Keep in mind that when paper wealth is “lost,” nobody gets it. Quantitative easing has not made the nation “wealthier”, nor will the massive paper loss we expect over the completion of the market cycle make the nation “poorer.” As I detailed in June (see When Paper Wealth Vanishes):“As in equal or lesser speculative bubbles across history, there’s a common delusion that elevated stock prices represent wealth to their holders. That is a fallacy, and we can hardly believe that given the collapses that followed the 2000 and 2007 extremes, investors (and even Fed policymakers) would again fall for that fallacy so readily. The actual wealth is in the cash flows that are ultimately delivered into the hands of shareholders over time. Individuals can realize their paper wealth by selling now to some other investor and receiving cash in return, but only a small proportion of investors can actually convert current paper wealth into cash by selling to other investors without disrupting the bubble. The new buyer then receives whatever cash flows the stock delivers into the hands of existing holders, and can eventually sell the claim to the remaining stream of future cash flows to yet another investor. Ultimately, a share of stock is nothing but a claim on the long-term stream of cash flows that will be delivered into the hands of its holders over time. The current price and the future cash flows are linked together by a rate of return: the higher the price you pay today for a given stream of future cash flows, the lower the rate of return you can expect achieve by holding that investment over the long-term.”Emphatically, the wealth of a nation is not measured by the price that the most reckless speculator will pay for the last few shares that change hands at the most exuberant moment of a bull market, multiplied by the entire number of shares outstanding. No, the wealth of a nation is its accumulated stock of productive real investment, human capital, and resources. Everything else cancels out because every security owned by some holder is also the liability of some issuer (see Stock Flow Accounting and the Coming $10 Trillion Paper Loss).Securities are ownership claims on a long-term stream of future cash flows. Paper gains don’t create aggregate wealth, and paper losses don’t destroy it. Think of it this way. Suppose a security promises you a $100 payment 10 years from now. If you pay $32 for that security, you’ll get a 12% annual return on your money. If you pay $122 for that security, you’ll get a -2% annual loss on your money. Does the economy have more “wealth” in the second case? No. The security represents $100 in 10 years, regardless. Now, you may be able to sell the security to someone else for $122, and let them hold the bag over the next 10 years. In that case, you may end up with more wealth, but your gain will come at someone else’s loss. In short, aggregate wealth does not increase just because securities become overpriced. Aggregate wealth is not destroyed just because valuations normalize.Put simply, many investors, and even some policy makers at the Federal Reserve, are under the delusion that paper market capitalization represents real wealth to the economy as a whole. The truth is that the wealth is in the productive assets of the economy and the long-term stream of cash flows they generate. Price fluctuations can certainly affect the distribution of wealth. Those who repeatedly buy stocks from others at depressed prices, and sell them to others at elevated prices, will accumulate the purchasing power of others. Those who repeatedly do the opposite will surrender their purchasing power to others. But the aggregate wealth of the economy as a whole is unaffected by those price fluctuations.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, September 07, 2015

Quote of the Day: The Difference between Real Wealth and Paper Wealth

Sunday, December 16, 2012

Phisix’s Inflationary Boom: Normal Profit Taking From Record Highs

However, given the steep ascent and overbought conditions by the Phisix, expect temporary corrections and possibly rotational activities.

I believe that should an interim correction emerge from an overheated Phisix occur, then rotation dynamic will reinforce the current inflationary boom.

In spite of all the euphoria, the FED’s operations may likely be reaching a tipping point.The combined monthly $40 billion MBS purchases by US Federal Reserve, as well as, the $45 billion long term (10-30 year) US treasury bond buying from Operation Twist means that the Fed’s balance sheet is likely to expand to about $4 trillion by the end of 2013 from $ 2.8 trillion or an increase of about $1.17 trillion, according to Zero Hedge.Yet the sterilization measures by Operation Twist of selling $45 in short term bonds to offset the long end buying will likely end by this year as the Fed runs out of short term securities to sell.Essentially, roughly half of the US budget deficit will be monetized by the FED.

But it seems obvious as soon as one once begins to think about it that almost any change in the amount of money, whether it does influence the price level or not, must always influence relative prices. And, as there can be no doubt that it is relative "prices which determine the amount and the direction of production, almost any change in the amount of money must necessarily also influence production

That is a 2.5% inflation target by any other name, and it's striking to see a central bank in the post-Paul Volcker era say overtly that it wants more inflation

there has never occurred a hyperinflation in history which was not caused by a huge budget deficit of the state.

It's tempting to think that somehow printing money means an increase in spending power, while issuing bonds means that the government is taking something in return for what it spends, but it's important to focus on the general equilibrium. In both cases, regardless of whether government finances its spending by printing money or issuing bonds, the end result is that the government has appropriated some amount of goods and services, and has issued a piece of paper – a government liability – in return, which has to be held by somebody. Moreover, both of those pieces of paper – currency and Treasury securities – compete in the portfolios of individuals as stores of value and means of payment. The values of currency and government securities are not set independently of each other, but in tight competition...To the extent that real goods and services are being appropriated by government in return for an increasing supply of paper receipts, whatever the form, aggressive government spending results in a relative scarcity of goods and services outside of government control, and a relative abundance of government liabilities. The marginal utility of goods and services tends to rise, the marginal utility of government liabilities of all types tends to fall, and you get inflation.This is important, because it means that the primary determinant of inflation is not monetary policy but fiscal policy.

At the current average decay period of around 40% per action, we should see the ECB or Fed enact something new by around February 4th (just as the debt-ceiling comes to a head).

Monday, July 12, 2010

Wage Convergence: Myths And Facts

Dr. John Hussman, in this excellent weekly article, dispels the myth of cheap labor to argue for convergence of wages between the US and developing nations.

Dr. Hussman writes,

(bold emphasis mine)

“Why do workers in developing nations earn a fraction of the wages American workers earn?

``While protective and regulatory factors such as trade barriers, unionization, and differences in labor laws have some effect, the main reason is fairly simple. U.S. workers are, on average, more productive than their counterparts in developing countries. While the gap between U.S. and foreign wages can make open trade seem very risky, it is simply not true that opening trade with developing nations must result in a convergence of wages. The large difference in relative wages is in fact a competitive outcome when there are large differences in worker productivity across countries.

From Korean Times

``The main source of this difference in productivity is that U.S. workers have a substantially larger stock of productive capital per worker, as well as generally higher levels of educational attainment, which is a form of human capital. This relative abundance of physical and educational capital has been a driver of U.S. prosperity for generations. Neither advantage in capital, however, is intrinsic to American workers, and it will be impossible to prevent a long-term convergence of U.S. wages toward those of developing countries unless the U.S. efficiently allocates its resources to productive investment and educational quality. This is where our policy makers are failing us.”

So how then will the prospects of wage convergence occur?

By massive interventionism and inflationism.

Again Dr. Hussman

``If we as a nation fail to allow market discipline, to create incentives for research and development, to discourage speculative bubbles, to accumulate productive capital, and to maintain adequate educational achievement and human capital, the real wages of U.S. workers will slide toward those of developing economies. The real income of a nation is identical its real output - one cannot grow independent of the other.”

Dr. Hussman’s observation has important parallels to the prescient work of Dr. Ludwig von Mises who once wrote,

``What elevates the wage rates paid to the American workers above the rates paid in foreign countries is the fact that the investment of capital per worker is higher in this country than abroad. Saving, the accumulation of capital, has created and preserved up to now the high standard of living of the average American employee.

``All the methods by which the federal government and the governments of the states, the political parties, and the unions are trying to improve the conditions of people anxious to earn wages and salaries are not only vain but directly pernicious. There is only one kind of policy that can effectively benefit the employees, namely, a policy that refrains from putting any obstacles in the way of further saving and accumulation of capital.”

Hence, we learn of three indispensable variables as key to higher real wages: savings, capital invested per worker and productivity. Interventionism only achieves the opposite. Everything else is footnote.

Sunday, November 09, 2008

The Rise of Value Investors Amidst A Prevailing Fear and Loss Environment

``If stocks are attractive and you don't buy, you don't just look like an idiot, you are an idiot.'' -Jeremy Grantham, Baron Buys, Grantham Spots `Once in Lifetime' Chance

It is a curiosity to occasionally hear questions about profitability in today’s market similar to “Are you up or down?”

Because for as long as people have positions in the financial market whether directly (equities, fixed income, currencies, commodities) or indirectly (mutual funds, hedge funds, ETF, UITF and etc.) the unequivocal answer is that given today’s downside volatility-losses are the rule, not the exception.

Today’s Fad: Losses Everywhere

Think of it; nearly $30 trillion of market capitalization wiped out from global equity markets year to date alone. Banks have written off about $680 billion and still counting. As we earlier argued in Spreading the Wealth? Market IS Doing It!, the political morality polemics about income inequality has been in a wash since market losses appear to have sizably narrowed the controversial gap.

Still world real estate market continues to bleed; in the US estimates of losses have been at $1 trillion (globeandmail.com). We don’t have the collateral damage estimates or casualty figures from the fallout in other markets, most especially in Europe and in some other parts of Asia, which includes China or Japan or Australia.

Nevertheless, we have also enormous unaccounted for losses in the derivative, currency (a roster of emerging market victims from Reuters), commodities, bonds, structured finance and other financial markets.

Retirement accounts of baby boomers have been nursing some $2 trillion in the deficits (msnbc.com), thereby putting in jeopardy the retirement plans of many Americans. With Americans likely to work longer, apparently the incoming Obama presidency would have to deal with policies related to health insurance costs, Social security and Private Pensions and flexible work arrangements to address the challenges of the coming transition.

Moreover, the losses have now been spilling over to the real economy enough to impact corporate bottom lines and dividends. In the US, according to the Howard Silverblatt of S&P (Businessweek), earnings growth which had originally been optimistically forecasted at 14.2% for the third quarter have so far posted 13.9% in the red with 77% of companies reporting.

And by corporations we also mean major pension funds and retirement institutions.

As an example many Filipinos are familiar with the US largest retirement fund, The California Public Employees Retirement System, known as CalPERS, which accounted for a total portfolio value of $185 billion on Friday, down 23% from $239 billion at the start of its fiscal year. (latimes.com). The CalPERS fund is down by nearly $54 billion.

According to the same article, ``CalPERS "is taking hits across all asset classes," Feckner said. But the losses would have been even greater "if we had not spread our money out" by diversifying investments….For now, working with interim executives, CalPERS is sticking with a strategy that leans heavily on stocks, which account for about 40% of its holdings. No decision has been made about shifting the investment mix -- possibly toward bonds and other fixed-income assets, Feckner said.” (emphasis mine)

The point is; much like the CalPERs experience, investing in markets is NOT about “trying to time the markets”, as to literally assess one’s portfolio as being “up or down”, but applying portfolio management across the company’s risk profile and time horizon objectives.

In addition, President Rob Feckner underscores the viciousness of the present bear market as impacting “across all assets” meaning that the collateral damage has been broad based and severe enough for most investor’s to escape its wrath.

Warren Buffett Has Been NOT Immune

Because of ferocity of the bear markets, not even gurus are immune.

We have spilled so much ink about the wondrous feat of the world’s most successful investor Warren Buffett, but viewed from real world developments, Mr. Buffett’s investments have not been entirely unaffected see Figure 1.

On a year-to-date basis, Berkshire Hathaway has fallen victim to the powerful grip of bearmarket forces with its share prices down over 20%. And it is not just in share prices, but likewise reflective of corporate bottom line performance, with most of the damage emanating from derivatives related losses.

Some important highlights from CNN Money, ``Warren Buffett's Berkshire Hathaway Inc. on Friday reported a 77% drop in third-quarter earnings, hurt by declining insurance profits and a $1.05 billion investment loss…

``Berkshire began the year with an unrealized $1.67 billion loss on its futures, options and other derivative contracts. The value of those derivatives, which are tied to the value of the overall markets and the credit health of certain companies, improved in the second quarter by $654 million. But in the third quarter amid unprecedented market turmoil, their value fell by $1.05 billion, leaving a loss of $2.21 billion through the first nine months of the year…

``Berkshire finished the third quarter with $33.4 billion cash on hand. That is up from the end of the second quarter when the company had $31.2 billion cash on hand…

``Year to date, Berkshire's net worth slipped to $120.15 billion from $120.73 billion, but during October, price declines in investments and increased liability for equity index put option contracts accounted for a $9 billion decline in net worth.”

So similar to CalPERs, the troubles of Warren Buffett’s flagship in Berkshire Hathaway have been mainly due to the downside repricing of its asset holdings than from the direct impact of the economic downturn to its operations (yes, insurance and Berkshire’s Mid American subsidiary Constellation Energy has suffered from losses).

Remember, Berkshire Hathaway isn’t just your typical fund manager, but is an active investor to manifold diversified industries tacked into the company’s portfolio as subsidiaries, unlike CalPERs which functions principally as passive investors.

A second observation is that as we wrote in Warren Buffett Declares A BUY!, the recent months have shown Berkshire increasing its cash portfolio but over the year have plunked some $11 billion into the markets. Its cash holdings is still a significant 30% relative to the company’s overall net worth, but down from 40% at the start of the year when using the present net worth figures as basis.

Nonetheless, investments in the market doesn’t have to come directly from Berkshire as some of its subsidiaries have been doing the dirt work of expanding via acquisitions such as office furniture CORT which recently acquired Aaron Rents Corporate furnishing for $72 million (bizjournals).

So yes, while Mr. Buffett’s long term holdings are temporarily “down”, influenced by the gyrations of the market, aside from escalating impact from economic variables, overall, his portfolio’s direction has not been driven by the ridiculous idea of “ticker based” assessment but from the perspective of portfolio risk distributed allocation!

In Berkshire’s case, 60% exposure to market risks and 40% cash at the start of the year has changed to the direction of increasing exposure in market risk given the present conditions.

Betting Against Warren Buffet’s Oracle?

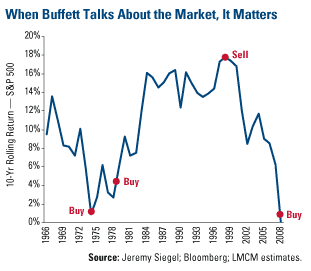

Mr. Buffett hasn’t been your stereotyped market timer, figure 2 from US global investors shows how the legendary Warren Buffett has incredibly “TIMED” the market with his publicized calls to a near precision or perfection during the past 43 years!

Put differently, Mr. Buffett doesn’t exactly “time” the markets in a literal sense as market technicians are wont to do. His selling call in the late 90s didn’t come with outright liquidation of the entire Berkshire’s portfolio simply because some of his portfolio holdings had been designed as a “buy and hold forever”.

Although he did express some regrets for failing to do so, Mr. Warren Buffett quoted at PBS.org in 2004, ``We are neither enthusiastic nor negative about the portfolio we hold. We own pieces of excellent businesses -- all of which had good gains in intrinsic value last year - but their current prices reflect their excellence. The unpleasant corollary to this conclusion is that I made a big mistake in not selling several of our larger holdings during The Great Bubble. If these stocks are fully priced now, you may wonder what I was thinking four years ago when their intrinsic value was lower and their prices far higher. So do I.” (emphasis mine) So if the Oracle of Omaha had been subject to regrets, how much more the mere mortals of the investing world?

To reiterate, in periods where he believes markets are conducive for selling Mr. Buffett raises cash in proportion to his allocation targets and positions defensively. On the other hand, in periods where he thinks opportunities for greater returns with a margin of safety embedded on his risk profile, as he does today, he raises his market risk exposure gradually.

Yet, the Mr. Buffett’s rarified but highly prescient audacious landmark calls can be construed from a combination of his interpretation of economic cycles, fundamental valuations and importantly sentiment, the seemingly indomitable “simple-but-hard-to-apply” Buffett doctrine- ``be fearful when everybody is greedy and greedy when everybody is fearful”.

Given his formidable track record, betting against him isn’t going to be a prudent choice.

The Illusion of Bull and Bear Markets

It also to our understanding that gurus don’t see markets the same way ordinary market participants view them, like in the manner which we typically label as Bull or Bear Markets.

Mr. Nassim Nicolas Taleb, the famed iconoclastic author of the best selling book The Black Swan, wrote in Fooled by Randomness ``I have to say that bullish or bearish are often hollow words with no application in a world of randomness-particularly if such a world like ours, presents asymmetric outcomes.” (highlight mine)

Incidentally, Mr. Taleb has been one of the recent exceptions or outliers, whose managed funds have remarkably been up during the recent gore in the financial markets. This from Wall Street Journal, ``Separate funds in Universa's so-called Black Swan Protection Protocol were up by a range of 65% to 115% in October, according to a person close to the fund.”

While Mr. Taleb’s magic seems to work best with market crashes as he has done so in Black Monday of October 19th 1987, he hasn’t been as effective when markets are going up, ``Mr. Taleb's previous fund, Empirica Capital, which used similar tactics, shut down in 2004 after several years of lackluster returns amid a period of low volatility.” (WSJ)

In parallel, Dr John Hussman recently wrote of the pointless exercise of classifying markets as bullish or bearish, ``From my perspective, the whole issue of bull market versus bear market doesn't get investors anywhere. Asking whether stocks are in a bull market or a bear market is like asking Columbus what kind of trees are planted along the edge of the earth. The question itself makes a false assumption about how the world works. My view is that bull markets and bear markets don't exist in observable reality – only in hindsight. What gain is there to investing based on something that's unobservable when you can manage your investments based on directly observable evidence? What we can observe directly is the prevailing status of valuations and the quality of market action.” (underscore mine)

In short, such gurus tend to view markets strictly in the context of fundamentals than from sheer momentum.

Conclusion

To recap, the sharp volatility in the financial markets has been the prevailing trend such that anyone exposed to the market has been subject to losses in the market directly or indirectly.

Even the biggest institutions or the best investors have not been immune from current adverse market developments.

While this is not to justify present losses in the essence of John Maynard Keynes’ famed pretext, ``It is better for reputation to fail conventionally than to succeed unconventionally", the point is to learn from the perspective of übermarket professionals that investing is not about attempting with futility to catch undulating short term waves but of shaping one’s portfolio based on risk distributed time preference profiles amidst observable evidence of market action and fundamental and or economic parameters.

Yet since the prevailing trend of losses has become a mainstream bias, a mounting chorus from value investors seems to have surfaced.

Warren Buffett’s recent contrarian buy calls may have either generated a momentum or provided justifications for the rising incidences of converts (from former bears into current bulls). We formerly listed Dr. John Hussman, Jeremy Granthan and Mohammed El-Erian as the early apostates.

We are adding to our list prominent market savants are Vanguard’s founder John Bogle, Fidelity International’s Anthony Bolton, former Merrill Lynch’s Bob Farrell, Steve Leuthold, Research Affiliates LLC’s Rob Arnott and others.

Even Dr. Marc Faber believes that the low is near but in contrast to the others believes global markets will ``stick at this low point for a long time.”

Yet, some of the rabid high profile hardcore bears whom have basked in the recent glory of market collapse seem to remain stuck with idea of market Armageddon.

But there seems to be one stark difference between the former (converts) and the latter: the former are full pledged money managers while the latter appears to be ivory towered ensconced members of the academia or publishers who aren’t money managers.

Monday, October 13, 2008

Some Prudent Advice from Dr John Hussman

Here are some important pointers from one of my favorite contrarians, the well-respected Dr. John Hussman on today’s market. BTW, Dr. John Hussman has been widely known as one the “perma bear” in the investment community. Excerpts From “Four Magic Words: "We Are Providing Capital"…

(all highlights mine)

1. ``Look, a few weeks ago, there was a $700 billion pile of money on the table, but the only way for Wall Street and bureaucrats to get their paws on it was to scare the public out of its collective gourd. They succeeded, but created the psychology that the U.S. was on the verge of depression if the bailout wasn't passed. Having created that psychology, the crisis took on a life of its own.”

Our Comment/Interpretation: The Power of suggestion took its own life; government engendered or prompted this panic!

2. ``Word to the wise - don't accept advice or analysis about this crisis from anyone who failed to anticipate it in the first place! The people warning about Depression now are the same reckless jackasses who told investors that stocks were cheap and “resilient” at the highs.

Our Comment/Interpretation: To Preach Doom Has NOW become MAINSTREAM! Halloween costumes are a fad. Beware of these false prophets.

3. ``Stocks are now measurably undervalued…Stocks are now at the same valuations that existed at the 1990 bear market low.”

Our Comment/Interpretation: From the valuation viewpoint, today’s market is a BUY.

4. ``The problem in the U.S. financial system amounts to roughly 5% of the mortgage assets outstanding. Virtually all of this panic can be traced to the wipeout of shareholder equity in highly leveraged institutions, but it's only a small percentage of the volume of loans in the financial system. Investors are now being quoted ridiculous dollar figures in the trillions and quadrillions (e.g. the total value of the U.S. housing stock, or the un-netted notional value of financial derivatives) as if these figures represent potential losses. The people spouting these figures are appealing to the worst impulses of a frightened public that doesn't fully understand the market mechanisms at work here.

Our Comment/Interpretation: Problems in the US economy should be seen in the right perspective. It’s easy to sell fear.

5. ``The proper way to address homeowner distress is not for the government to buy troubled mortgages and simply reduce the principal. That idea is utterly insane. If that policy was enacted, every homeowner in America would have an incentive to immediately go delinquent on their mortgage. Rather, Congress should provide for a relatively modest alteration in bankruptcy laws, allowing judges to write down mortgage principal but at the same time provide the mortgage lender with what I'd call a “Property Appreciation Right” (PAR) that would give the lender a claim on some amount of future price appreciation of property owned by the borrower. In that way, the mortgage lender would have the prospect of being made whole over time, homeowners who have faithfully made payments on their own mortgages would not be discriminated against, and homeowners in trouble would surrender some future price appreciation for immediate reduction in their monthly payment burden.

Our Comment/Interpretation: TARF is a bad idea. Infuse capital instead.

6. I recognize that all of this is very scary, particularly the rate at which the market has declined, which seems unprecedented. But it is important for investors to understand that the current selloff has all the quite standard markings of a “panic,” of the type that Charles Kindleberger described in Manias, Panics, and Crashes: a “seizure of credit in the system.” It is just mind-boggling to hear financial reporters and Wall Street “professionals” foaming at the mouth that the difficulties we are observing today are wholly new and unprecedented. We've seen these before.

``Economist Stephen Roach wrote weeks ago that “ The most important thing about financial panics is that they are all temporary. They either die of exhaustion or are overwhelmed by the heavy artillery of government policies.” That fact is worth remembering here.

Our Comment/Interpretation: Market panic has been PART of the cycle! See below…

7. ``In contrast, if your asset allocation is consistent with your risk tolerance, you're diversified, and you have a “full cycle” investment horizon, stick with your discipline. If your exposure to risk is small, a panic is a good time to increase it gradually on depressed prices. That is what good investors do. The bad investors are the ones that establish leverage at tops and are forced to sell at bottoms. Those investors unfortunately exist, and their behavior can amplify movements in both directions, but a disciplined, gradual, diversified strategy should allow for that.

7. ``In contrast, if your asset allocation is consistent with your risk tolerance, you're diversified, and you have a “full cycle” investment horizon, stick with your discipline. If your exposure to risk is small, a panic is a good time to increase it gradually on depressed prices. That is what good investors do. The bad investors are the ones that establish leverage at tops and are forced to sell at bottoms. Those investors unfortunately exist, and their behavior can amplify movements in both directions, but a disciplined, gradual, diversified strategy should allow for that. Our Comment/Interpretation: Good Investors buy on Panic, Bad investors buy the fad. Always maintain discipline!

8. ``In a market economy, profits are the compensation that people earn for providing scarce resources. One of the scarcest resources here and now is the willingness to accept risk, the willingness to put a bid out at a low price so that someone can actually sell. You don't exhaust your whole risk budget, or even the majority of it, but you move gradually, in steps, the scarier and more volatile the market, the smaller the size of the trades and the bigger the discounts you require. In short, a good investor provides scarce resources, liquidity, risk bearing and (if you're a good investment analyst) information, when those resources are in furious demand.

Our Comment/Interpretation: It is the time to take risk, and be promptly paid for it.

Thank you, Dr. Hussman.