In the US, IPOs have now become a craze.

This intro from a mainstream USA Today article captures the zeitgeist: (bold mine)

Investors are buying up just about anything with a ticker symbol, and that frenzy certainly includes stocks that are brand new to the market.

IPOs have metastasized into a centripetal force for wild and rampant punts… (bold mine)

The performance of IPOs is starting to hit the kind of feverish pitch not seen since the last market peak in 2007, and it even has hints of the IPO heyday of the 2000 dot-com boom. The signs:First-day pops. Container Store's first-day return is certainly one to remember, rising 101% from its $18 a share IPO price to $36.20 a share. Container Store was the fifth IPO to double in its first day of trading this year, the biggest year for 100% one-day jumps since 78 did it in 2000. Seeing stocks double on their first day has become rare. During 2012, just one IPO, a company named Splunk, doubled on its first day, said Jay Ritter, professor of finance at the University of Florida. No IPOs doubled on their first day in 2009, 2008 or 2007, Ritter said. IPOs on average have gained 16% on their first day this year, Renaissance said, the highest in at least a decade…Already this year, 182 companies have seen their shares start trading, up 50% from this point last year, said Renaissance. This coming week week of 11/4, 10 IPOs are expected to hit the market, including the much-anticipated online message service Twitter. At the current pace, there could be 220 IPOs in 2013, making it the busiest year for IPOs since 2000 by topping the 217 deals in 2004, Renaissance said.

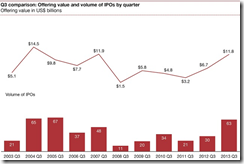

Volume and number of IPOs in the US has now equaled or surpassed the 2005 highs according to the chart from PWC. The above represents 3rd quarter data which means given the current incredibly strong momentum, this would be so much higher.

I have previously pointed out “The scrapping for yields has impelled many to jump on the IPO bandwagon despite poor track record of newly listed companies”. The IPO mania only validates my view where market activities have increasingly been detached with ‘fundamentals’. Market participants see only one direction for stock prices; up up and away.

By flagrantly pushing up prices for the sake of momentum and for adrenaline boosting short term punts, they have virtually ignored or dismissed all forms of risks

With 100% one day returns, the appropriate metaphor for the IPO mania is that everyone is a scalper or a day trader now.

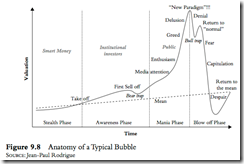

IPOs are useful sentiment indicators as these give us hints on the whereabouts of the stages of the stock market cycle.

And the late stock market guru Sir John Templeton was right when he warned that the "time is different" represents the four most dangerous words on investing as they account for popular delusions.

Yet while the mania may continue and even accelerate or intensify, what is unsustainable won't last.

No comments:

Post a Comment