At the start of the year I noted that Abenomics’ inflationism via the yen devaluation will eventually take a bite out of Japan’s corporate profits:

In short, corporations appear to be very hesitant to raise prices perhaps in fear of demand slowdown. Thereby this means a squeeze in corporate profits. Abenomics has only worsened such existing conditions.

The distortion of the pricing system means that the entrepreneur's economic calculation process has been skewered. Now pressure on profits will affect the production process thereby presenting a structural constraint on real economic growth.

Such signs are becoming more apparent. From the Bloomberg: (bold mine)

Business leaders in Western Japan warned central bank chief Haruhiko Kuroda that the yen’s slide to a six-year low is boosting costs of imported raw materials and fuel and may spell trouble for the economy.Companies in the industrial city of Osaka report that their profit margins are deteriorating as they can’t pass along the higher costs even as sales rise, Osaka Chamber of Commerce and Industry Chairman Shigetaka Sato told Kuroda at a gathering yesterday. Kansai Economic Federation Chairman Shosuke Mori said the rise in fuel costs warrants close monitoring.

Real growth requires a stable currency system for the same reason: economic calculation

The president of Japanese auto parts maker Exedy Corp., Haruo Shimizu, urged Kuroda to strive for a stable currency. Companies increasingly source goods from suppliers overseas after manufacturers shifted production offshore during the period of yen strength and the currency’s decline means this is now more costly than buying from domestic suppliers, he said.

So for as long as the perversion of the pricing mechanism holds, there will hardly be any meaningful real economic growth regardless of what statistics say.

Abenomics has been nothing new. It’s just another modern day adaption of the age old mercantilist/protectionist dogma. Such short term snake oil fixes signifies doing the same thing over and over again while expecting different results.

The great Austrian economist Ludwig von Mises warned of its disorderly domestic economic adjustments.

Sooner or later, the prices of all domestic goods and services will adjust to the change in value of money, and the advantages that a devalued currency offers to production, and the obstacles that an overvalued one sets against production, will disappear.

Since devaluation has been about the political picking of winners and losers, and more importantly, the invisible transfer of resources to these politically advantage groups, the great Mises adds that

Every attempt to promote a single interest group through selective changes in the value of money must inherently fail, ignoring all other reasons, because the economic effects of this kind of measure are only temporary; in order to maintain those effects there would have to be a continuing increase of the notes. This could, however, end in no other way than with a complete devaluation of the money in circulation (emphasis added)

Of course inflationistas always think in the frame of their (domestic) actions while discounting the actions of the others.

Yet even any short term boon may even neutralized by the response of other governments to also devalue. Again Professor Mises (bold added)

If one looks at devaluation not with the eyes of an apologist of government and union policies but with the eyes of an economist, one must first of all stress the point that all its alleged blessings are temporary only. Moreover, they depend on the condition that only one country devalues while the other countries abstain from devaluing their own currencies. If the other countries devalue in the same proportion, no changes in foreign trade appear. If they devalue to a greater extent, all these transitory blessings, whatever they may be, favor them exclusively.

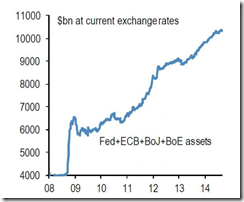

Almost every major (and even EM) central banks today has tinkered with devaluation (inflationism) as seen through the massive expansion of their balance sheets. (chart from Zero Hedge).

This means that to sustain a global race to devalue would be disastrous. (bold mine). Mises concludes

A general acceptance of the principles of the flexible standard must therefore result in a mutual overbidding between the nations. At the end of this race is the complete destruction of all nations' monetary systems.

Global central banks have been in the uncharted experimental process of testing the supposed magic of inflationism (devaluation) to its economic limits. Abenomics has been the lead model in terms of aggressiveness.

But don't worry be happy, as part of the invisible redistribution process, central banks will ensure that "this time is different"! Thus stocks are bound to rise forever!

No comments:

Post a Comment