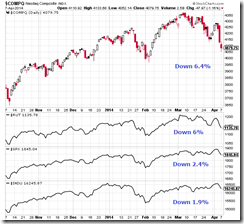

While the recent declines in major US stock indices looks like just another typical “buy the dip” correction, market breadth appears to exhibiting signs of deterioration.

The average US stocks, according to Bespoke Invest, has been down by an average 12.8% from their recent 52-week highs.

By size category. Small caps have been the biggest losers. I suspect that this may be in proportion to the earlier gains.

By sector. Of the 10 sectors, half have fallen below the average. I have no clue yet whether the current degree of declines by each sector have reflected on the scale of their earlier gains. But recent declines seem as largely broad based with exception of the Utilities

Nevertheless the Nasdaq Biotechnology index has been down by 17.04% as of last night and seems to be knocking at door of the bear market. If the biotech falls into a bear market will it drag the rest? Or will it be the other way around, where stocks of major composites buoy the Biotech away from the grasp of the bear market?

We will see soon if these have merely been a shakeout or an inflection point

Interesting developments.

1 comment:

On Monday April 7, 2014, The see saw destruction of fiat wealth got strongly underway as Aggregate Credit, AGG, traded higher as the Interest Rage on the US Ten Year Note, ^TNX, traded lower to 2.70%, and as World Stocks, VT, were led lower by Solar Energy, TAN, Uranium Producers, URA, China Technology, CQQQ, US Infrastructure, PKB, Social Media, SOCL, Resorts and Casinos, BJK, Transportation, XTN, Global Industrial Producers, FXR. IPOs, FPX, Nasdaq Internet, PNQI, Retail, XRT, Consumer Services, IYC, and Small Cap Consumer Discretionary, PSCD.

Energy Producers, XOP, traded lower, on a lower price of Oil, USO.

Global Financials, IXG, were led lower by the National Bank of Greece, NBG, Stockbrokers, IAI, Investment Bankers, KCE, and the Too Big To Fail Banks, RWW.

Nation Investment, EFA, was led lower by Egypt, EGPT, Russia, RSX, Russia Small Caps, ERUS, China Industrials, CHII, China Small Caps, ECNS, German Small Caps, GERJ, Greece, GREK, and the Russell 2000, IWC.

The failure of credit has commenced, and is seen in Retail, XRT, US Infrastructure, PKB, Consumer Services, IYC, Small Cap Consumer Discretionary, PSCD, such as the Automobile Dealers, the Credit Service Companies, MA, V, AXP, DFS, Asset Managers, BLK, AMG, Stockbrokers, IAI, Investment Bankers, KCE, the Too Big To Fail Banks, RWW, and the German Small Caps, GERJ, Greece, GREK, the Russell 2000, IWC, trading flower.

The Small Cap Growth, RZG, and the Large Cap Growth, JKE, are leading the Small Cap Value, RZV, and the Large Cap Value, JKF, lower, as is seen in their combined ongoing Yahoo Finance chart.

Utilities, PUI, are topping out on the trade lower in the Interest Rate on the US Note, ^TNX, to 2.70.

Greed has turned to fear as investors with selling out of consumer stocks and credit intensive stocks on the exhaustion of trust in the world central banks monetary authority. Risk-on investing has turned to risk-off investing.

The world has passed through an inflection point. Inflationism has turned to destructionism. As is seen in Ephesians 1:10, Jesus Christ, operating in the economy of God, has pivoted the world out of liberalism, meaning freedom from the state, where the investor was “free to choose”, to the new normal of authoritarianism, where the debt serf is required to comply.

Bible prophecy of Revelation 13:1-4, foretells that out of soon coming Eurozone Club Med credit crisis, regional economic fascism will rise to govern the world as the Beast Regime with its policies of diktat and debt servitude, replaces the Creature from Jekyll Island with its policies of credit and investment choice.

Post a Comment