Back to my JGB-Japan debt crisis watch.

The Japanese financial markets are back into their natural state: stable instability.

The JGB yields of 5, 10, and 30 year maturities have all been trading higher as of this writing

I will not say that this has been due to the Bernanke 2014 taper.

Intraday 10 year JGB yields opened low (even when the US Treasury counterpart zoomed) and seesawed steeply between the .81+% and .85+% twice.

As of this writing 10 year yields are near the peak of the trading session.

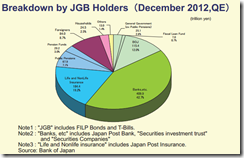

The latest update on outstanding JGBs reveals of an increase of 5.3% to ¥969.12 trillion, with the Bank of Japan’s (BoJ) holdings hitting an all time high of ¥127.88 trillion at the end of March, up 43.8% from the previous year. (Japan Times) The BoJ’s share of total JGBs now accounts for 13.2% as against 12% in December 2012 as shown above as per Japan’s Ministry of Finance

The report also says that JGB holdings by overseas investors grew 6.5 percent to ¥81.55 trillion, also a record high as of the fiscal yearend, the BOJ said.

While foreign punters increased their JGB holdings, cash rich resident Japanese appear to be in a “capital flight” mode

From the Bloomberg,

Japan’s companies stockpile of cash reached a record in the first quarter as they poured investment abroad, underscoring Prime Minister Shinzo Abe’s challenge to boost the nation’s investment and wages.Private companies’ cash and deposits rose 5.8 percent from a year before, to 225 trillion yen ($2.4 trillion) -- an amount in excess of the size of Italy’s economy or the liquid assets held by American firms, Bank of Japan data showed in Tokyo. Businesses held 55 trillion yen in direct investment abroad.The cash and deposit holdings of Japan’s non-financial companies reached a record in the January-to-March period, according to BOJ figures dating back to 1979. The $2.4 trillion equivalent compares with the $1.8 trillion in liquid assets -- such as cash, deposits and money-market fund shares -- held by nonfinancial U.S. firms, according to Federal Reserve data.

So instead of domestic investments, in contravention to the desires of politicians, the Japanese are acting to preserve the purchasing power of their savings via overseas investments or placements.

And without investments to spur productivity growth, there will hardly be sufficient sources of funding for the towering debt which the Japanese government continues to accumulate.

BoJ officials publicly exhibit "confidence" on the supposed success of Abenomics. But such confidence does not seem to be shared by the people within the institution as insiders appear to be apprehensive over the chances of success of Abenomics.

This report from the Wall Street Journal reveals of the cracks in the officialdom promoting Abenomics: (bold mine)

But for bank officials tasked with making sure the bond market operates smoothly, things have been anything but smooth over the past three months, as they scrambled to tame wild swings in bond yields triggered by the BOJ’s decision in April to double its already massive purchases of Japanese government bonds.“They seem real desperate, asking us what they can do to contain the situation,” an official at a Japanese trust bank said recently.“Mr. Kuroda comes across as being unfazed by the rises, but those at the Market Operations Division are determined to push them down,” added the official who declined to be identified, given the bank’s relationship with the BOJ.The three-dozen officials at the BOJ’s Market Operations Division have suddenly found themselves in the spotlight after the bank, under Mr. Kuroda’s leadership, adopted bold monetary loosening measures in early April.

And anxious they should be.

Wild vacillation of the JGBs has also been reflected on the Nikkei which slumped 1.74% today.

Asian markets hemorrhaged badly today from a combo of interest rate risks factors seen via unstable JGBs, the spike in US treasury yields and the bedlam over at China’s credit markets

ASEAN bond markets likewise bled today. Today’s actions appears ominous to my recent warnings that the Philippine bond bubble is an accident waiting to happen

Europe’s stock markets as of this writing are also in deep red.

The French 10 year yield has also skyrocketed as of this writing.

Four of what I see as the very critical bond markets (Japan, France, China and the US) appear to be in varying degree of seizure.

And these has upset a broad spectrum of risk assets from stocks to commodities across the globe.

If the steep gyrations in the global bond markets are sustained, then the previous booms will metastasize into a global debt crisis sooner than later.

No comments:

Post a Comment