For a clearer view click here to redirect to source

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, November 05, 2013

Saturday, June 15, 2013

Incredible Photographs: Nearly Tens of Thousands of Chinese Line Up for Gold During the Dragon Boat Festival

Tuesday, June 04, 2013

In Beijing, Property Curbs Fail to Stop Bubbles

Beijing, which already has China’s strictest real estate curbs, is being forced to take additional steps to contain surging home prices as demands for record-high down payments fail to deter buyers.The city has enforced citywide price caps since March by withholding presale permits for any new project asking selling prices authorities deem too high, according to developer Sunac China Holdings Ltd. (1918) and realtor Centaline Group. Local officials will need further tightening as they struggle to meet this year’s target of keeping prices unchanged from last year, said Bacic & 5i5j Group, the city’s second-biggest property broker.The failure of official curbs to stem price increases in the nation’s capital highlights the government’s struggle to keep housing affordable as urbanization sends waves of rural workers into China’s largest cities. New-home prices in Beijing rose by 3.1 percent in April from the previous month, the biggest gain among the nation’s four so-called first-tier cities, and climbed by the most after Guangzhou in May, according to SouFun Holdings Ltd. (SFUN) They rose in each of the first five months of this year…Beijing, the nation’s third-most populous city, is the only city that enforces price caps in earnest, according to Bacic & 5i5j. Guangzhou and Shenzhen in the southern province of Guangdong are rejecting presale permits for some projects seen as too expensive, CEBM’s Luo said. The three cities, along with Shanghai, are considered first-tier.In one of his last policies, Wen, replaced by Li Keqiang less than a month later, on Feb. 20 called on city governments to “decisively” curb real estate speculation after home prices surged the most in two years in January.Beijing followed with the toughest curbs among the 35 provincial-level cities that responded with price-control targets, becoming the only region to raise the minimum down payment on second homes from 60 percent and to enforce a 20 percent capital-gains tax on existing homes, according to Centaline Property Agency Ltd., China’s biggest property agency.Still, new-home prices in the city of 19.6 million, jumped 10.3 percent in April from a year earlier, the biggest rise after Guangzhou and Shenzhen, the National Bureau of Statistics said May 18. Prices of existing homes jumped 10.9 percent, the most since they reversed declines in December, and the greatest gain among all the 70 cities tracked by the government.

Wednesday, May 29, 2013

Fitch Defies S&P on China’s Credit Bubble

Chinese banks are adding assets at the rate of an entire U.S. banking system in five years. To Charlene Chu of Fitch Ratings, that signals a crisis is brewing.Total lending from banks and other financial institutions in China was 198 percent of gross domestic product last year, compared with 125 percent four years earlier, according to calculations by Chu, the company’s Beijing-based head of China financial institutions. Fitch cut the nation’s long-term local-currency debt rating last month, in the first downgrade by one of the top three rating companies in 14 years.“There is just no way to grow out of a debt problem when credit is already twice as large as GDP and growing nearly twice as fast,” Chu, 41, said in an interview.

Amid the global credit crunch of 2008, China ramped up lending by state-controlled banks to prevent an economic slowdown. The assets of Chinese banks expanded by 71 trillion yuan ($11.2 trillion) in the four years through 2012, according to government data. They may increase by as much as 20 trillion yuan this year, Chu said April 23. That will exceed the $13.4 trillion of assets held by U.S. commercial banks at the end of last year, according to the Federal Deposit Insurance Corp.Chu says companies’ ability to pay back what they owe is wearing away, as China gets less economic growth for every yuan of lending.

China’s expansion of credit hasn’t caused a surge in the proportion of bad loans, data from the banking regulator show.While loans overdue for at least three months have grown for six straight quarters to reach 526.5 billion yuan at the end of March, the ratio of nonperforming loans declined to 0.96 percent as of March 31 from 2.42 percent at the end of 2008, according to the China Banking Regulatory Commission.

Yet for as long as the bubble inflates, or for as long as housing prices moves up, the Ponzi financing scheme may continue to thrive.

Chu, who has covered Chinese financial institutions at Fitch for seven years, says these figures are distorted. The ratio of nonperforming loans to total lending has declined mainly because credit has surged, she said. Moreover, the regulator’s data doesn’t reflect the real amount of debt because of the ways banks move loans off their books, Chu said.Some loans, often for real estate, are bundled together and sold to savers as so-called wealth-management products, while other assets are sold to non-bank financial institutions, including trusts, to lower the lenders’ bad debt levels, according to Chu. Wealth management products and trusts are sold to investors eager to get more than the government-mandated benchmark of 3 percent annual interest on bank savings accounts.“The data may be somewhat accurate for the on-balance-sheet loan portfolios of the banks, but banks have substantial off-balance-sheet positions for which there is no asset-quality information,” she said.

Shadow banks are manifestations of regulatory arbitrages or the circumvention of regulations. China's shadow banks has been mainly through Wealth Management Products (WMP) which have mainly been about short term financing

WMPs are vehicles that can borrow/lend, and banks engage in transactions with their own and each other’s WMPs. This makes the pools of assets and liabilities tied to WMPs in effect second balance sheets, but with nothing but on-balance-sheet liquidity, reserves, and capital to meet payouts and absorb losses. These hidden balance sheets are beginning to undermine the integrity of banks’ published balance sheets.

A jump in the ratio of credit to GDP preceded banking crises in Japan, where the measure surged 45 percentage points from 1985 to 1990, and South Korea, where it gained 47 percentage points from 1994 to 1998, Fitch said in July 2011. In China, it has increased 73 percentage points in four years, according to Fitch’s estimates.“You just don’t see that magnitude of increase” in the ratio of credit to GDP, Chu said. “It’s usually one of the most reliable predictors for a financial crisis.”

The nation is in a better position now to tackle nonperforming loans, said Liao Qiang, a Beijing-based director at S&P. In the past decade, China’s economy has quadrupled, the number of urban residents surpassed those on farms and policy makers allowed freer flows of its currency in and out of the country. Its foreign-exchange reserves surged fivefold from 2004 to $3.3 trillion at the end of 2012.“Given that China’s credit is mostly funded by its internally generated deposits, I don’t think a real financial crisis, which is normally manifested in a liquidity shortage, will happen anytime soon,” S&P’s Liao said by phone. Local-currency savings stood at 92 trillion yuan at the end of 2012, according to the National Bureau of Statistics.

Chinese banks extended 2.8 trillion yuan of loans in the first quarter, 12 percent more than a year earlier and the second-largest quarterly total on record, government data show. Economic growth in the period slowed to 7.7 percent from 7.9 percent in the fourth quarter.Only 29 percent of last year’s aggregate financing translated into economic growth, the lowest rate on record, as borrowers use more resources to finance outstanding debt and less for investment, Sanford C. Bernstein & Co. analyst Michael Werner wrote in January.

The reality is that the Chinese government has already launched a stealth stimulus since last year.

Friday, November 16, 2012

Emerging Market Central Banks Pile Up on Gold at Near Record Pace

Central banks continued to purchase gold in the third quarter at near-record pace, driven by emerging market central banks looking to diversify away from traditional reserve currencies amid heightened economic insecurity and continuous unconventional monetary easing, according to World Gold Council data released Thursday.Gold reserves at central banks increased by 97.6 metric tons during the July-September period, albeit at a slower pace compared with a record year-ago quarter. The official sector accounted for 9 percent of overall gold demand during the third quarter.“I wouldn’t emphasize the fall of 31 percent [from a year ago],” said Marcus Grubb, managing director for investment at the WGC. “Anything close to 100 tons is very high by the last 15 years.”The world’s central banks collectively bought 374 tons of gold in the first nine months of this year. That’s higher than last year’s 343 tons for the same period.“We still think we might beat last year’s total for central banks of 456 tons, though it’s going to depend on Q4,” Grubb said. “[This year will likely come in at] somewhere between 455 tons and 500 tons, which will be another record since the early 1960s.”

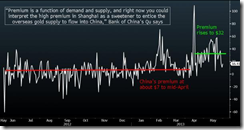

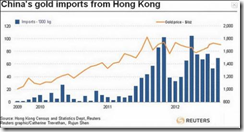

Year-To-Date China has now imported a whopping 582 tons of gold, more than the official holdings of India at 558 tons, and which through November has certainly surpassed the holdings of the Netherlands, and make China's gross imports in just 2012 nominally the equivalent of Top 10 largest sovereign holder of gold.This way at least we know where China is recycling all that vast trade surplus, which incidentally in October just printed, goalseeked or not, at the highest level - $32 billion - since January of 2009. Too bad China no longer recycles all those excess reserves into US Treasury paper (as we showed previously here).YTD China gross imports from Hong Kong:

Monday, October 22, 2012

China’s Cumulative Gold Imports Surpasses ECB Holdings

First it was more than the UK. Then more than Portugal. Then a month ago we said that as of September, "it is now safe to say that in 2012 alone China has imported more gold than the ECB's entire official 502.1 tons of holdings." Sure enough, according to the latest release from the Hong Kong Census and Statistics Department, through the end of August, China had imported a whopping gross 512 tons of gold, 10 tons more than the latest official ECB gold holdings. We can now safely say that as of today, China will have imported more gold than the 11th largest official holder of gold, India, with 558 tons….one unspinnable aftereffect of China's relentless appetite for gold comes from a different place, namely Australia, where gold just surpassed coal as the second most valuable export to China. From Bullionstreet:Australia's gold sales to China hit $4.1 billion in the first eight months of this year as it surged by a whopping 900 percent.According to Australian Bureau of Statistics, the yellow metal became the second most valuable physical export to China, surpassing coal and only behind iron ore….In other words, take the chart above, showing only Chinese imports through HK, and add tens if not hundreds more tons of gold entering the country from other underreported export channels such as Australia. One thing is certain: China no longer has any interest in buying additional US Treasurys.

Saturday, October 13, 2012

Asia as the World’s Precious Metal Hub: Singapore Cuts Taxes on Gold as Hong Kong Adds Storage Facilities

Singapore has repealed a 7% tax on investment-grade gold and other precious metals to spur the development of gold trading in the country. It is hoped the move will lift demand for gold bars and coins in the fourth quarter and applies to gold of 99.5% purity, silver of 99.9% purity and platinum of 99% purity.While in the works for several months, the repeal came into effect on October 1.Singapore is hoping the scrapping of the tax will lure bullion refiners to the country and convince trading houses to open storage facilities, transforming it into a key Asian pricing hub. along the lines of London and Zurich. Currently holding 2% of global gold demand, the Southeast Asian city-state aims to hike that to 10% to 15% over the next five to 10 years.Currently, Singapore imports gold bars from Australia, Switzerland, Hong Kong and Japan, which are then sold to buyers in Southeast Asia and neighbouring India.Singapore's investment gold demand nearly tripled to 3.5 tonnes in 2011, according to consultancy firm GFMS. Singapore has already tripled gold imports year over year, ending December.At least one major refiner has already shown interest in opening a factory in Singapore. More gold traders are expected to set up offices and store more bullion, post the move.Gold scraps from the across the region are also traded in Singapore, which helps determine the premiums for gold bars against prices in London. Earlier, refiners were put off by Singapore's taxes, opting instead to mould and sell gold bars in Hong Kong, which does not impose duties on bullion, and Japan, where the consumption tax on gold was very low.

While the current world hubs for gold trading and storage are London, Zurich, and New York, stores of physical metal are also beginning to migrate east. Gold storage facilities are springing up all over Asia like mushrooms after a summer rain.Back in 2009, the Hong Kong Airport Authority set up the first secure gold storage facility inside the confines of the Hong Kong Airport.This September, Malca-Amit, the Tel Aviv-based diamonds and precious metals company is opening a second state of the art facility at the airport, which will have capacity for 1,000 metric tons of gold.That compares to the 4,582 tons that the US government claims is in Fort Knox, and the record 2,414 million tons that the world’s exchange traded gold funds collectively held – mostly in London– as of July 5th.Malca-Amit also has a facility in Singapore’s Freeport complex, and the company is planning a third Asian precious metals storage facility in Shanghai in the near future.

Tuesday, October 02, 2012

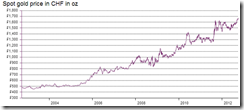

Charts: Gold versus Major Fiat Currencies

It must be emphasized that gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium. Above all, the supply and provision of gold was subject only to market forces, and not to the arbitrary printing press of the government.

Monday, September 10, 2012

China’s Imports Drop, Japan’s Economy Slows

Despite the recently announced $157 billion infrastructure spending based bailout, China’s economic decline continues…

From Bloomberg, (bold mine)

China’s imports unexpectedly fell and industrial output rose the least in three years, signaling more stimulus may be needed after the government last week said it approved subway and road projects across the nation.

Inbound shipments slid 2.6 percent in August from a year earlier as exports rose 2.7 percent, the customs bureau said in Beijing today. Production increased 8.9 percent, the National Bureau of Statistics said yesterday. Inflation accelerated for the first time in five months.

The data underscore risks that full-year growth in the world’s second-biggest economy will slide to the lowest in more than two decades, undermining support for the ruling Communist Party before a once-in-a-decade leadership transition due later this year. The rebound in inflation, excess capacity in some industries and banks’ bad debt risks from past monetary easing highlight the potential cost of ramping up stimulus efforts…

China’s trade surplus was a more-than-estimated $26.7 billion as imports fell for the first time since 2009 outside of the Lunar New Year, today’s report showed. Fixed-asset investment growth in the first eight months eased to 20.2 percent, yesterday’s reports showed.

Slowing imports corroborates signs of a steepening slowdown in China’s economic activities.

But for the steroid starved mainstream, inflationism has been never enough. People simply adore the idea of turning stones into bread.

However a rebound in consumer price inflation may put a kibosh on current bailout policies. (chart from Tradingeconomics.com)

Nonetheless, China’s economic deterioration gives more evidence of the seminal phase of the global stagflation dynamic

Well bad news has not been limited to China though, Japan’s economy has reportedly slowed materially.

From the same article…

Japan’s economy expanded in the second quarter at half the pace the government initially estimated, underscoring the risk of a contraction as Europe’s debt crisis caps exports, a government report showed today.

Gross domestic product grew an annualized 0.7 percent in the three months through June, less than a preliminary calculation of 1.4 percent. The nation’s current-account surplus fell to 625.4 billion yen ($8 billion) in July, the lowest for that month since 1996, according to a finance ministry report and Bloomberg historical data.

Both developments exhibit the ongoing global economic slowdown dynamic which stock markets seems to ignore.

The momentum from last week’s rejuvenated equity markets from the combined announcement of bailout packages from ECB and China has so far been carried over today.

It would be interesting to see how Chinese authorities will respond to sustained news of pronounced downswing of their economy.

China’s massive gold imports which in 2012 according to Zero Hedge, has “imported more gold than the ECB's entire official 502.1 tons of holdings” and the current inflationist bailout policies seem as conflicting political moves.

Thursday, July 26, 2012

The Deepening Gold Markets of Asia: Hong Kong Opens New Gold Storage

Gold markets in Asia will get a huge boost from the opening of Hong Kong’s largest gold storage

From Bloomberg,

Hong Kong’s largest gold-storage facility, which can hold about 22 percent of the bullion now in Fort Knox, will open in September to meet rising demand from banks and the wealthy, according to owner Malca-Amit Global Ltd.

The facility, located on the ground floor of a building within the international airport compound, has capacity for 1,000 metric tons, said Joshua Rotbart, general manager for the Hong Kong-based company’s Malca-Amit Precious Metals unit. Two of the vaults may hold assets, including gold, for banks and financial institutions, and others will be used for diamonds, jewelry, fine art and precious metals, said Rotbart.

The move in Hong Kong reflects increased demand for gold in Asia even as the commodity struggles to sustain its rally into a 12th year. Gold-demand growth in China, the world’s second- largest user after India last year, is slowing, according to the World Gold Council. Vault charges will depend on each customer’s operations, according to Rotbart, who declined to give a figure for the venture’s cost beyond millions of dollars.

Reports attribute this to the growing wealth in Asia, from the same article…

Asia-Pacific millionaires outnumbered those in North America for the first time last year, according to Capgemini SA and Royal Bank of Canada’s wealth-management unit. The number of individuals in the region with at least $1 million in investable assets rose 1.6 percent to 3.37 million, helped by increases in China and Indonesia, according to the firms’ World Wealth Report, released last month. So-called high-net-worth individuals in North America dropped 1.1 percent to 3.35 million.

Gold markets in Asia will likely become more competitive, from the same article…

The new storage facility will compete with services offered by the Airport Authority Hong Kong, which began storage operations at a 340 square meter site in 2009 for government institutions, commodity exchanges, bullion banks, refiners, wealthy individuals and exchange-traded funds. Capacity is reviewed on a regular basis to ensure there is adequate storage over the medium term, the authority said in a statement.

Singapore’s Push

Singapore is also among economies in Asia vying for a greater share of the bullion trade. In February, the government announced a plan to exempt investment-grade gold, silver and platinum from a goods and services tax, starting from October. The aim is to raise the city-state’s share of the global gold trade to as much as 15 percent in five to 10 years from about 2 percent, according to IE Singapore, the external trade agency.

Competitive gold markets are signs of the burgeoning free markets in Asia.

Besides, gold has been embedded in the culture for many Asian nations (e.g. India, Vietnam, Malaysia, China, etc…), which I think is why the “gold as money” theme will be more receptive to Asians.

Yet this seems to exclude the Philippines, where much of the public still cling to the romanticized notion that the US dollar represents as THE ultimate currency—this seems tied to the popular social democratic mindset which gives mandate to the political economy of state (crony) capitalism.

I believe that the Asia’s blossoming gold market has been more than just about the showcase of wealth, but about gold as insurance…which essentially may pave way for gold to reclaim its role as money.

Perhaps this may signal that Asia may lead the world towards the restitution of sound money.

Wednesday, July 11, 2012

China’s Oil Imports Slump, Gold Imports Soar

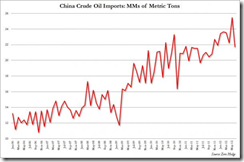

A slump in oil imports could also be an indicator of slowing economic growth and perhaps the end of China’s hoarding of strategic reserves.

Notes the Zero Hedge, (bold original)

Following months of ever higher Chinese imports, no doubt predicated by stockpiling and hoarding reserves, in June Chinese crude oil imports plunged from over 25 million metric tons to 21.72 MMTs, the lowest since December, or about 5.3 million barrels a day, down over 10% from the previous month's record import. While the number was still quite higher than the 19.7 million tons, the sudden drop is concerning, especially since the price of Brent slid materially in June, and if anything should have resulted in even more imports if indeed China was merely stockpiling crude for its new strategic reserve facilities. Which begs the question: was the demand actually driven by the economy, and just how bad is the economic slowdown over the past month if not even stockpiling at preferential prices can offset the drop in end demand?

From Dow Jones:

China's refineries may process less crude in the third quarter due to weaker domestic demand for diesel, which has led to persistently high stockpiles and steady exports from the country's largest refiner, China Petroleum & Chemical Corp, or Sinopec Corp.

The country's crude throughput declined in both April and May, falling 0.3% and 0.7%, respectively, compared with the corresponding months a year earlier.

Weaker demand for diesel, a primary driver of refinery output, has tracked China's economy, which has slowed for five consecutive quarters. Manufacturing activity in June grew at its slowest pace since November.

Meanwhile gold imports through Hong Kong has been soaring

Again from Zero Hedge (bold original)

There are those who say gold may go to $10,000 or to $0, or somewhere in between; in a different universe, they would be the people furiously staring at the trees. For a quick look at the forest, we suggest readers have a glance at the chart below. It shows that just in the first five months of 2012 alone, China has imported more gold, a total of 315 tons, than all the official gold holdings of the UK, at 310.3 according to the WGC/IMF (a country which infamously sold 400 tons of gold by Gordon Brown at ~$275/ounce).

From Bloomberg:

In May, imports by China from Hong Kong jumped sixfold to 75,635.7 kilograms (75.6 metric tons) from a year earlier, Hong Kong government data showed. The nation “remains the most important player on the global gold market,” Commerzbank AG said in a report. The dollar fell from a five-week high against a basket of currencies, boosting the appeal of the metal as an alternative investment.

“Higher physical demand in China is good news for the market,” Sterling Smith, a commodity analyst at Citigroup Inc.’s institutional client group in Chicago, said in a telephone interview. “The mildly weak dollar is also positive.”

The World Gold Council has forecast that China will top India this year as the world’s largest consumer because rising incomes will bolster demand.

And those looking at the trees will still intone "but, but, gold is under $1,600" - yes it is. And count your lucky stars. Because while all of the above is happening, Iran and Turkey have quietly started unwinding the petrodollar hegemony. From the FT:

According to data released by the Turkish Statistical Institute (TurkStat), Turkey’s trade with Iran in May rose a whopping 513.2 per cent to hit $1.7bn. Of this, gold exports to its eastern neighbour accounted for the bulk of the increase. Nearly $1.4bn worth of gold was exported to Iran, accounting for 84 per cent of Turkey’s trade with the country.

So what’s going on?

In a nutshell – sanctions and oil.

With Tehran struggling to repatriate the hard currency it earns from crude oil exports – its main foreign currency earner and the economic lifeblood of the country - Iran has began accepting alternative means of payments – including gold, renminbi and rupees, for oil in an attempt to skirt international sanctions and pay for its soaring food costs.

“Iran is very keen to increase the share of gold in its total reserves,” says Gokhan Aksu, vice chairman of Istanbul Gold Refinery, one of Turkey’s biggest gold firms. “You can always transfer gold into cash without losing value.”

Turkey’s gold exports to Iran are part of the picture. As TurkStat itself noted, the gold exports were for “non-monetary purpose exportation”. Translation: they were sent in place of dollars for oil.

Iran furnishes about 40 percent of Turkey’s oil, making it the largest single supplier, according to Turkey’s energy ministry. While Turkey has sharply reduced its oil imports from Iran as a result of pressure from the US and the EU, it is unlikely to cut this to zero. The country pays about $6 a barrel less for Iranian oil than Brent crude, according to a recent Goldman Sachs report.

According to Ugur Gurses, an economic and financial columnist for the Turkish daily Radikal, Turkey exported 58 tonnes of gold to Iran between March and May this year alone.

None of these looks anywhere a good news.

Gold prices, at present, may partly have been driven by the Iran sanction dynamic but I think that China may have been insuring themselves from risks of a currency crisis through the stockpiles of gold and oil.

Nonetheless I am not sure if the slump in oil imports represents an anomaly or an indication of a deepening slump in the economy and or may have redirected some of that money to the stimulus directed towards state owned enterprises.