The big men of the Street are as prone to be wishful thinkers as the politicians or the plain suckers. I myself can’t work that way. In a speculator such an attitude is fatal. Perhaps a manufacturer of securities or a promoter of new enterprises can afford to indulge in hope-jags.– Edwin Lefevre Reminiscences of a Stock Operator

It would seem as blissful ignorance or complicit negligence for the mainstream and their favored experts to treat the bear market as mere technical definitions

The Philippine Phisix technically touched the bear market territory last week to post a 21.6% decline. The local benchmark hit a low 5,789.06 on June 25th from its May 15th peak at 7392.2.

The bear market comes in the light of an equally stunning 11.12% bounce over the past three days which recovered about 57% of the previous losses.

Along with the previously hammered equities ASEAN peers, the Phisix posted an amazing weekly gain of 4.58%.

The past two weeks has so far been validating my concerns.

Two weeks back I wrote[1],

What I am saying is that unless the upheavals in global bond markets stabilize, there is a huge risk of market shock that may push risk assets into bear markets.

Markets will remain highly volatile, however as previously noted, volatility will go on both direction but with a downside bias, unless again, global bond markets are pacified.

I believe that such dynamic, viz. sharp volatilities in both direction but with a downside bias, will remain as the dominant theme going forward, unless again, the turmoil in the global bond markets will subside and stabilize.

Bear Market, Bear Market Cycles and Media Partisanship

A bear market is technically defined by investopedia.com as a “downturn of 20% or more in multiple broad market indexes…over at least a two-month period.”[3]

I will add to this the bear market cycle which, for me, represents a process of declining prices that accrues to losses of 50% or more over time period of a year or more.

In short, there is a difference between technicality (bear market) and trend (the bear market cycle).

This lays out the Php 64 billion dilemma: With this week’s foray into the bear market territory, will the Phisix transition to a bear market cycle?

This seems a question no one bothers to answer.

For every transaction there is a buyer and a seller. This means that the aggressiveness of either the buyer or seller sets the direction of changes of the prices of securities. Higher prices means buyers are more aggressive and vice versa.

But media has a different interpretation of events. They put color or moralize into the actions of the marketplace. If stock prices go down, based on the expert quotes, then these have been blamed on extraneous factors such as foreigners, irrationality and mere emotional kneejerk responses. In short, sellers are rogue, dumb and impulsive actors.

However if prices goes up then they are imputed to ‘fundamentals’, which implies of sensibility and rationality. Buyers are smart, sane and right.

This is a classic example of sell-attribution bias[4] at work: success attributed to skills and failures on bad luck.

But there is a darker implication to this; media politicizes the stock markets by implicit discrimination of the actions whom they are opposed. They see that the only righteous path for the Philippine asset class has been up up and away! To question the doctrines of bubbles is blasphemy.

The succession of heavy market losses has begun to impact on the public’s psychology. Early this week, media quoted a sell-side “expert” who claimed that he was bearish technically but still bullish fundamentally. First signs of crack?

The next day, after the Phisix plumbed into the bear market zone, which constituted the fourth consecutive series of steep 2.5+% losses, ironically and unbelievably, the Inquirer.net in the front page (though at the lower corner) declared that Philippine stocks as “officially entering the “bear” market”[5] without a single quote from experts!

It is hard to believe that this has just been about the rush to beat the deadline or the lack of interests by experts to rationalize.

With markets repeatedly disproving media, the latter’s credibility continues to shrink and importantly, it is further evidence of their deep confusion over the ongoing developments. This also reveals of their partisan reportage or how media have become effective unofficial mouthpieces for vested interest groups

Yet such eerie moment of silence proved to be a point of “capitulation” that inspired the resounding 11.2% 3-day rally.

Once the gigantic rally has been set motion, the whole rigmarole of the so-called “fundamental” based “I told you so” platitudes, emanating from experts who never saw this coming, populated the airspace anew.

This seems proof of the reflexive action of markets at work. If losses should continue to mount, then the eroding credence of the bullish dogma will only deepen. Losses will influence expectations (as shaped by prices) and outcomes (as shaped by actions).

Most importantly, seemingly lost on all the discussions is the most crucial question—if “entering” bear market has merely an aberration or a transition to a general trend of even deeper losses?

2007-2008 Phisix Bear Market Cycle

This brings us now to our inquiry on how the Phisix responded to during historical accounts of incursions into the bear market.

Will the following headlines give you the impression that the Phisix has been into a bear market?

2007 1st half earnings of PSE-listed firms up 41.4% at P148.75B[6] September 2007

Philippine peso closes 2007 as strongest Asian currency[7] January 2008

Economy grew 7.3% in 2007, fastest in 31 years[8] January 2008

It is fait accompli to say that despite all these appearance of popular sanguinity, the Phisix did fall into a non-recession bear market in 2007-8 predicated on a US financial crisis that rippled across the globe.

The above news accounts were made during the onset of the bear market cycle.

The Phisix lost a staggering 56% from the October 2007 high which culminated with a capitulation panic in the post Lehman bankruptcy in October 2008. The bear market cycle lasted for a one year despite numerous “denials”, or what is popularly known as “relief” rallies (red arrows).

I see bear market bounces as “denials” of reality by the bulls.

In late 2008, the Phisix had a 4-month bottoming period which became the staging point for today’s high octane bullmarket.

The popular talk then had been how “diversified” the Philippine economy was, which should have “insulated” the Philippines from a global storm, where according to the mainstream the Philippines will hardly fall into a recession.

Technically the idea of a non-recessionary impact on the Philippine economy was correct. But fundamentally this has been misguided.

“Correct” because the Philippines posted positive statistical growth[9] throughout the crisis, but basically “misguided” because the political meme where the “Philippine economy turned in its best performance in 31 year” collapsed in barely a year, but not enough to reach negative growth.

Different administrations, but same sloganeering.

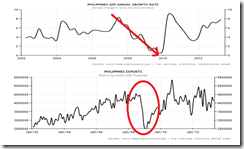

One of the basic channels of the collapse, aside from the Phisix and the financial sector, had been in the export sector[10].

If there had been a wager between the bulls and the bears, in terms of recession, the bulls would have won it, not by reasoning, but by sheer luck. Such luck was handily provided by the accompanying massive bailouts, both from the fiscal and from the monetary fronts, from governments of most of the major economies of the world.

The efficacy and longevity of this “luck” as seen via the US$10+ trillion in central bank asset expansions and ballooning public debt appear as being tested today.

Paradoxically, the degree of equity losses of a non-recession bear market in the Philippine Phisix and the epicenter of the 2007-8 crisis, the US, via the S&P 500 has almost been identical, 56% and 57% respectively.

Usually for (ex-US) crisis stricken economies, equity losses would have reached anywhere between 70-90%.

While the Philippine statistical economy nosedived, profits of listed companies did pullback in 2008 by a substantial 29%. But this supposedly comes from a “banner year for the economy and for many corporations” (according to the former PSE president)[11] where profits posted record highs in 2007. The revenues of publicly listed companies even grew by 12.8% as profits fell in 2008.

In the Philippine Stock Exchange during the 2007-2008 bear market cycle, there hardly had been any single issue that withstood the wrath of the bears, as a majority of blue chips fell by over 50% and third tiers collapsed in the range of 70-90%[12].

Succinctly put, markets hardly appear to differentiate between “fundamentals”.

Yet such are same fundamentals that are being brandished as justifications for further inflation of the domestic asset bubbles.

But there is a “fundamental” difference between 2007-2008 relative to 2013, which mainstream has been blind to or continues to dismiss or ignore: The Philippine economy was less leveraged then than is today.

If the current asset meltdown has failed to stem the rate of growth of credit, then by the end of this year, the ratio of credit relative to statistical economy would reach or may even surpass the 1997 Asian crisis levels. Such threshold would indicate of increasing fragility to an environment of monetary tightening.

And despite the market stresses, the BSP reports of unhampered rate of bank lending growth this May[13]. General banking credit expanded by 13.3% year on year, almost double the rate of economic growth, with critical areas continuing to post substantial unsustainable rate of growths; such as construction, real estate, trade (wholesale and retail) and financial intermediation at 51.22%, 24.31%, 13.04% and 13% respectively.

Such loan growth has been reflected on money supply growth[14] which also registered a 16.3% y-o-y growth this May, largely on Net Domestic Assets which has been underpinned by the increase in private sector lending by 15.4% over the same period.

Going back to the original premise of incursions to bear market territory, we can see that in 2007 prior to the transition to the bear market cycle, the Phisix practically erased all the losses from the bear market episode; such is the fury of the “denial” or relief rallies.

Unfortunately this would not be enough to curtail the comeback of the bear market that commenced in August of 2007.

The false breakout of October 2007 may have trapped many technical people.

This resonates with the current rally whether in the Phisix or in the Japan’s Nikkei which has also touched the bear market zone.

Bear Market Strains of 1987, 1989, 1994 and 1997

A somewhat similar story can be seen in 1994-1997.

In 1993 the Phisix posted a staggering one year nominal currency gain of 154%. This bullrun peaked in early January of 1994.

Then the initial appearance of the inroads to the bear market emerged with a 25% rout.

I call the 1994-1995 epoch a “quasi” bear market because the retracement levels from peak to the bottom had not reached the 50% loss threshold. Total loss over the said period was only 33%. It was not to be reckoned as full bear market cycle.

The half-baked bear market cycle has been characterized by 3 bear market technical strikes.

The third incursion of the bear market in 1995 incited a fierce rebellion by the bulls which lasted for a little over one year and posted a 49% gain. But this failed to break significantly beyond the 1994 highs, similar to 2007.

In between 1994-1997 there had been some false bullish signals (mostly reverse head and shoulders) which had been falsified. Eventually the “double top” prevailed. See how deceiving pattern watching can be?

I also call the 1994-95 bear market as the “the boy who cried wolf”. My view is that the markets have already been anticipating the crash of 1997, but hardly found the right outlet or timing to ventilate this. Thus the three bear market strikes yielded to a massive denial rally.

This 1996-97 rally eventually capitulated where the Phisix crashed by 69% in 15 months which was equally expressed via the Asian Financial Crisis.

The actions of the Phisix can be seen as resembling Thailand’s SET[15] the focal point of the Asian crisis.

The SET fantastically reached its zenith in 1994 following a dramatic bubble run. Notice that the SET soared by about 12x from 1986 through 1994.

The SET’s topping process seemed similar to the Phisix which was marked by highly volatile markets seen via several sharp bear market attacks and counter rallies which produced “lower highs and lower lows” through 1997 before the harrowing 85% collapse.

The SET in the 80-90s seems like a glorious example of Newton’s Third Law of motion[16]: To every action there is always an equal and opposite reaction. Whatever boom produced by monetary policies had essentially been neutralized or eradicated by a devastating economic bust which was compounded by a reduction of purchasing power via the devalued baht.

In short, the losses was even larger than the gains made by the prior bust where only a few benefited from.

Asset bubble bust, economic depression and the loss of purchasing power via devalued currencies[17] also applied to ASEAN majors including the Philippines.

Funny how despite the massive devaluation of the Peso, the only exports the Philippines has excelled on is human exports. This runs in contrast to the mercantilist concept which sees cheap currencies as driving exports.

The emergence of bear market episodes can likewise be seen in both the short term virtual bear market cycles of 1987 and 1989.

Both posted huge losses of 53% and 63% each which came in less than a year, particularly 5 months and 11 months, and had been consequences of political instability via coup attempts.

The “black Monday” US market crash of October 19, 1987[18] became an aggravating factor that spoiled the second denial rally of 1987.

Yet both had varying degrees of denial or relief rallies.

Other accounts of bear market (20% loss over 2-3 months) seizures were interspersed in the final capitulation phase of the 1997-2003 bear market cycle particularly in 2000-2002.

What concerns us today are the bear markets strains during market highs.

Recommendation: Don’t Ignore the Bear Market Warnings

In and on itself, these historical accounts would be insignificant without the understanding of how bubbles operate.

In the context of bubble cycles, ALL FIVE events where the strains of bear market surfaced during stock market highs (1987, 1989, 1994, 1997 and 2007) led to significant losses for the Phisix. Except for 1994, the rest transitioned into a full bear market cycle in differing scales and durations.

“Denial” rallies are typical traits of bear market cycles. They have often been fierce but vary in degree. Eventually relief rallies succumb to bear market forces. The denial rally of 2007 virtually erased the August bear market assault but likewise faltered and got overwhelmed.

History gives us clues but not certainties. The reason for this is that people hardly ever learn from their mistakes.

From the above perspective, it would seem as perilous, dicey and mindless to disregard the potential adverse impact of the reappearance of the bear market that magnifies the risks of a transition towards a full bear market cycle.

Unlike populist notions that bear markets have been devoid of “fundamentals”, bear market signals are symptoms of underlying pressures from maladjusted markets and economies or even strains from politics. The former two symptoms are more representative of today’s conventional markets here and abroad, while the political factor was largely behind the 1987 and 1989 bear market cycle.

The mainstream’s citation of statistically based “fundamentals” serves as convenient justifications for personal biases and interests rather than objective risk analysis.

In reality, market actions have been driven by either fear or greed in response to diverse phases of the policy induced bubble cycle. During bull markets people use “fundamentals” as pretext to herd into the bidding up of asset markets, whereas during bear markets people stampede out of asset markets regardless of valuations. All the rest have been narrative fallacies supplied by media to a gullible throng in search of confirmation of their biases.

Beyond the ken of popular wisdom has been one of the major engines of today’s markets: the policy of negative real rates. Negative real rates founded on highly flawed economic theories have been designed to promote consumption by punishing savings and rewarding the vicious cycle of credit expansion that has underpinned the speculative excess, the grotesque mispricing of asset markets and of the flagrant misallocation of resources. The corollary from such imbalances has been the disorderly and chaotic exits and the subsequent economic depression. Thus the business cycles. Other interventionist policies such as the increasing government spending (funded by taxes debt or debt) also compounds to systemic fragility as the genuine economic forces are being crowded out.

“Fundamentals” tend to flow along with the market, which is evidence of the reflexive actions of price signals and people’s actions. Boom today can easily be a recession tomorrow.

A consoling factor has been that the stock markets of Thailand and Indonesia has not fallen into the bear market zone…at least not yet. If these three major ASEAN markets will synchronically submit into the domain of the bears, then the bigger the risks of a full bear market cycle.

Ultimately it will be the global bond markets (or an expression of future interest rates) that will determine whether this week’s bear market will morph into a full bear market cycle or will get falsified by more central bank accommodation.

Philippine Bond Markets Feel the Heat, Unstable Global Bond Markets

So far developments in the local bond markets have hardly been encouraging since they appear to be moving in the direction as I expected.

Two weeks back I wrote[19]

Remember, the yield of the 10 year Philippine bonds seem to suggest that her credit risk profile has been nearly at par with Malaysia and has (astoundingly) surpassed Thailand, which for me, signifies as a bubble.

And as I have earlier pointed out, the interest rate spread between the US and Philippines has substantially narrowed. This reduces the arbitrage opportunities and thus providing incentives for foreign money to depart from local shores to look for opportunities elsewhere or perhaps take on a home bias position.

The EM and ASEAN bond markets are highly vulnerable to market shocks.

Well Philippine 10 year bonds[20] have sold off (yields spiked) last week even as stock markets took a sudden leap of faith.

Friday, the Asian Investor[21] noted that the “level of risk aversion was typified by a 30 cash-point drop of longer-dated Philippine sovereign paper” which actually signified “a race by portfolio managers to secure liquidity in preparation for redemption requests from bond fund investors.” The same article notes of a swift drying up of liquidity in the Asian bond markets.

What this means is that the bond vigilantes have landed on ASEAN shores! If the global bond market carnage continues, ASEAN will also bear the brunt of a bond selloff.

And despite the seeming calmness in the equity markets, the mayhem in global bond markets has spurred many central banks to dispense of “record amount of US debt”. This week, bond funds from the US and emerging markets also “suffered their biggest investor withdrawals on record”[22]

So the pressure on the global bond markets has hardly stabilized.

Rising interest rates via higher bond yields have hardly been evidences of economic strength as rising premiums of Credit Default Swaps (CDS), as shown by the chart above[23], indicates of mounting default risks.

It would be misleading to dismiss the threat of default risks by comparing 2008 with that of the current levels and imply of “low” risks. Three months back there were hardly any tremors seen on these CDS markets. The use of anchoring and contrast effects has hardly been helpful in ascertaining in the direction of markets.

In reality, those charts are indicative of a recent change, albeit a negative one. Whether such deterioration will continue or not, will hardly be foretold by the past records but by future actions of market participants.

The other aspect revealed by these charts is that the negative changes or rising default risks has been happening across different nations albeit at variable scales. Said differently, there have been multiple hotspots for potential bond market seizures.

A more important chart that should compliment the expanding menace of credit default risks is the growth of systemic credit in major economies as shown above,

As the Bank of International Settlement rightly points out[24]:

Instead, the debt of households, non-financial corporations and government increased as a share of GDP in most large advanced and emerging market economies from 2007 to 2012 (Graph I.2). For the countries in Graph I.2 taken together, this debt has risen by $33 trillion, or by about 20 percentage points of GDP. And over the same period, some countries, including a number of emerging market economies, have seen their total debt ratios rise even faster. Clearly, this is unsustainable. Overindebtedness is one of the major barriers on the path to growth after a financial crisis. Borrowing more year after year is not the cure

As a reminder, every economy is like a thumbprint, they are distinct. Market size, scale and freedom, comparative advantages or patterns of trades, political and legal institutions, direction of policies, culture, infrastructure, financial system capital markets and many more variables makes them heterogeneous like individuals.

This means that each nation will have different capability and willingness to take on credit, and thus, risk profile differs. Alternatively this means that there is no line in the sand for a credit event to happen as experts project them to be.

The point being: interest rates and default risks can function as feedback loop mechanism. Should rising interest rates increase the perception of default risks, then growing risk aversion would lead to the tightening credit standards and higher interest rates and vice versa.

For a system that has accumulated high degree of imbalances based on previous credit expansions, realized defaults will only amplify the process.

Again until the global bond markets are stabilized, current environment remains basically unfriendly or unfavorable to risks assets. If equity markets continue with their ascent in the backdrop of sustained rioting of global bond markets then this can be analogized as the cartoon character Wile E. Coyote ignorantly running off the cliff and finally realizing that there is no ground underneath him.

Trade with extreme caution.