Here is what I wrote last week[1]

after 3 successive weeks of advances which racked up 8.53% in returns, it would be normal to see some profit taking.

So apparently correction of the Phisix materialized.

In line with the activities of the region’s bourses, the Phisix fell 2.76% this week.

For our ASEAN peers, the outcome had been mixed. Thailand and Malaysia was modestly higher while Indonesia joined the Phisix in a correction mode but had been down moderately.

The BRICs or Brazil, Russia, India and China continue to suffer from hefty losses.

Whatever bounce we have seen lately have mostly signified as deadcat’s bounce for the BRICs. So far only India (BSE) has shown a little bit of strength compared to her contemporaries; China (SSEC), Brazil (BVSP) and Russia (RTSI)

If you have noticed, events have become sooo incredibly short term oriented, exceedingly volatile, and at worst, complacency seems to have become a dominant feature, especially in the Philippine setting, where the current environment has largely been seen as hunky dory.

And part of my concern stems from idea that BAD news has been interpreted as GOOD news where many have come to believe that either local and regional markets have become immune to the external developments or that interventions has been seen as a sure thing and will always be successful.

And as I have pointed out during the past few weeks, my other concern is that perhaps the Philippine market may have been “jockeyed” to project political goals.

Bubble Cycles: This Time Will NOT be Different

“This time is different” are four words that I fret most. For the late investment legend Sir John Templeton these are the four most dangerous words in investing[2].

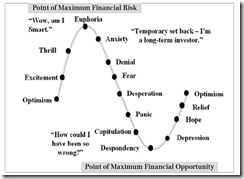

Such statement is symptomatic of overconfidence, a deeply ingrained euphoric sentiment or an embedded belief that a new paradigm has somewhat reconfigured how life would play out.

A classic example is when the late distinguished monetary economist Irving Fisher infamously declared that the US stock market, at the climax of the bullmarket in 1929, had reached “a permanently high plateau.”[3] What followed in the coming months were the gruesome Wall Street Crash and the Great Depression.

So when I stumble upon news which avers that “Southeast Asia is looking more a safe haven than a risky bet, with foreign investors souring on China and India and pouring money into markets proving resilient to the global gloom”[4] such assumptions gives me a creepy feeling.

That’s because such sentiment evokes of the memories of the excruciating Asian crisis which once was heralded as the “Asian Economic Miracle”[5] in 1994 and which ultimately turned out into a grand cataclysmic bubble bust in 1997.

Yet it took 3 years for the bust to occur.

But euphoria does seep through public’s consciousness even when bubble cycles have not been homemade.

Exactly during the pinnacle of the last boom phase of the Philippine stock market, a local news outfit featured the ‘basura queen’ in June of 2007[6]. Basura is a local term for garbage and a stock market colloquial or slang for high risk issues.

The ‘Basura’ Queen swaggered about her making millions out of ‘basura’ issues, or the penny stock equivalent of Wall Street.

Overconfidence and the increasingly desperate search for returns seem to be revving up the public’s appetite for gambling.

But the seeds of a homegrown bubble are also being sown.

The Fitch Rating, a US credit rating agency recently, seems to have echoed on what I have been repeatedly warning about: that the Philippines may be on the ‘brink’ of a domestic credit boom[7]. Not just on the brink, we are already having a domestic credit boom[8].

Of course, local officials will hardly do anything about this, since the credit boom will spruce up the economy over the short term and would thereby provide an image booster or political advertisement to the incumbent administration as their “major accomplishment”.

The boom will be seen as a feat, but the bust will be passed on like a hot potato. In politics, who cares about the future?

Besides, officials have limited knowledge of the unseen or undefined “equilibrium” levels from where or which point to put the policy brakes on.

In addition, since the Philippine political economy have been mostly state driven, chieftains of the industries involved in the boom, who are most likely allies of the administration, will exert their political capital to influence on the direction of policymaking thereby extending the boom to unsustainable levels.

Finally since policymakers have innate Keynesian leanings, who try to promote consumption as the main policy thrust, the policy of negative real rates will drive

1. consumer spending through acquisition of more debt via mortgages, credit cards, and other consumer loans,

2. encourage more government spending which will be financed by low interest rates from the private sector, particularly channelled through banks and other financial institutions, which again would add to systemic debt, and importantly leads to consumption at the expense of production, and lastly,

3. fuel capital intensive speculation which will likely be directed to real estate projects, manufacturing and mining, and which again leads to more systemic debt accrual. Such misdirection of allocations of resources eventually leads to the consumption of capital. A great bust.

Again all inflation is political, designed to push the interests of a few at the expense of the society

And I am talking here of a locally fuelled bubble which is aside from today’s present risk: contagion.

Europe’s Capital Flight Paradigm

In case of a full blown global recession, there has hardly been convincing evidence that ASEAN bourses will entirely decouple.

As I predicted Japanese foreign direct investments capital flows into ASEAN has currently been intensifying[9].

Since Japan’s capital flows into ASEAN have still been couched on the term ‘investments’ based on ‘growth’, this has yet to translate into a full capital flight dynamic where Japanese investors frantically stampede into ASEAN assets regardless of risk conditions.

Once Japan’s debt crisis reaches a ‘tipping point’[10], where in the face of the dearth of access to private capital and from external financing, and where the Bank of Japan (BoJ) will substitute as the buyer or financier of last resort of local sovereign papers in order to save the banking system, then this ‘growth’ dynamic will likely be substituted for ‘flight to safety’[11].

Such dynamic appears as partially being played out in the Eurozone: government debts of Germany, Finland and Netherlands[12] (as well as Denmark[13]) have become lightning rods against the concerns of the Eurozone’s dismemberment and this dynamic has also began to diffuse into Belgium and France.

Yes, it is panic time in the Eurozone as expressed by the bond markets…

…but not in the equity markets

I think that the difference is that the European Central Bank (ECB) has yet to aggressively step up as the buyer and financier of the last resort which is why most of the capital flows have been absorbed into government bonds.

Nevertheless some of these safehaven flows may have already been rechanneled to the equity markets of Germany (DAX), Denmark (KFX), Netherland (AEX) and Belgium (BEDOW).

Meanwhile the Finnish and French bellwether has yet to ventilate similar ‘capital flight’ dynamics.

Remember if the risk conditions in the Eurozone stabilize, then these capital flight dynamics will likely be reversed as money flows back to their sources, and the current boom may turn out to another bust, which ironically may again fuel more destabilization.

Some bullish background, eh?

Contagion Risk Must Not be Discounted

We shouldn’t forget that the Asian Crisis proved that contagion risk was a real risk that spread throughout the region.

As the Reserve Bank of Australia noted[14],

One can then locate the onset of crisis in Korea, Indonesia, Malaysia, and the Philippines in a process of contagion: a flip to the bad equilibrium to which the economies were vulnerable, in response to the ‘wake-up call’ (i.e. signal) from Thailand that this was a possible outcome.

This was likewise true with the 2007-2008 meltdown of the US property and mortgage bubble.

Remember that the real effects of an external transmission of contagion were hardly felt since the Philippine economy escaped a recession and that the ensuing global slowdown hardly left an imprint to local corporate earnings, yet the Phisix lost over half of its value from peak to trough[15]!

So while it may be true that those years had different conditions from today, despite some of the real relatively positive changes on ASEAN economies, we must be reminded that globalization and dependence on the US dollar through international currency reserve accumulation via the global banking system has been the umbilical cord for global asset markets.

Merchandise trade as % of GDP remains as a significant factor to ASEAN economies particularly to the Malaysia and Thailand.

But the Philippines also depends on foreign remittances (10.73% of GDP 2010[16]) as well, and to the lesser extent Indonesia (>1% of GDP 2010[17])

While the Philippines and Indonesia may be less exposed, the question will be internal dynamics.

Dependence on government spending only provides temporary relief (benefits the cronies) at the expense of the future (higher taxes, higher debt levels, and higher inflation)[18].

Has the political, legal, tax and regulatory environment eased to incentivize entrepreneurs to take on more productive ventures?

Philippine economic growth has recently been powered by exports[19], most likely due to global restocking. But with a ongoing recession in the Eurozone, as well as, a pronounced slowdown China and other major emerging market economies, and importantly the US, expectations of robust “double digit” growth signifies as wishful thinking…unless major central banks come up with more aggressive short term palliatives.

And a slowdown in global merchandise trade has been prompting for a contraction on trade surpluses (perhaps partly due to increasing domestic demand) and a reduction of foreign currency reserves, as some emerging market central banks have attempted to stabilize exchange rate values with use of these surpluses and thus results to monetary tightening conditions that may not be conducive for equities[20].

In addition, the banking crisis at the Eurozone will prompt for major balance sheet adjustments in order to raise capital mostly through shrinkage, particularly banks are slated to reduce balance sheets by €2 trillion by dumping 7% of these assets by the end of 2013. This also means that supply of credit to the economy will contract.

Of course the real problem isn’t due to credit contraction which affects mostly the government and their protégé the banking system but of the failure to undertake real reforms focused on competitiveness and productivity[21].

Yet under the worse policy scenario arrived by IMF estimates according to DBS Research[22], a dramatic slowdown in the economy compounded by bank deleveraging (bursting bubble) will affect even the US and emerging markets will not be spared (most especially in Eastern Europe).

So we can hope for the best and prepare for the worst.

So underneath the headlines, ASEAN+3 (China Japan and South Korea) have doubled their Chiang Mai Initiative Multilateralism (CMIM) currency swap buffer to USD 240 billion which was a third funded by total foreign reserves accumulated by ASEAN 5 (US 765 billion as of April)[23][24].

So while Asian central bankers have been adding insurance against the risk of the aggravation of Europe’s banking crisis, domestic investors have been in a buying binge.

Yet the ongoing Euro-Brazil, Russia, India, China slowdown compounded by deleveraging within their respective economies has already affected Singapore whose economy suffered a contraction last quarter[25]

Yes China’s economy managed to post 7.6% growth last quarter, but many questioned on the validity of the statistics used to arrive at this output which for some have been overstated for political reasons[26]

And yet US and European markets rallied fiercely last Friday, which according to news drew on the conclusion that the recent conditions of China’s economy will lead to more monetary accommodation by policymakers[27]. Bad news again seen as good news.

I think that such knee jerk response represents more of a melt-up from “crowded short positions” rather than a major inflection point.

As Prudent Bear analyst Doug Noland rightly points out[28],

But the downside of the Credit cycle radically alters rules of the game. Over time, reality sinks in that the previous prosperity was in fact an unsustainable boom-time phenomenon. The downside of the Credit cycle ensures faltering asset prices, deflating household net worth and financial sector deficiencies, along with the revelation of problematic economic imbalances and maladjustment. It’s not long into the bust before many see themselves as losers – and to have lost unjustly at the hands of an unfair system. The growing ranks of losers become an increasingly powerful political force.

Nevertheless I expect Friday’s huge jump to filter into Asian markets including the Phisix at the start of the week.

My conclusion remains: for as long as political gridlock over policies persists (in the US, China and Eurozone) and central bankers of major economies remain rudderless, markets will remain subject to extreme volatility from the collision of hope (expectations of decoupling, deeply embedded Pavlovian expectations of major central bankers coming to the rescue and of the narcotic effects of inflationism) and reality (ramifications from deflating bubbles: economic slowdown and deleveraging). Not to discount of the possibility of major policy errors from too much focus on the short term fixes.

While I remain bullish over the Phisix over the long term, the short term horizon has been filled to the brim with uncertainties coming from almost every direction. This for me magnifies the tail event risks.

[1] see Why Current Market Conditions Warrants a Defensive Stance July 9, 2012

[2] SirJohnTempleton.org Consider these 'words of wisdom' about investing September 20, 2006

[3] Wikipedia.org Irving Fisher

[4] Reuters.com Southeast is Asia safe haven as China, India stumble, July 14, 2012

[5] Wikipedia.org 1997 Asian financial crisis

[6] See Philippine Stock Exchange: The PUBLIC’s MILKING Cow???!!!, June 17, 2012

[7] Inquirer.net Philippines on the brink of a credit boom, must be wary of dangers—Fitch Rating, July 6, 2012

[8] See Why has the Phisix Shined? July 2, 2012

[9] See Japan’s Capital Flows to ASEAN Accelerates July 4, 2012

[10] See The Coming Global Debt Default Binge: Japan’s Government Under Financial Strains July 9, 2012

[11] See Will Japan’s Investments Drive the Phisix to the 10,000 levels? March 14, 2012

[12] Bloomberg.com AAA Yields At Zero Drive Investors To Belgian Debt: Euro Credit July 13, 2012

[13] See Denmark Cuts Interest Rates to Negative July 6, 2012

[14] Corbett Jenny, Irwin Gregor and Vines David From Asian Miracle to Asian Crisis: Why Vulnerability, Why Collapse? 1999 Reserve Bank of Australia

[15] See Dealing With Financial Market Information February 27, 2011

[16] Tradingeconomics.com Workers' remittances and compensation of employees; received (% of GDP) in Philippines

[17] Tradingeconomics.com Workers' Remittances And Compensation Of Employees; Received (% Of GDP) In Indonesia

[18] See S&P’s Philippine Upgrade: There's More than Meets the Eye July 3, 2012

[19] ABS-CBNNews.com May exports growth at 17-month high, July 10, 2012

[20] See Emerging Market “Liquidity” Conditions Deteriorate July 5, 2012

[21] See What to Expect from a Greece Moment June 17, 2012

[22] DBS Vickers Economics Markets Strategy 3Q 2012 June 14, 2012

[23] Ibid

[24] Wikipedia.org Chiang Mai Initiative

[25] See Contagion Risk: Singapore Economy Contracts, July 13, 2012

[26] See China’s Economic Growth Slows Anew, Economic Data Questioned July 13, 2012

[27] Bloomberg.com S&P 500 Erases Weekly Loss On JPMorgan Rally, China, July 13, 2012

[28] Noland Doug Game Theory And Crowded Trades Credit Bubble Bulletin, Prudent Bear.com July 13, 2012

No comments:

Post a Comment