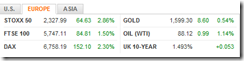

Amazing volatility.

Graphics from Bloomberg

European markets appear to skyrocketing (after yesterday’s deep slump) on the proposed accord by the ECB and EU politicians.

From Bloomberg, (bold emphasis added)

After 2 1/2 years of incremental crisis management and false starts, a bargain is beginning to emerge between Europe’s politicians and central bankers over how to calm bond markets and end the debt tumult that threatens the euro’s survival.

The European Central Bank sketched out its side of the deal yesterday, offering to buy Italy’s and Spain’s bonds on the market as long as the euro governments’ bailout fund makes purchases directly from the two countries’ treasuries and ties them to tough conditions.

ECB President Mario Draghi offered only a glimpse of the new strategy, with the actual interventions weeks or months away and a host of obstacles standing in the way before Europe can claim to be on a path out of the crisis that emerged in Greece in late 2009. Investors looking for a quicker fix pushed down the euro, European stocks and bonds of at-risk countries.

“All of the announcements, if transferred into actual activity, would be close to the big bazooka approach that the markets are looking for,” said Charles Diebel, head of market strategy at Lloyds Banking Group Plc in London. “Market disappointment is hardly surprising in this context but we may well find this lays the groundwork for the grand plan in coming weeks.”

The conditions set by the ECB on EU governments, again from the same article…

A bond-buying program would require Italy and Spain to make austerity and economic-reform commitments -- or potentially only restate the ones they’ve already made -- and submit to international monitoring. Spain has already gotten over the stigma of relying on outside help by tapping a 100 billion-euro program to shore up its banks.

Draghi’s pledge took the ECB further away from its roots as a politically autonomous central bank, modelled on Germany’s Bundesbank, with prime responsibility for containing inflation and only a lesser focus on the broader economy and the stability of the banking system.

The Bundesbank’s leader, Jens Weidmann, was alone on the ECB’s 23-member policy council in expressing “reservations,” Draghi told the press. For now, Weidmann stayed silent, contrasting with the objections to the ECB’s original bond- purchasing program that were immediately voiced by his predecessor, Axel Weber, in May 2010.

I really doubt if the prospective deal will be complied with.

The political institutions of the EU have broken much of the self-made/imposed regulations (e.g. Maastricht criteria, changes in collateral eligibility rules and etc...) to accommodate the interests of the political authorities and the banking cartel.

Yet such agreement seems as justification for the deployment of ‘big bazooka’ inflationism, perhaps through the reactivation of the Securities Markets Programme (SMP) that would only defer on the day of reckoning or to buy time for whatever political reasons.

And I also think that the team Ben Bernanke and the US Federal Reserve may not be pulling the trigger for QE 3.0 perhaps until after the ECB-EU’s joint actions.

More from the same article,

One reason Draghi had to buy time is that European governments won’t be able to act until at least mid-September, the earliest possible startup date for the planned 500 billion- euro permanent rescue fund, the European Stability Mechanism. It faces a German supreme court ruling on Sept. 12.

Until then, Europe’s only rescue vehicle is the European Financial Stability Facility, with as little as 148 billion euros left over after last month’s approval of Spanish bank aid.

So the likelihood is that the deal will likely prompt Spain and or Italy to access the EFSF (temporary fund) first, from which the ECB may provide bridge financing until the ESM (permanent fund) is ready. Yet political authorities seem to optimistically think that these would be enough to deal with the crisis. They are most likely to be mistaken.

It’s just incredible to see how financial markets respond like a pendulum—swinging from one extreme end to another—in the collision of expectations from promises to inflate as against the reality of unsustainable arrangements and of the ongoing economic recession in the EU.

One might just easily generalize that financial markets have almost been rigged by the central banks.

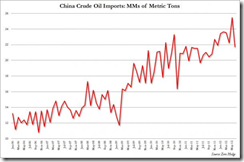

Nonetheless, all talk about the prospective actions by the ECB-EU seems to have scarcely influenced on the price actions of gold and oil. While both are up signifying a return to the risk ON mode, the degree of gains have not been the same as the equities. Could gold be sensing something else?

Be careful out there.