Economic repression leads to the informal economy. That's because people respond to the incentives brought about, not only by environment, but also from social policies.

In the gold mining sector, increased economic restriction has driven the expansion of smuggling activities. Moreover, unseen to the eyes of the mainstream and politicians, interventionism in the gold mining sector inflates the risk of environmental hazards, corruption, violence and political instability as I earlier pointed out here. This is simply called the law of unintended consequences.

Well, the prolific peripatetic analyst Simon Black of the Sovereign Man echoes my observation on smuggling (bold original)

Like most places, unfortunately, the Philippine government is idiotic and continues to pass new laws and taxes in order to get their ‘fair share’ of other people’s sweat, especially related to mining projects.As the law stands, all gold and silver produced must be sold to the Bangko Sentral, the country’s central bank. Yet after the government started enforcing a 7% tax on precious metals last year, most small-scale producers are now selling to smugglers instead.According to Assistant Central Bank Governor Manuel Torres, who heads the bank’s refinery operations, as much as 95% of all the gold mined in the Philippines is now being sold to smugglers and moved out of the country illegally.And the trend has been accelerating. In 2011, central bank gold purchases dropped at an annualized rate of 4%, then 76%, then 88% during the second, third, and fourth quarters. In the first quarter of 2012, gold purchases were down 92%. It’s staggering.

And of course, someone’s foolishness could present as opportunity for another.

Most of this smuggled gold finds its way here to Hong Kong, and then onward to China, where there is a voracious demand for gold despite rising prices.Of course, it’s perfectly legal to bring gold, tax-free, into Hong Kong.This is why when Hong Kong reports its official trade statistics, ‘gold imports’ from the Philippines are 30 times higher than what the Philippines government reports as ‘gold exports’ to Hong Kong!It’s an enormous discrepancy, and it gives a huge indication of how much gold smuggling is really going on.

Gold smuggling in the Philippines looks like a symptom of a larger global disorder

In Mongolia, so called ‘ninja miners’ also use crude methods to avoid government tax, mining and smuggling gold across the border to China. Gold smuggling in Sierra Leone became so problematic that the government finally had to capitulate, slashing its mining tax in half for small-scale producers.It’s certainly an important lesson that governments should heed, further proof that obtrusive attempts to impose heavy taxes only push economic activity into the black market.

While the Philippines gets much of the attention for such glaring and embarrassing policy failures, incidences of gold smuggling seems to be mushrooming around the world: Nepal and Bhutan, Burma, India, Italy, Congo, Russia, Turkey and elsewhere for the same reasons: economic repression.

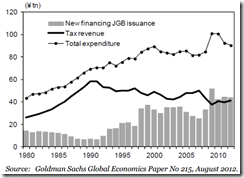

Given that monetary inflationism have become the dominant policy in combating the seemingly interminable government sponsored debt crisis, economic restrictions will only intensify the cat-and-mouse dynamic between guerilla capitalism (informal) and governments.

Guess who will prevail?