Our results are consistent with macroprudential policies having a causal impact on capital flows and domestic credit, but the confounding effect of the endogeneity of the policies themselves is an issue that we should bear in mind in interpreting our results. The introduction of macroprudential policies does not happen in a vacuum. They often reflect the external environment and the perception that surges in bank or bond capital flows may lead to destabilising capital outflows in any subsequent reversal of such flows. To the extent that new macroprudential policies happen only after a period of discussion within the government, central bank and other public authorities (such as financial regulators), the introduction of such policies often coincides with the late stages of the boom. To the extent that the boom subsides under its own weight, the introduction of the macroprudential policy and the subsequent slowdown of capital flows and credit growth would be a coincidence, not a causal effect. Valentina Bruno, Ilhyock Shim and Hyun Song Shin Comparative Assessment of Macroprudential Policies June 2, 2015 Bank for International Settlements

In this Issue:

Phisix 7,600: China’s Stock Market Crash; Crashing Casino Stocks Influence Changes in Headlines and Opinions, PSE Revenues Expose Smaller 1Q GDP!

-HOW China’s Stock Market Crash Can Trigger Global Financial Crisis 2.0

-New Trading System, New Breakfast Club Pump; ADB Warns of Liquidity Crunch

-Magic Wand Public Work Economics Leads to Infra-Bubble/Time Bombs

-Philippine Casino Industry: Price Losses Influences Headline Numbers and Opinions

-PSE Consolidated Revenues Reveal 1Q GDP Grew by Only About 1%!

-April Imports Collapse (Third in Four Months); Wholesale Price DEFLATION in April

Phisix 7,600: China’s Stock Market Crash; Crashing Casino Stocks Influence Changes in Headlines and Opinions, PSE Revenues Expose Smaller 1Q GDP!

HOW China’s Stock Market Crash Can Trigger Global Financial Crisis 2.0

I open this week’s outlook with Friday’s stock market crash in China.

The reason for this is that the risks of global financial crisis from a full pledged stock market collapse seem to have significantly been underpriced by the public. Everyone seems so complacent.

Chinese stocks plunged more than 7% last Friday on a sharply volatile trading week that erased marginal gains acquired early in the week.

This week’s nose dive compounds on last week’s more than 13% collapse that has brought the Chinese stocks to the gates of the bears.

The Shanghai Composite index ended the week bloodied by 6.37% and by 19.69% over two weeks. Year to date, the same benchmark remains substantially up at 29.62%. Yet other benchmarks fell more than 20% in two weeks.

First a condensed background

Mostly through easing policies, the Chinese government has deliberately inflated a stock market boom in the hope to buy time and to forestall her credit financed property bubble from imploding.

Unfortunately similar to the property bubble, the giddy near-vertical pump of Chinese stocks, mostly by retail punters, had also been pillared on DEBT.

I previously noted how margin debt reached a record $419 billion the other week, as well as disguised lending by banks, brokerages and trust companies for stock market speculation.[1]

The stock market boom as I explained yesterday has inflated balance sheets of debt laden corporations, has served as an alternative channel for firms to access public's funds via equity offerings, has provided short term profits and "confidence" to the speculative public, which bear markets threaten to reverse.[2]

Friday’s broad based meltdown may have been prompted mainly by margin calls.

The Nikkei Asian Review noted that “Slightly more than 2,000 stocks went limit-down, more than 70% of the roughly 2,860 listed on the two mainland China bourses.”[3]

And since “margin trades must be settled within six months in China, and investors who took out loans are required to return the funds regardless of how the market is performing.”

Although “the China Securities Regulatory Commission plans to allow settlement carryovers down the road, but this does not help investors who are facing repayment deadlines now and likely are unloading their holdings.”

Moreover, “Regulators moved to curb lending by brokerages to investors following rumors that an investor committed suicide after losses on margin trades involving train manufacturer CRRC. A subsequent report said margin trades were not the cause of the suicide, and the truth is yet to be known. However, this incident changed the mood in the market”

Thus with margin trades accounting for “one-quarter of all trade value in mid-April” this week’s carnage led to decline of margin trades “to the low 10% range at the end of last week.”

Last January, I warned on this[4]

Given the huge growth of stock market credit or the record levels of margin debt, losses from today’s crash will likely lead to margin calls which may prompt for even more selling. And absent access to new credit many heavily levered firms will see their balance sheets impaired from sustained stock market losses.But if regulators are here just to put a brake, or in effect, a façade at it, then today crash could just be part of the script to a manipulated boom.At the end of the day, any credit inspired stock market ramp, is by its very nature, unsustainable.

Of course there may be other factors involved.

The price pyramiding feedback loop requires of new recruits and of the recycling of the proceeds by sellers into the bidding process. Given the stratospheric price levels, more money is required to bid up prices from existing holders. Existing sellers must also be persuaded that prices will continue to rise for them to plough back proceeds into the frenzied bidding process. Thus the apparent shortage of new recruits and increasing doubts of sustainability has apparently provoked a chain of selling.

Additionally, the winning record streak has only induced a wave of supply via IPOs into the market: In the first half of the year, the Shanghai stock market led the world in initial public offerings: 78 companies issued shares in Shanghai, raising $16.6 billion, according to a study by the accounting firm EY. Hong Kong was No. 2 with 31 deals that raised $16 billion. Shenzhen was No. 5 with 112 deals that raised $7 billion.[5] This extrapolates to the law of demand and supply in motion but at a very fast clip.

Valuations have been an issue too. But extended valuations may persist until the underlying beliefs and or the sources of funding dynamic radically changes. Remember Chinese stocks have soared in the face of a faltering economy! In other words, stocks have hardly been about valuations but about responses to economic and financial policies.

As a matter of valuations at the end of May, Chinese benchmarks the Shanghai and Shenzhen sported market caps of $5.9 and $4.4 trillion respectively for a total of $10.3 trillion! Then, both Chinese equity bellwethers exceeded the Nasdaq at $7.4 trillion but still remained halfway from the NYSE’s $19.7 trillion. Meanwhile the Shanghai index passed Japan’s Topix at $ 5 Trillion over the same period.

As a side note, I would like to add that suicides appear to be typical responses to stock market crash-economic depressions. British Medical Journal estimated that in 2009, 5,000 people took their own lives in 54 countries which were related to the financial crisis. Some 23,000 people have been estimated to have committed suicide a year following the stock market crash of 1929.

Yet the focus of Friday’s selling activities has been margin trades alone. Considering that Chinese stocks have been fueled by credit, not only from margin trades, a sustained fall will mean more souring of stock market related debts that may spillover to the real economy which has already been hobbled by overleverage.

As of the 2Q 2014, China’s debt yoke has been estimated at $28 trillion which accounted for 282% of GDP, according to McKinsey Global Institute. And the list of bond defaults as shown above from SocGen (via Zero Hedge) will only swell.

Furthermore, China’s banking assets as of May 2015 was at 180.37 trillion (USD$29.04 trillion), according to China Knowledge. This has been almost twice the US banking system’s $ 15.4 trillion as of June 26, 2015 (Federal Reserve of St. Louis)!

On the other hand, China’s forex reserves which was at $3.73 trillion in March 2015 down from the high of $3.99 trillion in June 2014 represents only 12.8% of banking assets or 13.2% of overall debt. This means reserves will not be enough to support any bank balance sheet contraction of more than 13%.

The debt dilemma above denotes of largely of domestic burden. However, the current debt onus will weigh on their economy which will be transmitted to China’s trading and financial partners.

For instance, Philippine exports to China crashed 17.9% in April 2015 year on year. While some may impute this to the South China Sea controversy, the Gavekal team noted that trade data of South Korea, Hong Kong and Thailand mirrors China’s fast slipping Industrial output. Taiwan’s declining industrial output also resonates with China’s. Thus, a stock market crash would only upend the fleeting confidence recently provided by rampaging stock market bulls. The crash will not only bring to the forefront domestic debt troubles but also drag on economic activities.

And the linkages will also include China’s foreign debts.

The Bank for International Settlements[6] reckons that “Outstanding cross-border claims on Chinese residents totalled $1 trillion at end-December 2014, making China the eighth largest borrower worldwide”. Yet these claims are “primarily driven by short-term claims.”

In short, magnified debt woes from a stock market crash will likely ripple across the oceans and impact international creditors.

And given that credit in US dollars to non-bank borrowers outside the United States totaled $9.2 trillion as of end-September 2014[7], a major credit crunch in China could just mean the evaporation of access to US dollar credits by OTHER overseas borrowers as creditors may just refuse to rollever debts. In short, the impact will NOT be limited to China but will slam the world.

While currency swaps may alleviate part of the liquidity problem, this will unlikely resolve balance sheet impairments and subsequent market responses on these.

Thus the Chinese government will likely move mountains to prevent a bear market from taking command. The Chinese government through her central bank, the People’s Bank of China (PBoC) may take a page out of Bank of Japan’s Abenomics to conduct direct (or indirect) stock market interventions via a QE. The Chinese government may also use reserves from State Administration of Foreign Exchange (SAFE) to intervene, as well as, order state owned enterprises to support stocks (whether in stealth or as mandate)

While such actions may help alleviate current conditions, given the complexities of the Chinese and the interrelationship with foreign markets, the debt burden, such interventions are likely to have short term effects. And may result to unintended consequences like a weak currency or capital flight or etc…

Unfolding developments in China undergirds heightened risks of a global financial crisis.

Well as I write (Saturday), the Chinese government just panicked and eased!

According to the Wall Street Journal, the PBoC announced a 25 basis point cut, its benchmark lending rates by 25 basis points to 4.85 percent on Saturday, the fourth reduction since November. The central bank also reduced one-year benchmark deposit rates by 25 basis points to 2 percent, as well as lowered the reserve requirement by half a percentage point for banks with sizable lending to farmers and small businesses.

But here’s the zinger: The central bank has rarely cut both interest rates and the reserve-requirement ratio on the same day. The last time it did so was in October 2008, the height of the global financial crisis[8].

Remember that this has been the fourth rate cut since November, and the previous rate cuts have done nothing but add to the imbalances to the system. So while this may temporarily provide support on stocks, it remains to be seen how far this policy patchwork will cover surfacing malinvestments.

In addition, such rate cuts cannot be compared to Former Fed chair Alan Greenspan's response to stock market crash of October 1987. Because conditions by the US then and conditions by China today have been a world apart, e.g. there was no US property bubble in 1987 as with China today.

New Trading System, New Breakfast Club Pump; ADB Warns of Liquidity Crunch

I’m pretty much impressed by the ingenuity of domestic stock market operators.

Last week, these operators unveiled a new modus. Aside from the previous panic buying day, afternoon delight and marking the close, this week they introduced the ‘breakfast club pump’.

This breakfast club pump coincides with the debut of the PSEtrade XTS trading system which came online last Monday. In the past panic buying day pumps, which embodies an all-day session activity, such activities begins at least 30 minutes to 1 hour after the opening bell.

The breakfast club pump simply means a massive price push right from the opening bell. It’s the reverse of marking the close. It’s an opening gap up! The breakfast club pump has been intended to generate momentum.

Stock market operators tried this new method in four sessions last week. Twice it failed, twice it worked.

Last Friday, June 26th it almost failed. But like the 22nd and 24th, they had to compliment this with afternoon pumps and marking the closes to secure the day’s objectives. The 24th signified the near perfect execution where the benchmark surged by 1.22% and where 36% of the day results came from marking the close.

And in four of five sessions, marking the closes delivered most, if not the meat, of the returns for the day.

Philippine stocks cannot operate by price discovery, so it has to be supported and guided by flagrant pumps by stock market operators.

Curiously despite all such brazen manipulations, the benchmark edged higher by only .27% for the week!

Given the intensely battered broad markets have been from sellers, I expected at least some reprieve. Reprieve was partially attained this week. Winners and losers ended the week all square or at a draw with 418 each. The distribution from Monday to Friday as follows: 97-67 in favor of advancers, 70-92 in favor of decliners, 97-71 gainers, 70-97 losers, and on Friday’s PSEi .53% advance, 84-91 for the losers.

In other words, there has hardly been any abatement on the broad market selloffs in spite of the record 7,600.

Additionally even in the PSEi basket only 13 advanced for the week against 17 decliners.

Meanwhile he Gavekal team observed that based on MSCI World Index, only 15% of issues have been in bear markets. By region, MSCI Europe “have the fewest stocks in a bear market at just 11%. In MSCI Pacific, 14% of stocks are in a bear market and in MSCI North America, nearly one out of five stocks are in a bear market.”[9]

For the Phisix, a third of index issues have been in bear markets. For the entire PSE, about half of issues are in bear markets. Those weekly dominance of losing issues reinforces the broad based grip of bear markets.

But thanks to all such managed pumps, the Phisix still trades on record highs.

Nonetheless the MSCI indices reveals of how anomalous current conditions have been for Philippine equities

Additionally, the average peso volume (weekly) traded at the LOWEST level for the year and the LOWEST level since October 24, 2014. The Phisix has been creeping higher on collapsing peso volume!!

And given their relentless support at higher price levels, stock market operators might run out of ammo once bears reemerge from their hibernation.

And without a significant improvement in the bids through peso volume at current price levels, anytime bearish forces reappears they will easily roll past the psychological support levels of 7,400 and 7,350 with hardly any resistance.

And because of this week’s mixed broadbased performance, other sentiment gauges such as the average daily trade and the average total issues traded exhibits remarkable thinning of liquidity.

And speaking of shrinking liquidity, the Asian Development Bank jumps into the picture.

The Asian Development Bank in their Asian Bond Monitor for June 2015 press release warned of volatility risks from global concerns such as the “unresolved Greek debt crisis” and from “possibility of an interest rate hike in the United States”[10].

The ADB further observed that “Low liquidity in the region’s bond markets could worsen” the impact from fund outflows. In addition, “global risks have the potential to put further strain on markets that lack liquidity” and that “higher US interest rates could further strengthen the dollar, hurting issuers of foreign currency bonds and increasing debt servicing costs in local currency terms on existing US dollar bonds”.

Based on ADB’s compilation of the yield curve from the ASEAN-4, only Indonesia (upper right window) seems to correspond to the risks of rising interest rates from the US. Indonesia’s yield slope has hardly changed even as yields rose across the curve.

Paradoxically for the Philippines, the ADB points notes that “Between 2 March and 15 May, yields for most tenors of Philippine local currency (LCY ) bonds rose on speculation over the timing of a possible rate hike by the United States (US) Federal Reserve”.[11] Yet as one will note from the above (upper left window), the supposed increases in tenors have been marginal for most, EXCEPT for the short end.

In other words, the risks of possible rate hike by the United States haven’t been much of a factor for the Philippines or for Malaysia and for Thailand, unlike in Indonesia.

Instead what has STOOD OUT for the Philippines has been the sharp FLATENNING of the yield curve which has not been the same with any of our neighbors.

The flattening of the yield curve implies that liquidity has been shrinking which should likewise be manifested on credit activities*. And since credit activities have been the centerpiece for G-R-O-W-T-H, continued liquidity contraction indicates that G-R-O-W-T-H rates will also decline, if not contract in the future.

*BSP report for May credit will be issued next week.

So the low volume trade in stocks, as well as, the growing slack in market internal indicators plus bank credit activities dovetails with the flattening dynamics which as I explain below has been complimented by 1Q performance of listed issues.

Meanwhile the BSP maintained rates for all policy tools this week: overnight borrowing or reverse repurchase (RRP) facility, the overnight lending or repurchase (RP) facility and interest rates on term RRPs, RPs and special deposit accounts (SDA). The reserve requirement ratios were likewise left unchanged.

Intriguingly, the cat is out of the bag as an official of the BSP admitted[12] (bold mine): The Philippine central bank said on Thursday it is cutting its inflation estimates for this year and next mainly on slower economic growth and steady food supply. The central bank now sees average 2015 inflation at 2.1 per cent against a previous estimate of 2.3 per cent, Francisco Dakila, managing director of the central bank's Monetary Policy Sub-Sector, told reporters. Average inflation is forecast at 2.5 per cent for 2016, versus the previous 2.6 per cent.

Well how about that…slower economic growth for 2015 and 2016? Has this been a media misquote? Or has this been part of the publicity campaign or signaling channel effort to project soft landing?

And curiously too, media has not just been demanding stimulus via government infrastructure spending they seem to have conceived of monetary stimulus tools too. For instance this headline: “Policy rate cut still not out of question”

Magic Wand Public Work Economics Leads to Infra-Bubble/Time Bombs

And for those who believe in magic wand economics in the form of public works-infrastructure spending, learn from India’s recent experience.

In India, since government spending on infrastructure has been mostly funded by loans from mainly public banks, where many of these loans have inflated and soured, thereby impairing bank balance sheets, the Reserve Bank of India warns of a bank based infrastructure time bomb.

Here is a quote from the First Post (bold mine)[13]: There is a clear warning from the Reserve Bank of India (RBI) to the North Block on the build up of stress on the balance sheet of Indian banks emerging from infrastructure loans. The financial stability report (FSR), released on Thursday, offers some critical insights into the depth of this problem. The numbers tell us two things: One, bad loans continue to be the head-ache of public-sector banks largely, much more than private or foreign banks. Second, there is a clear concentration risk developing from loans given to infrastructure companies. Finance minister, Arun Jaitley should be the one worried most about the infra-bubble developing on the books of state-run banks, for the simple reason that these banks, which make up for 70 percent of India’s Rs 95 lakh crore banking industry are at the mercy of the government for capital…The bottomline is that the level of stressed assets from infrastructure and related areas has risen to a level where some of the weak lenders are sinking. As the RBI has warned, project delays are the major reasons why things have worsened to this extent. When projects fail to meet the promised date of commencement of operations (mainly clearance issues), this leads to cost overrun and stress on corporate balance sheet

India’s infrastructure experience somewhat parallels with China except through the details of the implementation of projects.

Chinese infrastructure projects have largely been conducted by local governments whose funding emanates from Local government financing platforms (LGFPs). This infrastructure-real estate (fixed investment) boom has prompted China’s local governments to accumulate debts to about $2.6 trillion based on Chinese government estimates or $3 trillion based on mainstream international estimates. The disturbing degree of debt accrual has impelled the Chinese government to embark on a debt for bond swap which somewhat replicates the ECB’s LTRO. The Chinese government has even doubled down this debt for bond swap from 1 trillion yuan (USD $161 billion) to 2 trillion in mid-June.

So in the real world, contra the media and the establishment’s much favored magic wand economics, public work projects leads not only to inefficiency, wastage, excess capacity, corruption and cronyism, importantly, they lead to “infra-bubbles” as per India’s Finance Minister Jaitley or “infrastructure time bomb” as per the First Post!

In short, public works leads to greater risks of financial instability!

Politics has hardly ever been about the long term, but about instant gratifications and of feel good intentions. And instant gratifications and feel good intentions almost always leads to unintended consequences.

Philippine Casino Industry: Price Losses Influences Headline Numbers and Opinions

Now of course unintended consequences are becoming apparent

Recently I wrote about the reflexive feedback loop between prices (cognitive) and expectation-action (participatory) where prices influence expectations, and consequently, actions and vice versa.

Such reflexive feedback loops signifies a self-reinforcing mechanism which pillars every price trend. The same dynamic sees to it that hardly any trends are carved into the stone to last forever. That’s because this process will lead to the eventual widening of divergences between perceptions and reality—a manifestation of THE inflection point of the incumbent trend into a new trend

Thus for inflection points, the “unrecognized trend” will further evolve into a “self-reinforcing process in the opposite” that highlights such psychological transition.

Applied to the real world or in real time conditions, the symptoms of action-reaction dynamics will be seen as follows: Deterioration of market prices will filter into headline numbers and the other way around—headline numbers will affect prices.

Thus the process of every major trend reversals does NOT just happen in random but rather occurs in time consuming stages.

So in the context of turnaround from bull to bear markets, the unfolding transitory process will be similar to the stages depicted by the Kübler-Ross Grief Cycle: denial, anger, bargaining, depression and acceptance. Or improvised to fit financial markets: From euphoria to anxiety to denial to fear to desperation to panic and finally to capitulation[14].

Such transitory process can be spectacularly seen in the Philippine casino industry.

In April of 2013, I wrote that the Philippine casinos have been a bubble. The race to build casinos incited by easy money policies has made domestic casinos vulnerable to regional, as well as, to local economic developments. I concluded then: At the end of the day, basic economic logic says that all these yield chasing activities (whether the shopping mall, casino, housing and vertical projects) will end badly[15].

It has been futile to convince anyone of the risks presented by the debt financed overcapacity of domestic casino industry, because stocks and headline statistics were booming. The mainstream’s predilection for ticker tape or the recency bias mostly determined the content or essence of their outlook.

Yet the decaying performance of the casinos of Macau and Singapore (or even the US counterparts) had simply been brushed aside or ignored.

With the domestic casinos established positioned to compete with the region for the “Chinese high rollers”, oxymoronically, the establishment forgot all about the fate of “Chinese high rollers”[16].

The mainstream declared that “this time is different!” for domestic casinos.

Well…such delusions were good until it lasted.

Last December, in the realization that Macau’s dilemma was hardly a deviation, foreign investors dumped domestic casino stocks[17]

Yet the establishment denied the selloff as a one-off knee jerk event.

Unfortunately, the selling streak from December only deepened through Friday’s close.

Year to date, fortunes of the big three have regressed, with shares of casino majors deep into the palm of the grizzly bears: Bloomberry -29.19%, Travellers International Hotel Group -35.88% and Melco Crown -58.47%!

Now prices have begun to convert the mainstream’s expectations.

Here are some fantastic comments by ‘experts’ as covered by the Bloomberg[18]:

Says a domestic bank fund manager “The chain reaction from Macau hit everyone…Expectations VIP players will come in large numbers didn’t happen. The stocks have fallen quite significantly but not everyone is rushing back in, and there’s no clear light at the end of the tunnel.”

As I said above, the establishment forgot all about the fate of “Chinese high rollers”. Only when the price action has been committed had they resorted to rationalizing ex-post activities or reasoning from price changes.

And no, Macau’s chain reaction didn’t hit everyone, only the blind.

And yet even more rationalization.

A gaming political authority attributes the Philippine-China spat over South China Seas: Geopolitics “seems to be getting in the way of seeing planeloads of tourists”.

Perhaps. Yet to what degree has Philippine-China tensions influenced the decline in Chinese tourist and high rollers? So this looks more like “after this therefore because of this” narrative of current events

Yet rationalizations are signs of denial.

But apparently denials has still accounted for the dominant psychological force in viewing the industry.

From another bank analyst: “Some investors are overestimating the impact of the China market, and the slump in Philippine gaming stocks is excessive”

Anxiety coated with severe denial!

Yet there appears to be initial signs of fear.

A sell side analyst said: “The first-quarter results raised the question; can there be aggressive growth without the numbers coming from China? The growth in earnings didn’t match the pace most wanted to see. The market isn’t overreacting, there’s genuine uncertainty.”

Now ‘expert’ denials and fears have surfaced in the face of deteriorating headline numbers: Bloomberry fell to a first-quarter loss of 533 million pesos (11.8 million) as costs spiked with the expansion of the Solaire casino, increased marketing expenses and provision for bad debts. Travellers’s profit rose 1.6 percent to 1.74 billion pesos, while Melco Crown Philippines, which opened City of Dreams in December, posted a record 3.09 billion-peso loss.

Yet contra the domestic consensus, a foreign financial outfit downgraded the industry which it expects profits to tumble by 56% in 2016!

Do you notice of the stark differences in the expectations between domestic and foreign experts?

Well domestic contemporaries have been mostly blinded by the endowment effect—people ascribe more value to things merely because they own them—or put differently, because of the home bias—the preference for home assets rather than foreign assets.

Domestic experts have come to believe that nothing can EVER be wrong in the context of the Philippine markets and the economy. So they apparently forgot all about economics. Instead they assumed the role of cheerleaders for inflationary boom.

So with a one-tract mindset, reversals become a source of rabid denials.

Current domestic problems may partly be about the Chinese government’s political persecution of the opposition paraded as ‘anti-corruption drive’. It may also perhaps been about tensions from territorial dispute. But it’s mostly about the Chinese economy.

In addition, Macau’s casinos continue to bleed which strengthens the case that the casino turmoil will have an extended life.

Here’s another thing which no one seems to care about: IF those financial losses from these entities mounts, then losses eventually will parlay into a cash flow squeeze that will lead to contraction of balance sheets. Subsequently, this may evolve into problems associated with debt repayments and to debt access. Finally, the last stage will be a debt crunch.

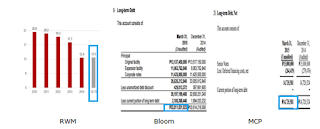

And standing between the prospective deepening of losses by these major casinos are the various creditors which holds debts worth Php 61.25 billion! That’s broken down into RWM’s 1Q15’s Php 13.5 billion (left), Bloom’s Php 33.01 billion (1Q15 17Q middle) and MCP’s Php 14.74 (1Q15 17Q; right).

In short, establishment experts better pray for the swift recovery of the Chinese economy otherwise losses will likely morph into a debt crunch for some of these firms. And the casino credit crunch may transform into a causa promixa for a domestic credit event!

In other words, current events signify the proverbial tip of the iceberg.

And casinos are part of the many symptoms of industry excesses.

Hotels have been mushrooming almost everywhere.

The rampaging monthly bank loan growth of 30%+++ has been a trend since the second half of 2013 through April 2015.

Yet ironically, the NSCB’s 1Q 2015 growth data reveals that the hotel industry has been underperforming. Where has all the money been flowing to? The industry has been generating so much credit relative to output which has signified a prospective sign of brewing debt problems.

And because of the appearance of supply gluts, to compete for market share, hotels have been aggressively slashing prices mostly channeled to as marketing promos through credit cards. Eventually, the cut throat competition will come at the cost of economic viability for many firms

I am sad that eventually some of them (which includes hotel-casinos) will not survive in their current forms which means many will be affected (creditors, employees, suppliers, shareholders)

However, as consumer, I am glad because prices will become even more affordable for me and my family to eventually patronize them.

As one would note, the reflexive mechanism between changes in price and changes in expectations-actions have clearly been at work for Philippine casinos.

Resistance to change have hallmarked the current transition process which means the inflection point from bull to bear markets will yet be a long process.

PSE Consolidated Revenues Reveal 1Q GDP Grew by Only About 1%!

Misperceptions abound.

The Philippine Stock Exchange recently touted the net income growth for publicly listed firms in 1Q 2015 which clocked a 13.9%. This has spurred the officialdom to rationalize that they are “optimistic that listed companies will be able to sustain their solid profit growth throughout 2015. This strong performance by corporate Philippines will remain to be one of the main drivers of stock market growth”[19]

The PSE has not been candid with its assessment and believes headline numbers will be enough to convince the public of G-R-O-W-T-H sustainability.

The PSE provides the numbers:

The 13.9% growth to Php158.28 billion from Php138.96 billion year on year. Most of the “increase was mostly driven by significant profit gains in the property and services sectors.”

Profits of the property Sector soared by 52.4 percent to Php27.42 billion mainly due to “higher real estate sales and leasing income as well as a non-recurring share sale gain for one property firm” (inflated profits from vendor financed sales?)

Profits of the service sectors surged by 27.9 percent to Php25.57 billion, primarily from airline companies and telcos as “the main contributors”

Profits of the finance sector increased by 7.7% mainly from Securities trading (from manipulated pumps perhaps??? Remember the PSEi peaked in April, profits from securities trading could be negative now)

Profits of the Holding Firms advanced 6.5% to Php43.65 billion from “better performances from the business units”

Profits of the mining sector eked higher by 2.9% to Php2.97 billion arising mainly from better prices of precious metals in the global market, higher sales of nickel as well as foreign exchange gains.

Finally profits of the Industrial Sector declined 1.5% to Php30.84 billion supposedly “on lower oil prices and higher operating expenses.”

Given all the supposed auspicious assessment, the PSE didn’t bother to explain why the bear markets in a third of index issues and why the bear markets in the half of the listed issues.

But here are the more important numbers.

Consolidated revenues during the said period “was marginally higher by 1.6 percent to Php1.58 trillion from Php1.55 trillion in the first three months of 2014.”

In addition the share of profits by PSEi firms “accounted for 70.4 percent of the total market net income, with its 30 constituents posting a combined profit of Php111.41 billion in the first quarter of 2015, higher by 9.2 percent from the same period a year ago.”

The above numbers tell us that the profit margins by listed companies account for about 10% of the revenues.

Notice that consolidated revenues for ALL listed firms grew by ONLY 1.6%! Yet the PSE didn’t bother to explain why this has been so.

If GDP represents the monetary value of all goods and services or the output in a country at a given period then consolidated revenues for ALL listed firms should give us a clue of the actual performance of the GDP.

Consolidated revenues signify as market expenditures of goods and services from these listed firms. Since they are reported mostly based on actual activities, then they should more accurately reflect on economic activities than the GDP which merely signifies an estimate. (I understand that some companies have become accounting chefs who master at cooking of the books)

At Php 1.58 trillion, consolidated revenues accounted for 52% share of the statistical GDP based on current prices at Php 3.04 trillion in 1Q 2015!

And with listed firm’s 52% share of the statistical GDP which just grew by ONLY 1.6%, this means unlisted firms delivered a whopping 9.75%[20] growth for the 1Q GDP to grow by 5.5%! Just which part of the unlisted formal sector or firms delivered such a stunning rate of growth rate???!!!

And if we apply the GDP deflator to the consolidated revenue numbers we get a .64% growth! So based on PSE’s data, 1Q GDP was hardly at 5.2% but 1.6% (nominal) or .64% (deflator adjusted growth)! Even if we give the benefit of the doubt where some unlisted firms superbly outperformed, 1Q GDP should have been at 2% at most.

So there must have been a secret sunshine industry out there that has delivered the GDP. Or that 1Q GDP as I suspected was merely a statistical pump.

And here’s more.

With PSEi firms signifying 70.4% share of overall listed income which grew by just 9.2% as against the 13.9% for the entire PSE listed firms, this means some firms outside the PSEi index delivered the kernel of the 25.08% gains!

The PSE specified them in their release, in particular telcos (that’s specifically Globe), airlines (mostly CEBU Pacific and secondarily PAL) and some in the property sector which included non-recurring gains. In other words, the bulk of the 13.9% income growth emanated from select companies and not from the broad markets!

Yet PSE officials make them appear as if they have been broadbased.

Also the underpeformance of the Phisix in the context of income growth reveals of a significant drag by some issues to have limited the gains of the benchmark to just 9.2%. For instance the 52.4% growth by the property sector when applied to the Phisix bigwigs had been moderated by significant decreases somewhere.

Given that the PSE didn’t show any details we are left to wonder how this came about.

The PSE should produce a data set from which the public can see rather than simply make exaggerated claims.

April Imports Collapse (Third in Four Months); Wholesale Price DEFLATION in April

Here is more proof that the Philippine economy has been weaker than what has been broadcasted on the headlines.

April imports practically collapsed.

It’s been the third month in four where imports have been down by 8.5% or more[21]. Nominal imports have plunged to 2012 levels!

Some have defended the import contraction as having benefited capital investments. Yet seen from the nominal dollar perspective, gains from imports on industrial machinery and equipment have been miniscule.

What advanced in April imports have been food & live animals. All the rest posted significant declines.

Importantly, given that many of electronic imports have been used as part of the assembly for higher value components for re-exports, declines in electronic imports have been portentous indicators of future electronic exports. Electronic exports accounts for the largest share of goods exports (see April data).

In short, April’s drop in electronic imports may likely extrapolate to reduced electronic exports over the coming months.

Yet as part of the massive denial, one foreign financial titan warned that “the recent downturn in non-commodity imports bears watching and suggests some slowing in domestic demand.”[22]

Well, the reality has been that domestic demand has been declining for quite sometime now.

Government monitoring of various real economy prices have been pounding the table on this.

That’s unless that prices have no relevance to the market economy. Market prices, which coordinates the balance of demand and supply, for the mainstream, operates in a vacuum!

And this goes to show why hardly any of what media reports about the economy, has really been about the economy but about political cheerleading.

Furthermore I have been validated.

The collapse in Bureau of Custom’s April tax and tariffs collections which was misleadingly blamed on oil prices, got reflected on April Imports.

Here is what I wrote last week[23]: (bold added)

Based on the data from Bureau of Treasury, year on year changes in the Bureau of Customs revenues turned NEGATIVE in THREE of the last five months. On the other hand, December posted a HUGE 85% spike. Yet, April’s significant negative 8.5% data would mean FOUR negatives in the last 6 months. The most likely implication from the substantial decrease in collections data by the government agency must be that Philippine imports continue to underperform in April. Except for February 2015, import growth have been quite sluggish since November 2014If this turns out correct, then again it’s not about oil.Instead, to borrow James Carville’s election slogan for ex-US president Bill Clinton, “It’s the economy stupid”

Again, in groping for an explanation, media blamed anew the collapse of April’s import on oil even if USD based oil prices SURGED in April as discussed last week.

It’s not just a plethora of misperceptions but about rampant misrepresentations too.

And speaking of the prices operating in a vacuum, changes in wholesale prices for April (year on year) posted NEGATIVE growth AGAIN.

Said differently, wholesale prices have been DECREASING since May 2013. And deep price DEFLATION has affected wholesale prices for the past FIVE months.

Why have PRICES been CONTRACTING?

Given the continuing CONTRACTION in imports, as well as, SHRINKAGE in manufacturing, this implies that current price DEFLATION has NOT been about supply side shocks. Instead, weak price pressures have been MANIFESTATIONS of DEEPENING SLACKS on the demand side.

Unfortunately, again hardly anyone from the mainstream can see the economic relationship between prices and trade-production if this HAS NOT been supportive of the BOOM story.

The Aldous Huxley “Facts do not cease to exist because they are ignored” syndrome reverberates!

Yet the deflation in wholesale price data has been broad based. And for those few items which posted gains such as “indices of beverages and tobacco at 8.4 percent; chemicals including animal and vegetable oils and fats, 2.0 percent; and machinery and transport equipment, 2.5 percent. The miscellaneous manufactured articles index retained its March growth of 1.8 percent”[24] –in looking at the import data, the selective price increases could have been from the weak peso aside from partial demand contributions.

Since these products have been available for sale in APRIL but were likely imported in March, then the USD-php’s 1.3% increase in March may have contributed to the April price increases on these few items.

The bottom line is that denials will not do away with reality. Manipulated markets and statistics, as well as, propaganda will eventually be exposed and dealt with by the markets harshly.

[1] see Chinese Stocks Suffers Biggest Weekly Crash since 2009! June 20, 2015

[2] See China Stocks Crash over 7% Friday, Tests Bear Market Levels! June 26, 2015

[3] Nikkei Asian Review 2,000 Chinese stocks go limit-down as margin traders flee June 27, 2015

[4] See Chinese Stocks Crash 7.7% on Margin Trades Crackdown by Authorities January 19, 2015

[5] Portland Herald Q & A: Stocks drop by 7 percent in China June 27, 2015

[6] Bank for International Settlements Highlights of the BIS international statistics BIS Quarterly Review, June 2015 June 8, 2015

[7] Bank for International Settlements Global liquidity indicators March 18, 2015

[8] Wall Street Journal People’s Bank of China Cuts Interest Rates June 27, 2015

[9] Eric Bush More Stocks Than You Might Guess Are In A Correction Gavekal Capital June 26, 2015

[10] See ADB Joins 'Warning' Chorus: Emerging East Asia’s Bond Markets Face Rising Risks June 23, 2015

[11] Asian Development Bank Asian Bond Monitor June 2015 p.61 ADB.org

[12] Business Times Singapore Philippine central bank cuts 2015, 2016 inflation estimates June 25 2015

[13] First Post, RBI financial stability report: An infra-bomb is ticking in state-run banks’ books June 26, 2015

[14] See Record Phisix in Big Jeopardy! BSP 2Q Survey Reveals Bearish Consumers! More Cracks on Fundamental Headlines! June 14, 2015

[15] See The Philippine Casino Bubble April 11, 2013

[16] See Phisix: As Risks Mounts, PANIC BUYING Grips the PSE! September 8, 2014

[17] See Phisix: Tremors Rock Philippine Casino Stocks, Malaysian Financial Markets December 8, 2014

[18] Bloomberg.com House Doesn’t Always Win as Philippine Casino Bet on China Sours June 24, 2015

[19] Philippine Stock Exchange, Corporate profits grow 14% in the first quarter June 25, 2015

[20] [.52 (1.6)+ .48 (9.725)=5.5]

[21] Philippine Statistical Authority External Trade Performance: April 2015 June 25, 2015

[22] Inquirer.net PH imports shrank 12.8% in April June 26, 2014

[23] See Phisix 7,600: Shrinking Market Liquidity and Media’s Demand for More Stimulus! June 21, 2015

[24] Philippine Statistics Authority General Wholesale Price Index (1998=100) : April 2015 June 22, 2015