But politics has only been an aggravating factor to what has been a slowing statistical economy for Thailand (annualized).

Except for the anomalous one time spike, Thailand’s economy has been largely performing below the average at 3.77% (calculated by tradingeconomics.com based from 1994 until 2013) from 2012-2013. The World Bank says that Thailand economy grew by only 3% in 2013

So given the growing slack in the economy worsened by a political crisis that has rendered the incumbent government paralyzed, what recourse has the Bank Thailand recently taken to provide cushion to her economy?

After holding policy steady for months as the country’s disintegrating political situation took its toll on the economy, the Bank of Thailand finally reached its breaking point Wednesday, cutting overnight rates by a quarter-percentage point in a close vote.

Wednesday’s decision takes the benchmark rate to 2.0% from 2.25%, and comes as the BOT said economic growth won’t even reach the central bank’s 3% target this year – after it was forecast at 4% as recently as November. Economic growth already has slowed from 6.5% in 2012 to 2.9% in 2013, bottoming out at just 0.6% in the final quarter of the year.

That illustrates the depths to which Thailand’s economy has sunk as massive demonstrations seeking the overthrow of Prime Minister Yingluck Shinawatra enter their fifth month.

Price pressures were seen as one reason the BOT remained on hold in preceding months: While inflation wasn’t high enough to warrant a rate increase as in India or Indonesia, it wasn’t quite benign enough to allow the central bank to ease policy either.

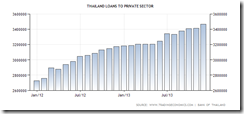

Loans to the private sector continues to massive inflate. In my estimates, through 2013 until January 2014 credit growth ballooned by about 9%

Such rate of growth has likewise been reflected on money supply growth. Thailand’s M3 jumped by an estimated 9.8% over the same period.

Thailand credit and money growth has been thrice the rate of the economic rate of growth. So the question is where has all these money creation been spent or invested?

I have no updates on the Thailand’s housing statistics. But the World Bank figures gives some clues. Growth in the construction growth sector remains positive but may be on a seminal downtrend.

On the other hand, note that growth in real investment and equipment has been on a decline since the 4Q of 2012 and has turned negative during the 2nd Q of 2013. In other words, Thailand’s economy has been materially slowing even prior to the outbreak of the political crisis.

Additionally while growth in housing loans appear as slowing down, % of housing loans relative to the economy remains at near the record 80% level.

And the more important factor has been the surge in Non-performing loans (NPL) from 2012-2013.

And Thailand’s slowing exports as I noted earlier, has only swelled her balance of trade deficit and shrank her current account surplus. And this implies that part of her trade deficit may have been financed by the growth in private sector debt.

The other possible channel for excess credit growth and money creation has been to balloon a massive denial rally in Thailand’s stock market as measured by the SET (stockcharts.com) since the post New Year crash of 2014.

In sum, Thailand’s central bank intends to prevent a surge in NPLs from becoming a systemic risk by keeping interest rates low. The Thai central bank may also be desiring to keep the construction boom (or even the stock market boom) afloat in order to maintain the picture of positive statistical growth.

The question is how feasible and lasting will this be? Without productive growth, there will be lesser resources generated to pay for existing liabilities. Worst, zero bound rates will induce more borrowing, which should add to Thailand’s debt burden.

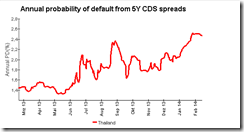

The rallying baht and sinking yields has given the impression of a relief in “inflation” pressures, thus justifying the trimming of official rates.

But my guess is that Bank of Thailand (BoT) may have partly used her foreign currency reserves to attain such picture of calm. The BoT’s forex reserves has shrank from July 2013 which adds to the earlier decline.

In short, the BoT applied financial band aids to what has been a debt cancer.

Nonetheless with even more borrowing for households to speculate, which will be also manifested in her elevated money supply figures, the pressures on the baht will resurface in the near future, and so will such be reflected on the inflation data as well as in her bonds via rising yields.

As one would note, like all the rest of her peers, the Thai central bank thinks that policies that promote and support debt will solve their nation's economic problems. The problem is these officials keep applying the same panacea without generating the desired results, so they keep on adding more. Either this or they are just kicking the proverbial can down the road.

Yet the problem with “kick the can” policies is that this only increase the imbalances in the system that magnifies the potential harm from a blowup.

For central banks, one must provide more alcohol to solve the problem of alcoholism.