When you make your customer feel stupid, you've given him no choice. He needs to blame you. Some ways to make people feel stupid:…Collect money as though you're in the long-term relationship business, but in every other way, act like you don't expect the relationship to last…Seth Godin

In this issue:

Phisix 7,800: Record Phisix as the BSP Continues with Deflation Spiel!

-Record Phisix 7,800: Driven by the Property Sector and Set by Index Managers

-Shang Properties: A Canary in the Coal Mine?

-BSP Chief: Don’t Take Economic Numbers at Face Value!

-BSP Signals the Arrival of Bail-INs?!

-Deflation is a Symptom from Different Causes: Productivity or Debt

-Macroprudential Policies as Potential Sources of Future Problems

-The Flaws of the BSP’s Concept of the 3 Major Trends

-The Link between the BSP and Philippine Tycoons at the Forbes List of the World’s Richest

-Confessional: The BSP Chief Admits to the Knowledge Problem!

-The Many Faces of a Mind: Ideas, Events and People

Phisix 7,800: Record Phisix as the BSP Continues with Deflation Spiel!

Record Phisix 7,800: Driven by the Property Sector and Set by Index Managers

Once again the Phisix soared to new record highs.

And it appears that index managers took the upper hand in the engineering of the new highs. There had been three sessions of “marking the close” this week: a massive pump on Monday and on mopping up operations pump on Friday. Yet there had been a minor dump that followed a runup last Thursday.

Managing of the index has not just been about wild, unfettered and hysteric speculations with total disregard to valuations and the risk environment, but about symbolisms.

Some parties must be so desperate to meet some unspecified target soon as to disallow market pricing dynamics to take hold naturally. In short, profit taking has been viewed as a taboo.

When I wrote last week to show how the Phisix has been emitting signs of exhaustion, despite this week’s record, current events has only been reinforcing this.

The widening gap between the Phisix and the 50 day moving averages has reached levels which may be considered as extremely overbought. To borrow from hedge fund manager John Hussman “Overvalued, overbought and overbullish”. And if history were to repeat, such overstretched levels will very soon reach a maximum point of elasticity that should result to at least a sharp snapback.

While index managers may temporarily prevent these, unfortunately suppression of market forces—which inflates more imbalances—means that when market forces reassert themselves they will vent those imbalances with a vengeance. These are what accounts for all the crises through time.

Additionally this week’s managed record highs have been reached with diminishing peso volume. The average daily peso volume has been the second lowest since the week ending November 21, 2014 (left pane).

It’s true that market breadth via the advance decline spread showed material improvements, advancers led decliners by 500 to 379 and has dominated all the session of the week.

But it appears that while market breadth improved, the wild record churning appears to have backed off from its recent peak (right window).

And it now appears to be an all property sector show. While financials came in as a far second on a weekly basis (+2.74%), stocks from the property sector has been running ablaze for the index to take the leadership anew (+3.32%).

Year to date, the property sector has been pulling away from the pack (+12.44%). Together with the Holding sector (+9.45%), these two related sectors has lifted the Phisix to its record levels underpinned by an 8.72% gain year to date.

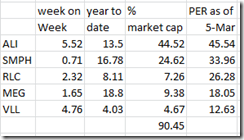

Here is the performance of the top 5 property issues. These stocks constitute 90.45% share of the property index basket as of Friday.

The charts of many of the property stocks have gone parabolic or near vertical.

Yet these massive ramps come in the light of ultra-high valuations. Valuations that have been premised on wildly unrealistic optimistic expectations. Since they have been priced for perfection, there is no margin for errors. It’s all been pump and push.

Such one way ticket outlook masks all the risks accruing behind them.

Shang Properties: A Canary in the Coal Mine?

As an aside, the following company used to be a favorite. That’s because when my children were still kids, I occasionally brought them to spend weekends at their hotels. But in this article, I shed sentiment to take the hat of an investor.

Edsa Shang [PSE:SHNG], an upscale property and shopping mall developer, hasn’t been part of the Property index basket but is categorized under the property sector.

On a year on year basis, Shang’s condo sales for the 3Q has tanked by 34%! As seen on a year to date basis, 3Q condo sales slipped by 10.2%. Condo sales account for 49.4% quarter on quarter and 52.26% of Shang’s revenue during the 3Q seen on a year to date basis. This implies that 3Q sales dragged down the firm’s 1H performance!

This is interesting because the surge in mall vacancies occurred during 4Q 2014 and 1Q 2015.

So if condo sales will not pick up, and if the rate of store vacancies will hardly improve, then Shang’s balance sheets would seem in jeopardy, as profits and cash flow will dissipate while the risk of losses emerges.

The weakening of the top line figures has been reflected on the firm’s free cash flows. On a year to date basis, free cash flow has slumped by 60.5%.

So the firm’s spending gap had to be financed by debt…

In addition, the company acquired loans to finance their aggressive expansion at the Fort that has also exacerbated the draining of the free cash flows.

So debt financing of the operations and debt financed expansion has resulted to a 129% bulging of debt!

The nice part has been that the Shang has retained earnings about Php 17.4 billion which provides some cushion.

But such cushion may be quickly eroded, if the Shang’s top line conditions won’t improve to filter into free cash flows.

Debt financing has now become the lifeblood for the Shang.

Yet Shang’s Php 11.38 billion debt has been puny compared to the casinos (Php 57 billion) or to San Miguel (Php 461 billion 3Q 2014), or to the P 4.275 trillion of banking loans (production and consumer loans excluding RPPs) in the system as of December.

But the problem has been hardly about Shang but about the “Butterfly effect” or the non-linear or asymmetric flow linkages between debtors and the creditors.

Remember almost every property company has been in a frantic race to build capacity. That race hasn’t been limited to the majors or to publicly listed companies. There are numerous minor developers out there. New townhouses has appeared on our neighborhood from what I understand has been a project by an individual developer. At my abode’s proximity, new residential condos have been erected and has been placed on the market from various local developers.

Yet the race to build supply for the perceived limitless pockets of the resident consumers has again been heavily financed by debt. Balance sheets of publicly listed companies have been evidently manifesting such dynamic. Shang is just an example.

Unfortunately, pockets of domestic consumers, whose per capita has been at only $6,500+ (2013, PPP based from World Bank and IMF) or $2,800+/- (2013, Nominal based from World Bank and IMF), has a growth rate at below 6% (Peso), or 5.3% in 2013 (US dollars).

Think 6% growth in demand versus vastly over 10% growth in supply. As a caveat, housing and malls are just part of the household basket of expenditures, which means that not every peso growth will be spent on housing or malls.

So Shang’s current conditions may just serve writings on the wall.

Debt is NO free lunch.

BSP Chief: Don’t Take Economic Numbers at Face Value!

It’s been a curiosity to see the Philippine central bank, Bangko Sentral ng Sentral, Governor Amando M. Tetangco, Jr reiterating the risks of deflation at almost every recent speech.

This is what I will be discussing here.

But before this, here is a quote from the good Governor in his recent speech to economic journalists[1]. The quote serves as testament to what I have been saying all along…NEVER trust statistics or numbers alone! (bold mine)

Economic numbers rarely tell the complete story when taken at face value. Therefore, a responsible journalist who seeks to offer readers a fuller appreciation of the information will examine the figures within a broader context or against an array of other relevant indicators.

Given the facts on hand, a good reporter will know which leads to chase, and which to set aside, perhaps for another day, for another story. The objective is to understand what is happening -- and why -- so that the facts can be pieced together into a sensible and useful news report for their publics.

It’s a good advice. Unfortunately it’s an advice which will NOT or will hardly be heeded. The reason is simple, this has been fundamental institutional dilemma predicated on a combination of the agency problem and public choice theories: In essence, media will mostly promote and or protect organized interest groups who are their sources of revenues and who are their sources of their political clout. So journalists or so-called ‘experts’ will almost always serve as loudspeakers of political agents and of the various representatives, especially of the major industries. They will parrot rather than take critical views of their patron’s insights. And any criticism will mostly focus on the superficial than of the system that benefits the status quo. Media will hardly rock the boat unless there is popular public demand or clamor for it.

But this would be a nifty topic for another day.

BSP Signals the Arrival of Bail-INs?!

In that same speech he peculiarly focused on disinflation and the divergence in economic outcomes especially from countries experiencing deflation.

Such divergence has been attributed to the current policies including that of the BSP, in particular, “ample fiscal policy space, a sound and responsive banking system, an increasingly inclusive financial system, and a healthy external position, all of which contribute to a solid outlook for growth.”

In effect, what he seemed to have wanted was for journalists to write of rousing acclamation of the “success” of the current policies, particularly the BSP’s policies.

From that speech alone, I’d say that the good Governor needs to practice what he preaches.

Statistics is NOT economics.

The BSP chief had been more elaborate on the second speech[2].

Pardon me, but the importance of keeping track with the thoughts of the monetary leadership are the potential clues to policy direction, their assessment of the balance of risks, their perception of socio-economic problems and the role of politics in monetary policies.

Here he discussed the Great Financial Crisis (GFC) of 2007-8 which had been transmitted “because of highly interconnected markets, that economic weakness spread to the rest of the globe”

He further noted that traditional policies didn’t work therefore the innovation: “We could therefore no longer rely on the familiar channels of transmission of monetary policy. At the time, new transmission channels emerged such as the “expectations channel” and the “risk-taking channel”. So, advanced economy central banks needed to employ non-conventional monetary tools.”

The innovation of unconventional tools as applied by advanced economies: “Asset Purchase Programs in all letters of the alphabet some of which you would normally throw away in a game of Scrabble came into vogue. Q-E-1, QE2 (with operation twist) in the US, OMT [or Outright Monetary Transactions] and TLTRO [or Targetted Long-Term Refinancing Operations] in Europe, and Q-Q-E (Quantitative and Qualitative Easing -- the three arrows) in Japan”

And there has supposedly been a radical change in the direction of policies away from tax payer bailouts: “In addition, financial stability and the systemic nature of risks became the driving forces for the global financial reform agenda. “Too big to fail” was no longer going to be the bottom line. Even as we speak, ladies and gentlemen, financial reforms are being put in place so that those defined to be “systemically important institutions” would not have to be bailed out by taxpayer money. These SIFIs would instead be mandated to meet a higher capital standard. SIFIs have to have more “skin in the game”, so to speak.

Before I continue: Oops! Has bank bail-IN or deposit haircuts arrived?!! It’s been in the agenda for G-20 last November 2014. So it would not be far fetch that the political dragnet will be laid on a global scale in preparation for a global crisis.

Has the BSP chief been conditioning the public for the eventual implementation of deposit haircuts or bail in once deflation (bubble bust) emerges?

Hmmm…

Deflation is a Symptom from Different Causes: Productivity or Debt

Going back to the evolving role of monetary policies, the governor admits that old rules fail, so new adapted rules have led to “uncharted territory”: “Micro prudential regulations, while necessary, are no longer sufficient. It may be recalled that micro prudential measures are meant to improve individual institutions’ resilience to risks. Central banks must now also have macroprudential measures in place. Macroprudential measures look to address the interconnected nature of the system and help ensure safety at the system level. In truth, some have said that at the height of the GFC, Central Banking was the “only game in town”. Monetary policy was made to bear the brunt of the heavy lifting in responding to the effects of the crisis because there was very little fiscal policy space, particularly in the AEs.

.png)

He didn’t mention why advance economies have ‘very little fiscal policy space’, the simple answer to that is that AEs have been wallowing on debt. Since the GFC, government has taken over private sector in issuing mountains of debt.

The McKinsey Global on the explosion of government debt[3]:

Government debt grew by $25 trillion between 2007 and mid-2014, with $19 trillion of that in advanced economies. To be sure, the growth in government spending and debt during the depths of the recession was a welcome policy response. At their first meeting in Washington in November 2008, the G20 nations collectively urged policy makers to use fiscal stimulus to boost growth. Not surprisingly, the rise in government debt, as a share of GDP, has been steepest in countries that faced the most severe recessions: Ireland, Spain, Portugal, and the United Kingdom. The challenge for these countries now is to find ways to reduce very high levels of debt

And because AEs have been drowning in debt then the recourse has been to use monetary policies “to bear the brunt of the heavy lifting” in response to the crisis. Negative Zero bound rates have been intended to alleviate the burden of debt mostly by governments.

This has been the deflation he fears about, but has been reluctant, throughout all his public talks, to point out in detail. Why?

Because the Philippine government will be one of the next countries to gorge in public debt when the private sector sinks?

Deflation should not be stereotyped. Deflation is symptom that has been different causes.

Price deflation is a natural outcome of productivity growth. Mobile phones have become widespread today because of increased output from competition. Competition has led to falling prices as quality improved due to innovation. And falling prices has prompted for an increase demand which means the law of demand works, as “price of a product decreases, quantity demanded increases!”

Hence, there are more people with mobile phone than with bank accounts

Productivity deflation combined with the law of demand in the context of fixed broad band services chart from ITU (International Telecommunications Union) 2013 Facts and Figures, has increased the penetration levels of broad band services.

The deflation menace which keeps haunting the BSP chief represents balance sheet problems, it is debt deflation.

This is why deflation is seen as a problem because debt problems can lead to government bankruptcies.

Macroprudential Policies as Potential Sources of Future Problems

Yet such fixation over macroprudential policies seem as fighting the next war. The reason is that policymakers have been attempting to fix previous problems while new problems emerge from elsewhere or as consequence from current regulations.

For instance, in the US, new rules to require more liquidity could drive out liquidity out. The Dodd Frank statute has reportedly changed the way banks compute for deposit insurance premiums. This has raised the cost of premiums, thus requiring deposits to earn more to offset such increases. But there are newly instituted restrictions on how banks may invest institutional deposits. Those investment restrictions again compound on the burden for banks to hold deposits. The result: banks now charge depositors the cost of storage—negative deposit rates. And a higher cost of storage may mean less liquidity in the system.

Paul Kupiec, a resident scholar at the American Enterprise Institute and a former director of the Center for Financial Research at the Federal Deposit Insurance Corp explains at the Wall Street Journal its origins[4]: (bold mine)

How did this happen? The popular narrative is that the financial crisis was caused by investor “runs”—i.e., when large volumes of uninsured deposits and investors in commercial-paper simultaneously moved money out of banks and other financial institutions. Bank regulators embraced this narrative and the Basel Committee on Banking Supervision crafted new international rules to limit banks’ ability to fund themselves with short-term liabilities. These new rules have been adopted by U.S. bank regulators and they are set to be phased-in over several years.

But there is a huge glitch. The Basel Committee apparently never considered the possibility that interest rates would remain at or near zero for many years and that, in a zero-rate environment, the new liquidity rule would make it uneconomic for banks to hold large institutional deposits unless they charged these customers negative interest rates. The Basel liquidity rule was supposed to ensure that banks have adequate liquidity, but instead it is encouraging banks to reject liquid deposits.

From the above perspective negative rates have signified as unintended consequences from policymaker’s knowledge problem or the tendency to address the visible while ignoring the epiphenomenon or secondary or long term effects from such policies.

If those old rules didn’t work why does Mr. Tetangco think that current crop of rules would do the wonders?

The BSP chief skirts the debt deflation problem and points instead to low oil prices as source of deflation that affects the world through different channels: “1) heightened deflation pressures in the EU and Japan, 2) led to reduction in capital expenditures in the US that now threatens to soften economic growth and inflation in the US, and, 3) caused some emerging markets to also be leery of the adverse growth effects if deflation becomes more pervasive.”

While there may be distortions from political interventions, oil prices are still driven mainly by demand and supply. When the BSP chief says heightened deflation pressures in the EU and Japan, this means low oil prices functioning as a secondary or as aggravating factor to the current conditions. He doesn’t say demand for oil has been low because of economic stagnation in Japan and in Europe due to balance sheet problems.

This also applies to emerging markets whose economies has been bogged down by internal slowdown due to having too much debt and whose predicament has been exacerbated by tanking commodity prices and the soaring US dollar.

As you can see when he says that a responsible journalist should “offer readers a fuller appreciation of the information will examine the figures within a broader context or against an array of other relevant indicators”, this would be my role.

Yet it is a role that will hardly be appreciated by the mainstream because this will infringe on the interests of many entrenched groups benefiting from the status quo.

And it is also my role to point out of the gaping holes signifying patent inconsistencies in his assertions.

The Flaws of the BSP’s Concept of the 3 Major Trends

And based on this, the assumption of an oil driven deflation has led the BSP chief to see the following as the coming trends: “1) Multi-speed global growth, 2) Policy divergence among advanced economies, and 3) Bouts of financial market volatility as global markets rebalance positions in the face of US dollar strength and volatility in commodity markets.”

Multi-speed global growth is a function of nations undergoing different stages of bubbles. The policy divergent response to global growth represents such conditions.

As I noted last week, China has been panicking. The Chinese government has not only downscaled growth targets, but this week, the Wall Street Journal reports rate cut on Special Lending Tools[5].

China’s central bank has taken a fresh move to lower borrowing costs for businesses in a weakening economy, just days after it cut policy interest rates for the second time in less than four months. The People’s Bank of China has lowered interest rates that it charges commercial lenders on a special short-term lending tool, known as the standing lending facility, two people with direct knowledge of the matter told The Wall Street Journal.

And it would be a mistake to presume decoupling to be an outcome of divergent policies and varying bubble stages.

The world remains “highly interconnected markets”. Oil prices have been showing it.

But there are important differences during the GFC and today.

In 2007-8, the credit bubble problem was a US centric problem which spread to the world.

Today represents what I call as the periphery to core phenomenon. Emerging markets had largely been unaffected by the GFC, but since almost all adapted the zero bound template from Mr. Bernanke, and many adapted fiscal policies, like China, they inflated bubbles earlier than the struggling advanced economies.

So when many EMs have reached a point where bubbles began to weigh on their economies such struggles and tensions began to reveal itself on commodity prices.

Later as the US inflationary driven recovery began to manifest on asset prices, Bernanke’s trial balloon of lifting QE resulted to the EM’s taper tantrum. The taper tantrum exposed on the vulnerabilities of EM economies to its dependence on carry trades moored on the FED’s sustained accommodative stance.

The withdrawal syndrome reinforced the weakness of EM which had a feedback mechanism to Advanced Economies

As I explained last year[6]:

if the adverse impact of emerging markets to the US and developed economies won’t be offset by growth (exports, bank assets and corporate profits) in developed nations or in frontier nations, then there will be a drag on the growth of developed economies, which would hardly be inconsequential. Why? Because the feedback loop from the sizeable developed economies will magnify on the downside trajectory of emerging market growth which again will ricochet back to developed economies and so forth. Such feedback mechanism is the essence of periphery-to-core dynamics which shows how economic and financial pathologies, like biological contemporaries, operate at the margins or by stages.

What has been seen as divergent has really been the source of existing problems: bubbles everywhere.

Yet those easing measures undertaken by China, Japan and the ECB last year helped kick the can down the road.

But there has been increasing accounts of tremors or fractures on what has been a placid picture, as seen last October.

And those fractures appear to be spreading.

The BSP chief should understand that there has been global financial NO crisis yet.

The proof of the pudding is in the eating. All these divergence which he intends to sell as “decoupling” will be exposed when a crisis will hit one of the major economies.

It would represent a brazen misplaced belief to see the Philippines as seemingly immune to a global credit event by mere recitation or enumeration of banking or economic statistics.

The BSP chief falls into the trap from which he warns about: “Economic numbers rarely tell the complete story when taken at face value”. This is what I said earlier he should practice what he preaches.

How can a system be sound and stable if one of the publicly listed companies has long term debt equivalent to 4% of the total resources of the banking system? This swells to 8-9% of the total banking system if we include the aggregate quarterly short term credit activities conducted by the company.

How can the system be sound and stable when domestic casinos, which carry a debt cross worth about Php 57 billion on their shoulders, have been faced with headwinds from what seems as a shrinking global market? Reduced demand for casinos has been taking its toll on regional casino operators as well as US casino operators.

How can a system be sound and stable when supply side—vertical condos, housing projects, shopping malls and hotels—have been in a hysteric race to build capacity, mostly financed by debt, that has been far beyond what domestic demand can satisfy?

How can a system be sound and stable when stock market valuations have reached galactic levels or proportions that had been associated with past crises?

How can the Philippines decouple when our neighbors’ currencies like the USD-Indonesia rupiah which has now segued off the books along with the USD Malaysian ringgit which continues to get crushed?

Yet will the Philippines survive a meltdown in China or Japan?

Since 2008 the Philippines has acquired so much debt than her actual output which means she is more vulnerable today than 2007 conditions which has been relatively much healthier.

Yet with this, how will the Philippines survive a potential meltdown in China or Japan?

Statistics is NOT economics.

The Link between the BSP and Philippine Tycoons at the Forbes List of the World’s Richest

The BSP chief warned the public about the “the pitfalls of chasing the markets” last August[7].

He came up with a lengthier follow-up last October[8]: “To reduce the possible financial stability impact of extended periods of negative real interest rates. Right now because of excess liquidity in the system, the industry doesn’t seem to mind much that real interest rates are negative. But ladies and gentlemen, when the tide turns, those projects that you may have “approved” based on a specific expected value may not provide you the “return” you anticipated. With this in mind, our policy actions have been aimed at helping you manage your own risk appetites.”

Such admonition was backed by: “BSP remains cognizant that keeping rates low for too long could result in mis-appreciation of risks in certain segments of the market, including the real estate sector and the stock market as markets search for yield.

So what happened? The Phisix is now at 7,800! The public has essentially defied the BSP chief’s warnings! The BSP seem to have lost control over financial stability which they declare they consistently monitor “the BSP will also remain alert to possible threats to financial stability”. So misappreciation of risks is not equivalent to threats to financial stability? What defines financial stability? Who decides the limits to financial stability?

Why do the Philippines need to remain under the stimulus of financial repression “negative real rates” if indeed the macro and institutional foundations has been strong and sound?

Too hooked on substance addiction from the political and vested interest groups?

Do you know how the Forbes acquires the numbers for their lists?

They do it through surveys, interviews, analysis on business deals and for private or non listed companies. The main source: the stock market. Here is the Forbes methodology as of 2012[9] (bold mine)

Throughout the year our reporters meet with the list candidates and their handlers and interview employees, rivals, attorneys and securities analysts. We keep track of their moves: the deals they negotiate, the land they’re selling, the paintings they’re buying, the causes they give to. To estimate billionaires’ net worths we value individuals’ assets, including stakes in public and private companies, real estate, yachts, art and cash–and account for debt.

Not that we pretend to know what is listed on everyone’s private balance sheet, though some folks do provide that information. We do attempt to vet these numbers with all billionaires. Some cooperate, others don’t…

Our estimates of public fortunes are a snapshot of wealth on Feb. 14, 2012, when we locked in stock prices and exchange rates from around the globe. Some on our list will become richer or poorer within weeks–even days–of publication. Privately held companies are valued by coupling estimates of revenues or profits with prevailing price-to-revenues or price-to-earnings ratios for similar public companies.

As one would note, much of those headline wealth has been pillared on fantastically mispriced or overvalued assets.

It’s a sign that such listed wealth has merely been ‘paper wealth’ as they have been dependent on a sustained dynamic of “pitfalls of yield chasing” and the “mis-appreciation of risks” from the gullible public.

It is why Brazil’s Eike Batista who was once the eight richest man in the world in 2011-2 with estimates of his personal worth varying from $25 to $35 billion has seen his wealth precipitately transmogrify into NEGATIVE $1.2 in billion just TWO years!! Yes from elite to a negative billionaire as recently discussed.

Such fabulous wealth has been dependent on the invisible transfers from the public to the elites. Such subsidies has been channeled through the distorted markets enabled and facilitated by “the industry doesn’t seem to mind much that real interest rates are negative” and by “BSP remains cognizant that keeping rates low for too long could result in mis-appreciation of risks in certain segments of the market, including the real estate sector and the stock market as markets search for yield”. In short, these elites have been handed with a silver platter from monetary policies for them to attain such prominent titles.

Yet for these elites to hold onto their esteemed positions means that the public needs to keep up the bid on such overvalued equity holdings.

And it has not just been stocks but also about those negative real yielding bonds they have issued to the public to finance capex, dividends and debt repayments, aside from the bidding up of and real estate assets for speculation premised on boundless spending power by Philippine consumer.

So have these guys and or the government been pressuring the BSP from keeping up with measures to implement financial stability controls? Has there been a regulatory capture involved?

Confessional: The BSP Chief Admits to the Knowledge Problem!

Now back to the repeated talk of deflation.

Why the reiteration of deflation risks as if it were an incantation signifying conditions posing as “clear and present danger”.

Yet look at the third major trend declared by the BSP chief: Bouts of financial market volatility as global markets rebalance positions

Read again: Bouts of financial market volatility as global markets rebalance positions

Has all these deflationary chatters have been about expectations of bouts of volatility? Has the BSP been using financial market volatility as camouflage to send interest rates down? Or could it be that they are using external factors as an excuse to talk down the markets? Or could the BSP even possibly use exogenous events as escape clause to exculpate them from accountability in case of a reemergence of volatility?

The BSP keeps bringing up the issue of deflation yet remains non-committal citing the need for flexibility.

Yet such justification for flexibility has been anchored on shockingly ignorance!!! (bold mine)

Keeping one’s own house in order entails putting together policies that are responsive. However, what can be considered responsive today, may not necessarily be what is responsive in the future. Keeping one’s house in order, therefore, requires creativity and innovativeness.

Read again: “What can be considered responsive today, may not necessarily be what is responsive in the future?” Huh? He brings about time inconsistent policies and the knowledge problem as pretext for BSP’s actions.

Have I not been talking of escape mechanism?

This hasn’t been a misquote. The BSP chief says the same under the first speech…

There are no absolutes in dealing with these issues. There are many ifs and buts. And, a number of factors and variables, including concerns related to technology and geopolitics, would need to be considered.

Friends, there is no crystal ball for these things. So, as we continue to navigate a challenging economic landscape this year, it is imperative that the intent of policies from central banks and other authorities is clearly understood by the public.

Hasn’t central banks been about central planning of money and credit? Shouldn’t their econometric models tell them of the probabilities from the varying risk scenarios and likewise probabilities from the consequences and risks for every actions they implement?

So what gives?

This represents a marvelous admission of the knowledge problem!

I will rephrase and translate the quote above and include a segment of the initial excerpt:

Friends, there is no crystal ball for these things. We are clueless about what has been happening and what will be happening. Our action depends on what will happen. We will cross the bridge when we get there. But if “what can be considered responsive today, may not necessarily be what is responsive in the future”, then we really don’t know how to react! We will experiment at your expense and HOPE it works! If it doesn’t, then we will keep trying. “So it is imperative that the intent of policies from central banks and other authorities is clearly understood by the public”…that we really don’t know!

Wow! Awesome! The statement’s policy guidance would be like the proverbial drunk searching for his lost keys under the lamppost even if he had lost in the park because “that’s where the light is”! (streetlight effect)

This validates the great Austrian economist F. A. Hayek who once wrote of the fatal conceit of central planners[10]:

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design. To the naive mind that can conceive of order only as the product of deliberate arrangement, it may seem absurd that in complex conditions order, and adaptation to the unknown, can be achieved more effectively by decentralising decisions, and that a division of authority will actually extend the possibility of overall order.

Importantly, this exposes on whatever rampart that has supposedly been attained by the Philippine political economy as nothing more than statistical façade. Things look good now because they seem to working, so the BSP gets a pat on the back and goes even to lecture journalists of what they should write about.

Unfortunately, the BSP has little or no idea about what’s in store for the future. So to make sure that they don’t get the blame, the BSP puts up bogeyman: deflation, in specific, foreign sourced deflation, for now…oil, while at the same time citing the need for policy flexibility! Great!

As for whatever prospective actions the BSP policy takes, such will likely be shrouded with uncertainty, as well as, and most importantly, unintended consequences.

Since they really have been clueless, their response will likely be tilted towards addressing immediate problems at the expense of future problems. This has partly been what makes of time inconsistent policies: market responses to changes in the regulatory environment. Simply said, change regulations, the market respond in ways that may not be expected by regulators creating future problems (see US bank’s negative rates above). As you can see, nothing here is linear. It’s plain human action. Action begets reaction.

This should be a great revelation. It’s an exposition of the fallacy of omnipotence and efficacy of central planning. And this confessional also divulges that the Philippines political economy has mostly been about showbiz.

Again statistics is NOT economics.

The Many Faces of a Mind: Ideas, Events and People

In a recent conversation, I stumbled on a quote which I had long wanted to put as part of my heading. But since it has significance to the stock market, I’ll just make a short note on this.

Great minds discuss ideas, average minds discuss events, small minds discuss people

The above quote has frequently been attributed to the former First Lady, Eleanor Roosevelt, wife of erstwhile US President Franklin Delano Roosevelt. Unfortunately the attribution is being disputed.

1) Ideas (future orientation via theoretical-empirical deduction):

In my perspective*, the stock market operates under the combination of frameworks of mainly the Austrian Business Cycle based on the Theory of Money and Credit, complimented by the Stock Market cycle, the Credit cycle, Minsky’s financial instability theory, Irving Fisher’s Debt Deflation theory, George Soros’ reflexivity theory, crowd psychology and Behavioral finance/economics, balance sheet analysis, Public Choice theory, the Principal Agent problem theory, the Chaos theory and the Black Swan theory.

Of course, before things get complicated, let me fall back to basic logic; for instance, analysis on the proportionality of population/income growth rate relative to supply side growth rate.

*A caveat and clarification: I am not proposing or suggesting that I have a ‘great mind’, what I am saying is that in the spectrum of financial markets, I take market analysis and investing seriously. I only show how I use an amalgamation of theories (or ideas) as means to see the world, and likewise, to assess on the risk-reward tradeoff from a given environment.

Yet my articles here, no matter how unorthodox, have been about ideas. If I propound any anecdotal accounts, they are predicated on these ideas. They are not intended for self-aggrandizement.

Ironically, how can a contrarian, who daringly takes on an unpopular stand, get glorified? Populism is about saying and pandering to what the crowd wants to hear rather than what they need to hear.

Unlike many populist talking heads, this isn’t a matter of just writing articles, most especially to get likes or to get the public’s plaudits; I have skin in the game or I have stake holdings in the marketplace. My family’s survival depends on this. My clients and my principal also trust and rely on my actions. Besides, I do not sell subscriptions or public lectures…yet.

On this premise, I try to live and abide by Warren Buffett’s elementary rule for investing:

Rule Number 1: NEVER Lose Money.

Rule Number 2: NEVER Forget Rule # 1.

While this may seem like a simple task, in reality, it is exceedingly difficult to attain. Yet it is a task worthy for me or for any aspiring prudent investor’s engagement. Also it is a humbling task. For all these years, I have been burned so many times that I earnestly and steadfastly try to learn and improve from my mistakes. And this is the reason behind my unorthodoxy—developing an independent mindset for survival. And this journey I have been sharing with you.

2) Events (anchoring on past data):

The stock market in the lens of extrapolating statistics and financial ratios into the future. The absolute acceptance of these numbers as unassailable consecrated truths.

Add to these news accounts of business deals, announcements by corporate leaders and politicians and other headline developments which are frequently interpreted from a post hoc dimension.

Also this comes with heuristical interpretations of current events cloaked with economic-financial terminologies. Or people (usually ‘experts’) who believe and make the public believe that they have been making economic or financial discussion (usually by dropping economic terms), when they are only talking their personal biases or communicating in behalf of their industry’s interests.

This represents the mainstream approach.

3) People (giving weight on the immediate actions of select personalities):

Who's buying or selling what?! How? Why? Basically, celebrity type personality based rumors and gossips adorned in the vernacular of finance and economics.

Discussion of ‘events’ and ‘people’ dominate the internet circles.

Record stocks have ingrained or embedded so much misperception for many to think that they have acquired erudition, if not cerebral invincibility. Yet they fail to realize that rising asset prices have only been accommodating their faulty premises, which in turn, have been bolstering their confidence, as well as, inflated egos, to the extremes.

Yet the feedback loop between misperceptions—that have been rewarded by rising prices (operant conditioning) and that has inflated both confidence and egos—and the subsequent piling up on asset prices (yield chasing) on the belief of the validity of such misperceptions, magnify the process of systemic mispricing that abets on the buildup of imbalances in the system.

Unfortunately, history tells us that aggregate overconfidence, which has been typical symptoms of credit fueled manias, has never been a good sign.

And applied in the context of attaining Warren Buffett’s investing rule, this shows why the right ideas are priceless.

[2] Governor Amando M. Tetangco, Jr Sustaining Economic Growth Speech at the MAP Gen Membership Meeting (GMM) and First MAP Economic Briefing for 2015 with the theme, ?Innovative Leadership for Sustained Growth? February 24, 2015 BSP.gov.ph

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)