``Cycles in markets do exist, but it's impossible to pinpoint how long they will last with any precision. Much depends on the actions of government officials and the intelligence of the public. Each time is different. I recall commentators calling for a six-year gold cycle, or a 10-year real estate cycle. They are all ephemeral, because, as Shakespeare says, our actions are "not in the stars, but in ourselves."-Dr. Mark Skousen Investment U

Here is Friday’s introductory from the Economist magazine (emphasize mine),``Stockmarkets across the Asia-Pacific region have been hitting all-time highs recently, reflecting the underlying strength of economies across the region and the perception that Asian stocks represent the best prospect of growth at reasonable risk. Thanks in part to the de-linking of Asia's economies from the US, and a greater reliance on intra-regional trade (particularly with China), Asian markets seem well-placed to withstand the slowdown in the US that is expected next year. But a more dramatic braking of the US economy could yet see funds flowing out of the region as fast as they have flowed in.”

In my latest presentation I built my bullish case of the PHISIX and the Philippine asset class, over the LONG-TERM, premised upon the following: accelerating Globalization trends, the ongoing phenomenon of Wealth and Capital transfer, increasing dynamics of regional and global financial integration, evolving demographic trends, transitional fiscal and monetary policies under present conditions and cyclical factors.

It is true that part of the increasing Globalization trends has been the intensification of intra-regional trade, mostly due to the structural shift in the global trade framework which has been molded out of a mostly supply-chain platform paradigm.

Such evolution has equally led to a massive reconfiguration of the industrial construct among nations, which underscores the David Ricardo’s Theory Comparative Advantages and the international division of labor or the increasing trends of specialization, and importantly, the reformation of fund flows, which has likewise buttressed the progress of the world’s capital or financial markets.

Today, there has been increasing chatters of a de-linking or decoupling of Asia from the West, similar to the latest lengthy quip from the Standard and Poor’s who argues in their latest outlook ``The World Won’t Sniffle If the US Sneezes” (emphasis mine),

``Some of the strength can be attributed to a weaker U.S. dollar, attractive equity valuations, and healthy profit margins, helped by ample global liquidity and corporate restructurings induced by M&A activity. But there’s another key factor at work; namely, the rest of the world is beginning to look more like the United States.

``America’s robust gross domestic product (GDP) growth over the past few years has been fueled largely by consumers’ appetite for everything from iPods to hybrid autos to home refurbishments. But as American spenders are tightening their purse strings, falling unemployment in developed countries is causing German, French, and Japanese consumers to loosen theirs.

``More significantly, rising per capita income in emerging markets — which, according to the International Monetary Fund, account for 27% of global GDP — is dramatically increasing emerging middle-class demand for such things as autos, branded apparel, home appliances, packaged goods, and consumer electronics. This trend extends beyond products, however, and as employment rates and disposable income rise, consumers are demanding access to financial services and health care as well.”

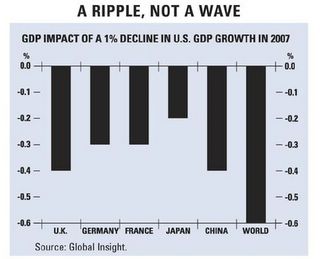

Figure 1 S & P: Mitigated Impact by Decoupling?

Like typical coins, there is an obverse side, Stephen Roach, Chief Economist of Morgan Stanley argues against present day theme of decoupling is unlikely given the much entwined dimensions of trade, economy and finances, Mr. Roach wrote (emphasis mine),

``Given the dominant role that the US consumer has played in driving the demand side of the world economy and the equally important role played by the Chinese producer in shaping the supply side, decoupling won’t be easy. By our calculations, China and the US collectively have accounted for an average of 43% of PPP-based global GDP growth over the 2001-06 period -- well in excess of their combined 35% share of world output. Globalization makes decoupling from such a concentrated growth dynamic especially difficult, as ever-powerful cross-border linkages have become increasingly important in tethering the rest of the world to these dominant engines of growth.

Mr. Roach asserts that the evidential lack of sustaining domestic demand, the need for a diversified share of export mix (the USD $800 billion trade deficit suggests the world still depends on US as its key market whose consumption in 2005 totaled about $9 trillion or ``20% larger than consumer spending in Europe, 3 1/2 times that of Japan, nine times the size of China’s consumer, and fully 17 times the scale of Indian consumption” according to Mr. Roach), and the need for policy autonomy draws such an issue into serious question.

I actually stand in the middle ground of this debate.

Because we are aware that mainstream “experts” usually justify their explanation of events based on recent outcomes, we become wary over the penchant for oversimplification. In my case, the following chart is a res ipso loquitur (thing speaks for itself).

Figure 2: stockcharts.com:Dow Jones World and Dow Jones Industrial

In the past, I have repeatedly shown you of the accelerating correlation trend of global financial markets, such that for instance, the US Dow Jones Industrial Averages appears to have inspired for a rally in the global equity markets last July, as measured by the global benchmark, the Dow Jones World Stock Index, seen in figure 2.

The chart simply reveals that in over a year’s period, global markets have markedly shadowed or has been tightly associated with the performances of the US Dow Jones benchmark. In short, to argue that global markets have decoupled could be reckoned as hardly a fact. Yes, there is no question that global markets may have outperformed. Yet, outperformance does not itself translate to an autonomous motion.

Nonetheless, while there are indeed some signs that the world is undergoing some sort of transitional shift towards dissociation from developments from the US, the liquidity spring which has bolstered today’s financial and economic world still largely depends on the dictates from whence it originated.

Anyway, the embryonic “decoupling” signs could be gleaned from the present day developments in the world capital markets.

Yes, the US remains as the largest capital market of the world in general. However, a noteworthy development is the apparent signs of growing slippages.

Figure 3: The Economist: Europe overtakes US in Corporate Debt ArenaIn terms of hedge-fund and mutual fund assets, securitization, syndicated loans and turnover in equities and exchange-traded derivatives, as well as high-yield “junk” bonds, the US still commands the prominent heft. However, according to the Economist magazine, ``Europe's corporate-debt market overtook America's last year”, as shown in Figure 3.

Nonetheless, London has been the leader in foreign exchange trading and over-the-counter or off-exchange derivatives.

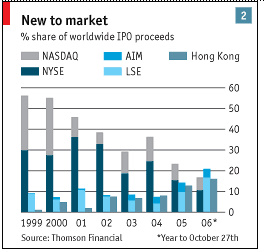

Figure 4: The Economist: Hong Kong and London Leads the IPO market

``The loudest sucking sound has been in the market for initial public offerings, a crucial barometer of financial wellbeing. America's share (measured by proceeds) has collapsed since the late 1990s. Five years ago the New York Stock Exchange dwarfed London and Hong Kong. This year it is being beaten by both.” wrote the Economist.

So aside from Europe, we are today witnessing the emergence of the Asian financial markets as a potential moving force in the global financial markets stage.

Moreover, there has equally been mounting trends towards the private-equity investment or public firms taken private, worldwide. Trends of increasing corporate buybacks plus progressing private-equity developments, which has reduced supplies of equities available for public investment, have likewise been attributed to today’s buoyant equity markets. The “rationalization” being that of increasing “shortages of supply” relative to demand, which is essentially another euphemism for veiled inflation or too much money chasing for decreasing supply of listed equity firms.

Clearly, these trends could be discerned as indications that the US has been chafing at its competitive edge, in almost every segment of the industry, including that where it once mightily towered upon, the FINANCIAL DOMAIN.

Several factors had been cited to this erosion of leadership, such as growing competition, CHOKING regulatory policies (Sarbanes-Oxley), FRAGMENTED regulatory regime (multiple jurisdictions/entities), HIGHER COST of compliance, prominence of class-action suits, slow adaptation to technological innovation (electronic trading platform) and tougher immigration laws.

However, I believe that this is more than just micro-based policies or developments but as an offshoot to the prevailing collective macro trends of globalization, financial integration, global demography and the wealth transfer phenomenon.

As these trends gets to be even more pronounced, more capital will flow back into the Asian region, where in the backdrop of a “deepening” or growing sophistication of its financial markets, its excess/surplus foreign reserves, growing competitiveness of its manufacturing base, the leapfrogging of its technological research and development share, the development of more skill-based labor force and rising middle class will underpin any much touted decoupling.

Until the financing of the massive US current account deficit ends, such cross-linkages of Asia with that of the US will likely continue and be the dominant theme for sometime to come.

This essentially makes ex-US global financial markets STILL vulnerable to the sentimental turns brought about by adversarial developments in the US economy and financial markets, but much to a lesser degree compared to the 1990s.

Let me borrow the Economist’s poignant conclusion (emphasis mine), ``However, there seems little risk of a 1997-style meltdown, even if equity markets do look a little overpriced at the moment. Most major Asian economies are characterised by current-account surpluses, large foreign-exchange reserves and high rates of domestic savings. These improved economic fundamentals will serve the region well over the next few years as the global economy slows and investors become more risk-averse. Nevertheless, the dip in Asian capital markets and a slide in Asian currencies against the US dollar in May and June served as a reminder that the region is not immune to a change in global investor sentiment. In an environment of heightened investor uncertainty, some Asian markets could suffer further sharp corrections.”

No comments:

Post a Comment