Nothing can now be believed which is seen in a newspaper. Truth itself becomes suspicious by being put into that polluted vehicle. The real extent of this state of misinformation is known only to those who are in situations to confront facts within their knowledge with the lies of the day. I really look with commiseration over the great body of my fellow citizens, who, reading newspapers, live & die in the belief, that they have known something of what has been passing in the world in their time; whereas the accounts they have read in newspapers are just as true a history of any other period of the world as of the present, except that the real names of the day are affixed to their fables. –Thomas Jefferson

In this issue:

Phisix: The Showbiz Political Economy and the Showbiz Financial Markets

-The Philippine Showbiz Political Economy

-Mainstream Media as Kingmakers

-Showbiz News#1: Government Infrastructure Spending will Boost The Economy

-Showbiz News#2: Improving Competitiveness and Economic Freedom

Phisix: The Showbiz Political Economy and the Showbiz Financial Markets

In the world of politics, various vested interest groups will always work to “capture” political or legal institutions to advance their interests.

The Philippine Showbiz Political Economy

And a manifestation of such dynamic would be the movements of authorities and the people from the industry affected by the legislation and regulation, otherwise known as revolving door[1].

In the US, revolving door relationships between regulators and the regulated has mostly been evident between the bureaucracy[2] and Wall Street and also in the defence industry[3].

To cite some examples, former Federal Reserve chairman Alan Greenspan has reportedly taken advisory roles in PIMCO, Deutsche Bank and hedge fund Paulson & Co[4]. Former US Secretary Tim Geithner has reportedly assumed presidency of a Wall Street private equity firm[5]. Mr. Geithner’s predecessor Henry ‘Hank’ Paulson served as Chairman and CEO of the influential Goldman Sachs before assuming the Treasury post[6]. Former Harvard President and Eight Director of the National Economic Council under President Obama, has reportedly been employed with a hedge fund, also a special adviser to a venture capital firm and has joined the board of P2P lending company[7]

The regulated become regulators, or vice versa, the regulators become the regulated. There are many reasons why for instance former regulators join the industry after their term, it can be about expertise, reputation, insider network/connection, and as lobby force. This applies to the opposite as well—industry people becoming regulators.

The essence of the revolving door politics, aside from the capture aspect, is that such are hallmarks of the axis of power politics.

In the Philippines, revolving door has been conspicuous not in the bureaucracy but rather in elective positions. Many from mainstream media, usually celebrities, end up with positions from almost all levels of the political spectrum through direct participation in electoral politics. When some of the celebrity politicians retire, some go back to media. Aside, some politicians marry media celebrities where the latter become partners in their political careers. Some politicians contract celebrities during campaign period.

Such dynamic reveals that in the Philippines, the corridors of power politics have significantly been influenced by mainstream media through populism.

Mainstream Media as Kingmakers

Yet mainstream media’s role as the “fourth estate” or as “kingmakers” in Philippine politics has largely been unrecognized by the public.

Such role is important because what mainstream media airs or writes reflect on their self-interests. Although these have been framed to convey interests of the public, in reality they have not.

Take for instance certain media programs sell Orwellian themes as entertainment, collectivist slogans have been part of daily rituals for certain variety shows, and worst, people’s personal lives have become part of reality programs where personal relationships are now subject to audience lynching.

Such media activities, which appear like implicit indoctrination of the subjugation of the individual in favor of the state, helps shape the populist legal and political system. Today, mainstream media seemingly determines what is legally and politically correct and what is not.

Mainstream media’s deepening role as seeming agents for political interests groups reminds me of Niccolo Machiavelli, who because of his masterpiece “The Prince”, has earned disrepute or notoriety as advocate of evil and immorality via “Machiavellism”[8]. To the contrary, what Machiavelli did was to expose on the how devious real politics work. The reason Mr. Machiavelli wrote was in order show “the real truth of things than an imaginary view of them”[9] Apparently people prefer the imaginary and the romanticized view of politics.

Machiavelli says further that for politicians to rule they would need to have “have the good will of its inhabitants”[10]. And such goodwill should be propped up by praiseworthy qualities portrayed of a leader through generosity, compassionateness, faithfulness, courageousness, courteousness, chasteness/purity, simplicity, strong, decisive, religiousness and more. Sounds familiar?

Hasn’t it been a regular fare where media try to promote ‘political chasteness’ by rewarding or praising people who return lost valuable items? Yet while such actions are indeed commendable, returning lost valuables are vastly distinct actions from political decisions to distribute other people’s money. If government bureaucrat Z take property from C, to give to A rather than B (political distribution), how will this be the same as any average citizen returning to C his inadvertently misplaced property? But that’s the way media packages them.

And according to Machiavelli these traits are necessary for appearance, even if they are not attainable, “it would be most laudable for a Prince to be endowed with all of the above qualities that are reckoned good; but since it is impossible for him to possess or constantly practise them all, the conditions of human nature not allowing it, he must be discreet enough to know how to avoid the infamy of those vices that would deprive him of his government”. The bottom line is that to justify political distribution of resources via the barrel of the gun would extrapolate to a world of smoke and mirrors, something which media sells.

Nonetheless while mainstream media aggressively instil upon society of what it deems as righteous, the government resorts to shame campaigns against the informal sectors in order to collect taxes to feed on the insatiable spending appetite of politicians, the government also institutes edicts that curtail economic activities (see below), intervene with household affairs, media also cheers on the government’s bubble blowing policies, as well as, other forms of political redistribution be it infrastructure and or other welfare spending supposedly to promote growth.

The mechanical solution by media and their experts on social ills can be reduced the following premises: replace personalities in question (personality based politics), throw money at the problem, and or prohibit, tax and or regulate those whom have been publicly denounced by media as politically incorrect.

Yet all these signify as simplistic short term knee jerk responses with unforeseen long consequences. Such is the great French economist Bastiat’s distinction between the bad and good economist, where the former focuses on what is seen and the latter on what is unseen.

As I said before, media’s perception of economic growth can be analogized as one minus one EQUALS two.

And acts to restrain economic activities means acts to inhibit civil liberties.

Yet in the world of politics, freedom is a right perceived to be applicable only to oneself, but not to the others. In the Philippine context, freedom is a privilege when you are part of the political class or the politically connected.

Showbiz News#1: Government Infrastructure Spending will Boost The Economy

What has this got to do with the stock market and financial markets? Everything.

Philippine financial markets are inclusive segments of the political economy, thus evolving political trends plays a significant role in ascertaining how resources will be distributed. Such factors will be reflected in prices of non-financial and financial markets. Contra media, all human action is interconnected.

Last Holy Thursday one media outlet raved about how a massive government spending program estimated at Php 113 billion pesos (US 2.5 billion) would “make economic growth inclusive and lift millions out of poverty”. I pointed out that this has been part of the monumental pivot by the Bangko Sentral ng Pilipinas (BSP) to promote domestic demand via bubble blowing policies and fiscal policies that came at the expense of many other industries including external trade.

And opposite to the interpretation by the BSP chief of Bastiat’s distinction between the bad and the good economist, public works is one major aspect which the great French economist frowned on.

Mainstream media only sees the supposed benefits from government spending on infrastructure, but hardly the costs. Yet media and political authorities fail to demonstrate how government spending would “make economic growth inclusive and lift millions out of poverty” except to assume in a post hoc fashion that all spending equals growth.

The fundamental reason why Bastiat argued against the age old economic myth is that resources used by the government will always have to be taken away from somewhere: particularly resources (savings) or output (income) of non-political economic agents. The result will be a NET transfer of resources from productive agents to unproductive agents[11]. Costs are not benefits.

Public choice theorists would further expand on Bastiat’s opposition, noting that “costs are diffused, while benefits are concentrated”[12].

A bridge that will be built anywhere within the national geographical borders will likely benefit mostly residents of the area. Even for people living within the vicinity of the project, the benefits will not be the same. This means that some residents will benefit more than the others. But the costs are shared by people who even won’t be using the bridge. And because such political projects are not determined by profits and losses, but by political choice/s, we will never know if these projects ever deliver their alleged utility. Thus the benefits are assumed as true, but the costs are disregarded. Yet again, costs are not benefits.

But for the public choice theorist, most of the windfall from public works accrues to the political spectrum—the special interest groups.

Because a great segment of society has been oriented towards looking at the visible, the primary beneficiary will be the politician who would be seen as “doing something”, thus reinforcing the chances of a re-election.

Meanwhile, the invisible beneficiaries are those politically connected who will likely have significant economic interests in such projects. These may include the private sector side of Private Public Partnership (if the project is opened for private sector project management), the sub-contractors (if these are government operated projects), and or direct and indirect suppliers of equipment, materials and labor for such projects. The domestic property speculator who wishes to see increased value on his properties may also lobby to have a bridge built within the proximity of their properties.

You see, media will never disclose whether their companies or associated companies have direct or indirect exposure on such government projects. Besides truth telling would mean political pressures to reduce expenditures which may translate to a vastly reduced government. Since media plays kingmaker such perspective defeats their interests.

And there is a third major unseen cost from the government infrastructure spending.

Since the Philippine government has been running a budget deficit as I showed last week, the massive infrastructure would mean bigger deficits which extrapolate to either bigger debt or more inflation. All these imply of greater systemic risks.

Yet not all deficit spending are inflationary. If such deficits are funded by issuing bonds from which people and institutions simply draw down their bank deposits to pay for the bonds, there is no money created. No inflationary pressures

But this would be a different issue if such deficit will be financed by selling banks to the banking system. Banks will create new money by creating new deposits from which will be used to acquire the bonds. The new money is then spent by the government which enters permanently into the spending stream of the economy thereby affecting prices and causing inflation[13]

And if we look at the BSP’s data on money supply aggregates, which in February posted the eight successive month of 30++%% growth, the banking sector’s claim on the central government accounts for 16.5% of February M3. So if we assume that the national government will source their financing of such spending via loans from the banking sector then we will have a trifecta force of the BSP’s unleashing of the inflation monster through a higher money supply growth rate from the current mid 30% levels.

As a refresher, the first major force has been the domestic bubble or the credit financed spending spree by the property and property related sectors (trade, hotels and financial intermediation). Aside from the Cantillon effects of the quantity theory of money, the Peso will likely be affected by the widening of trade deficits from the sudden surge of credit financed demand from bubble sectors which will most likely strain domestic supplies and thus impel for more imports relative to exports. And a weaker peso means higher prices for imported goods which should add to price inflation pressures. The first and second forces will continue to reinforce each other for as long as the BSP doesn’t materially tighten, and for as long as, artificial profits from the intertemporal price spreads as a result of such inflationary dynamics exists.

Bank financed government infrastructure spending will compound on and complete the BSP’s inflation trifecta.

I am reminded of a scene in which Greek mythological god Zeus commands his brother Hades “to release the Kraken” from Clash of the Titans here. I imagine the same conversational scene except that instead Zeus and Hades this is between the Philippine chief executive ordering the BSP top honcho to release the inflation Kraken.

But I suspect aside from the inflation trifecta another scenario may be at work. It is possible that the massive government infrastructure spending may be meant as a contingent or an “automatic stabilization” measure. Perhaps the BSP may be considering the imposition of more superficial tightening. And in realization that a pullback in banking credit risks a slowdown of aggregate specific demand, which subsequently will be transmitted to a downshift in statistical GDP, the BSP hopes that government’s spending will substitute or offset for such slowdown.

As side note, next week will be the schedule for the release of banking loan and liquidity condition data. We will see if the 30++%% growth will make 9 straight months.

But if the second scenario is true, there are still huge gaps with such assumptions. Any retrenchment in the rate of money supply growth will expose on the diversion of resources from wealth producers to speculative capital consuming agents. With bubble activities getting less support from money supply growth, trouble is in the horizon. And trouble will not be a statistical but a real economic issue, because this will imply bursting bubbles (debt deflation) and or real economic contraction.

Demand, which has artificially been inflated by temporary profits, celestially priced assets, inflated incomes, and corporate capex from supply side credit funded growth, will contract when such easy money conditions reverse. Such will prompt for the chain link of unprofitable heavily indebted enterprises into a liquidation mode as they struggle to raise cash for debt repayment.

Besides, the proposed spending will hardly be as significant relative to the risks from the private sector. Based on M3, banking claims on the private sector accounts for 68% which is about thrice the government share. In addition, despite the proposed government spending, unless the government will arbitrarily suspend property rights of property owners, via eminent domain, in order to rapidly build these projects, there will likely be mountains of legal obstacles that may cause delays.

Finally media and their experts hardly ever try to examine from history empirical evidences of the alleged miracle of public works.

I have previously pointed out how Japan in the 1990s spent 100 trillion yen through 10 fiscal ‘public work’ stimulus programs to fight off the lost decade[14], yet until today which is 24 years after the bubble bust of 1990, Japan remains hooked to the stimulus machine even as credit risks continue to mount. As example of credit risks, the markets for Japanese Government Bonds (JGB) have become so illiquid, such that there have been occasions where JGBs have not been traded in 24 hours[15]. These are JGBs not emerging market bonds.

And the lack of liquidity has prompted for rare accounts of negative rates. Japanese bond traders have reportedly been afraid to short JGBs due to lack of liquidity, but reckon that such conditions are not sustainable. Taking away liquidity means limiting shorts for JGBs. So Abenomics has not only created more risks in the banking and financial, it has mangled the price discovery. Such only increases the risks of Japan’s potential Black Swan scenario[16].

As one would note monetary interventions—zero bound rates and QEs—have all been designed by governments for continued open access to the credit markets. Financial repression signifies the means to achieve such ends.

And yet bubbles, which are offspring of financial repression, are simply the belief of attaining “something for nothing”. Governments through money and credit inflation hope to achieve “something for nothing”. In the process they put their respective societies at greater risks of a “something for nothing” backfire: a bubble bust or hyperinflation.

Yet bubble worshippers worldwide, mainly seen through the lens and manuscripts of mainstream media, fail to reckon that there are natural economic and political limits to bubble blowing.

How about China? China has engaged in a whopping US$586 billion in public investment stimulus in 2008 in order to avoid the US centric based global crisis. Today, China has been grappling with a horrific debt burden that has become a clear and present danger for a black swan scenario[17].

One should probably realize that China’s supposed investment “public works” spree has led to massive ghost projects that been financed through massive credit creation. Now the proverbial debt chicken has been coming to roost.

I was especially stunned when I read US political insider Philippa Malmgren claim “China’s shadow banking system seems to have grown by the size of the entire US financial system in last year alone”[18]. If true then this shows even deeper fragility of China’s financial and economic conditions.

Yet many in the mainstream media tend to discount China’s risks and who put a lot of faith in the Chinese government. Ironically, China’s central bank, the PBoC, whom are supposed to be on top of the money and debt situation, can even hardly come to grips with how to calculate her money supply statistics[19]. If they can’t get even the numbers right for measurement, how do you expect the Chinese authorities to deal with millions of moving parts in her political economy?

The bottom line is that economic logic tells us that the fanciful claim that government infrastructure spending will “make economic growth inclusive and lift millions out of poverty” represents no more than wishful thinking.

That’s entirely Showbiz!

Showbiz News#2: Improving Competitiveness and Economic Freedom

Another showbiz claim is that the Philippines have become more economically free and competitive.

Institutions like the Heritage Foundation have fallen for the charm of publicity stunt of so-called anti-corruption campaign and boom time statistics while being remiss of how bubbles have been intensely inflated. Such is an example of being misled by looking at the ‘form’ rather than a comprehensive understanding of the ‘substance’.

Yet Pork barrel scandals signify a smidgen to the proportion of immorality of inflation or how inflationism corrupts society. This has been signified by 8 months of 30++% money supply growth.

Even the chief promoter of the inflation dogma recognized of its deadly potentials

Writes John Maynard Keynes[20] (bold mine)

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

The global swelling of interest over Thomas Picketty’s controversial book on wealth and inequality “Capital in the 21st Century” represents a symptom of the political wedge “the object of the hatred of the bourgeoisie”, brought about by inflationism “whom the inflationism has impoverished” caused by global central banking policies. Without knowing it, Thomas Picketty’s own chart attests to this dynamic[21]. Ever since the world has gotten off the Bretton Wood gold exchange standard, bubble blowing policies has increasingly been transferring wealth from society to the politically connected asset owning elite.

I have previously pointed out how the same “Reverse Robin Hood” dynamic hounds the Philippines today[22]. Yet if this 30++% money supply growth will be sustained for a longer period, the same contentious class division politics will likely envelop domestic politics. The problem is when violence takes on the upper hand.

When Keynes noted that “the process of wealth-getting degenerates into a gamble and a lottery”, one can see how this is being transposed into real time activities via frenzied speculation in the Philippine Stock Exchange.

The above table represents that Price Earnings Ratio (PER) and Price Book Value (PBV) ratios of the pre-Asian Crisis[23].

As of Friday’s close, the 30-member Phisix PBV based on 2013 is 3.53 while against the four year 2010-2013 average is 3.89. Also as of Friday’s close PE Ratio of the blue chip benchmark is at 22.92 based on 2013 and 26.31 based on the average eps during the last 4 years. In comparison with 1995-6, what we can see is that current valuations have been priced ABOVE or BEYOND the pre-Asian (1995-96) crisis levels.

The 1993-1996 PER PBV story can be seen through a chart that I have posted before.[24]

Here’s a synopsis. In 1993 the Phisix posted a spectacular 154% nominal returns. This led to a 5.2 PBV and 38.8 PER. For the next two years, or 1994-95, the Phisix attempted to correct. The Phisix encountered 3 and a half bear market strikes (20% declines) during the said period. By the end of 1995 the Phisix lost 32% from the January 1994 peak, a half baked bear market. This has partly been reflected on the reduced PER and PBV.

Yet in 1996 until March 1997, the Phisix erased all the bear market losses and returned 48%. But the bull uprising failed to breakout to a new high. The failed breakout eventually led to a stunning collapse accompanied by the advent of the Asian Crisis. The Phisix fell by a harrowing 69% loss in 19 months. Again current values are very much dearer than the 1995-1996 levels. The implication is that the Phisix has not been just excessively OVERVALUED and outrageously MISPRICED, but such are signals of heightened financial fragility or susceptibility to instability. Such are evidence of valuations brought about by BUBBLE CONDITIONS.

A caveat. The composition of the Phisix has been different then from today. Second, I don’t know how the averaged had been attained. Was 1994-97 a rising tide lifts all boats phenomenon? Or has it been like today, where high flying high PER- high PBV stocks pulled up the index while low returning and equally low PER and low PBV dragged the index? The problem with looking at the average is that we tend to omit how real actions have taken place.

And pls remember I noted in the past that Indonesia’s PBV ratio has been the highest among ASEAN peers[25].

Here are more signs of the how the Philippine economic process has been “degenerating into a gamble and lottery”.

The former value investor and the most successful stock market investor, Warren Buffett in article at Fortune in 2001 wrote that for him the “best single measure of where valuations stand at any given moment[26]” has been the market capitalization to GDP.

He explains that reality when looking at the Market Cap to GDP ratio the mainstream stock market hokum “growth story” has been out of touch with reality. Why? Because “for investors to gain wealth at a rate that exceeds the growth of U.S. business, the percentage relationship line on the chart must keep going up and up. If GNP is going to grow 5% a year and you want market values to go up 10%, then you need to have the line go straight off the top of the chart. That won't happen.”

In short for a normally functioning market it is not mathematically possible for wealth from asset prices to vastly outstrip economic growth over the long run. Then Mr. Buffett wasn’t aware of the Greenspan-Bernanke-Yellen PUT, but even with additional lift from central bank actions, I believe that Mr. Buffett’s rule still holds true.

How does this apply to ASEAN stock markets?

Well surprise, Mr. Buffett’s warnings in 2001 would resonate with ASEAN financial showbiz stock markets today!

As of 2012, based on World Bank data, market cap to gdp would be as follows: Philippines 105.6, Thailand 104.7, Malaysia 156.2 and Indonesia 45.2. You can see the chart here. Given the rallies of 2013 and today, such data should be a lot higher now

Note: The threshold tolerance levels for each country’s market cap to gdp have been distinct.

The Philippines has surpassed the 1997 highs at over 100! Thailand is at 1997 highs. Each time Indonesia reached the 40+% market cap to gdp watershed, the succeeding returns have been negative. Malaysia, on the other hand, has been approaching the 2000 and 2007 levels but remains distant from the 1997 levels, where the latter seems like an outlier.

Three of the four ASEAN stock market bellwethers are at cyclical tops suggesting massive overvaluations. Again, these are signs of looming trouble.

In the Philippine Stock Exchange, current sentiment remains entrenched in a frenetic mania.

Despite some correction this week, the Phisix remains in a ‘one way’ upside trade. The consensus has taken stock in the belief that there is no way for Philippine stocks to go but up up and away (!)—in spite of the headwinds of the falling peso and growing interest rate risks.

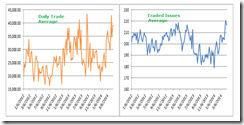

Notice again that stock market participants have been so wildly bullish on the stock market. Daily trade churning has even surpassed the May 2013 highs when the Phisix was at 7,400 (left window). This aggressive churning can be seen as powering not only blue chips via the Phisix but also the broader market—second and third tier issues (right window)—also above the May 2013 highs. Yet trading volume has been far from May 2013 levels. Such have been signs of desperation to bring back the salad days.

One way trades signifies as very delicate and perilous position. Except for me and the very few observers of the bubble cycles, the reversal of the one way trade of the Chinese yuan has caught the mainstream by surprise. I’ve been saying that the yuan’s fall represents capital flight from a growing recognition of the China’s credit risks[27]. Yet losses from the yuan’s one way trade via the Targeted Redemption Forwards (TRF) have been estimated at $4.8 billion and counting according to the Zero Hedge[28].

The point is expect big surprises on one way trades.

Yet like the Austrian economists, Mr. Keynes was well aware that inflationism “while the process impoverishes many, it actually enriches some.” He just didn’t explain how transmission mechanism worked in the above quote.

Let me show you a recent example

A week back one of the major blue chip holding company issued $300 million worth of equity linked bonds at a staggering 5 year .5% interest rate paid semi annually[29] as part of her proposed CAPEX financing.

The company offered the option to exchange bonds with equity shares of a property subsidiary priced at a fantastic premium equivalent to 8.14 PBV and 46.77 PER! The bonds were offered to investors outside the US and “to qualified institutional investors within the Philippines”. [Note: I refrained from citing the name of company in order to focus on the issue, details can be seen in the footnotes]

In my view this represents an incredible subsidy by the retail depositors whose funds have been pooled into “qualified institutional investors”. These highly paid yield chasing managers fund managers have taken unnecessary risks due to the “one way trade” outlook. Yet the subsidy comes in not only in the form of extremely low interest rates but importantly a TRANSFER of risks from the borrower to the lender/new equity holder. This seems like a magnificent lose-lose proposition for the poor depositors enrolled to these “qualified institutional investors”.

And the above validates the ideas of the great Austrian economist Ludwig von Mises who explained one of the two social consequences of inflationism as “all deferred payments is altered to the advantage of the debtors and to the disadvantage of the creditors”[30]

And in my view, this seems like a wonderful real time example of the movie Wolf of Wall Street.

When the market reverses (soon), these “qualified institutional investors” will be left holding the empty bag whether we talk of bond or equity. Nevertheless the institutional fund managers will point to the knowledge problem to justify their present actions. They are likely to adapt a John Maynard Keynes “appeal to the majority” or “comfort of the crowd” as escape hatch. (bold mine)

A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him."

Ever wonder why the mainstream cannot see bubbles? And ever wonder why Wolves of Wall Street have been a commonplace but less elaborate than the one portrayed in the movie?

So aside from how inflationism “impoverishes many”, and “enriches some” this is another shining example of how the “wealth-getting” process “degenerates into a gamble and a lottery”. Showbiz financial markets!

And this does not touch on the domestic bond market whom have been in a record convergence trade or narrowing of the yields relative to the US treasury counterparts.

My point is that a country cannot attain improvement in competitiveness and raise economic freedom levels when their governments adapt rampant inflationism. Remember inflationism is a system wide issue. And importantly inflationism signifies only one part of the grand scheme of Financial Repression policies which includes many other forms of interventionism such as price controls and capital controls and more. So it will be a folly to look at cursory or minor regulatory enhancements[31] to rationalize assessments of competitiveness or economic freedom.

As a good example, the following data shows why the BSP will resort to capital controls.

Despite mainstream cheerleading of current improvements of the recent improvement of portfolio flows and Foreign Direct Investment (FDI), the World Bank points at many deeply rooted structural problems with the Philippine economy.

The fundamental problem which limits Foreign Direct Investment (FDI) flows to the Philippines has been that the Philippine government prefers to remain a closed economy through a suffocating web of regulations via a nationalist Foreign Ownership Restrictions (FOR)[32] [bold mine]

Compared to other major ASEAN economies, the Philippines attracts relatively little FDI. Between 1970 and 2012, FDI inflows averaged less than US$500 million per year (figure 18). The country’s long history of political and macroeconomic instability, its weak institutions, poor infrastructure, and stringent FORs explain the low FDI. Since 2009, the Philippines exhibited macroeconomic stability, but many other constraints remain unresolved. In particular, as discussed, de-jure FORs are the second most stringent in the region (after Thailand), while the Philippines ranks last among 77 countries in de-facto restrictions on FDI in services. Restrictions on foreign landownership also pervasively discourage investment.A complex legal framework imposes FORs. The 1987 Constitution explicitly restricts ownership and management in a number of sectors. For natural resources, public utilities, and nonsectarian educational institutions, corporations must be at least 60 percent owned by Filipinos. Advertising is restricted to corporations 70 percent owned by Filipinos, while mass media and all professions are generally reserved for Filipinos. In addition to the constitutional restrictions, the Foreign Investment Act gives the president of the country the authority to impose FORs in other sectors through a biannual Foreign Investment Negative List. The latest order, in October 2012, expanded the number of restricted sectors and activities. Since 2000, only large retailers and casinos have experienced reductions in FORs.In addition to de-jure restrictions, various de-facto restrictions create barriers to FDI. Investment requirements and promotion schemes are not standardized across sectors. This, and the lack of a central body to coordinate investment promotion agencies, creates confusion for prospective investors. Investors face complex procedures in acquiring permits and licenses, with some investment promotion agencies characterized by red tape, a lack of transparency in guidelines and procedures, slow processing, and allegations of corruption. Existing enterprises also face high costs of doing business, owing to poor infrastructure, the high cost and irregular supply of power, insecure property rights, inconsistent tariff and nontariff barriers, and policy inconsistency.

Instead of opening the economy, the present administration “expanded the number of restricted sectors”. This is hardly about improving competitiveness and economic freedom. Moreover the sectors recently opened (since 2000) has been large retailers and casinos which essentially accomodates today’s bubbles.

Yet the above represents a huge problem, which won’t be seen by the mainsream statisticians cum economists.

Why? Because this shows that 2009 BSP pivot to a bubble blowing economy[33] has essentially placed the Philippine formal economy in a ONE way trade or that the BSP policies has put ALL the formal economy eggs into a single basket, in the hope of a winner take all payoff.

The BSP has taken the flexibility option off the table by redirecting most of the efforts and resources of the formal economy to pump the bubble, which the Philippine government and the BSP now prays for its perpetuity.

You see, while today’s external accounts would look “strong” they are very susceptible to a dramatic deterioration. Why? Because the Philippine populist nationalist politics has erected ‘natural barriers’ to forces that may cushion any external account deterioration. Such barriers as noted above has intensified. The Philippine government thinks that domestic bubble blowing will shield her from external influences. [Well that’s what’s been said, the reality for domestic bubbles has been access to credit] So they have been closing the economy to the benefit of special interest groups. Piketty Philippine version, anyone?

Said differently, Philippine regulations have tilted the economic playing field towards foreign short term speculative money flows rather than to long term Foreign Direct Investments. This makes the Philippines highly vulnerable to a precipitate shift in sentiment—whether internally or externally sourced.

Isn’t showbiz all about short term? See the harm that the showbiz populist political economy can do?

Even from current conditions, external account balances are due for weakening.

Increasing inflation risks from 30+% money supply growth in a feedback loop with the weak peso may be compounded by foreign money efflux. Portfolio money have always been fickle. A change in sentiment for any reasons like escalation of the Ukraine standff or more signs of China’s economic and financial woes or a sustained US technology stocks selloff or others—may instantaneously reverse portfolio flows. A sudden reversal of sentiment would force the BSP to drain her forex reserves to support the peso or use the least appealable option of tightening which the BSP knows would expose the façade of credit financed growth.

Yet sustained outflows from the unraveling of domestic imbalances could mean the BSP would both tigthen and deplete forex reserves simultaneously. Such would be the equivalent of nightmare on elm street for the BSP. So the BSP’s likely nuclear option response will be to impose capital controls. The World Bank report clearly shows how the Philippine government has been severely been limiting her options that would lead to a protectionist response.

And such protectionist response seem as being signalled by media in terms of instilling and conditioning the acceptability of draconian political and economic repression. Here I hope that I am wrong or at least such trend will reverse.

Yet these are signs of improving competitiveness and economic freedom?

As for the showbiz political economy and showbiz financial markets, unfortunately all shows come to an end.

[1] Wikipedia.org Revolving door (politics)

[2] See Chart of the Day: More Crony Capitalism December 18, 2011

[3] See Video: Revolving Door Relations Between Pentagon and Defense Contractors December 4, 2012

[4] Wikipedia.org Alan Greenspan After the Federal Reserve

[5] Wikipedia.org Timothy Geithner

[6] Wikipedia.org Henry Paulson Career after public service

[7] Wikipedia.org Lawrence Summers Post-NEC career

[8] Wikipedia.org Niccolò Machiavelli

[9] Niccolo Machiavelli. The Prince. Chapter 15 verse 2 The Harvard Classics. 1909-14 Bartleby.com

[10] Niccolo Machiavelli op. cit Chapter 3 verse 1

[11] See Frédéric Bastiat on the Philippine Government’s Massive Infrastructure Spending Program April 17, 2014

[12] Wikipedia.org Public Choice Special interests

[13] Murray Rothbard, Ten Great Economic Myths Chapter 2, Making Economic Sense Mises.org

[14] See Abenomics Fails to Spur Business Spending May 21, 2013

[15] See How Abenomics distorts the JGB markets April 15, 2014

[16] See Japan’s Ticking Black Swan February 24, 2014

[17] See Will China Trigger the Black Swan Event in 2014? January 20, 2014

[18] K. PHILIPPA MALMGREN China Under Attack International-Economy.com

[19] See Central Planning Failure: China’s PBOC Edition April 26, 2014

[20] John Maynard Keynes The Economic Consequences of the Peace (1919) p.235 (Google Book) (PBS.org)

[21] See Video: Peter Klein on the Fundamental Flaws of Thomas Piketty’s view of Inequality April 26, 2014

[22] See The Atlantic on Philippine Economic Boom: Looks Great on Paper, May 8, 2013

[23] Urbi Garay The Asian Financial Crisis of 1997 - 1998 and the Behavior of Asian Stock Markets, University of West Georgia

[24] See Phisix: Scrutinizing the Property Inspired Rally February 24, 2014

[25] See Phisix: A Deeper Look at the Philippine and Indonesian Stock Market Mania March 17, 2014

[26] Warren Buffett; Carol Loomis Warren Buffett On The Stock Market December 10, 2001 CNN Money Fortune

[27] See China’s Shanghai Index drops 5% in 4 days as the Yuan sinks February 25, 2014

[28] Zero Hedge Someone Is Betting That The Chinese Currency Collapses By The End Of 2014? April 26, 2014

[29] Businessworldonline Ayala raises $300M, sets ‘record’ capex April 12, 2014, Businessmirror.com Ayala offers $300-million bonds to fund power, infrastructure projects April 3, 2014

[30] Ludwig von Mises 1. Inflation III. INFLATION AND CREDIT EXPANSION Intervention An Economic Analysis Mises.org

[31] See Philippine Economy: The Unseen Factors behind the “Doing Business” improvements October 30, 2013

[32] World Bank Preserving Stability and Promoting Growth WORLD BANK EAST ASIA PACIFIC ECONOMIC UPDATE APRIL 2014 p.75

[33] See Phisix: In 2009, the BSP Engineered a Crucial Pivot to a Bubble Economy April 14, 2014

No comments:

Post a Comment