Global military spending has begun rising in real terms for the first time since the U.S. began its withdrawal of troops from wars in Iraq and Afghanistan, according to the Stockholm International Peace Research Institute.Defense budgets rose 1 percent to $1.68 trillion in 2015, making up about 2.3 percent of the world’s gross domestic product, Sipri said in a report Tuesday. While the U.S. spent the most at $596 billion, that was down 2.4 percent compared with 2014, while China’s outlay increased 7.4 percent to $215 billion.Concern about a possible advance by Russia into North Atlantic Treaty Organization territory following the Crimea invasion and hostilities in east Ukraine led to a surge in spending in Eastern Europe, as Chinese ambitions in the South China Sea spurred arms purchases among Southeast Asian states.Defense budgets have been under pressure since the financial crash, with some of the world’s biggest spenders, including the U.K., France and Germany, scaling back amid austerity programs. Following the November terror attacks in Paris and the expansion of campaigns against Islamic State, those countries plan “small increases” in 2016, Sam Perlo-Freeman, the report’s author, said.Russia, where slumping oil receipts have weighed on the economy, fell to fourth position in the global rankings, with Saudi Arabia taking third spot. The Mideast country, also hurt by the lower price of crude, would have cut spending too had it not been for the $5.3 billion cost of its military campaign in Yemen.Russia’s defense budget is set for a slight fall in nominal terms and an 8 percent real decline, Perlo-Freeman said, while Saudi Arabia plans a “large cut,” though with a significant budgetary reserve.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, April 07, 2016

Charts of the Day: Global Military Spending Soars!

Monday, April 13, 2015

Quote of the Day: One of the most pervasive and dangerous myths of our time is that military spending benefits an economy

No, the real enemy is the taxpayer. The real enemy is the middle class and the productive sectors of the economy. We are the victims of this new runaway military spending. Every dollar or euro spent on a contrived threat is a dollar or euro taken out of the real economy and wasted on military Keynesianism. It is a dollar stolen from a small business owner that will not be invested in innovation, spent on research to combat disease, or even donated to charities that help the needy.One of the most pervasive and dangerous myths of our time is that military spending benefits an economy. This could not be further from the truth. Such spending benefits a thin layer of well-connected and well-paid elites. It diverts scarce resources from meeting the needs and desires of a population and channels them into manufacturing tools of destruction. The costs may be hidden by the money-printing of the central banks, but they are eventually realized in the steady destruction of a currency.

Tuesday, March 19, 2013

Charts of the Day: World Military Spending and Arms Trade

AMERICA still spends over four times as much on defence as China, the world’s second-biggest military spender. But it has been clear for some time that on current trends China’s defence spending will overtake America’s sooner than most people think. What is less clear is when that date will be reached. It all depends on the underlying assumptions. The 2013 edition of the Military Balance published by the London-based International Institute for Strategic Studies (IISS) shows convergence could come as soon as 2023. That is based on extrapolating the rate of Chinese military spending since 2001—a 15.6% annual growth rate—and assuming that the cuts in the America's defence budget required under sequestration are not modified. The latter is more likely than the former. The latest Chinese defence budget is based on spending increasing by a more modest 10.7% annually. That would mean that China overtakes America in 2032.However, if China’s headlong economic growth stalls or if more money is needed to serve the health and social needs of rapidly-ageing population, China might slow spending on its military by something like half its current projection. If that happens, the crossover point could be delayed by up to a decade. It is also possible (though at present America’s fiscal travails suggest otherwise), that as China rises, America will feel forced to start spending more if the security guarantees it currently makes to allies such as Japan, South Korea and Taiwan are to retain their credibility into the third decade of the century. Already, China spends more on defence than all of those three together. It is all very well for America to talk about a strategic rebalancing towards Asia, but if the money is not there to buy the ships, the aircraft and all the expensive systems that go with them, it will eventually sound hollow.

The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists

Monday, June 06, 2011

Spratlys Dispute: Why AFP’s Plan to Build Up Military Signifies War on the Filipinos

Governments always look for an excuse to expand power. And General Douglas MacArthur was right, government always try to keep “us in a continuous stampede of patriotic fervor -with the cry of grave national emergency” by conjuring “terrible evil at home, or some monstrous foreign power that was going to gobble us up if we did not blindly rally behind it”

The geopolitical tensions over Spratlys Island have prompted the Philippine government to shop for arms, according to yesterday’s news.

From the Philippine Daily Inquirer,

Amid increasing concern over renewed tensions in the South China Sea, the Philippine Embassy here is shopping for excess defense equipment from the United States under Washington’s Foreign Military Sales (FMS) program.

Jose L. Cuisia Jr., the Philippine ambassador to the US, said he has asked the Department of National Defense and Armed Forces back home to provide him with a wish list of military equipment they will need to shore up the country’s defense capability.

He said he expected the defense department to “prioritize” its modernization goals, but was careful not to explicitly link the purchase of US excess defense articles to the Philippine military’s job of securing the territorial sovereignty of the country in the face of China’s alleged intrusions into the areas of the disputed Spratlys group claimed by the Philippines

The idea that the Philippines can resolve the current dispute with China over an ‘arms race’ or by brinkmanship is not only unfeasible and anachronistic but outright ridiculous.

Unfeasible because in almost every aspect, the Armed Forces of the Philippines cannot measure up to China’s People Liberation Army in terms of numbers and in technology.

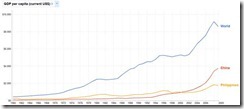

In addition, China is by far wealthier (in terms of GDP per capital) than the Philippines and thus can afford to spend more for her military services. [Google Public Domain]

Chart from Tradingeconomics.com

Considering that China has unveiled its newest stealth warplane and aircraft carrier, it would seem that no amount of nonsensical ‘arms race’ will prevent a ‘determined’ China from encroaching on Spratlys.

But this isn’t to say that China will do so.

I say anachronism too because military engagement has not been the du jour foreign policy for China.

Had she assimilated an imperialist path, Taiwan, which China claims as part of her territorial sovereignty, would have been invaded. And so with the Japanese held Senkaku Islands, which China has claims too along with the Spratlys. A similar political friction arose in Senkaku Island in 2010 following a collision between Japan’s Patrol boats and a Chinese trawler.

Yet China’s geopolitical strategy has been to expand trade and investments around the world.

Derek Scissors of Forbes magazine writes,

China's hefty investments in sub-Saharan Africa have received deserved attention, but its investment in Latin America has been overblown by some. One reason is a common event in bilateral commercial transactions--grand announcements that never come to fruition. In mid-April Venezuela proclaimed a $20 billion oil-for-loans deal with China, but Caracas' track record in this area encourages skepticism. China has little investment in the Arab world, which is perhaps surprising in light of its focus on energy, but it has sizable engineering and construction contracts there. Australia, at $30 billion, is the single biggest draw for Chinese investment. The U.S. is second at $21 billion, Iran third at $11 billion.

The places where the Chinese have invested most often are also the places where their investments have been most often thwarted: Australia, the U.S. and Iran, in that order. Failures stem from a variety of causes, such as nationalist reactions in host countries, objections by Chinese regulators and mistakes by the Chinese firms themselves. According to the Heritage tracker, the value of failed investments from 2005 to 2009 is a staggering $130 billion. Chinese investment could have been a full 40% larger than it was had the failed deals closed.

So the more appropriate action to resolve any territorial dispute should be to actively increase trade with China.

As Frederic Bastiat once said,

When goods don't cross borders, armies will

Greater trade will likely ensure an amicable or diplomatic settlement because both China and the Philippines would like to see a continuity of this mutually beneficial relationship.

And this goes back to the reason why the call for more military spending represents a war against the citizenry.

As the great Ludwig von Mises wrote,

The adequate method of providing the funds the government needs for war is, of course, taxation. Part of the funds may also be provided by borrowing from the public, the citizens. But if the Treasury increases the amount of money in circulation or borrows from the commercial banks, it inflates. Inflation can do the job for a limited time. But it is the most expensive method of financing a war; it is socially disruptive and should be avoided.

More military spending means higher taxes and risks of higher inflation. It also means redistribution of wealth from the ‘productive’ private sector to government appointed intermediaries and suppliers or non-productive capital consuming activities.

Doing so leads to lower economic growth, higher unemployment, lower investments, higher risk premium and a lower standard of living. Also this amplifies the risks of corruption.

In addition a military build-up could also extrapolate to using newly acquired weapons against the citizenry to suppress political dissent or for repression or to expand in the engagement of military conflict with local subversives.

So instead of seeking diplomatic solutions, the likely path is to have more turmoil which heightens political instability which should further weaken the economy. It's another lesson we never seem to learn.