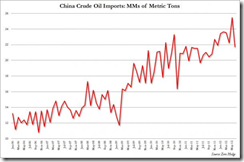

A slump in oil imports could also be an indicator of slowing economic growth and perhaps the end of China’s hoarding of strategic reserves.

Notes the Zero Hedge, (bold original)

Following months of ever higher Chinese imports, no doubt predicated by stockpiling and hoarding reserves, in June Chinese crude oil imports plunged from over 25 million metric tons to 21.72 MMTs, the lowest since December, or about 5.3 million barrels a day, down over 10% from the previous month's record import. While the number was still quite higher than the 19.7 million tons, the sudden drop is concerning, especially since the price of Brent slid materially in June, and if anything should have resulted in even more imports if indeed China was merely stockpiling crude for its new strategic reserve facilities. Which begs the question: was the demand actually driven by the economy, and just how bad is the economic slowdown over the past month if not even stockpiling at preferential prices can offset the drop in end demand?

From Dow Jones:

China's refineries may process less crude in the third quarter due to weaker domestic demand for diesel, which has led to persistently high stockpiles and steady exports from the country's largest refiner, China Petroleum & Chemical Corp, or Sinopec Corp.

The country's crude throughput declined in both April and May, falling 0.3% and 0.7%, respectively, compared with the corresponding months a year earlier.

Weaker demand for diesel, a primary driver of refinery output, has tracked China's economy, which has slowed for five consecutive quarters. Manufacturing activity in June grew at its slowest pace since November.

Meanwhile gold imports through Hong Kong has been soaring

Again from Zero Hedge (bold original)

There are those who say gold may go to $10,000 or to $0, or somewhere in between; in a different universe, they would be the people furiously staring at the trees. For a quick look at the forest, we suggest readers have a glance at the chart below. It shows that just in the first five months of 2012 alone, China has imported more gold, a total of 315 tons, than all the official gold holdings of the UK, at 310.3 according to the WGC/IMF (a country which infamously sold 400 tons of gold by Gordon Brown at ~$275/ounce).

From Bloomberg:

In May, imports by China from Hong Kong jumped sixfold to 75,635.7 kilograms (75.6 metric tons) from a year earlier, Hong Kong government data showed. The nation “remains the most important player on the global gold market,” Commerzbank AG said in a report. The dollar fell from a five-week high against a basket of currencies, boosting the appeal of the metal as an alternative investment.

“Higher physical demand in China is good news for the market,” Sterling Smith, a commodity analyst at Citigroup Inc.’s institutional client group in Chicago, said in a telephone interview. “The mildly weak dollar is also positive.”

The World Gold Council has forecast that China will top India this year as the world’s largest consumer because rising incomes will bolster demand.

And those looking at the trees will still intone "but, but, gold is under $1,600" - yes it is. And count your lucky stars. Because while all of the above is happening, Iran and Turkey have quietly started unwinding the petrodollar hegemony. From the FT:

According to data released by the Turkish Statistical Institute (TurkStat), Turkey’s trade with Iran in May rose a whopping 513.2 per cent to hit $1.7bn. Of this, gold exports to its eastern neighbour accounted for the bulk of the increase. Nearly $1.4bn worth of gold was exported to Iran, accounting for 84 per cent of Turkey’s trade with the country.

So what’s going on?

In a nutshell – sanctions and oil.

With Tehran struggling to repatriate the hard currency it earns from crude oil exports – its main foreign currency earner and the economic lifeblood of the country - Iran has began accepting alternative means of payments – including gold, renminbi and rupees, for oil in an attempt to skirt international sanctions and pay for its soaring food costs.

“Iran is very keen to increase the share of gold in its total reserves,” says Gokhan Aksu, vice chairman of Istanbul Gold Refinery, one of Turkey’s biggest gold firms. “You can always transfer gold into cash without losing value.”

Turkey’s gold exports to Iran are part of the picture. As TurkStat itself noted, the gold exports were for “non-monetary purpose exportation”. Translation: they were sent in place of dollars for oil.

Iran furnishes about 40 percent of Turkey’s oil, making it the largest single supplier, according to Turkey’s energy ministry. While Turkey has sharply reduced its oil imports from Iran as a result of pressure from the US and the EU, it is unlikely to cut this to zero. The country pays about $6 a barrel less for Iranian oil than Brent crude, according to a recent Goldman Sachs report.

According to Ugur Gurses, an economic and financial columnist for the Turkish daily Radikal, Turkey exported 58 tonnes of gold to Iran between March and May this year alone.

None of these looks anywhere a good news.

Gold prices, at present, may partly have been driven by the Iran sanction dynamic but I think that China may have been insuring themselves from risks of a currency crisis through the stockpiles of gold and oil.

Nonetheless I am not sure if the slump in oil imports represents an anomaly or an indication of a deepening slump in the economy and or may have redirected some of that money to the stimulus directed towards state owned enterprises.

No comments:

Post a Comment