The US-Indonesia rupiah pierced on the 12,000 psychological threshold today

Intraday, the US-IDR closed at the highest level

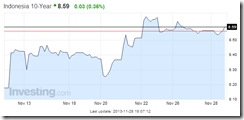

Indonesia’s LCY 10 year bonds also fell again at the last minute.

Indonesia’s officials dismissed concern over the rupiah’s unhinging noting that this would “help local manufacturers increase their exports”

Unfortunately Indonesia’s stock markets hardly seemed to agree as the JCI slipped, albeit modestly.

The falling rupiah which means higher CPI inflation also extrapolates to a significant distortion of economic calculation for commercial or business enterprises. For instance in response to popular clamor, the Indonesian government pushed up minimum wages significantly, although varying at local levels.

Higher minimum wages means an increase in input costs which erodes on any advantage from a weaker currency.

This hasn’t just been an Indonesian story.

Thailand surprisingly cut interest rates yesterday which spiked up local stocks yesterday.

Unfortunately the zero bound rates policy appears to have only an overnight magical impact as the Thai SET fell by 1% today.

The good news is that the IDR plunge has not triggered a panic. Yet it remains to be seen how ASEAN financial markets will react if the rupiah and or if Thai’s stocks continue to substantially decline.

Risks remains very high.

1 comment:

Hi Benson,

Thank you for sharing information about USDIDR.

We are predicting that USDIDR would reached 12k around December. However, outflows from Indonesian assets has brought it earlier than we think.

With Fed tappering issue still hanging around the cloud we are now expecting the USDIDR to reach at least 12,200 in near future.

The USDIDR may calm a bit, around the middle of next year. Hoping that Indonesia's export to U.S will increase significantly.

Post a Comment