I have repeatedly been pointing out here that given the recent sharp run up, the Phisix have been exhibiting signs of ‘exhaustion’ where normal profit taking should take hold. But apparently corrections now appear to be a taboo. Index managers see any downside as intolerable. The Philippine benchmark has now been engineered to move in a single direction! And this applies to everyday activities!

For the day, following a strong start, the Phisix found itself succumbing to profit taking thus has been in the red through most of the session. That’s until the pre-run off period where again the ‘marking the close’ not only virtually reversed the day’s losses but importantly, set another fresh high record session for the domestic benchmark!(charts from technistock.net and colfinancial.com)

Again the modus remains the same. The pump revolves around 3-5 biggest market caps whose weights add up to about 20% of the Phisix basket.

Those significant last minute major pumps can be seen in three sectors, service, property and finance. The holding sector also contributed but to a lesser degree compared to the above.

These are the top 20 most active issues of the day based on the table from the PSE. Some of the above have been subjects of the closing session pump.

Peso volume was only about Php 7.6 billion but the special block sales from AC (Php 7.5 billion) and SM (Php 1.6 billion) bloated the day’s volume to Php 17.234 billion.

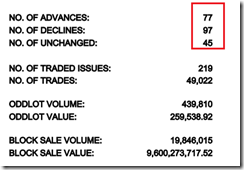

As evidence of the profit taking mode, aside from sluggish (ex-special block sales) peso volume decliners led advancers by about 20 issues. Even the top 20 traded issues reveal of 9 decliners relative to 8 advancers and 3 unchanged.

Additionally, today’s number of trades fell below 50,000. This means less churning activities compared to the average bristling pace of 50-60k a day from December 2014 onwards.

Since February, the advance decline spread seems to favor decliners (10 days against 7 days for advancers), hence emitting signals for ‘correction’.

But again correction has now become a taboo.

Yet this reveals of the lamentable quality of record highs.

No comments:

Post a Comment