CNBC recently came out with a slide show depicting that troubles in the Eurozone and in the US has been prompting investors to search for new or alternative markets to invest in. And based on their selections mainly derived from demographics, natural resources or geography they came up with the following list:

10 Algeria

9. China

8. Egypt

7. Vietnam

6. Malaysia

5. Bangladesh

4 India

3 Peru

2 Ukraine

And the winner of CNBC’s best countries for long term growth…

…is the Philippines.

Given the endowment effect or home bias I should be screaming “yehey, buy buy buy the Philippines!”

Here is what CNBC has to say on the Philippines

1. Philippines

Projected annual growth: 7%

2010: $112 billion*

2050 projected GDP: $1.688 trillion

The Philippines has one of the fastest-growing populations in Asia. The population is set to jump by almost 70 percent over the next 40 years, and HSBC believes the combination of its powerful demographics and strong fundamentals will drive the economy to become the world’s 16th largest by 2050. That would mark a jump of 27 places from its current ranking of 43.

The country is one of the world’s largest exporters of labor, with over 9 million Filipinos working abroad, according to the latest data from the Commission of Filipinos Overseas. In 2010, almost $19 billion was sent back to the Philippines as remittances from Filipinos working abroad.

More recently, the country’s fast-developing business process outsourcing (BPO) industry has helped keep some of the workforce from leaving the country. Already 350,000 Filipinos are estimated to work in call centers, compared with 330,000 Indians, according to the Contact Center Association of the Philippines. The industry is projected to provide more than 1 million jobs within two years.

The economy’s focus on the services sector and domestic consumption, as well as a lower exposure to global financial markets, helped it to escape a recession following the 2008 global financial crisis.

It would seem as reductio ad absurdum to predict on long term growth based simply on variables of natural resources, demographics and or geography.

If these variables have been instrumental in generating prosperity, then the linkages should have been evident today.

Yet in looking at the world’s top 20 wealthiest nations based on per capita income from Wikipedia.org we see limited influences of abundant natural resources, young populations (demographics) or geography.

Why?

Countries with natural resources are usually afflicted by what is known as resource curse, which according to Wikipedia.org

refers to the paradox that countries and regions with an abundance of natural resources, specifically point-source non-renewable resources like minerals and fuels, tend to have less economic growth and worse development outcomes than countries with fewer natural resources. This is hypothesized to happen for many different reasons, including a decline in the competitiveness of other economic sectors (caused by appreciation of the real exchange rate as resource revenues enter an economy), volatility of revenues from the natural resource sector due to exposure to global commodity market swings, government mismanagement of resources, or weak, ineffectual, unstable or corrupt institutions (possibly due to the easily diverted actual or anticipated revenue stream from extractive activities).

In reality, the biggest reason why the resource curse occurs has been due to the cartelization of resource based industries by politicians and their oligarchic cronies. These have mostly led to a political economic regime that have been anchored on anti-competition regulations which inhibits external and domestic trade.

Also it would be pretty naïve to focus on geography when vastly improving modes of transportation have been reducing the attendant costs.

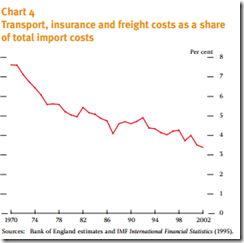

Transport, Insurance and freight costs as share of import cost have been on a secular decline

Mark Dean of the Bank’s International Economic Analysis Division and Maria Sebastia-Barriel of the Bank’s Structural Economic Analysis Division notes in the following study,

One of the most obvious costs to international trade is the cost of transporting goods from one country to another. Transport technologies are continually improving and transport services are also becoming cheaper through increased competition. The goods transported are also changing; some goods are now transported electronically, such as newspapers and magazines, due to improvements in communication technology and others are becoming lighter, for example mobile phones. All this should be reflected in lower transport costs.

In short, falling transaction costs diminishes the impact of geographic vantages.

Finally while I agree that “go forth and multiply” should generally be positive for the global economy; that link may not be obvious.

Most of the nations with the fastest population growth (table from Wikipedia) have hardly been the best economic growth performers. To the contrary most have been economic bottom dwellers.

The fundamental reason is that commercial activities have been severely restrained due to lack of property rights, deficiency in the rule of law, failure to protect contractual rights and limitations to voluntary productive exchanges. Also the political economic environment by many of these economies can be characterized as having been plagued by despotism and socialism. So the positive effects of population growth have been stunted, instead large populations morphs into a social burden.

Next, based on population growth, Indonesia has far outsprinted CNBC’s top 10 (chart from Google Public Data).

Indonesia has likewise been a resource rich country, and as our neighbor has been endowed with geographic advantages. So it would be a curiosity for me that Indonesia has been glossed over by CNBC.

And in terms of debt management, (chart from tradingeconomics.com) Indonesia has thus far bested the Philippines.

While this is both good news for the Philippines and Indonesia, the bottom line is that CNBC’s coverage hardly seems objective. There must be some undeclared biases in their methodology, such that even considering the few specious variables they can be amiss of other major potential contenders for investors, as Indonesia or Thailand.

And finally too much reliance on domestic consumption is unsustainable. This has been the Keynesian mantra embraced by mainstream media.

When excess consumption (government and private) in the Philippines will get manifested in the current account balance, which has still been positive today due to remittance and portfolio flows, the country’s declining debt to gdp trend will reverse and deteriorate.

Current negative real rates policies have already been adding to consumption activities via an artificially stimulated boom from domestic monetary policies by the BSP.

Yet the obverse side of a boom is a bust. And that’s hardly a long term positive growth proposition.

[As a caveat I don’t trust government statistics considering that almost two fifth of the Philippine economy is considered informal or underground or shadow. There are yet many factors not captured by statistical aggregates.]

Finally it should be a reminder that the key to prosperity is through attaining trade competitiveness (chart from the WEForum) via economic freedom or a deepening of the market economy or capitalism. The most competitive nations have almost reflected on the same standings as with the most prosperous nations.

To quote the great Ludwig von Mises

Capitalism is essentially a system of mass production for the satisfaction of the needs of the masses. It pours a horn of plenty upon the common man. It has raised the average standard of living to a height never dreamed of in earlier ages. It has made accessible to millions of people enjoyments which a few generations ago were only within the reach of a small elite.

Apparently, that’s not in the equation of CNBC. When reality is dealt with a blackout occurs.