Some people have decided that the Philippine equity benchmark, the Phisix, should close either 1% or more or at 6,700 level and above for the last trading day of April.

Today’s session was generally buoyant, so the last minute "marking the close" contributed only about 20+ points or only about a third of today’s 1.08% gains.

I ran a check on which sectors or issues delivered the goodies.

The service sector turned out to be hotshot even as most industries climbed higher towards the bell.

And it turns out that PLDT which has 52.64% of the service sector weighting was today’s most valuable player. (charts from colfinancials) PLDT gained 2.2% today. PLDT's weight in the Phisix as of today's close 11.65. So those who wanted to meet today's target focused their last minute bidding up on one big heavyweight.

Well, today’s “marking the close” represents the second end of the month occasion for the year.

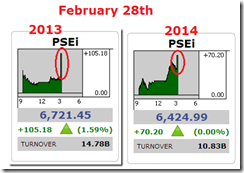

The Phisix had one last February which eerily resonated with also February of 2013.

And importantly, market actions since December of 2013 appear like a déjà vu compared with the furious run-up from December 2012 to end of May 2013. Aside from marking the close, even dates of correction and the parabolic moves resonate.

The difference is that volume in today’s last minute push has been significantly smaller than the February 2013 and February 2014 counterparts.

The Phisix tried to correct this week, but the bulls would have none of it.

Yet today’s actions magnifies the signs of the escalating mania or the "one way trade".

As I noted this weekend…

the Phisix remains in a ‘one way’ upside trade. The consensus has taken stock in the belief that there is no way for Philippine stocks to go but up up and away (!)—in spite of the headwinds of the falling peso and growing interest rate risks.

While the bulls will see this as positive, I would assert otherwise; a healthy uptrend won’t need the managing of the ticker tape. Instead such shows of the growing signs of desperation to bring back the outlandishly mispriced and overvalued equity markets to the bull market marked by easy money conditions last year. The peso closed today at 44.6 against the US dollar, slightly off last Friday’s close at 44.645

Will the current cycle be a replay of 2013? Will it be different?

This is just in: The BSP announced the 9th consecutive month of 30+% money supply growth, specifically 34.8% for March! The longer this takes the greater the risks of devastation from the inflation Kraken or Godzilla.

1 comment:

You write inflation Kraken or Godzilla.

I comment first Godzilla, then Inflation Kraken

Post a Comment