This passage from a report on Thailand’s monetary policy caught my eye; from Bloomberg

Daily minimum wages have risen as much as 89 percent after two increases in the past year. Most factories are located in an area where wages rose to 300 baht per day last April, an average increase of 38 percent, according to the industry ministry.

89 percent in one year wow!

Using the National Capital Region (NCR) as benchmark for the Philippines, minimum wage grew by 7% in 2012, according to the National Wages and Productivity Commission. Here is the history of minimum wages of the Philippines

The implication is that Thailand’s economy must either be experiencing a productivity miracle or in an advance stage of an inflationary boom, which in mainstream terminology will read as risk of “economic overheating”

Thailand’s economy according to the tradingeconomics.com has averaged 3.6% from 1994 until 2012

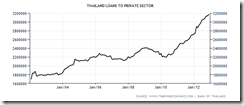

Yet Thailand’s credit markets represented by loans to the private sector (data provided by the Bank of Thailand again through tradingeconomics.com) shows that since December 2001 until November of 2012, the average growth rate has been 7.94%.

And it would appear 2010 served as the springboard for the rapid ascent of Thailand’s loan growth to the private sector.

Loan growth spiked as the Bank of Thailand floored interest rates in 2010. But the low point of 2010 in interest rates was second only to the record set in 2003 at 1.25%, according to tradingeconomics.com

Again one would notice that loan growth picked up in 2003 but the acceleration of the growth rates commenced in 2010, even as the Bank of Thailand negligibly raised interest rates in 2011. The Bank of Thailand eventually cut rates anew in 2012.

The above evidence suggest that Thailand’s economic growth seems mainly fueled by unsustainable credit expansion or a credit boom that has resulted to increases in input prices such as minimum wage.

And this has not just been a private sector concern.

Thailand’s government appears to have also used low interest rates and a lower US dollar to expand foreign denominated external debt tradingeconomics.com.

From 2005 until 2012 external debt by the government has grown at an average of 15.8%. Yet the average does not tell the accurate picture. The Thai government’s external debt resonates with the rate of growth in the private sector both of which has been intensifying since 2010.

While the external debt picture, as per cent to the GDP, seems far from the danger zone it reached in 1997 (tradingeconomics.com), no crisis are exactly similar.

A unique but troubling feature of today’s Thai debt build up is that short term debt as % of the total external debt has reached record levels (tradingeconomics.com), topping that of 1997. Ghost of 1997?

This makes the Thai economy highly vulnerable to sudden interest rate spikes where Thai’s interest rate fragility may originate or be triggered from internal or external sources.

I earlier mentioned that the strengthening Thai baht and low domestic interest rates have incited these intensifying debt build up from both the private and public sectors.

The chart above shows the USDTHB has been in going down since the advent of the new millennium- from tradingeconomics.com

External easing by the majors economies, as well as globalization, have also contributed to portfolio flows in bonds (topmost pane) and in equities (middle pane) and in foreign direct investments (FDIs—lower pane). These capital flows have provided finance to Thailand’s trade deficit (not shown) and strong financial markets. Thai’s SET beat the Philippine Phisix by a head’s length at the finish line in 2012, up 35.76% against 32.95% in nominal domestic currency terms.

The bottom line is that when debt rises far more than income, then trouble lies ahead.

Thailand’s Finance Minister Kittiratt Na-Ranong gripes about the lack of investment which the Thai government proposes to bridge, from the same Bloomberg article,

Another legacy of the 1997 crisis is a lack of investment due to concerns over the country’s debt levels, which has led to persistent current-account surpluses, Kittiratt said. Thailand has had a current-account deficit only once since 1997, according to data compiled by Bloomberg…Over the long term, the government plans to invest in infrastructure to increase imports and reduce pressure on the currency, Kittiratt said. He has proposed spending 2 trillion baht ($67 billion) over seven and a half years on projects such as a railroad network to accelerate investments and put the current account into a deficit.

Given the steepening rate of debt build up, the question is where has all these money been flowing?

A property bubble perhaps?

From the Bangkok Post in October of 2012

The Bank of Thailand is keeping a close watch for any indication of a pending collapse in the housing bubble after prices of housing estate units recently sharply increased, Mathee Supapong, a senior director at BoT, said on Friday.Housing loans provided by financial institutions were also substantially up and this was a case to concern, said Mr Mathee.

Officials say there has been no bubble. But no one can establish a bubble until after the fact (ex-post). The above only serves as clues to where the economic and social risks lies.

1 comment:

If you want a real credit bubble, look at S. Korea and China.

Post a Comment