The usual or conventional way to spin or rationalize a bubble is to embellish or sell them as “growth”.

And that’s the way media treats the outrageous valuations of the small cap Russell 2000 which I earlier discussed

And that’s the way media treats the outrageous valuations of the small cap Russell 2000 which I earlier discussed

Media says that since robust revenues from Russell 2000 companies depend on domestic demand, then the booming Russell 2000 heralds a strong economic recovery.

From Bloomberg:

Gains in smaller companies that are more dependent on U.S. growth show investors are betting the world’s largest economy will pick up even after jobs growth slowed and the government shutdown weighed on gross domestic product. Smaller firms are surpassing analyst earnings estimates by more than Dow (INDU) companies and are forecast to grow faster next year….

The average company in the Russell 2000 gets 84 percent of its sales from the U.S. and is valued at $972 million, compared with 55 percent and $152 billion for the Dow, data compiled by Bloomberg show.

And this trend supposedly should support the current bull market.

Smaller companies usually climb faster at the start of a bull market, making them a proxy for future economic activity. The Russell 2000 was up 71 percent in the first six months of the 2009 rally, compared with a 46 percent advance in the Dow. This year’s outperformance is occurring almost five years after stocks started rallying, signaling the economic recovery will accelerate from what has been the slowest rate since World War II….

Small-cap gains of this size have proven prescient in the past. They preceded faster economic growth and a broader stock market advance in 2003 and 1991, and coincided with them in 1979. The Russell 2000’s outperformance in 2003 was at the start of the last equity bull market, when the S&P 500 more than doubled from October 2002 through October 2007. GDP expanded at the fastest rate in four years in 2004.

To be balanced, the article did allot 3 short paragraphs to some critics, but almost the entire article has been framed to convey "bullishness".

For instance, they presented the National Federation of Independent Business’s optimism index which I used last Sunday on the side of the bulls. But if one would note of the actual quote by the NFIB, bullishness has hardly been the message.

Let us put into perspective the article’s allegation that outperforming stocks of smaller companies serves as harbinger to “the start of the bull market”

For instance, they presented the National Federation of Independent Business’s optimism index which I used last Sunday on the side of the bulls. But if one would note of the actual quote by the NFIB, bullishness has hardly been the message.

Let us put into perspective the article’s allegation that outperforming stocks of smaller companies serves as harbinger to “the start of the bull market”

The above represents the 3 year trend of the S&P 500

Based on the chart from bigcharts.com which compares the S&P 500 relative to the Russell 2000 over a ten year period, the Russell 2000’s shocking vertical climb, which has severely outclassed the S&P, seems like a manic episode.

And instead of a “start of the bull market”, the consequence based on past behavior of the RUT-SPX has been the opposite:

Each time the RUT pulls away from the S&P as in the case of 2007 and 2011 (green ellipses), what followed has been significant retracements (2011), if not a bear market (2007).

The same dynamic can be seen in the RUT-Dow Jones Industrials chart.

But there is more…

Notice that the spread—between RUT on the one side relative to the S&P and Dow Industrials—have not only been in an unprecedented widening, but the intensifying variance has also signified unparalleled duration.

In other words, at NO time in the last 10 years have we seen such a massive departure by the RUT vis-à-vis the SPX and the Dow in terms of relative variance of stock price performance for an extended period of time!

So while for the bulls, the above represents "this time is different!", but if past were to rhyme, today’s manic phase suggests of a coming major retrenchment. It's now a question of until when FED policies will be able to extend maintaining such massive imbalances.

Let’s go back to fundamentals…

Again recent surveys has not supported such incredibly wild optimism.

The July survey by Wells Fargo optimism improved (highest since Great Recession) but “recovery has been slow”

However according to an October survey by the Wall Street Journal, small business sentiment has materially deteriorated!

Of 692 business owners surveyed online between Oct. 7 and Oct. 16, 36% said they felt the economy was improving, down from 47% in September. Just 21% said they expect conditions to pick up in the year ahead, down from 30%, according to the survey, which was conducted before Congress reached an agreement on Oct. 17 to reopen federal offices. The survey was limited to firms with less than $20 million in annual revenue.

Overall, the WSJ-Vistage Small Business Confidence Index dropped to 97 from a record-high 105.3 in September, though it is up from 95.3 a year ago. The monthly index is based on survey responses to issues ranging from economic conditions to hiring and spending plans. The index had remained above 100, its baseline score, since February….

A separate survey of more than 600 small and midsize businesses, released Wednesday by the Principal Financial Group, also found that small-business owners are keeping spending tight. While two-thirds of owners said they had surplus capital, 75% said they aren't spending it, the survey found. Most owners blamed the spending slump on health-care costs and the unsteady economy.

So we have a parallel universe, soaring RUT while real business sentiment and activities reflect on apprehensions over the future.

Recent economic data supports these anxieties. Factory output in the US in September reportedly rose less than expected along with a slump in the pending sales of US housing

Recent economic data supports these anxieties. Factory output in the US in September reportedly rose less than expected along with a slump in the pending sales of US housing

From another Bloomberg article:

Factory output rose less than forecast in September and contract signings for U.S. home purchases fell the most in three years, showing the economy was having trouble gaining traction before the government shutdown.

The 0.1 percent advance in manufacturing followed a revised 0.5 percent gain in August that was smaller than initially estimated, figures from the Federal Reserve showed today in Washington. Pending sales of previously owned homes slumped 5.6 percent in September, the fourth straight month of declines, the National Association of Realtors reported.

So how will unimpressive factory output translate to explosive earnings growth for SMEs?

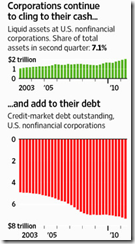

Also non-financial companies hold record cash even as they pile up on debt.

Nonfinancial companies held more than $2 trillion in cash and other liquid assets at the end of June, the Federal Reserve reported Friday, up more than $88 billion from the end of March. Cash accounted for 7.1% of all company assets, everything from buildings to bonds, the highest level since 1963.

So this squares with the October small business survey where “small-business owners are keeping spending tight”.

If small and medium firms have been dithering on capital spending, which should translate to future revenues, I wonder where will small businesses of the Russell 2000 get their profits to justify such stupefying valuations?

If small and medium firms have been dithering on capital spending, which should translate to future revenues, I wonder where will small businesses of the Russell 2000 get their profits to justify such stupefying valuations?

The trouble with fiction... is that it makes too much sense. Reality never makes sense.

No comments:

Post a Comment