can truly know what will happen next year, let alone a decade or more from now.They are wary of grand bargains that kick in years down the road, knowing that the failure to make hard decisions is how we got into today's mess. They remember that one of the basic principles of economics is scarcity, which is a powerful force in their own lives.They know that a society's wealth is not unlimited, and that if the economy is so fragile that the government cannot allow failure, then we are indeed close to collapse. For if you must rescue everything, then ultimately you will be able to rescue nothing.They also know that the only reason paper money, backed not by anything tangible but only a promise, has any value at all is because it is scarce. With all the printing, the credibility of our entire trust-based monetary system will be increasingly called into question.And when you tell the populace that we can all enjoy a free lunch of extremely low interest rates, massive Fed purchases of mounting treasury issuance, trillions of dollars of expansion in the Fed's balance sheet, and huge deficits far into the future, they are highly skeptical not because they know precisely what will happen but because they are sure that no one else--even, or perhaps especially, the policymakers—does either.

Saturday, May 25, 2013

PIMCO’s El Erian’s 6 Rules for Investors

1. Protect yourself against the haircuts that come from not-strong balance sheets, weak income statements and bad management

2. Don't give up all of your liquidity just to be "in"

3. Risk management: People used to think that diversification was good enough, but no more. "Diversification is necessary for any investor but it is not sufficient when central banks have distorted prices." He says the way to think about insuring tail risk is the same as you would car insurance. You maintain it at all times, not try to guess when you'll need it. He is talking about far-out-of-the-money options that hedge against unforeseeable outlier events, which is what his fund does.

4. Be reasonable about your return expectations. "Central banks bring growth from tomorrow into today - but markets price this future growth in quickly." He is saying that we have pulled forward a lot of future growth in the returns we've seen already.

5. Beware backward-looking labels. Back in the day, China and Brazil bonds were considered to be credit risks because they were emerging countries and Greek and Cypriot bonds were more interest rate risky, not credit risky, because they were considered to be "developed" countries. But that was then - nowadays China and Brazil's fundamentals mean that their bonds are more interest rate risk, it is Greece and Cyprus that become credit risks (both have defaulted). "Ask yourselves whether or not your labels still make sense as the world changes."

6. Be Resilient and Agile. The world is changing. The US is the sun in the solar system that is the global economy around which everything else revolves. There is nothing to replace the US just as there is no replacement for the sun. That being said, at the fringes, things are fragmenting away from the existing world order. The evidence of this can be found in the many bi-lateral agreements being struck between non-US partners (China and Brazil, Brazil and Africa etc).

Friday, April 26, 2013

Quote of the Day: Watch Asset Classes that are the Most Vulnerable to Wealth Taxes

When a government goes bust in a democracy (and most Western governments cannot possibly meet their unfunded liabilities) the majority of people who have no assets or just a few assets will always find it appealing to collect money from the evil “fat cats” (in the case of the US, the 1% who own 42.7% of financial wealth). It should be obvious that if 80% of the population owns just 7% of financial wealth, they will be tempted to transfer at some point in future, part of the wealth of the 5% or 10% richest Americans to the masses that have no savings.The problems we face today are there because the people who work hard for a living are now vastly outnumbered by those who vote for a living.Normally, we analyze various asset markets and individual investment opportunities according to their merits. But now, we also need to think which asset classes are the least and which ones are the most vulnerable to wealth taxes.

Thursday, April 04, 2013

Bill Gross: Past Performance in the Age of the New Normal

Bill Gross, manager of the world’s largest mutual fund, said the most renowned investors from Warren Buffett to George Soros may owe their reputations to a favorable era for money management as expanding credit fueled gains in asset prices across markets.The real test of greatness for investors is not how they navigated market cycles during that time, but whether they can adapt to historical changes occurring over half a century or longer, Gross, 68, wrote in an investment outlook published today entitled “A Man in the Mirror,” named after a song by Michael Jackson.“All of us, even the old guys like Buffett, Soros, Fuss, yeah - me too, have cut our teeth during perhaps a most advantageous period of time, the most attractive epoch, that an investor could experience,” Gross wrote. “Perhaps it was the epoch that made the man as opposed to the man that made the epoch.”Gross, one of the co-founders in 1971 of Newport Beach, California-based Pacific Investment Management Co., is examining his legacy as the bond shop he built over four decades is seeking to adapt to an environment that looks very different from the bull market that fueled Pimco’s growth to one of the largest money managers in the world. The prospect of elevated market volatility, an aging population and climate change could make investing far more challenging in the coming decades, Gross said.

If past history was all there was to a game, the richest people will be librarians.

Friday, January 04, 2013

Bob Farrell’s 10 Timeless Investing Guides

Retired wall street veteran and stock market guru Bob Farrell in his 10 “Market Rules to Remember” lays out when we should assume on such positions: (bold mine)

1. Markets tend to return to the mean over time

2. Excesses in one direction will lead to an opposite excess in the other direction

3. There are no new eras — excesses are never permanent

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways

5. The public buys the most at the top and the least at the bottom

6. Fear and greed are stronger than long-term resolve

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names

8. Bear markets have three stages — sharp down, reflexive rebound and a drawn-out fundamental downtrend

9. When all the experts and forecasts agree — something else is going to happen

10. Bull markets are more fun than bear markets.

Monday, October 22, 2012

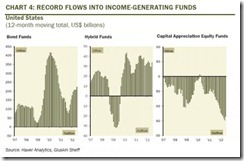

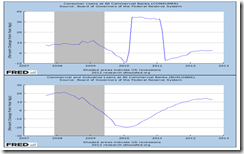

Will Frothy Bond Markets Drive the Phisix Higher?

One must be reminded that bubbles come in stages. So far the Philippines seem to be at a benign phase of the bubble cycle.Again bubbles will principally be manifested on capital intensive sectors (like real estate, mining, manufacturing) and possibly, but not necessarily, through the stock markets.This means that for as long as the US does not fall into a recession or a crisis, ASEAN outperformance, fueled by a banking credit boom and foreign fund flows operating on a carry trade dynamic or interest rate and currency arbitrages (capital flight I might add), should be expected to continue.And again I will maintain that ASEAN’s record breaking streak may be sustained at least until the end of the year 2012.

Much of the blame for this tends to be attributed to the fact that markets now move to a drumbeat of statements from politicians and central bankers, such as the head of the US Federal Reserve. “All 500 S&P companies have the same chairman and his name is Ben Bernanke,” says Jurrien Timmer of the Fidelity Global Strategies Fund.It is also true that securities within markets, as well as far-flung debt and equity markets have been trading more “in sync” with each other: the willingness of investors to take on risk being a common factor behind price moves.

Essentially, the Fed is inserting a sizeable policy wedge between market values and underlying fundamentals. And investors in virtually every market segment – including bonds, commodities, equities, foreign exchange and volatility – have benefited handsomely. In the process, many asset prices have been taken close to what would normally be regarded as bubble territory, with some already there.Central bank action, both real and perceived, rules the investment day, and will continue to do so for now. This is also the case in Europe.

Perhaps the most horrifying thing about the current combination of sales deceleration, margin contraction and high valuations is that it might not even be a sell signal. The central banks of the US and Europe may well keep investors trapped in risky assets indefinitely. Those who look at the fundamentals and flee to cash had better be patient.

Inflation, to sum up, is the increase in the volume of money and bank credit in relation to the volume of goods. It is harmful because it depreciates the value of the monetary unit, raises everybody's cost of living, imposes what is in effect a tax on the poorest (without exemptions) at as high a rate as the tax on the richest, wipes out the value of past savings, discourages future savings, redistributes wealth and income wantonly, encourages and rewards speculation and gambling at the expense of thrift and work, undermines confidence in the justice of a free enterprise system, and corrupts public and private morals.

Choose your battles wisely. After all, life isn't measured by how many times you stood up to fight. It's not winning battles that makes you happy, but it's how many times you turned away and chose to look into a better direction. Life is too short to spend it on warring. Fight only the most, most, most important ones, let the rest go.

[3] iShares.com MSCI Emerging Markets Index Fund us.iShares.com

[4] ADB, Asia Bond Monitor, Asianbondsonline.org September 2012

[5] Zero Hedge R(osenberg) & B(ernstein): Two Ex-Merrill Colleagues, Two Opposing Outlooks, One Permabull Rebuttal, October 19, 2012

[6] See How Capital Regulations Contributed to the Current Crisis December 5, 2011

[7] Wall Street Journal Japanese Banks Face Huge Rate Rise Risk, Warns BOJ, October 19, 2012

[8] Pedro Da Costa Central bank balance sheets: Battle of the bulge Reuters Blog April 12, 2012

[9] Asahi Shimbun BOJ mulls further monetary easing, October 18, 2012

[10] Zero Hedge Forget China; Japan Is 'Taking Over' The World Again October 15, 2012

[11] Bloomberg.com Softbank’s Son Seeks to Skirt Cross-Border Failure History, October 17, 2012

[12] See Will Japan’s Investments Drive the Phisix to the 10,000 levels? March 19, 2012

[13] Dan McCrum End to ‘alpha’ spells trouble for fund managers Financial Times September 10, 2012

[14] Mohamed El Erian Beware the ‘central bank put’ bubble Financial Times, October 10, 2012

[15] Dave Glen Markets Remain Bid Despite Weakish Fundamentals September 18, 2012

[16] See US Federal Reserve Policies Re-Inflate US Property Bubble October 20, 2012

[17] Henry Hazlitt What You Should Know About Inflation p.18 Mises.org

[18] Alcorn Petroleum Re: Comment on Inquirer.net News Article PSE.com.ph October 16, 2012

[19] Business Inquirer.net Drillers settle dispute on farm-in deal August 10, 2012

[20]Business Inquirer.net Century Properties sets backdoor listing on Philippine Stock Exchange, August 18, 2012

[21] Newsflash.org BOI OKAYS REGISTRATION OF PHILWEB AS NEW I.T. FIRM January 29, 2001

[22] See FED-ECB’s Nuclear Policies: Risk ON is Back! September 17, 2012

[24] See Applying Emotional Intelligence to the Boom Bust Cycle August 21, 2011

Friday, August 31, 2012

Is Financial Knowledge Key to Successful Investing?

The public doesn’t know how to manage their finances, that’s according to a study commissioned by the US SEC.

From the Wall Street Journal Blog,

Good news for those intent on committing fraud. Bad news for most everyone else. American investors apparently don’t know much about anything financial.

According to a review released Thursday of years of surveys of individual investors, they are presumably ripe for the picking by fraudsters because they don’t have much knowledge to counteract any outlandish offerings.

Here’s the key and rather astonishing quote: “These studies have consistently found that American investors do not understand the most basic financial concepts, such as the time value of money, compound interest and inflation. Investors also lack essential knowledge about more sophisticated concepts, such as the meaning of stocks and bonds; the role of interest rates in the pricing of securities; the function of the stock market; and the value of portfolio diversification…”

That is from the Library of Congress, which conducted the review on behalf of the Securities and Exchange Commission. The SEC, for its part, needed to study Americans’ financial literacy and assess what investors wanted to know about investments and advisers and how they wanted to receive the information. The SEC had a mandate for all that from the 2010 Dodd-Frank Act.

This generalized lack of knowledge (there certainly are plenty of exceptions) is particularly worrisome since more and more people are responsible for their own investment decisions as part of defined-contribution retirement plans, usually 401(k)s.

The Library of Congress said: “If employees do not have the requisite knowledge, they will not be prepared to make informed decisions regarding the management of their financial affairs, including investing for a secure retirement.”

The public (not limited to Americans) may not be technically sophisticated in the realm of finances but to claim that they are “not be prepared to make informed decisions regarding the management of their financial affairs” looks outrageously untrue.

This misleading assertion presupposes that government should play a role to compel people to get educated "financially".

In reality, America’s standard of living has been higher than most of the world because of capital accumulation.

As the great Ludwig von Mises wrote,

The average standard of living is in this country higher than in any other country of the world, not because the American statesmen and politicians are superior to the foreign statesmen and politicians, but because the per-head quota of capital invested is in America higher than in other countries. Average output per man-hour is in this country higher than in other countries, whether England or India, because the American plants are equipped with more efficient tools and machines. Capital is more plentiful in America than it is in other countries because up to now the institutions and laws of the United States put fewer obstacles in the way of big-scale capital accumulation than did those foreign countries.

Americans not only knew but appropriately acted to manage their state of affairs through the productive balancing of savings and investments which resulted to such high levels of capital accumulation

Moreover, having financial knowledge does not necessarily translate to having the expertise for “investing for a secure retirement”

In reality, financial knowhow does not make one infallible from loses.

In debunking the idea that financial success comes out of high IQs, I recently wrote,

The landmark bankruptcy by Long Term Capital Management in 1998 had been a company headed by 2 Nobel Prize winners. The company’s failure has substantially been due to flawed trading models.

In 2008, the 5 largest US investment banks vanished. These companies had an army of economists, statisticians and quant modelers, accountants, lawyers and all sort of experts who we assume, because of their stratospheric salaries and perquisites, had high IQs.

When Queen Elizabeth asked why ‘no one foresaw’ the crisis coming, the reply by the London School of Economics (LSE)

"In summary, Your Majesty," they conclude, "the failure to foresee the timing, extent and severity of the crisis and to head it off, while it had many causes, was principally a failure of the collective imagination of many bright people, both in this country and internationally, to understand the risks to the system as a whole."

Imagination had been scarce because the same army of experts heavily relied on mathematical models in dealing with investments. They did not follow the common sense advise by the real experts.

These people had all the supposed “expertise” yet they all burned investor's money.

The failure of pseudo financial mastery explodes the idea that “generalized lack of knowledge” will not enable people “to make informed decisions”.

To add, if one looks at the list of the victims of fraud committed by scam artist Bernie Madoff, they had hardly been about financial ignorance

Again I wrote,

Thus, it is no different when Bernard Madoff bamboozled $50 billion off from the who’s who list which includes top rated financial institutions among them banks, (e.g. BNP Paribas,Banco Santander, Fortis Bank Netherlands, HSBC Holdings, Nomura Holdings, Royal Bank of Scotland and etc.) insurers (CNP Assurances, Clal Insurance, Harel Insurance) and Hedge funds (Tremont Group Holdings, Fairfield Greenwich).

To consider, these institutions account for as supposedly smart money outfits since they are backed by an army of “elite professionals”, e.g. economists, accountants, risk managers, quants etc…). Yet at the end of the day, smart money seemed like everybody else; they got what they deserved because they substituted prudence with fad

In reality, inflationist “bubble” policies, which obscures price signals and whets the speculative or gambling appetite, have been the principal influence to fraud.

As a side note: even the most successful stock market investor Warren Buffett admits of occasional investing mistakes.

In Manias, Panics and Crashes Charles Kindleberger’s insight has been highly relevant, (I quoted from my previous article)

Commercial and financial crisis are intimately bound up with transactions that overstep the confines of law and morality shadowy though these confines be. The propensities to swindle and be swindled run parallel to the propensity to speculate during a boom. Crash and panic, with their motto of sauve qui peut induce still more to cheat in order to save themselves. And the signal for panic is often the revelation of some swindle, theft embezzlement or fraud

Bottom line: having financial knowledge is necessary but not sufficient reason for securing financial success.

Relevant theory backed by quality information from the desire to profit (stakeholder's dilemma) has to be used as framework for such analysis.

Morris Cohen in his 1944 book, A Preface to Logic provides a useful insight (quoted by Professor Don Boudreaux)

There can be no doubt that statistics deals with actuality, and that knowledge of actualities is always empirical, i.e., that we cannot obtain knowledge by purely a priori methods. There is, however, no genuine progress in scientific insight through the Baconian method of accumulating empirical facts without hypotheses or anticipation of nature. Without some guiding idea we do not know what facts to gather. Without something to prove, we cannot determine what is relevant and what is irrelevant.

And this should be complimented by emotional intelligence and self-discipline.

![clip_image001[4] clip_image001[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjlUq0pKsH-OLxTwRyMM04QfunLUXFFVnCohOJoSr-4oj0A12OcR2iWTLkJ3MIIw8zBj23uW3JRppg0HnVzjTncJnDoq8TAqtZjJt03ip5B7dFLQuP3opEZLb1iQYAMNvbKyQkk/?imgmax=800)

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhSIn9H1Ddsh50FR96VyezfaPntqdWylvWy6bxvYLU1QepkkVi65DnvR-JcAnRBAytT_fB7A0IgWtoTLXlDJZG57wY-OlfoPNnKy7wKFTnymBFHlmfr_oBJZa9fXw8fPgoQiqqV/?imgmax=800)

![clip_image004[4] clip_image004[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj6ynlFjyTZE6HsJfa9OBGJ1yia2UgcIIyidtjyAhZgLUT0__DgK-41yihe15x8tym9_dGUPmNKNg7TQENEpX4w44U9XO-iJvfXBiHXqwaK45lmdW0kirJXg4Xc7ipNGThVcv-G/?imgmax=800)

![clip_image005[4] clip_image005[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhg9hd6sD3j45zohi4T3F5AcTDxBqIoUAXMFgZRe4g2exF5iDG_uSHe2-rPZEkRe37Jh4XVoiX6Nx9QSC_BVZmDDmHnkw1dhPQkBvOlkcddCOFbABGQq436GGWOf8ce2dkyV7Gw/?imgmax=800)

![clip_image007[4] clip_image007[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhysAFt-O8ybC0qFt8W5oeRZwCHR_PiUVfZ1U2OSXgr3TsmGfhVfuMhvg59oKPIFMW0bVhebsfuU3NEA0WC-tBRtIvPHNHHVGcaS7yyjI4tJU8nj0Z5zu5FvCBW6FYXZigFSbXj/?imgmax=800)