Life is not about self-satisfaction but the satisfaction of a sense of duty. It is all or nothing.--Nassim Nicolas Taleb

The Reality Check

Except for the US, this week had been a gory one for global stock markets.

The Philippine benchmark the Phisix nosedived by 4.56%. Such loss was the second biggest in Asia, after Japan’s Nikkei. Except for Vietnam, Pakistan and Bangladesh, Asian markets hemorrhaged.

In two weeks, the Phisix surrendered 7.96%. From the highest weekly close during May 17th at 7,279.87, year-to-date gains crumbled from 25.2%, nearly a month back, to just 15.3%.

In almost a snap of finger, confidence evaporated. What seemed as the impregnable and infallible trade has been exposed, in just two weeks, as vulnerable and fragile.

Who would have thought that the conventional wisdom of the “rising star of Asia”, “no property bubble”, or “stunning growth” could produce such a bloody outcome?

What used to be mainstream heresy now represents as a reality check.

Just a few months back, mainstream experts pontificated that the Philippine stock markets have become more resilient from external events. They implied of “decoupling”. These experts cited many reasons such as the alleged low debt levels, huge foreign currency reserves or robust statistical economic growth among many others, mostly cherry picking of data sets.

In what seems as a turnaround, the same experts now attributes today’s market weakness to “global” factors. Such implied admission uncovers the myth of decoupling as consequence to the current meltdown.

Imagine today’s meltdown comes with no debt crisis yet. How much more if a debt crisis becomes a fact?

The susceptibility to exogenous dynamics is just one factor. The more important one is the massive buildup of internal imbalances as a result of quasi permanent boom monetary and fiscal policies. In short, domestic bubbles.

Should the onslaught of the global bond market vigilantes intensify, such imbalances will unravel. This would represent the “periphery-to-the-core” syndrome of the bubble cycle.

Yet most of mainstream experts appear to be in denial. They say that this episode is temporary, represents shopping for bargains and is tradeable.

They could be right. But if they are wrong, yield chasing could metastasize into concerns over return OF capital. Denials will morph into depression.

The context of “tradeablity” depends on two things: market timing, or in specific, the chance of catching a bottom and of the degree of rally.

These are factors nobody can predict with consistent accuracy. Not charts, not statistics. These will largely depend on lady luck.

If bull markets can have extended upside actions, panics extrapolate to a mirror image. This means that if markets continue to fall then what is seen as “bargain hunting” may mutate into “catching of falling knives”.

Two examples: Anyone who tried to bargain hunt the mining sector (left window) from the early part of this year would have been thoroughly bludgeoned.

On the other hand, in 2007 the initial selloff on the Phisix produced a tradeable bull trap: Those who bought during the August bottom and sold at the peak of October would have ideally profited from such ideal lady luck guided trade. But for those who bought into the late “false positive” rally, they would have all lost significant amount of money, unless they cut their position.

Let me be clear: For now, I am not saying that the bear market is here. What I am saying is that unless the upheavals in global bond markets stabilize, there is a huge risk of market shock that may push risk assets into bear markets.

Bottom line: Current markets seem as in crossroads; if political actions will be able to soothe the mercurial bond markets, then current conditions represents an interim bottom.

If not, or if the conditions of the bond markets deteriorates further, then the imminence of a bear market on risk assets.

This represents an “if, then” conditionality and not a linear based prediction.

The Return of Bond Vigilantes: “All These Trades Start To Fail Massively”

The above chart represents the changing dynamics of the risk ON-risk OFF environment.

From 2009 until 2011 (chart is abbreviated from 2010), the risk ON landscape produced a synchronized bull market in every asset class (blue arrows), particularly, the bond market (UST-US 10 year treasury price), the US stock markets (as measured by the SPX or the S&P 500), gold-commodities (Gold) and emerging market equities (MSCI Emerging markets- MSEMF). In other words, the 2009-2011 bull markets exhibited convergence and tight correlations.

But such relationship began to diverge in mid-2011 (green arrows). Emerging markets took the initial hit; then this spread to the gold-commodities market and, now to the bond markets.

This leaves the US equity markets as the only major asset class remaining on the upside as global stock markets have recently been slammed. [Amidst today’s selloffs are booming frontier markets]

US 10 year Treasury Prices appears to have topped exactly the same period last year and has been in a constant decline. Bond prices exhibit opposite relations to the yield[1].

The US Federal Reserve (FED) announced of the expanded unlimited QE 3.0 in September of 2012[2] the objective of which has been to “put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.”

Ironically, the FED’s QE program appears to be producing the opposite effect: an upward pressure on longer-term interest rates!

As of Friday’s close, US 10 year bonds are at critical support level or that yields are at crucial resistance level. A breakout of such thresholds will likely intensify the pace of the interest rate increases.

In contradiction to mainstream media’s post hoc narratives that the FED has been spooking the US Treasury markets, chart actions shows of a reverse causation: Rising interest rates have been compelling FED officials to make chatters about “tapering”. Or rising rates have prompted FED officials to realign their views with the market actions in order to maintain their so-called credibility.

The failed QE policies appear as being ventilated on the bond markets.

The returns based Dow Jones Corporate Bonds Index[3] (DJCBP) has recently collapsed as yields have significantly risen.

Even as the US stock markets have been performing strongly, REIT stocks (real estate investment trusts) represented by the Dow Jones US Mortgage REITs Index has also been plunging[4].

Meanwhile increasing rates has spilled over to the US housing seen via the Mortgage Backed Securities of government sponsored enterprises such as Fannie Mae[5] (FNMAM).

Media has been awash with the adverse ramifications of the rioting bond markets. High yields funds has posted the biggest record outflows[6], US credit default swaps rises to a two month high along with deepening losses from junk-bond exchange-traded funds[7] and carry trades endures from deepening losses.

This is noteworthy quote from the Economic Times[8] depicts of the aura of the current milieu

"Carry works as long as things don't change, and what really changed in our mind a few weeks ago was the message from the Fed," Rajiv Setia, the head of US rates research at Barclays in New York, said in a May 30 phone interview. "Once you start worrying about hikes, all these trades start to fail massively."

An improvement in the growth outlook induces confidence and henceforth should reflect on improvements on credit standing and credit quality.

But as the chart above shows[9], rising yields and increasing prices of credit default swaps[10] (or insurance premium on debt) have been indicative instead of market concerns over credit quality, or simply put, growing default risks.

Crashing global stock and bond markets, aside from sluggish commodity markets amidst rising interest rates demonstrates that bearish forces has been at margins spreading and outflanking the bulls.

Such likewise suggest of monetary tightening which has been seen through increasing signs of liquidations and deleveraging mainly on the credit markets.

If unlimited QE 3.0 has been putting pressure on interest rates, more QE will likely add to such pressure, and less QE also compounds on the interest rate risks woes.

The FED’s QE, like Abenomics, seems in a trap, where they are in a “damned if you do and damned if you don’t” predicament.

The very important difference between today’s bubble conditions from the US Lehman bubble days is that in the recent past, the bond markets specifically government bonds benefited from the bubble crash. Thus, governments from crisis stricken nations substantially channelled the rescue of financial institutions and of the political economy via the bond markets, thus the ballooning of government bonds[11] (upper window).

Today, the likely epicenter for a black swan event will be on government bonds first, and also on financial companies[12] exposed to government bonds as well as to asset bubbles.

This also translates to increasing risks of a bond bubble crash or a debt crisis.

This also signifies as a backlash or the unintended consequences from previous government “bailout” policies.

These factors are hardly bullish for stocks.

As a side note, asset bubbles and statistical improvements in the US hardly suggest of a “goldilocks economy”[13], not too hot or not too cold economy which US media tries to sell.

Instead they signify as the “periphery-to-the-core dynamics” of bubble cycles and the Wile E. Coyote syndrome: inflating asset bubbles on increased leverage amidst rising interest rates—such lethal mix are ingredients for a financial “all these trades start to fail massively” accident.

Foreign Money: the PSE’s 800 Pound Gorilla

I read one so-called expert say that last week’s bloodbath had some signs of what is known as a “sudden stop”.

Sudden stops[14] which represent a slowdown or reversal of private capital flows into emerging market economies usually occur to nations suffering from large current account deficits. Sudden stops are in truth symptoms of the unwinding of internal emerging market bubbles.

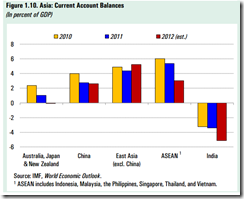

But this hasn’t been the reality with regards to the latest ASEAN selloff yet. While trade deficits have indeed been swelling, ASEAN’s current account balance[15] remains a surplus, albeit in a decline.

In today’s tightly connected global financial markets, contagions can occur even without a bubble bust. The Philippines Phisix suffered a collapse in 2007-8 even when the economy continued to post positive growth, and corporate earnings were just off the record highs[16]. In short, a parallel universe or a huge disconnect emerged between actions in the financial markets and real events.

Yet such developments are hardly accepted by the mainstream intelligentsia who continues to peddle unrealistic conventional methodologies to the unwitting and gullible public.

If bubbles in ASEAN’s real economy continue to inflate, which will get reflected on trade and current account balance, then eventually a “sudden stop” may become a reality.

Last week’s meltdown has basically been foreign driven. Emerging market bond markets and stock markets registered substantial outflows[17] and so with Asia ex-Japan Equity Funds, which according to Livemint[18], were triggered by a further dip in sentiment towards China.

The Philippine Stock Exchange posted a net weekly selling of Php 8.43 billion (US$ 200.65 million) the largest since October 2012.

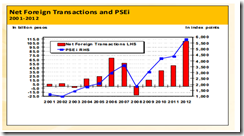

It is important to point out the biggest driver of the latest rally in the Philippine financial markets has been foreign money.

Foreign investors according to the BSP[19] were net buyers of P110.0 billion worth of stocks in 2012, more than double the P50.0 billion net purchases recorded in 2011.

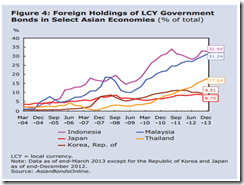

And foreign money has also underpinned the yield chasing rally of ASEAN’s local currency (LCY) denominated government bonds[20].

I found no updated data for the Philippines but I will apply deductive logic instead. Considering the general trend exhibiting significant increases of foreign money on our neighbors’ bond markets plus the recent credit upgrades, these factors should imply at least a similar pace of foreign money placements on Peso denominated bonds.

Yet if bond vigilantes continue to wreak havoc on the financial markets, then current inflows to bond and stock markets may reverse, as this week has shown.

We understand that an estimated 83% of the market cap held by the politically privileged economic elites.

If foreign money turns sour on emerging markets including the Philippines, it seems wishful thinking to be bullish on the Phisix in the knowledge of the disproportionate or lopsided balance in favor of foreign investors (15-16%) vis-à-vis local participants (about 1%).

Should a significant number of foreigners head for the exit doors, similar to 2008 as shown in the previous BSP chart, such would be enough to push the Phisix into a deep bear market.

We cannot expect local investors to absorb the massive wave of foreign exodus for mainly the same reasons as the low penetration level of household (estimated at 21 out of 100) access to bank accounts, the informal system can hardly migrate to the formal system due to regulatory obstacles such as “Anti Money Laundering Act”, and of the inadequate understanding of finances.

Besides, even those with access to the banking system appear to be risk averse, they are most likely invested in government papers.

Sovereign papers (bills and bonds) accounts for 87% of the Php 4 trillion (US $99 billion) Philippine Peso bond markets, according to the ADB.

But again if bond vigilantes persist to unsettle financial markets, even these sovereign paper holders in the local banking system will endure losses.

And this also will apply to the government. The Philippine government has $40.3 billion of US treasury holdings as of March 2013 according US treasury[21]. This accounts for 42% of the BSP’s total assets[22] or about half 49.6% of the BSP’s Gross International Reserve, as of November 2012. A bear market in US treasuries would shrink the vaunted GIR, as well as, impose losses on the BSP.

It would take the resources of the entrenched families of economic elite to help cushion any decline.

Again this is an “if then” proposition.

The Myth of the Yen Targeting Redux

The mainstream has been fixated with the yen rather than the JGBs from which the Bank of Japan’s policies has been directed to.

Some have come to mistakenly believe that the BoJ targets the yen. This is arrant nonsense. Look at the chart of Japan’s Nikkei and the USD-Yen exchange rate[23]. Do you think that the BoJ designed both the boom and the latest collapse of the Nikkei and the USD-yen?

Last Friday, the Nikkei has touched or encroached on the 20% threshold levels which demarcates of a bear market.

While I would say that previous boom of the Nikkei and the weakening of the yen has been a desired outcome by political authorities, they are coincidental. The ongoing reversal hardly represents a policy agenda.

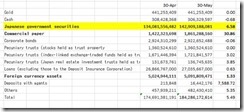

One of the supposed three arrows of Abenomics is the doubling of monetary base via the BoJ’s asset purchasing program. And since the announcement last April[24], the BoJ directly bought into JGBs (6.58%) and commercial papers (30.86%) and a scanty 1.33% of foreign currency assets as of May 31.

It is important to point out that JGBs account for 77.55% of BoJ’s balance sheets, while commercial paper and foreign currency assets represent 1% and 2.76% share respectively. So a 6.58% increase is substantial for 77% of BoJ’s assets.

Notice that the JGBs have traded rangebound from a high of nearly 1% to a low of .8% (left window).

The BoJ appears to have set an implicit target at .9% and thus the range which comes at the cost of a boom-bust cycle.

Since the announcement of the boldest experiment in modern central banking history, the BoJ’s JGB purchases allowed JGB sellers to use the proceeds to bid up on the asset markets. Along with the explicit inflation target of 2% which provided a boost to inflation expectations, direct interventions increased the monetary base from which the yen responded with a corollary sharp selloff.

The Nikkei and yen became tightly correlated arising from the feedback loop from such dynamics. Unfortunately the Nikkei punters came to realize that this was not sustainable. Ben Bernanke’s tapering talk provided the trigger for the tipping point.

Since, the yen has firmed along with a collapsing Nikkei.

Again boom bust cycles have not been the desired outcome but represents as the unintended consequence from aggressive inflationist policies.

Common sense or basic logic tells us that given the immense interest rate sensitivity from the gargantuan nearly ¥ 1 quadrillion of JGBs the BoJ will prioritize targeting JGBs rather than the yen.

Japan has nearly 250% debt to gdp, and as I pointed out last week[25],

The Japanese government’s tax revenues have been estimated by the Ministry of Finance at ¥ 43.1 trillion for 2013. National debt service accounts for ¥ 22.241 trillion which accounts for 24% of the general account budget or 51.4% of tax and stamp revenues. This may have been computed using perhaps less than 1%, if based on the yields of 10 year bonds. Thus a spike of interest rates to 2% will most likely wipe out the Japanese government’s ability and capacity to pay her obligations.

In targeting the yen, this would risks setting loose the bond vigilantes that would devastate on the JGB markets and bring about immediately a debt crisis.

Yen targeting will be like Godzilla running amuck and razing Tokyo.

Why would the Japanese government target the yen when merchandise trade as % gdp[26] accounts for only 28.59% (left window) in 2011 while exports constitutes[27] just 15.2% of gdp (right window) over the same period?

Such notion that the government will risk a debt crisis in order to pump up exports reeks of rank foolishness and is devoid of common sense.

Nonetheless crashing Japanese stock market has prompted Japan’s PM Shinzo Abe to use political suasion to convince their largest public pension fund, Government Pension Investment Fund (GPIF), to invest in risk assets as I recently noted. The GPIF has announced that they will comply by selling a fraction of JGBs and shifting 1% to domestic stocks and 3% a piece to foreign stocks and bonds. This announcement lifted the Nikkei from bear market territory to close with marginal losses.

Such a shift may provide a temporary boost or relief to Japan’s oversold stock markets and some of the world’s stock and bond markets which the GPIF will acquire.

But then consequences over the clashing goals of stoking price inflation and of low interest rates remains as the proverbial sword of Damocles which hangs over the head of Japan’s financial markets, and of the potential contagion risks particularly to Asia.

While JGBs appears to have stabilized at the costs of a volatility surge in the Nikkei and the yen, Japan’s credit default swap has been revealing of increasing stress via rising credit default swaps[28]. The Japanese government appears to be fighting the mythical hydra, where cutting of one of the monster’s many head would grow two more.

Finally the huge rally in Wall Street will likely provide a relief rally in the Nikkei and from the battered world markets. However, rising US markets and falling bond markets will eventually prove incompatible.

The Nikkei is expected to open strong as Nikkei futures suggest of a ‘gap up’ gain of 2.5%. Yet given the fantastic intraday swings during the past week, the question is will this hold?

Inflationistas are hoping that George Soros’ repositioning on Japan’s stock markets[29] would provide support to their cause.

In my view, if interest rates as expressed via the bond markets continue to rise across the world, any relief rally would be short-lived.

Everything now seems to depend on whether bond vigilantes will remain on a blitzkrieg or will be contained by forthcoming political actions.

Since we are at crossroads, where risks are extraordinarily high, do trade with extreme caution.

[1] Investopedia.com Advanced Bond Concepts: Yield and Bond Price

[2] CNN Money Federal Reserve launches QE3 September 13, 2012

[3] S&P Dow Jones Indices Dow Jones Equal Weight U.S. Issued Corporate Bond Index The Dow Jones Equal Weight U.S. Issued Corporate Bond Index is an equally weighted basket of 96 recently issued investment-grade corporate bonds with laddered maturities. The index intends to measure the return of readily tradable, high-grade U.S. corporate bonds. It is priced daily.

[4] S&P Dow Jones Indices Dow Jones U.S. Mortgage REITs Index The proprietary classification system described at www.djindexes.com defines the Mortgage REITs Subsector as real estate investment trusts or corporations (REITs) or listed property trusts (LPTs) that are directly involved in lending money to real estate owner

[5] Wikipedia.org Fannie Mae

[6] Bloomberg.com High-Yield Funds Post Record $4.8 Billion Outflow, BofA Says June 8, 2013

[7] Bloomberg.com Credit Swaps in U.S. Rise as Investors Search for Stimulus Clues June 7, 2013

[8] The Economic Times Carry traders lose on Federal Reserve’s talk of tapering QE June 5, 2013

[9] Zero Hedge It's Not Growth 'Hopes' That Has Backed Up Rates June 4, 2013

[10] Investopedia.com Credit Default Swap - CDS

[11] BBC News Is UK government debt really that high? December 22, 2009

[12] Branimir Gruić Philip Wooldridge Enhancements to the BIS debt securities statistics Bank of International Settlements December 2012

[13] Investopedia.com Goldilocks Economy

[14] Wikipedia.org Sudden Stop

[16] See Dealing With Financial Market Information February 27, 2011

[17] Reuters.com Outflows from bond funds hit record in latest week -EPFR June 7, 2013

[18] Livemint,com Emerging markets see highest fund outflow since 2011 December quarter June 8, 2013

[19] Bangko Sentral ng Pilipinas 2012 Annual Report

[20] ADB, Emerging East Asian Local Currency Bond Markets: A Regional Update Asian Bonds Online June 2013

[21] US Treasury MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES

[22] Bangko Sentral ng Pilipinas Economic and Financial Statistics

[23] Danske Bank Europe delivers the good news Weekly Focus, June 7, 2013

[25] See Abenomics: Will Japan Face a Debt Crisis Soon? June 3, 2013

[26] World Bank Merchandise trade as % of gdp Google public data

[27] World Bank Exports of goods and services (% of GDP)

[28] Tokyo Stock Exchange Credit Risk (CDS Indices)

[29] CNBC.com Investors Dump Japan, but Soros May Be Buying Again June 7, 2013